Get the free Pa Schedule Nw

Get, Create, Make and Sign pa schedule nw

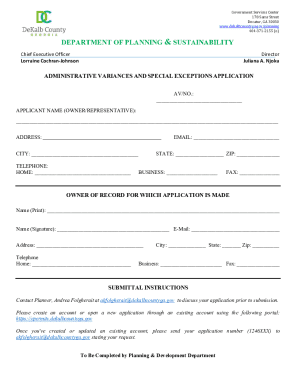

How to edit pa schedule nw online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pa schedule nw

How to fill out pa schedule nw

Who needs pa schedule nw?

PA Schedule NW Form - A Comprehensive Guide

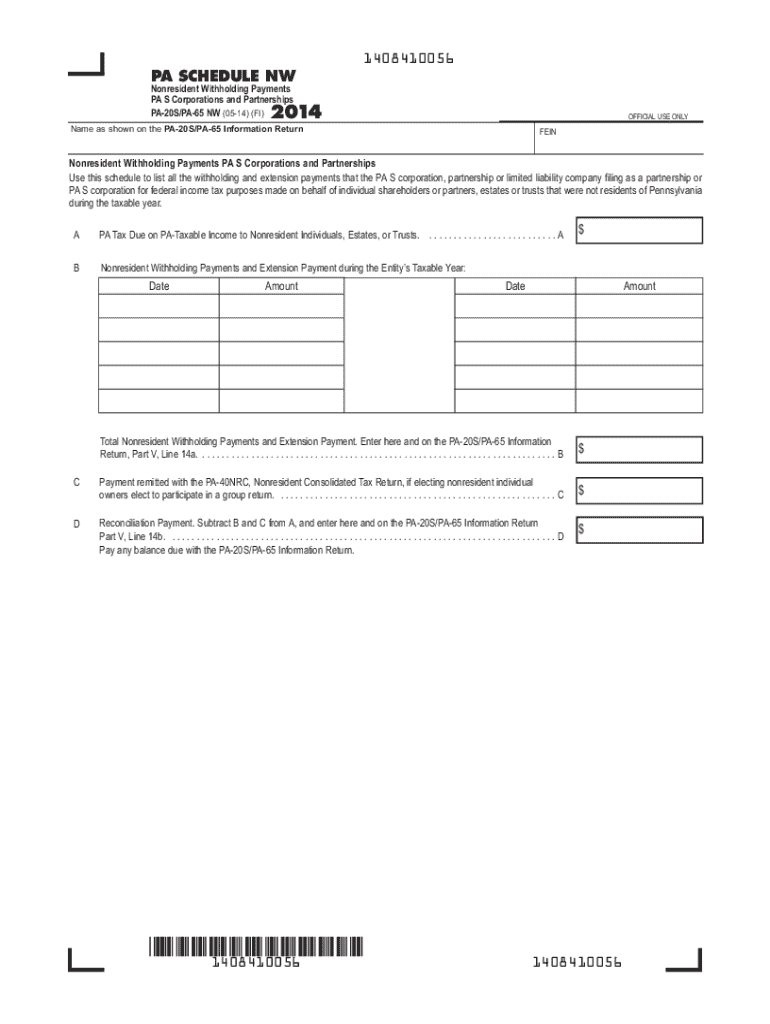

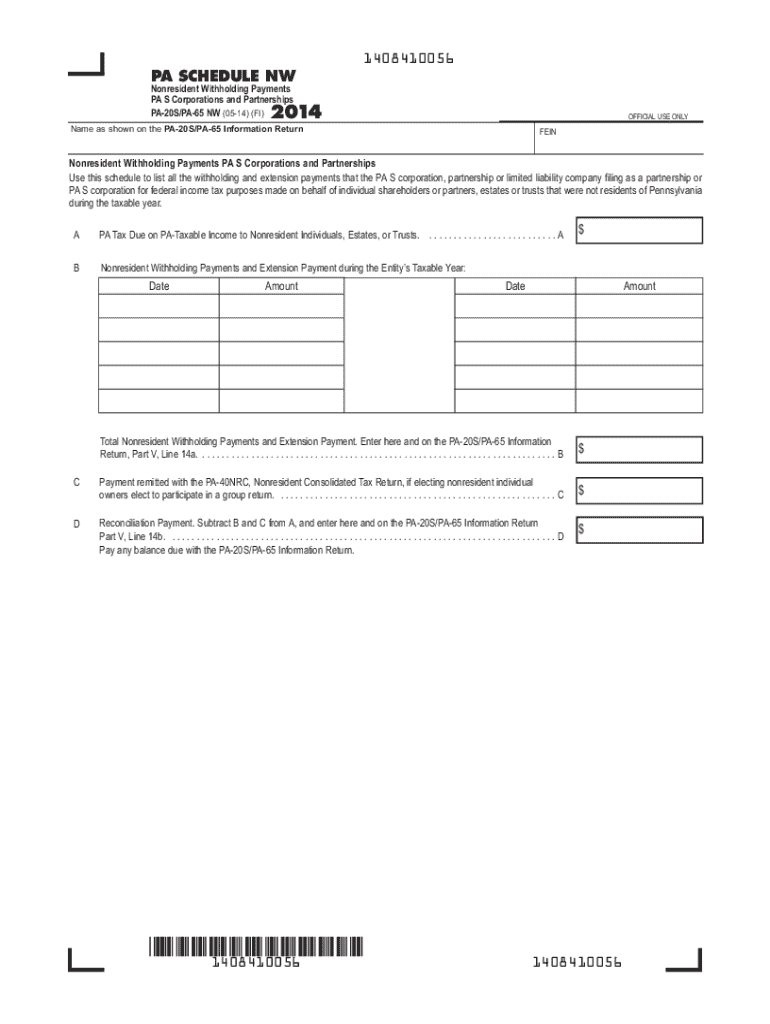

Understanding the PA Schedule NW Form

The PA Schedule NW Form is a crucial document required for reporting certain types of income received by residents of Pennsylvania. This form is particularly relevant for those who are either self-employed or engaged in a business that generates income subject to Pennsylvania taxation. Understanding how to accurately complete this form is vital for compliance with state tax regulations.

Its importance in the context of Pennsylvania tax regulations cannot be overstated. Failing to submit the PA Schedule NW Form properly can lead to serious legal and financial repercussions. By submitting this form, taxpayers ensure they meet Pennsylvania's tax obligations and can potentially qualify for tax benefits.

Key features of the PA Schedule NW Form

The PA Schedule NW Form serves multiple purposes in the realm of Pennsylvania taxation. Primarily, it is used to report income that is derived from a business or profession and is not subject to federal withholding. Understanding who needs to file and the eligibility criteria is essential, as incorrect assumptions can lead to filing errors.

Generally, individuals who make income in Pennsylvania and are not subject to federal withholding need to file the PA Schedule NW Form. This includes self-employed individuals, freelancers, and independent contractors. The eligibility for filing often hinges on tax residency status and whether the income surpasses certain thresholds set by the state.

Step-by-step instructions for completing the PA Schedule NW Form

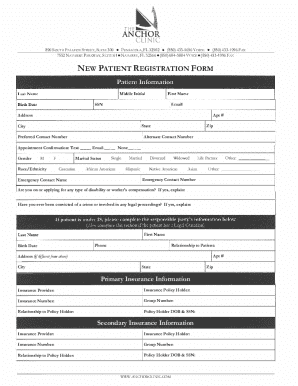

Completing the PA Schedule NW Form accurately requires attention to detail and the proper documentation. Initially, it is essential to gather all necessary information, including financial records and personal identification details. This prep work will streamline the actual filling out of the form.

Start with the personal information section, ensuring that all names, addresses, and identification numbers (like Social Security or tax identification numbers) are correct. Move on to the income reporting section where you will detail various income streams, followed by sections on deductions and credits which could potentially reduce your taxable income.

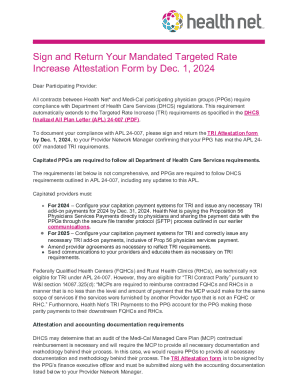

Digital tools and resources for filling out the PA Schedule NW Form

Utilizing digital tools can significantly enhance your experience when filling out the PA Schedule NW Form. pdfFiller offers a suite of features aimed at simplifying document management. Accessing the PA Schedule NW Form is straightforward, and its interactive features assist users in ensuring they do not miss any required fields.

The benefits of using pdfFiller include eSigning capabilities, which allow for seamless tax submissions without the hassle of printing documents. Furthermore, it offers collaboration features that enable multiple team members to work on the form together, ensuring accuracy and cohesiveness.

Frequently asked questions (FAQs) about the PA Schedule NW Form

As taxpayers embark on filing the PA Schedule NW Form, several common questions often arise. For instance, what should one do if a mistake is discovered post-filing? Usually, it's advisable to contact the Pennsylvania Department of Revenue for guidance on correcting the error.

Another typical concern involves amending a submitted PA Schedule NW Form. Taxpayers may need to file a specific amendment form if they need to adjust their originally submitted figures. Lastly, for additional support, resources are available through tax professional services or the state’s revenue department.

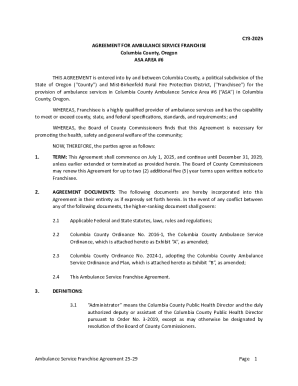

Important deadlines and filing guidelines

Awareness of critical deadlines is paramount when filing the PA Schedule NW Form. The last day to submit this form for the current tax year is generally April 15th, unless otherwise stated by the state. It's essential to adhere to these timelines to avoid unnecessary penalties or interest charges associated with late filing.

For optimal compliance, ensure the form is completed thoroughly and submitted on time. If necessary, explore options for extensions which can provide additional time beyond the typical deadline. However, it's crucial to be aware that any taxes owed must still be paid by the original deadline to avoid accruing interest.

Additional considerations

When dealing with the PA Schedule NW Form, several additional considerations emerge. Stay vigilant about any state-specific nuances that could affect your filing. Tax laws are subject to change, so regularly monitoring updates or revisions in tax regulations will help maintain compliance and avoid any unforeseen issues.

Maintaining organized tax records is pertinent for not just this form but for all tax-related matters. Investing in a systematic record-keeping method will make future filings simpler. This includes cataloging receipts, income statements, and prior tax returns, which is invaluable come tax season.

Conclusion: Navigating the PA Schedule NW with confidence

In summary, the PA Schedule NW Form plays a vital role in ensuring compliance with Pennsylvania tax regulations. Understanding how to fill it out and the implications of ensuring accuracy can save filers from unnecessary complications. With digital tools like those offered by pdfFiller, users can streamline their filing process, allowing them more time to focus on what truly matters.

Utilizing these resources empowers individuals and teams to manage and submit their documents effectively, promoting a stress-free tax season. By navigating the PA Schedule NW Form confidently, taxpayers set the stage for a smoother financial year ahead.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get pa schedule nw?

How do I make edits in pa schedule nw without leaving Chrome?

Can I edit pa schedule nw on an Android device?

What is pa schedule nw?

Who is required to file pa schedule nw?

How to fill out pa schedule nw?

What is the purpose of pa schedule nw?

What information must be reported on pa schedule nw?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.