Get the free Common Transaction Form

Get, Create, Make and Sign common transaction form

How to edit common transaction form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out common transaction form

How to fill out common transaction form

Who needs common transaction form?

Common Transaction Form - How-to Guide

Understanding common transaction forms

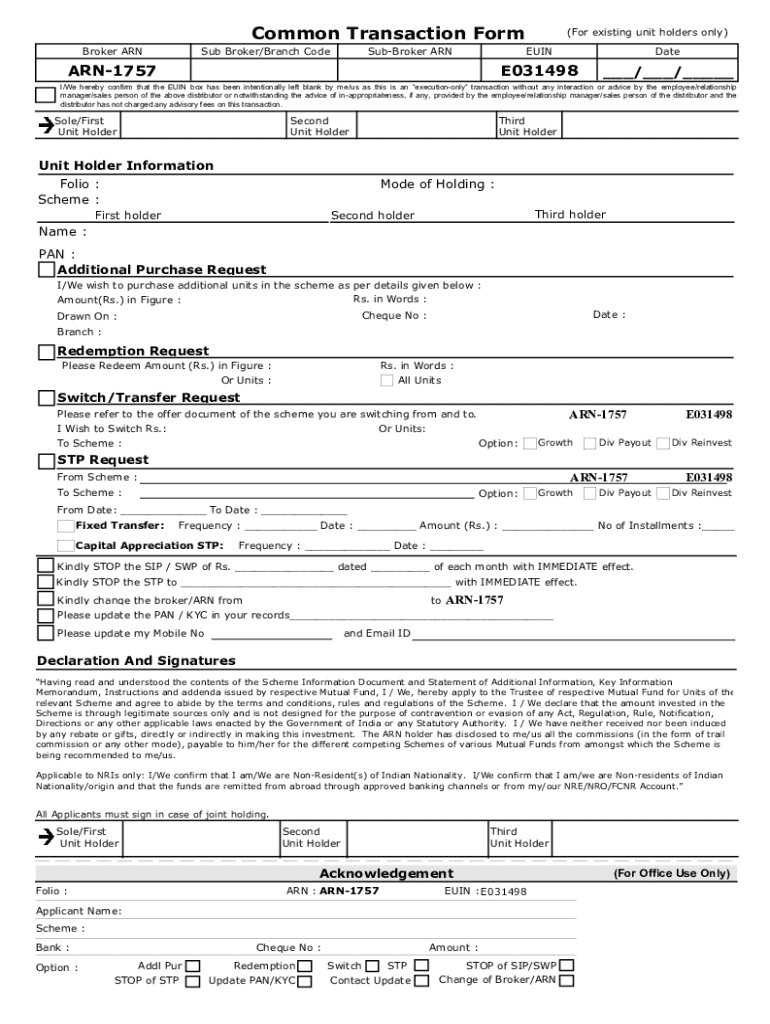

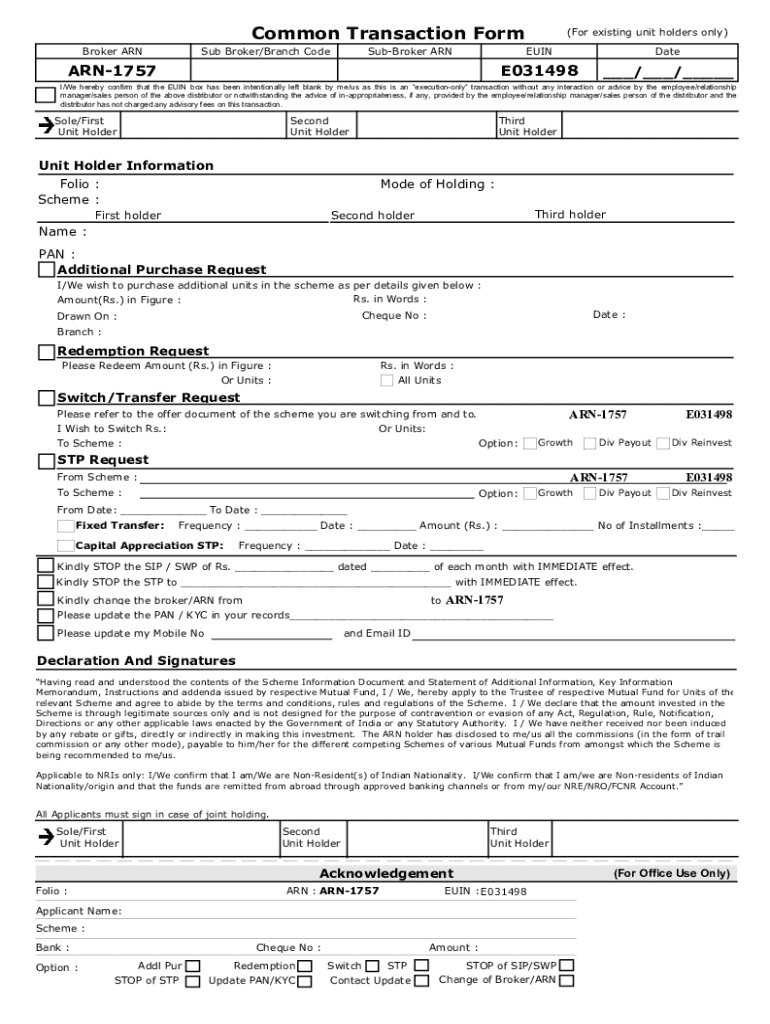

A common transaction form is an essential document used to facilitate and record exchanges between parties in various industries. This form serves as proof of the transaction, detailing the terms agreed upon by the involved parties, whether they are individuals or organizations. Transaction forms can take many shapes, serving purposes in financial transactions, real estate dealings, service agreements, and more.

The importance of transaction forms cannot be overstated; they not only protect the rights of both parties but also streamline operations by providing a clear reference point if disputes arise. Key elements of a common transaction form typically include the names and contact information of the parties, a description of the goods or services involved, payment details, and terms and conditions. Understanding these basic elements is crucial for effective transaction management.

Types of common transaction forms

Common transaction forms vary significantly depending on the context they are used in. For instance, sales agreements, purchase orders, and invoices each serve different purposes but share common features. A sales agreement outlines the terms under which a product is sold, while a purchase order is a buyer's formal contract to purchase goods from a supplier.

Understanding the difference between simple and complex transaction forms is also vital. Simple forms typically contain basic information, like names, amounts, and descriptions. In contrast, complex forms may require additional clauses for legal compliance or industry standards, often necessitating legal counsel. Examples of industry-specific forms can include lease agreements in real estate or service contracts in the freelance economy, each tailored to fit unique operational requirements.

Step-by-step guide to filling out a common transaction form

Filling out a common transaction form accurately is crucial for preventing misunderstandings and ensuring compliance with regulatory standards. Here’s a step-by-step guide to streamline the process:

Digital signatures and legal compliance

As businesses increasingly transition to digital practices, understanding digital signatures becomes imperative. A digital signature is an electronic representation of intent to sign a document and is legally binding in most jurisdictions, akin to a handwritten signature. When using common transaction forms, it’s essential to ensure that electronic signatures comply with legal standards to prevent disputes.

Using pdfFiller’s eSign features allows users to sign documents securely and efficiently. This tool ensures compliance with relevant laws, providing a streamlined process that validates the signature's authenticity. As a user, knowing how to implement these features can significantly enhance your transaction experience.

Collaboration and sharing options

Effective collaboration is essential when multiple parties are involved in a transaction. pdfFiller offers tools that allow teams to work on common transaction forms in real-time. This real-time collaboration enhances productivity and reduces the likelihood of miscommunication.

Sharing common transaction forms with stakeholders can be done easily through pdfFiller. By providing links or sending forms directly, you can keep everyone in the loop. Utilizing version control features also ensures that any changes made are tracked, allowing for clarity and preventing confusion over document updates.

Storing and managing your common transaction forms

Best practices for storing transaction forms securely are essential to minimize risks associated with data breaches and unauthorized access. With pdfFiller’s secure cloud storage, users can access their documents from anywhere while ensuring their safety and integrity.

Cloud storage facilitates easy access and sharing, greatly improving efficiency. Additionally, pdfFiller offers document management features that allow users to categorize forms, set reminders for renewals, and retrieve documents with ease, ultimately streamlining workflows.

Troubleshooting common issues

Encountering issues when filling out transaction forms is common, whether due to user error or confusion about specific requirements. Common errors include missing signatures, incorrect dates, or unresolved fields, all of which can lead to delays or disputes.

To address these problems, pdfFiller tools are invaluable. With features like form validation, users receive prompts to rectify mistakes, ensuring whether forms are correctly filled before submission. Furthermore, frequently asked questions (FAQs) can provide additional insights into resolving typical issues associated with managing and editing transaction forms.

Advanced tips for using common transaction forms efficiently

To maximize efficiency when working with common transaction forms, consider implementing automation features that allow for repeated use of standard forms. Automating routine documents, such as invoices or contracts, can save time and reduce the likelihood of errors.

Integrating common transaction forms with other business tools, such as CRM or accounting software, can further streamline processes. This integration allows for automatic data entry, minimizing repetitive tasks. Additionally, customizing forms to fit specific business needs will enhance their effectiveness, ensuring that they serve your unique operational goals.

Real-life case studies

Examining real-life applications of common transaction forms reveals their impact on efficiency and productivity. For instance, a small business might adopt a standardized invoice template that reduces billing time by 30%. Users of pdfFiller have reported increased turnaround times for document approvals and a decrease in errors due to the platform’s intuitive design.

Another success story involves a project manager utilizing pdfFiller to collaborate on contract negotiations in real-time. By directly editing and signing documents online, the team cut down negotiation cycles by over 50%, illustrating the transformative power of well-managed transaction forms.

Best practices for maintaining compliance and accuracy

Maintaining compliance and accuracy when using common transaction forms is vital for any business. Essential compliance checks include verifying that forms meet industry-specific regulations and ensuring they contain the necessary terms to uphold legal standards. Regular audits of your forms and processes can also help identify gaps in compliance.

Keeping up with regulations and standards relevant to your industry is crucial. This vigilance ensures your transaction forms remain compliant with current laws. Continuous learning and adaptation strategies, like attending webinars or subscribing to industry newsletters, can help users stay informed about evolving compliance requirements and best practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit common transaction form in Chrome?

How do I edit common transaction form on an iOS device?

How do I complete common transaction form on an Android device?

What is common transaction form?

Who is required to file common transaction form?

How to fill out common transaction form?

What is the purpose of common transaction form?

What information must be reported on common transaction form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.