Get the free Official Form 122a-1

Get, Create, Make and Sign official form 122a-1

Editing official form 122a-1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out official form 122a-1

How to fill out official form 122a-1

Who needs official form 122a-1?

A comprehensive guide to the Official Form 122A-1 form

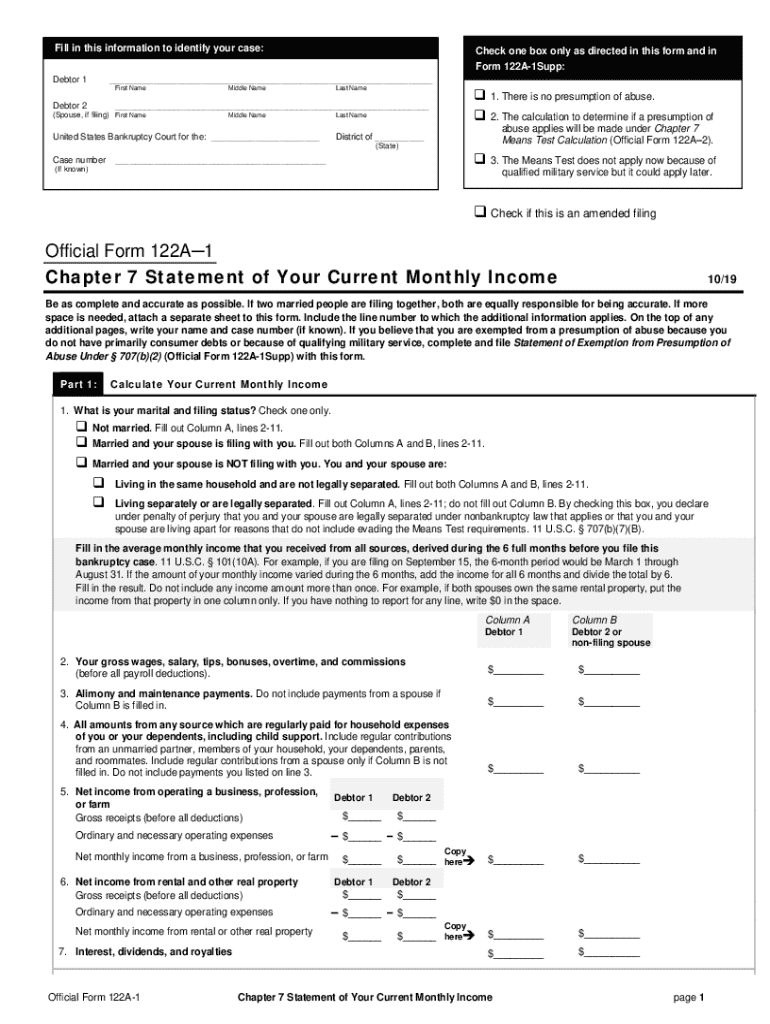

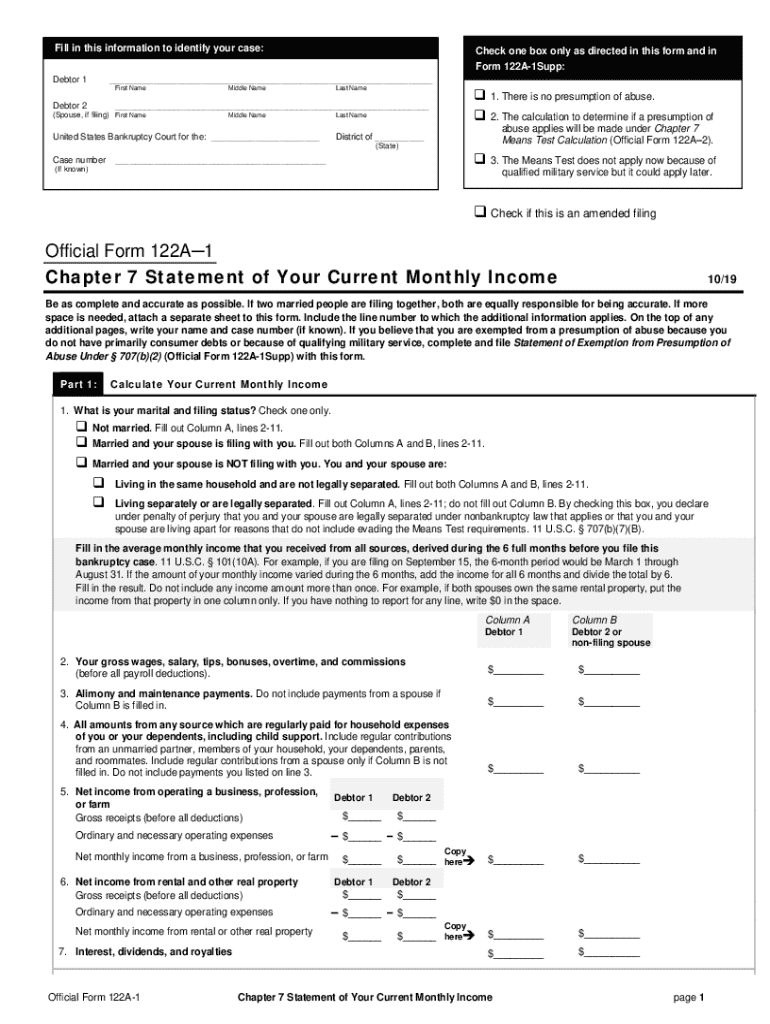

Understanding the Official Form 122A-1

The Official Form 122A-1 is a crucial document used in the bankruptcy process, specifically for individuals seeking to file for Chapter 7 bankruptcy. This form assesses whether an individual's income is low enough to qualify for Chapter 7 bankruptcy relief. By submitting this form, debtors demonstrate their financial condition, which is pivotal for their bankruptcy proceedings. The importance of accurate information cannot be overstated; incorrect data can lead to rejections or additional complications in the filing process.

Individuals who need to file the Official Form 122A-1 typically include those with unsecured debts, such as credit card debt, personal loans, and medical bills. If your income falls below the median income for your state and family size, this form will help determine your eligibility for Chapter 7 bankruptcy. It provides a streamlined approach to distinguish between those who truly need bankruptcy relief and those who may have other options available.

Key terminologies explained

Understanding the terms associated with the Official Form 122A-1 enhances your comprehension of the bankruptcy process. The 'means test' is designed to evaluate a debtor's financial situation compared to the median income levels in their state. It serves as a critical threshold to determine if filing for Chapter 7 is appropriate based on current income and obligations.

The term 'debtor' refers to the individual or entity that owes money to creditors, while 'creditors' are those to whom the money is owed. In the context of Chapter 7 bankruptcy, the debtor seeks to eliminate or restructure debts, allowing a fresh financial start. Understanding these key terminologies aids in navigating the complex landscape of bankruptcy.

Preparation steps for filing Official Form 122A-1

Before filing the Official Form 122A-1, gathering all necessary documentation is essential. This includes financial records that illustrate both income and expenses. Commonly required documents consist of recent pay stubs, tax returns, bank statements, and any other financial records that capture your current financial state. Accurate documentation provides a clear perspective of your finances and supports your case for bankruptcy.

Additionally, personal information such as your monthly income, household expenses, and any other obligations must be detailed on the form. Understanding your net income, which is your total income minus necessary business and personal expenses, is vital in ensuring you meet eligibility criteria for Chapter 7 bankruptcy.

While determining income, it’s also essential to assess family size, as this directly affects eligibility under the means test. The calculation for median income varies depending on the number of people in your household, typically using the census data. Special considerations, including common exemptions for secured debts like mortgages or student loans, may also apply and must be documented correctly.

Detailed breakdown of Official Form 122A-1

The Official Form 122A-1 consists of several key sections that facilitate the means test evaluation. Part 1 asks for the calculation of current monthly income, where debtors must list income from all sources, including wages, pensions, and government benefits. Being thorough in this section ensures compliance and accuracy during the bankruptcy review process.

Part 2 compares the debtor's income against the applicable median family income for their state, based on their family size. This part is vital in assessing whether the debtor's income falls below the median, which is the primary determinant for Chapter 7 eligibility. If the income exceeds the median threshold, the form may require additional calculations, impacting the bankruptcy process.

Part 3 focuses on deductible expenses, where monthly expenses must be itemized, detailing necessary living costs. The deductions play a critical role in determining disposable income, subsequently influencing the conclusion made in Part 4 regarding the means test outcome. This section helps paint a clearer picture of the debtor’s financial scenario.

For those seeking assistance, interactive tools such as income calculation tools and deduction estimators can simplify the completion process. Such resources are incredibly beneficial in accurately navigating the complexities tied to financial disclosures in bankruptcy law.

Step-by-step instructions for completing Official Form 122A-1

Filling out the Official Form 122A-1 requires meticulous attention to detail. Start by navigating through the various sections, beginning with personal information. In this section, include your name, address, and social security number to ensure clarity and verification of identity. It’s crucial to keep this data secure and properly formatted.

Next, document your income sources. List your wages, business income, and any supplemental earnings. Each source must be adequately reported to provide a complete financial picture. When detailing monthly expenses, be specific about fixed costs, including rent, utilities, and groceries, as these figures will directly affect the means test outcome.

As you fill in each section, be mindful of common mistakes. Inaccuracies in income reporting, miscalculated expenses, or failure to include all relevant deductions can lead to complications or rejection of your bankruptcy case. Double-checking the entries before submission can alleviate many potential problems.

Strategies for efficient filing and submission

When it comes time to submit the Official Form 122A-1, choosing the right filing method is vital. Electronic filing streamlines the process, offering immediate confirmation of receipt by the bankruptcy court. Alternatively, paper filing may take longer, hindering prompt processing of your case. Choosing the right approach depends on personal preference and the ability to navigate electronic systems comfortably.

Utilizing platforms like pdfFiller can significantly ease the submission process. This tool allows for smooth document management, including the electronic filing of forms, thereby enhancing efficiency. Organizing documents through pdfFiller ensures that all necessary papers are assembled, ready for submission.

Another advantage of using pdfFiller is the capability to use e-signatures. This feature allows for quick signing of documents, eliminating the need for printing and scanning, which can delay your case progression. Using electronic methods not only saves time but also simplifies the workflow significantly.

After filing Official Form 122A-1

Once you submit the Official Form 122A-1, it’s essential to be prepared for the ensuing bankruptcy proceedings. The timeline can vary, but generally, you can expect to hear back from the bankruptcy court within about 4 to 6 weeks. This period may include requests for more information or documentation if any discrepancies are found. Staying proactive and open to communication is vital to moving forward smoothly.

Preparing for potential outcomes is equally important. The court may approve your Chapter 7 bankruptcy, allowing you to discharge most unsecured debts, or it could reject your filing if it finds your income too high or if there are inaccuracies in your reported information. Understanding the implications of either outcome enables you to develop a strategy, including potential appeals or alternative debt relief options.

Frequently asked questions about Official Form 122A-1

As you navigate the complexities of the Official Form 122A-1, it's common to have questions. One of the frequent queries is regarding the duration of the entire bankruptcy process. Typically, after filing the form, debtors can expect the entire process to take several months, although each case may differ due to various factors.

Another concern often arises about what happens if an individual's financial situation changes after filing. If your income increases or your expenses change substantially, you are obliged to inform the bankruptcy court, as this could impact your ongoing case. Being transparent with the court is essential to avoid complications.

Conclusion on the importance of accurate filing

Completing the Official Form 122A-1 accurately is vital for a successful bankruptcy filing, ultimately impacting a debtor's financial future. Errors in reducing debts can prolong the process or even result in unmet goals regarding debt relief. Using an efficient platform like pdfFiller further streamlines this important task. With cloud-based capabilities, users can manage documents seamlessly, edit PDFs, and eSign necessary paperwork from anywhere.

The role of pdfFiller in this process cannot be understated—as it empowers users to navigate complex documentation easily, ensuring all forms are completed correctly. By leveraging such resources, individuals can enhance their bankruptcy experience, achieving a smooth and efficient resolution to their financial challenges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my official form 122a-1 directly from Gmail?

How do I execute official form 122a-1 online?

How do I edit official form 122a-1 straight from my smartphone?

What is official form 122a-1?

Who is required to file official form 122a-1?

How to fill out official form 122a-1?

What is the purpose of official form 122a-1?

What information must be reported on official form 122a-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.