Kansas Livestock Bill of Sale Form: A Comprehensive Guide

Overview of the Kansas Livestock Bill of Sale Form

The Kansas livestock bill of sale form is a crucial document in any livestock transaction, whether buying or selling. This legally binding record details the transfer of ownership and encapsulates all vital aspects of the transaction.

Utilizing a bill of sale is paramount for both buyers and sellers. It protects them by providing evidence of the transaction, outlining terms, and clarifying ownership rights. A well-structured form minimizes the risk of misunderstandings that could lead to disputes.

Identification of the parties involved (buyer and seller).

Detailed description of the livestock being sold.

Agreed sales price and payment terms.

Signatures of both parties to validate the sale.

Downloading the Kansas Livestock Bill of Sale Template

Accessing the Kansas livestock bill of sale template is straightforward with pdfFiller. You can find it in customizable formats to suit your needs, ranging from PDF to Word documents.

Having access to a template allows you to modify it to fit specific details concerning the transaction. This not only streamlines the process but also ensures compliance with local regulations.

Visit pdfFiller and navigate to the template section.

Download the form in your chosen format (PDF, Word, etc.).

Utilize the editing tools to fill in your transaction details easily.

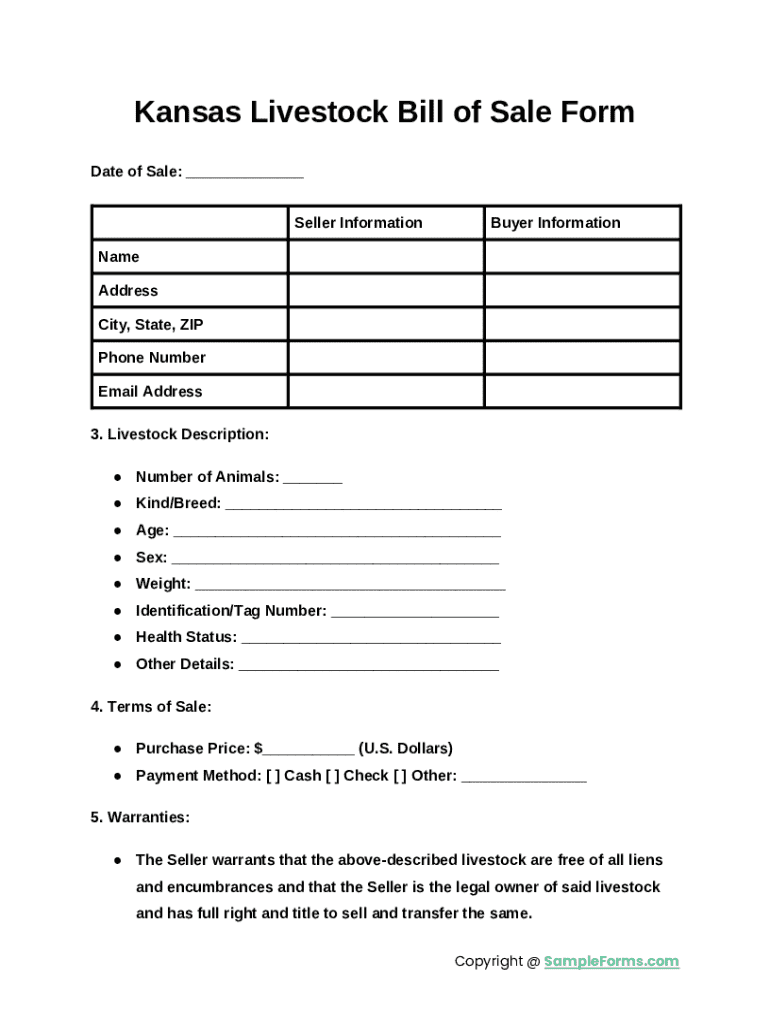

Understanding key components of the Kansas livestock bill of sale form

A robust understanding of the key components of the Kansas livestock bill of sale form will aid in completing it accurately. First and foremost, you’ll need the seller's information, which includes the name, address, and contact number, ensuring proper identification.

Similarly, it is crucial to capture the buyer's information, which must also include full contact details to establish clear ownership transfer. Next, a comprehensive description of the livestock is essential. This should cover aspects such as breed, age, health status, and any identifying marks to avoid any confusion.

Clarity on price and payment terms is non-negotiable. Specify whether payment has been made in full or will be made later, which sets expectations for both parties. Lastly, obtain signatures from both parties once all details are filled out, validating the transaction.

Detailed instructions for filling out the Kansas livestock bill of sale

Filling out the Kansas livestock bill of sale form can be a straightforward process if followed step by step. Begin by entering the buyer and seller information accurately. Identify roles clearly to avoid any ambiguity.

Next, provide a detailed description of the livestock. Include breed, age, sex, health status, and any other pertinent details. The more information included, the better for clarity. Then, specify the payment terms. Is there a payment plan? Is it a cash payment?

If any additional clauses need to be included, such as health guarantees or stipulations surrounding future care, make sure to outline them clearly before both parties sign.

Enter full names and addresses of both buyer and seller.

Provide an accurate description of the livestock.

Specify clearly the payment terms.

Include additional clauses if needed.

Tips for drafting an effective livestock bill of sale

When drafting a livestock bill of sale, ensuring clarity and specificity in language is key. This minimizes potential misunderstandings that may arise post-transaction. Avoid ambiguous terms or jargon that may not be universally understood by all parties.

Legal pitfalls often stem from minor oversights. Watch out for incomplete details or vague terms. It’s also crucial to document all components of the transaction thoroughly, which serves as evidence should any disputes arise.

Use clear and concise language.

Double-check all information for accuracy.

Retain copies of the bill of sale for both parties.

Common challenges in creating a livestock bill of sale

Creating a livestock bill of sale isn’t without its challenges. A common issue arises from misunderstanding the state-specific requirements governing livestock transactions; ignorance of regulations can lead to complications down the road.

Complex sales, such as selling multiple livestock or bundled transactions, can add layers of confusion. Documenting specifics for each individual animal in these cases becomes crucial.

Additionally, disputes can often occur post-sale. Therefore, it's advisable to keep detailed records of all communications and documents related to the sale to protect all parties involved.

Understand your state's specific requirements.

Document each animal clearly in complex sales.

Keep detailed records of communications.

Who needs a livestock bill of sale?

A livestock bill of sale is crucial for anyone involved in buying or selling livestock. This includes farmers, ranchers, and private sellers who seek to establish formal proof of transaction. It’s vital not only for individual sellers but also for businesses where accountability and traceability are paramount.

Buyers should also be diligent in obtaining a bill of sale to ensure clarity of ownership and rights concerning the livestock. This form is particularly important in different selling scenarios, whether at auctions or private sales, where it serves as protection for both parties.

Farmers and ranchers looking to sell livestock.

Private sellers requiring proof of sale.

Buyers aiming for clear ownership documentation.

When is a livestock bill of sale needed?

A livestock bill of sale is essential in various scenarios, most notably during transactions involving sales, transfers, and even gifts of livestock. Each transaction strengthens the need for clear documentation to avoid future disputes regarding ownership or terms.

Additionally, documentation is crucial in instances of trade or exchange where clarity regarding the terms of the transaction can be ambiguous. A bill of sale helps combat potential misunderstandings and provides legal backing.

Sales of livestock between private parties.

Transfers of livestock ownership to different entities.

Gifts or exchanges involving livestock.

Advantages of using a Kansas livestock bill of sale

Utilizing a Kansas livestock bill of sale provides significant advantages for both buyers and sellers. By using a formal document, each party achieves legal protection through documented consent to the transaction terms. This clarity fosters better trust and transparency, vital attributes for any business transaction.

Additionally, a well-prepared bill of sale simplifies future transactions. Maintaining clear records makes it easier to reference past sales during tax considerations or for future audits. For farmers and ranchers, this can streamline record-keeping efforts substantially.

Legal protection for both parties involved.

Easier to manage future transactions.

Facilitates record-keeping for accountability.

FAQs about the Kansas livestock bill of sale form

Understanding the specifics surrounding the Kansas livestock bill of sale form is critical. Here are some frequently asked questions that can enhance your comprehension of its purpose and requirements.

What should be included in a bill of sale? Essential details include seller and buyer information, livestock description, agreed price, and signatures.

Is a bill of sale necessary for every livestock sale? Yes, to ensure all ownership rights are legally documented.

How do I ensure my bill of sale is legally binding? Complete all required fields accurately and ensure signatures from both parties.

What if there is a dispute after the sale? Documenting all communication and maintaining records can provide protection.

Sample Kansas livestock bill of sale

An illustrated example of a completed Kansas livestock bill of sale can serve as a valuable reference. In this example, we see how both buyer and seller details are clearly presented, along with the livestock’s detailed description.

This sample emphasizes the importance of including all necessary terms and conditions, guiding users through a practical view of the form and outlining best practices for completion.

Legal & security considerations

Engaging in livestock sales necessitates a keen awareness of state laws affecting such transactions. Compliance with Kansas's specific regulations can help prevent legal disputes arising from improper title transfers or sales documentation.

Moreover, as digital transactions continue to rise, securing these documents becomes increasingly important. Employing secure digital platforms like pdfFiller can ensure that your bills of sale and related paperwork stay protected and accessible as you manage your livestock business.

Familiarize yourself with state laws on livestock sales.

Utilize digital services for secure documentation.

Retain copies both digitally and physically for record-keeping.

Related forms and documents

Beyond the livestock bill of sale, several other relevant agricultural forms may arise in various contexts. For instance, if you engage in leasing livestock, maintaining a livestock lease agreement can be essential.

Understanding when to utilize these forms in conjunction with the Kansas livestock bill of sale facilitates comprehensive management of livestock transactions, ensuring that all aspects of official documentation are covered.

Livestock lease agreements for rental transactions.

Health certificates confirming livestock status.

Sales invoices to track payment details.