Get the free Beneficiary Change Form

Get, Create, Make and Sign beneficiary change form

How to edit beneficiary change form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary change form

How to fill out beneficiary change form

Who needs beneficiary change form?

The Essential Guide to Beneficiary Change Forms

Understanding the beneficiary change form

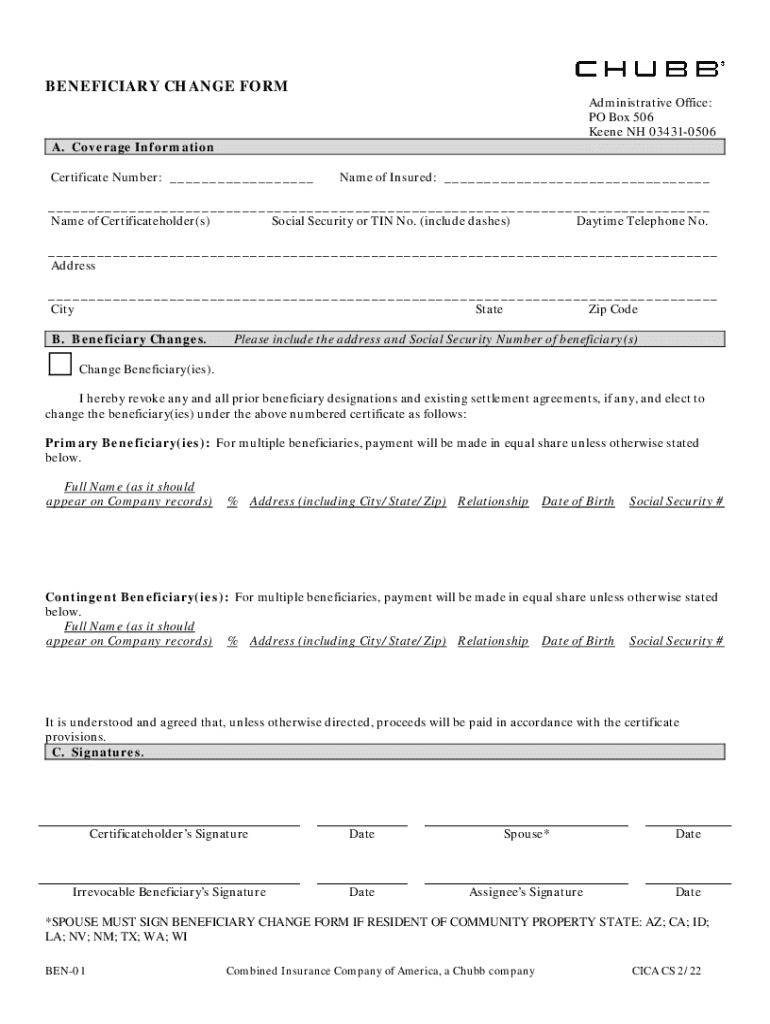

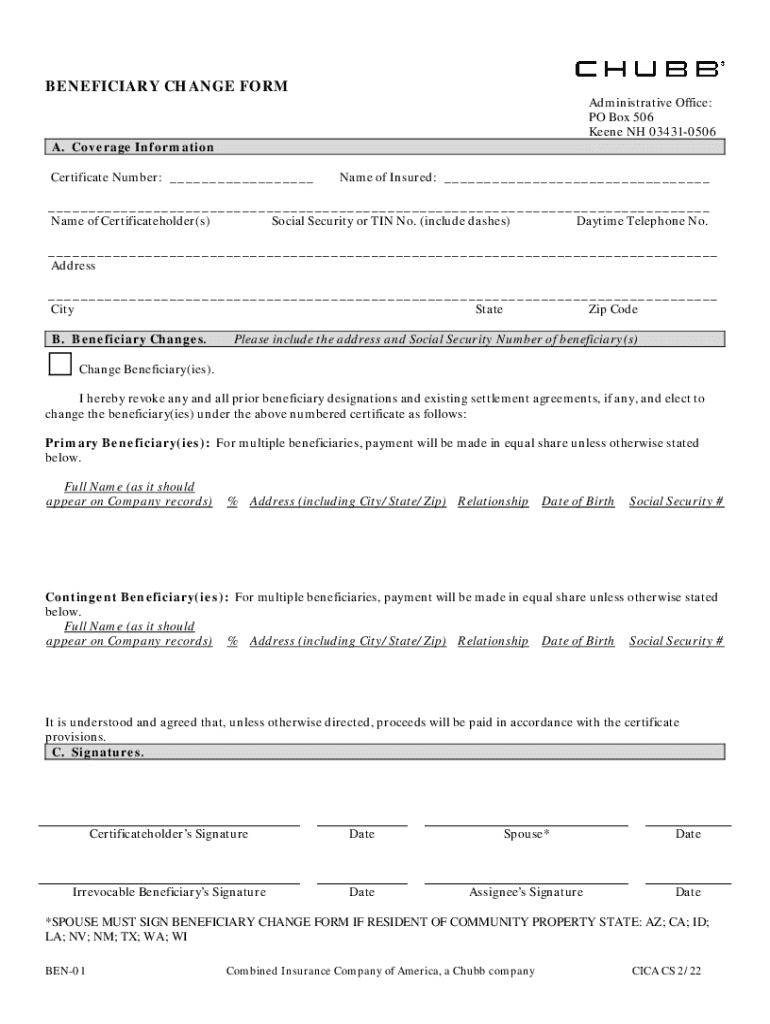

A beneficiary change form is a legal document that allows individuals to designate or update beneficiaries for various types of accounts and policies such as life insurance, retirement accounts, and trusts. Keeping this form updated is crucial since it directly impacts the distribution of benefits upon the policyholder's death, ensuring that funds go to the intended recipients without unnecessary complications.

Maintaining accurate beneficiary information is essential, as failing to update beneficiaries can lead to conflicts or, in worst-case scenarios, result in funds going to unintended family members or parties. Think about significant life events like the birth of a child, marriage, or divorce—each might necessitate a review of your beneficiary designations.

Types of beneficiary change forms

There are various beneficiary change forms tailored to specific types of accounts or policies. Understanding which form you need is crucial to protect your wishes and financial interests.

Life insurance beneficiary change forms enable policyholders to specify who will receive insurance proceeds. Retirement accounts have their own specific forms to enable changes, ensuring that funds are properly allocated upon death. Trust funds also require a beneficiary change form, particularly when beneficiaries change due to life events.

Health insurance beneficiary change forms help you list who will receive coverage or be involved in decisions about your medical care. Other variations exist, depending on institutions, such as forms used by benefits offices for servicemembers or dedicated clinics for specific programs.

Preparing to complete your beneficiary change form

Before you begin filling out a beneficiary change form, gather all necessary beneficiary information. This includes the full name, date of birth, and contact information of the individuals you wish to designate. Having this data handy will make the process more efficient.

Also, identify the specific type of beneficiary change form required for your needs, as each type serves a different purpose. Understanding state-specific requirements is equally important; some states have particular rules regarding beneficiary assignments, which could affect the validity of your form.

Step-by-step instructions for filling out the beneficiary change form

Filling out your beneficiary change form correctly is vital to ensure your wishes are honored. Start with Section 1, where you provide your personal information such as your full name, address, and contact details.

Next, move to Section 2, focusing on the current beneficiary details. It's crucial to accurately list all existing beneficiaries to avoid confusion. In Section 3, clearly articulate the changes you wish to make, detailing who is being removed and who will be added or changed.

Finally, Section 4 will require signatures and dates. Make sure to adhere to both your signing requirements and any witness requirements as dictated by your state or the policyholder’s institution.

To avoid common mistakes, double-check all entries, ensuring names are spelled correctly, and that you have provided accurate contact information.

Editing and modifying the beneficiary change form

In the digital age, modifying a beneficiary change form is easier than ever, especially when using tools like pdfFiller. Editing a PDF form using pdfFiller allows you to make the necessary adjustments, such as adding new beneficiaries or correcting errors without starting from scratch.

Ensure that any additional information fits seamlessly into the existing form format, limiting the potential for confusion. It’s paramount to keep the changes legally binding. Each modification must follow the same requirements as the original form to ensure it holds up in legal situations.

Signing the beneficiary change form

Once you’ve completed the beneficiary change form, signing it appropriately is the next step. If you're using pdfFiller, eSigning is an excellent feature, ensuring the document remains legally valid. It's essential to follow the provided steps meticulously to complete eSigning correctly.

In some situations, particularly with significant financial institutions, a witness signature may be required. Understanding when witness signatures are necessary can prevent delays in processing your change.

Submitting your completed beneficiary change form

After signing, submitting your beneficiary change form is the next crucial step. You can typically submit it via various methods, such as online through your financial institution's portal, by mailing a hard copy, or delivering it in person. Each method has its advantages, and selecting one will depend on your urgency and the specific instructions provided.

Once submitted, monitoring your form submission status can help confirm that changes are processed promptly. Most institutions provide a way to check the status of forms, ensuring your beneficiaries are updated as needed.

Managing your beneficiaries post-submission

After submitting your beneficiary change form, it is imperative to confirm that the changes have been processed. Contacting the institution directly is often the most reliable method for confirming updates. Additionally, documenting all changes made is essential; keeping copies of previously filed beneficiary change forms can provide clarity in the future.

Regularly reviewing and updating your beneficiary designations can simplify estate management and prevent future conflicts among family members, ensuring that your intents are honored.

Special considerations for specific groups

Certain groups, such as veterans and military personnel, have unique requirements regarding beneficiary change forms. Benefits offices often have specific protocols to follow when making changes to ensure compliance with both federal and state laws.

Additionally, changing beneficiaries for minors can pose complications, often requiring legal guardians to manage and oversee these changes. Similarly, divorce or separation often necessitates an urgent review of designated beneficiaries to prevent unintended distributions.

Utilizing pdfFiller for seamless document management

pdfFiller provides a robust suite of features for creating, editing, and managing document templates, including beneficiary change forms. Users can easily fill out forms on any device, whether at home or on the go, promoting increased accessibility.

The benefits of using pdfFiller include the ability to collaborate with family members on edits and share documents as needed, making the process of updating your beneficiary designations smoother. Tutorials are available within the platform, guiding users through each interactive tool, ensuring that everyone can make the most of their document management experience.

Frequently asked questions about beneficiary change forms

Updating your beneficiaries can often raise numerous questions. Many people wonder how often they should revisit their beneficiary designations—it's wise to do so after significant life events or at least every few years. Another common question is what happens if a beneficiary predeceases you; most institutions will revert to your estate if not specified otherwise.

Individuals also ponder over potential tax implications when making beneficiary changes, although generally, changing a beneficiary does not incur immediate tax consequences. It’s advisable to consult with a tax professional to discuss specific situations.

Conclusion: empowering your document management journey

Navigating the intricacies of a beneficiary change form can lead to a more secure financial future for you and your loved ones. By understanding the process, utilizing tools like pdfFiller for efficient document management, and keeping your beneficiary designations updated, you can minimize potential complications and assure that your wishes are honored.

Embrace the resources available through pdfFiller to take control of your documents. Managing beneficiary designations responsibly empowers not only you but also supports your family's peace of mind regarding future financial matters.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify beneficiary change form without leaving Google Drive?

How do I make changes in beneficiary change form?

How do I make edits in beneficiary change form without leaving Chrome?

What is beneficiary change form?

Who is required to file beneficiary change form?

How to fill out beneficiary change form?

What is the purpose of beneficiary change form?

What information must be reported on beneficiary change form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.