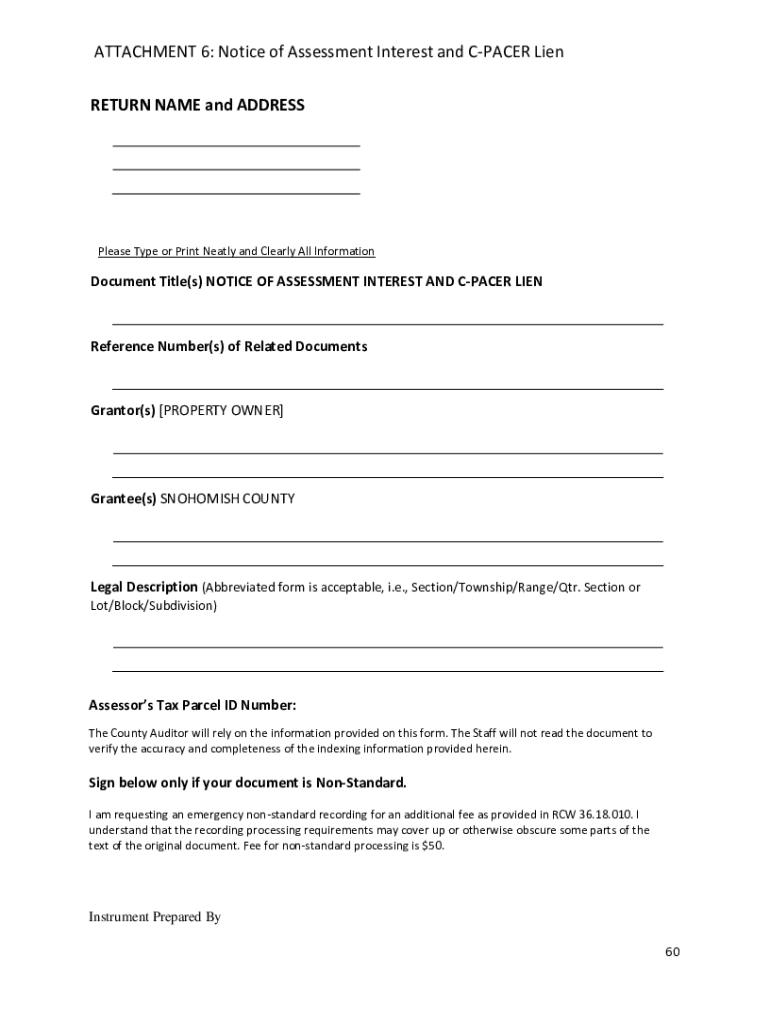

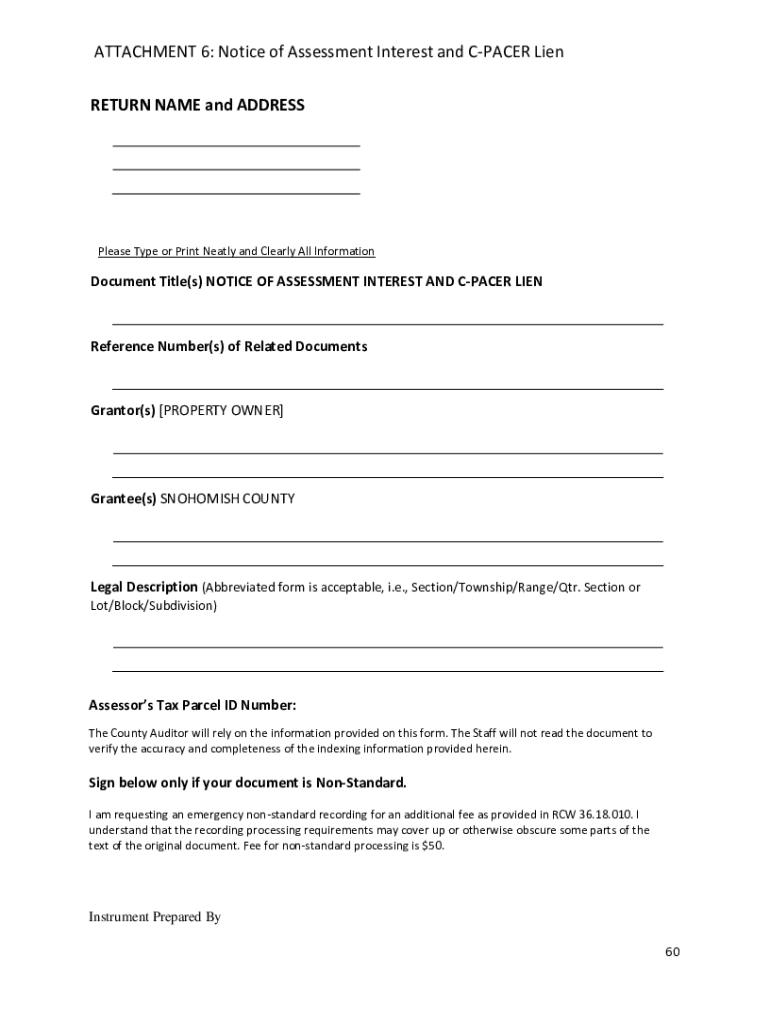

Get the free Notice of Assessment Interest and C-pacer Lien

Get, Create, Make and Sign notice of assessment interest

Editing notice of assessment interest online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of assessment interest

How to fill out notice of assessment interest

Who needs notice of assessment interest?

Understanding the Notice of Assessment Interest Form

Understanding the Notice of Assessment Interest Form

The Notice of Assessment Interest Form is a crucial document used by individuals and businesses to detail and appeal the interest applied to an assessment imposed by tax authorities. This form acts as a formal record of disagreements related to calculations of interest based on overdue taxes or assessments. It not only informs the taxpayer of the interest accrual but also provides them with the opportunity to contest incorrect charges.

Being well-versed in the purpose of this form is important. Mainly, it serves to protect the taxpayer's rights and outlines the responsibilities of both the taxpayer and the tax authorities. By understanding this form, taxpayers can ensure that their submissions are accurate and complete, helping them potentially save significant amounts of money from improperly calculated interest.

Key components of the Notice of Assessment Interest Form

The Notice of Assessment Interest Form consists of various sections, each designed to collect critical information needed for effective assessment and resolution. The primary sections of the form include Personal Information, Assessment Details, Interest Calculation, and Signatures and Declarations.

Understanding these components allows taxpayers to effectively navigate the form, ensuring each section is completed thoroughly and accurately.

Who needs to complete this form?

Filling out the Notice of Assessment Interest Form is typically necessary for any individual or organization that has received a notice of assessment from a tax authority indicating the imposition of interest on unpaid taxes. This includes taxpayers who initially disagreed with the amounts assessed and wish to contest the interest added.

Criteria for needing to fill out this form generally revolve around situations where a taxpayer believes that the interest charged is excessive, miscalculated, or based on an incorrect assessment. For example, businesses undergoing audits or individual taxpayers facing back taxes may find themselves in need of this documentation.

Step-by-step instructions for filling out the form

Filling out the Notice of Assessment Interest Form can seem overwhelming, but following these instructions can simplify the process.

By following these steps, taxpayers can ensure their form is filled out correctly and submitted within deadlines.

Understanding the interest calculation

Interest on assessments is calculated based on various factors including the period of the assessment, the interest rate adopted by the tax authority, and the principal amount owed. Understanding how this interest is computed can help taxpayers identify if the amounts assessed are accurate.

Several tools and resources available on pdfFiller can aid in calculating this interest. Several calculators enable taxpayers to input necessary figures to understand the interest at stake better. Furthermore, ensuring that one comprehensively documents all relevant dates can enhance accuracy in calculations.

Common issues and how to address them

Throughout the completion process, common issues such as incorrectly filled sections or missing information can arise. Taxpayers often overlook details that lead to form delays or rejection from authorities. If sections are filled incorrectly, it may result in incorrect assessments being upheld.

Understanding deadlines is pivotal; many authorities offer strict timelines for submissions which, if missed, might affect the outcome negatively. Utilize pdfFiller’s reminders and alerts, ensuring all submissions are timely and complete.

What to expect after submission

Once the Notice of Assessment Interest Form has been submitted, taxpayers can typically expect a processing timeline designated by the relevant tax authority. Notification of acceptance, rejection, or requests for additional information usually follows.

Tracking the status of your form can provide updates on the evaluation process. Most authorities allow for online tracking, giving taxpayers visibility into their submissions and any subsequent steps.

Rights and responsibilities of the taxpayer

Understanding taxpayer rights regarding assessments is essential. Taxpayers have the right to dispute incorrect assessments and seek clarifications on charges made against them. Additionally, all correspondence should be transparent, with authorities required to provide clear explanations regarding assessed interest.

Simultaneously, taxpayers have responsibilities, such as ensuring all information submitted is accurate and complete. Keeping track of all documentation is vital when navigating post-submission responsibilities.

Alternatives and options for disputing the assessment

In cases where taxpayers disagree with the assessment, they have several options for disputing it. These can include filing a formal dispute or protest, which provides a structured method to present their case.

Using pdfFiller simplifies the process of documenting these disputes. Taxpayers can easily create, fill out, and submit relevant forms for disputes. Other options include seeking a penalty waiver if applicable, and consulting tax professionals for additional assistance.

Support and help

For additional information regarding the Notice of Assessment Interest Form, it’s crucial to consult the frequently asked questions provided within the pdfFiller platform. Many queries often arise centered around submission processes and form requirements.

Accessing customer support through pdfFiller can also greatly assist taxpayers in resolving challenges they may encounter. Utilizing community forums might also prove beneficial, as users share experiences and solutions that can guide new users through their forms.

Related forms and documentation

Understanding additional forms associated with the Notice of Assessment can be beneficial, especially if disputes arise. Forms for appeals or adjustments may be necessary depending on individual circumstances.

Identifying when to use related forms ensures that taxpayers are adequately represented in their disputes, helping them achieve favorable outcomes based on clear documentation.

Leveraging pdfFiller for document management

pdfFiller provides significant advantages for managing tax-related documents, including the Notice of Assessment Interest Form. Users can enjoy its seamless document editing capabilities, robust e-signature options, and collaborative features that enhance team efficiency.

The platform’s cloud-based nature means taxpayers can access forms and documents from anywhere. This flexibility is essential for individuals or teams managing multiple assessments or needing to coordinate documentation across different locations.

User experiences and testimonials

Successfully completing the Notice of Assessment Interest Form can lead to numerous favorable outcomes for taxpayers. Various case studies highlight how users have successfully navigated their submissions with pdfFiller, achieving significant savings and transparent assessments.

Feedback regarding pdfFiller often revolves around the ease of use and the supportive customer service. Users report feeling empowered when using the platform, capable of submitting forms efficiently and effectively, ultimately allowing them to focus on their core responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit notice of assessment interest online?

How do I make edits in notice of assessment interest without leaving Chrome?

Can I sign the notice of assessment interest electronically in Chrome?

What is notice of assessment interest?

Who is required to file notice of assessment interest?

How to fill out notice of assessment interest?

What is the purpose of notice of assessment interest?

What information must be reported on notice of assessment interest?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.