Get the free Rematerialization Request Form - simplehai axisdirect

Get, Create, Make and Sign rematerialization request form

How to edit rematerialization request form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out rematerialization request form

How to fill out rematerialization request form

Who needs rematerialization request form?

Rematerialization Request Form: Your Comprehensive How-to Guide

Understanding the rematerialization request form

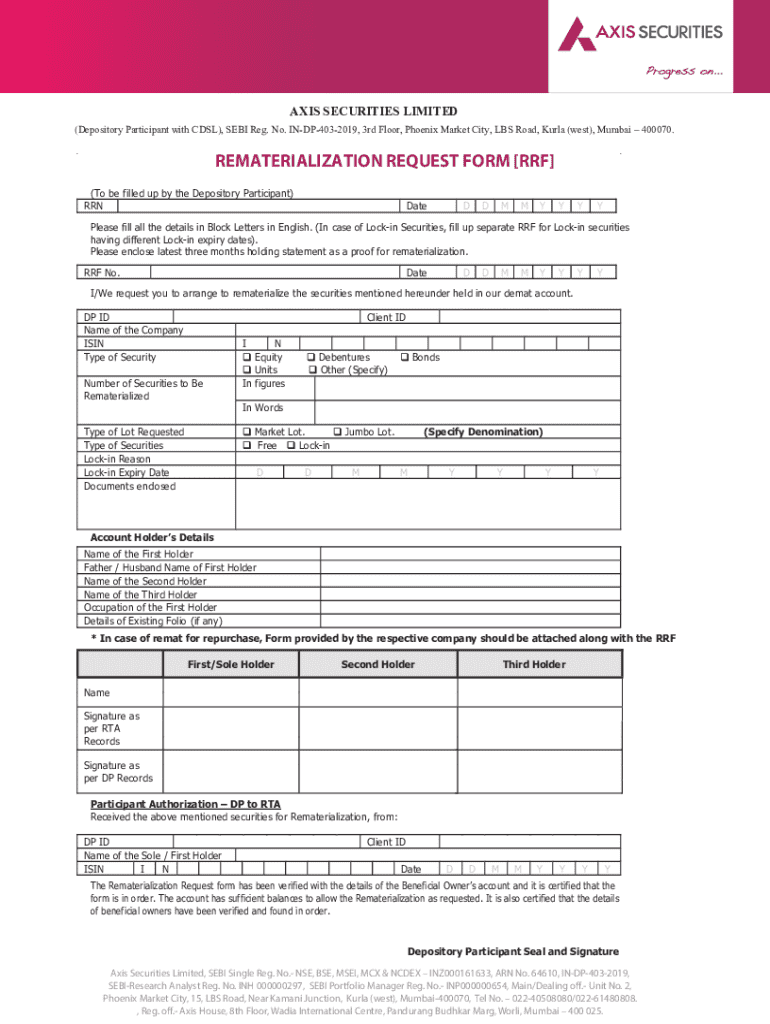

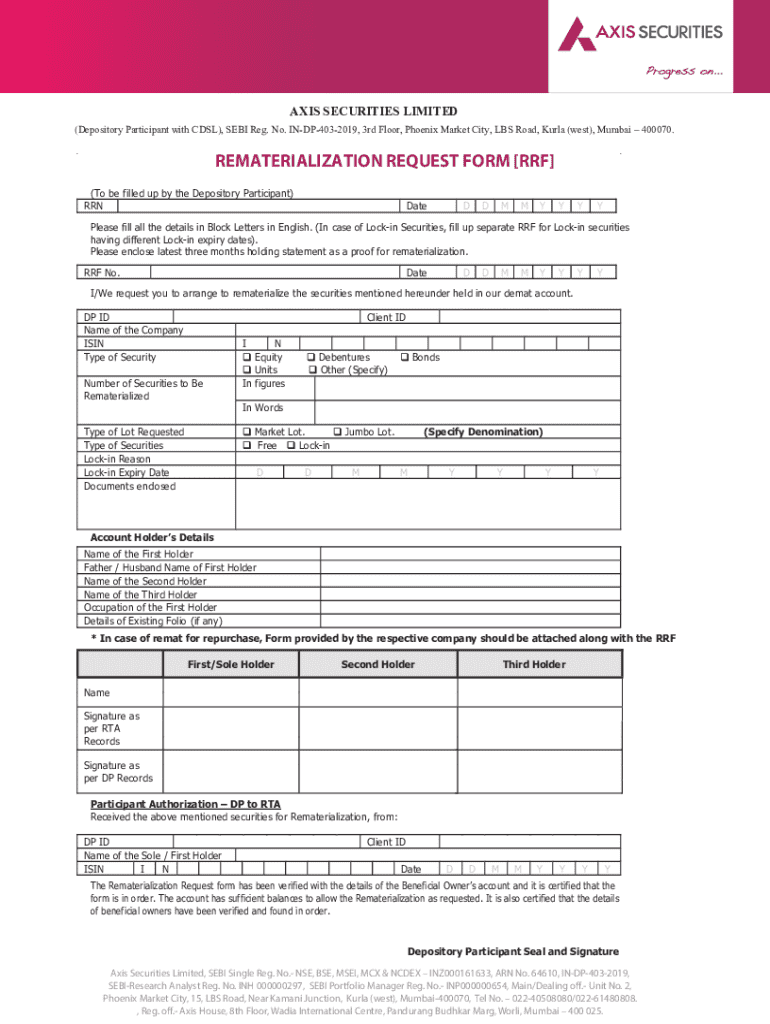

A rematerialization request form is a formal document used to request the reissuance of physical certificates or documents that were previously dematerialized or held in electronic form. This process is essential for maintaining accurate records and ensuring that individuals or organizations have access to their physical securities when needed. The primary purpose of this form is to streamline document management, enabling users to reclaim their certificates efficiently and effectively.

In the context of financial assets, rematerialization can be crucial for investors who may prefer to hold physical certificates for various reasons, including security, investment preferences, or legal requirements. The importance of rematerialization in document management cannot be overstated, as it plays a key role in corporate governance and record-keeping, ensuring compliance with regulatory standards.

When should you use this form?

Several scenarios warrant the use of a rematerialization request form. Primarily, you should consider submitting this form if:

Utilizing the rematerialization request form not only provides legal backing for your assets but also enhances your control over your financial documentation. Individuals and teams can benefit greatly by streamlining their asset management processes, making it easier to respond to market changes or personal investment objectives.

Preparing for the rematerialization process

Before initiating the rematerialization process, it’s essential to gather all necessary information to support your request. This includes personal details such as your name, contact information, and any unique identification related to your securities. Additionally, a comprehensive list of the financial assets you wish to rematerialize is crucial.

You will often be required to provide documentation to substantiate your identity and ownership of the assets. Typical documents may include identification proofs like your driver’s license or passport, and previous account statements that show your ownership of the dematerialized securities.

Familiarizing yourself with common terminologies related to rematerialization will simplify the process. Understanding key terms like 'dematerialization,' 'security,' 'transfer agent,' and 'certificated form' can prevent confusion during the form-filling stage. Make a note of any questions you might have about the process to clarify with your financial advisor or service provider.

Step-by-step instructions for filling out the form

Accessing the rematerialization request form is typically easy through financial service platforms or their designated websites. At pdfFiller, you can find the form by searching 'rematerialization request form' in the document templates section.

Once you have accessed the form, filling it out correctly is essential. Most forms will require you to complete the following sections:

To avoid delays, double-check for common mistakes. Common pitfalls include mismatched personal details, omitting mandatory fields, and failing to include all required documents as attachments. Ensuring accuracy in your submission is key to a smooth processing experience.

Editing and modifying your form

If you need to make changes after completing your rematerialization request form, pdfFiller offers robust editing tools. You can easily access the pdfFiller platform to upload your document and utilize its features for clarity and legibility. Options such as adding text, highlighting, or annotating can significantly enhance your submission.

Collaborative editing is also available, which allows team members to provide input. You can invite colleagues to review the document, making it easier to catch errors and improve overall quality. The platform enables tracking changes and comments, ensuring that all modifications are transparent and managed effectively.

Signing and finalizing your request

Once the form is complete, you need to sign it. pdfFiller provides options for eSigning the document, which is both efficient and compliant with legal standards. Adding your electronic signature is straightforward: just follow the prompts to create or upload your signature.

Legally, electronic signatures hold the same weight as traditional handwritten signatures. After signing, ensure that your rematerialization request is submitted according to best practices, either via email or an online portal specified by your service provider. Don’t forget to include all required attachments, like proof of identity and ownership documents, as these could be critical for processing your request.

Tracking your rematerialization application

Staying abreast of the status of your rematerialization request is vital. Most financial institutions provide a customer dashboard or portal where you can monitor its progression. Here, you can find updates regarding your application and estimated processing times. Be proactive in checking these platforms to prevent any surprises or miscommunication.

If you encounter any issues or delays, having the right contact information for support is essential. Most platforms will offer customer service options, including online chat or direct phone lines. Don’t hesitate to reach out for assistance; clarity can significantly streamline the resolution of any concerns.

Frequently asked questions (FAQs)

Users often have common inquiries regarding the rematerialization process. Questions typically revolve around what documents are necessary, the time frame for processing requests, and the costs associated with rematerialization. Addressing these upfront can aid users in better preparing for their applications.

Additionally, misconceptions regarding the legality and efficacy of rematerialization requests abound. It’s important to clarify that rematerialization is a standardized process, specifically designed to ensure security and transparency in asset management. By providing clear information, you can demystify the process and encourage more individuals to utilize this important tool.

Additional support and resources

pdfFiller enables users to manage their documents seamlessly beyond the basic form-filling. With features that enhance document handling, like templates, digital signatures, and direct sharing capabilities, it’s easier than ever to maintain an organized approach to financial paperwork. Integration with other platforms further allows for improved management of document workflows.

Should you require more personalized assistance, accessing expert consultation through pdfFiller can be invaluable. Professional help can guide you through complex issues, ensuring that you are fully informed about your rematerialization requests and other document-related concerns.

Connecting with the pdfFiller community

Engaging with other users within the pdfFiller community provides a platform for sharing experiences and tips on document management. Participating in forums or discussion boards can be an excellent way to learn about best practices, receive feedback, and build a network of like-minded professionals.

Staying updated with new features and enhancements is made easy by following pdfFiller’s official pages and joining social media platforms. Regular announcements and insights can help you leverage the full capabilities of pdfFiller, ensuring that you are always utilizing the latest tools available for document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete rematerialization request form online?

How do I edit rematerialization request form in Chrome?

How can I fill out rematerialization request form on an iOS device?

What is rematerialization request form?

Who is required to file rematerialization request form?

How to fill out rematerialization request form?

What is the purpose of rematerialization request form?

What information must be reported on rematerialization request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.