Get the free greenwood credit union skip a payment

Get, Create, Make and Sign greenwood credit union skip

How to edit greenwood credit union skip online

Uncompromising security for your PDF editing and eSignature needs

How to fill out greenwood credit union skip

How to fill out skip-a-payment program form

Who needs skip-a-payment program form?

Skip-a-Payment Program Form: Your Comprehensive Guide

Understanding the skip-a-payment program

The skip-a-payment program provides borrowers a unique opportunity to defer payment on their loans, enabling them to manage their finances more freely. This initiative is designed for individuals facing temporary financial hardships and those seeking short-term financial flexibility. By participating in this program, borrowers can relieve themselves of immediate financial pressure without negatively impacting their credit scores.

One major benefit of the skip-a-payment program is stress reduction associated with monthly repayments. It allows individuals to allocate their resources towards other critical expenses, such as medical bills or unexpected costs, giving them a chance to regroup financially without the weight of looming payments.

Who can benefit from this program?

The skip-a-payment program is beneficial for a wide range of borrowers, including individuals, families, and teams. Generally, those facing temporary setbacks due to job loss, medical emergencies, or other unforeseen circumstances can find relief through this program. Additionally, businesses with loans often engage in skip-a-payment arrangements to ensure cash flow during critical operational periods.

Eligible accounts typically include personal loans, home mortgages, and even credit card payments. Each lending institution has its criteria, so it's essential for potential participants to verify the types of accounts that qualify.

Using the skip-a-payment program form

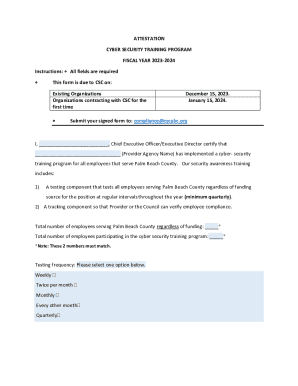

The skip-a-payment program form serves as the official application for borrowers who wish to halt their payment schedules temporarily. This form is crucial in documenting the request and ensuring the appropriate processing of the application. You can find this form on the pdfFiller platform, which provides easy access and user-friendly features to facilitate the process.

Locating the form on pdfFiller is straightforward. Users simply navigate to the forms section, search for 'skip-a-payment program form,' and access it with a few clicks. pdfFiller’s intuitive platform ensures that even those with minimal experience in online document management can find their way around effortlessly.

Interactive tools for easy completion

pdfFiller offers a range of interactive tools designed for effortless form filling. Users can complete the skip-a-payment program form step by step, utilizing features such as text boxes, checkboxes, and dropdown menus. This interactivity enhances accuracy and ensures all necessary fields are completed correctly.

Moreover, pdfFiller supports electronic signatures, allowing borrowers to finalize their applications without needing to print and scan documents. By following the on-screen prompts, users can quickly and effectively fill out the form, ensuring a smooth application process.

Step-by-step instructions for filling out the form

Filling out the skip-a-payment program form properly is crucial for a successful application. Each section must be accurately completed to ensure it meets the lender's requirements. Here’s how to effectively fill out the form:

Gather necessary information

Before you begin, gather all necessary documents and personal information including, but not limited to, your loan account number, personal identification, and proof of income or hardship as required. Having this information at hand will ease the completion process.

Filling out the skip-a-payment form: a detailed guide

Start with the personal information section. This section requires basic details such as your name, address, contact information, and Social Security number. Ensure that all information is correct to avoid any processing delays.

Next, move on to the loan information section. Specify the type of loan for which you are requesting a deferment along with the account number and the payment amount you wish to skip. This clarity helps lenders verify the application details quickly.

Finally, you’ll arrive at the signature section. pdfFiller allows for an electronic signature, making it easy to complete the process seamlessly. After signing, follow the submission guidelines provided by pdfFiller to ensure that your application is sent promptly.

Editing and managing your skip-a-payment form

Once the form is completed, there may be a need for edits or modifications. pdfFiller’s editing tools allow users to easily make changes even after initial submission. If you notice a mistake or need to update information, simply access your saved document on the platform, make necessary adjustments, and resubmit if required.

For document storage, pdfFiller offers cloud-based solutions that keep your files secure and accessible from anywhere. This is particularly beneficial for borrowers who need to reference their application or manage documentation in various locations. Best practices suggest labeling your documents clearly to enhance organization and retrieval.

Frequently asked questions

Common queries about the program

Many users have queries regarding eligibility for the skip-a-payment program. Common questions revolve around qualifying circumstances, the types of loans that can be deferred, and whether past due amounts affect eligibility. These inquiries are crucial for ensuring that borrowers understand their standing before engaging in the program.

Timing and processing of requests is another common concern. Borrowers typically want to know how quickly they can expect approval and what the response timeline looks like once a form is submitted. Best practices recommend submitting requests well in advance of payment dates to accommodate processing times.

Troubleshooting form issues

Errors can occur during the application process. Common issues include incomplete fields, incorrect personal information, or failure to electronically sign. Such problems are easily rectified using pdfFiller's built-in error notifications, guiding users to the specific areas needing correction.

Leveraging additional resources

Financial planning tools

In addition to the skip-a-payment program form, pdfFiller offers numerous financial planning tools that users can benefit from. These resources include budgeting templates and expense tracking documents, enabling individuals to gain better control over their finances.

Customer support options

For any users needing assistance, pdfFiller provides robust customer support. Whether it's clarifying concerns about the skip-a-payment program form or navigating the platform's features, reaching out to customer service can help resolve issues quickly.

Educational materials

Additional educational materials on pdfFiller's website can provide valuable insights into best practices for financial management and loan oversight. Exploring these resources can empower users to make more informed financial decisions.

Keeping track of your requests

Monitoring your application status

After submitting your skip-a-payment program form, it’s essential to monitor the status of your application. This can typically be done through the pdfFiller platform, which allows users to track the progress of their requests easily from their dashboard.

Communication with lending institutions

Effective communication with your lending institution is vital during the application process. If any delays occur in processing your request, don’t hesitate to reach out. Clear and proactive communication with lenders can often lead to faster resolutions and ensure that you’re kept informed throughout.

Engage with your financial institution

Importance of communication

Engaging regularly with your financial institution enhances your experience with the skip-a-payment program. Establishing a rapport with your lender can provide greater insight into your financial options and make you feel supported during times of financial strain.

Support resources for borrowers

Accessing support resources is imperative as you navigate through your financial journey. Lenders often offer workshops, online webinars, and one-on-one counseling sessions that can provide you with insight into managing debts and financial wellness.

Enhancing your experience with pdfFiller

Benefits of using pdfFiller for document management

pdfFiller stands out as a comprehensive solution for document management. It empowers users to seamlessly edit PDFs, incorporate electronic signatures, and collaborate with others in real-time, simplifying the entire process of managing forms like the skip-a-payment program form.

Maximizing your document workflow

To make the most out of pdfFiller, consider integrating it with existing document workflows within your personal or professional settings. Providing team members access to necessary forms, enabling collaborative edits, and ensuring everyone stays updated enhance the overall document management experience and productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in greenwood credit union skip without leaving Chrome?

Can I edit greenwood credit union skip on an iOS device?

How can I fill out greenwood credit union skip on an iOS device?

What is skip-a-payment program form?

Who is required to file skip-a-payment program form?

How to fill out skip-a-payment program form?

What is the purpose of skip-a-payment program form?

What information must be reported on skip-a-payment program form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.