Understanding the Massachusetts Livestock Bill of Sale

Overview of the Massachusetts livestock bill of sale

The Massachusetts livestock bill of sale is a critical document used in agricultural transactions where livestock is sold or transferred between parties. This legally binding agreement serves the primary purpose of documenting the sale, ensuring clarity around ownership transfer, and offering protection for both buyers and sellers involved in the transaction. In Massachusetts, where agriculture plays a significant role in the economy, particularly in rural areas, the livestock bill holds importance not just for individual transactions but for maintaining accurate records within the agricultural community.

For buyers, having a solid and comprehensive livestock bill means they can prove ownership, which is particularly critical for breeding or legal identification purposes. Sellers, on the other hand, benefit from the bill as it mitigates disputes over livestock ownership and terms of sale. The livestock bill of sale encapsulates the necessary details of the sale and underlines the legitimacy of the transaction.

Understanding the Massachusetts livestock bill of sale requirements

In Massachusetts, specific legal requirements govern the livestock bill of sale to ensure transparency and legality in transactions. These requirements include the identification of both the seller and buyer, a clear description of the livestock involved, and any agreed-upon payment terms. Importantly, the bill of sale acts as proof of the sale, reinforcing the legality of ownership transfer. Furthermore, it's paramount to include livestock breed, age, and any identifying marks that clarify the specific animal being sold.

Different types of livestock may also dictate variations in the bill’s content. For instance, selling cattle may require additional health documentation, while horse sales often necessitate information about registration and potential performance records. Thus, mastering the details pertinent to the specific livestock category you are dealing with is essential to avoid compliance issues.

Using pdfFiller for your livestock bill of sale

pdfFiller offers an accessible solution for creating and managing your Massachusetts livestock bill of sale. Users can access a template specifically designed for livestock transactions directly from the platform. This cloud-based document solution is not only user-friendly but allows individuals and teams to edit, eSign, and manage their documents with ease, making it the perfect fit for buyers and sellers engaged in livestock sales.

The interactive tools available through pdfFiller enable users to personalize their documents effectively. Users can add in necessary details or clauses specific to their transaction, ensuring that the bill of sale is tailored to their unique circumstances. This level of customization is vital in fostering clear communication and reducing the potential for disputes.

Step-by-step guide to completing the livestock bill of sale

Completing a Massachusetts livestock bill of sale can be straightforward if you follow a structured approach. First, you need to gather necessary information such as seller and buyer details, including names, addresses, and contact information. You'll also need to collect specific livestock information, which includes breed, identification number if available, and any condition notes regarding the animal.

Next, select the correct form from pdfFiller’s extensive library. Once you've chosen your template, fill it out using the gathered data. Be sure to review the document for accuracy before finalizing it. After verifying all information is correct, utilize pdfFiller’s eSignature tool to secure the document. Finally, manage and store your bill of sale within the platform, making it easily accessible for future reference.

Tips for drafting an effective livestock bill of sale

When drafting a Massachusetts livestock bill of sale, clarity and specificity are paramount. Describing the livestock in precise terms helps prevent misunderstandings and potential disputes. Ensure that the physical condition, breed, age, and any distinguishing characteristics of the livestock are clearly outlined. Moreover, including specific terms of payment and delivery can eliminate ambiguity — be explicit whether payment is made upfront or via installments.

Both parties involved in the transaction should have a comprehensive understanding of their rights and obligations as documented in the bill of sale. Taking the time to discuss terms and addressing any questions before finalizing the document can foster trust and transparency throughout the transaction process. This can ultimately lead to smoother transactions and a stronger relationship between buyers and sellers.

Common challenges in creating a livestock bill of sale

Creating a livestock bill of sale can come with its set of challenges. One common issue is misunderstandings related to livestock ownership and the details surrounding the transfer of ownership. This reinforces the importance of including explicit terms in the bill. Miscommunication can lead to disputes that may require legal intervention, so it’s wise to craft a clear and detailed document.

Additionally, compliance with state regulations can present challenges for those unfamiliar with legal requirements. Issues such as failing to include necessary information or omitting required documentation can compromise the validity of the bill. Therefore, thorough research and a commitment to accuracy during completion are vital to creating a compliant document.

Who needs a Massachusetts livestock bill of sale?

A Massachusetts livestock bill of sale is essential for various stakeholders involved in livestock transactions. Buyers who purchase livestock need the bill to establish legal ownership and may require it for registration or health certificate purposes. Sellers likewise require the document as proof of the sale for their records. Additionally, livestock brokers and agents often utilize the bill of sale to formalize transactions and streamline processes between parties.

Any situation where livestock is sold, transferred, or leased can benefit from having a bill of sale. This document not only serves as a safeguard against future disputes but also offers a mechanism for accountability in livestock transactions. Given the financial investment involved in purchasing livestock, this document becomes essential for ensuring both parties fulfill their obligations.

When is a livestock bill of sale necessary?

A livestock bill of sale is necessary in numerous scenarios, including private sales, auctions, and even trade between parties. For private sales, it acts as a crucial piece of documentation confirming the transfer of ownership and can serve as evidence if disputes arise later. In auctions, buyers often need a bill of sale to validate the purchase and facilitate ownership transfer.

Moreover, legal protection for both parties is a significant reason to use a bill of sale. When both the buyer and seller sign it, they establish a mutual understanding of the transaction terms, which provides a reference point should disagreements surface. Documenting the sale is not just prudent; it is often a requirement for registry bodies or financial institutions involved in livestock dealings.

Advantages of using a Massachusetts livestock bill of sale

One of the major advantages of using a Massachusetts livestock bill of sale is the protection it offers against disputes between buyers and sellers. By clearly documenting the details of the sale, both parties have a reference they can rely on should any misunderstandings arise post-transaction. This proactive approach helps establish trust in agricultural transactions.

Furthermore, the bill facilitates smooth transactions by laying out the terms clearly for both parties. This clarity can expedite the process of buying or selling livestock and provides peace of mind for both sellers and buyers. Ultimately, the bill of sale also establishes clear ownership and the formal transfer of livestock, a necessity for continued agricultural business operations.

Special considerations for different types of livestock

When dealing with different types of livestock, special considerations apply to ensure legal compliance and accuracy in the bill of sale. For example, selling cattle may involve health documentation that proves the animal's condition and vaccination status, which is beneficial for the buyer’s peace of mind. Additionally, horses often come with a history of training and performance records that should be documented in the bill.

Sheep and other farm animals may have fewer requirements but still demand proper documentation to establish ownership and compliance with any state regulations. Each type of livestock has its unique considerations; thus, understanding what’s required ensures a smooth transaction process.

FAQs about the Massachusetts livestock bill of sale

When creating a Massachusetts livestock bill of sale, several questions often arise. Critical information required includes seller and buyer details, livestock characteristics, payment terms, and any specifics important to the transaction. Unlike other types of bills of sale, the livestock bill often requires additional details relevant to agricultural practices and health assurances.

Many users often wonder if they can customize the livestock bill of sale template in pdfFiller. The answer is a resounding yes. pdfFiller provides users with the flexibility to adjust templates, adding or removing information as needed to align with their specific livestock transaction requirements.

Sample livestock bill of sale

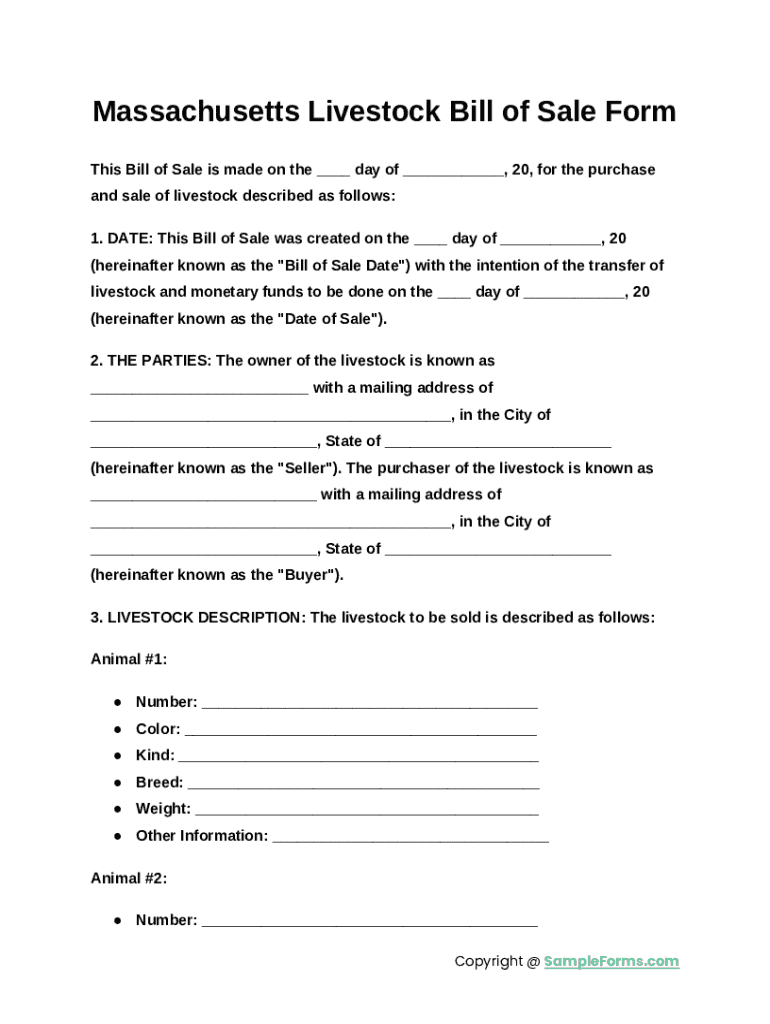

To aid users in drafting their own bills of sale, pdfFiller offers a preview of a completed livestock bill of sale template. This sample highlights key fields such as seller and buyer information, livestock identification details, payment terms, and any applicable conditions. By reviewing this sample, users can gain insight into what constitutes a thorough and legally compliant document.

The sample also emphasizes the importance of accurately filling out each field, as vague descriptions or incomplete information can lead to complications. Users should take the insights from the sample and apply them to their own unique transactions to maximize the effectiveness of their livestock bills of sale.

Related business documents for livestock transactions

Alongside the livestock bill of sale, several related business documents may be required when dealing with livestock transactions. For instance, health certificates, registration papers, and transportation permits kick in when the livestock moves from one location to another or when health checks are mandatory. Having these documents on hand ensures a seamless transaction where all legalities have been observed.

Accurate record-keeping and document management are crucial for ranchers and farmers. Implementing an organized system can help streamline operations, minimize confusion, and ensure that all necessary documentation is readily available during livestock sales.

Important terms for a bill of sale

Understanding key terms associated with livestock bills of sale is crucial for all parties involved. Terms such as 'consideration,' which refers to the payment made for the livestock, or 'as-is,' indicating that the buyer accepts the livestock in its current condition without warranties, are pivotal in streamlining transactions. 'Full disclosure' is another term that emphasizes the seller's obligation to provide any important information about the livestock that might affect the buyer's decision.

Being well-versed in these terms helps both buyers and sellers navigate their roles more effectively. By ensuring that everyone involved comprehends the terminology, potential disputes over the definitions can be mitigated, thus ensuring a smoother transaction.

Disclaimer regarding legal compliance

When engaging in livestock transactions, it’s important to frame your Massachusetts livestock bill of sale with legal compliance in mind. While this guide outlines essential aspects of the bill, always consult legal expertise tailored to your specific transactions. Each sale might entail different nuances based on livestock type, involved parties, or local regulations.

Understanding state laws governing livestock sales is imperative, as failure to comply with these regulations can lead to disputes or legal complications down the line. Efforts toward compliance enhance the credibility of the transaction and protect both parties involved.