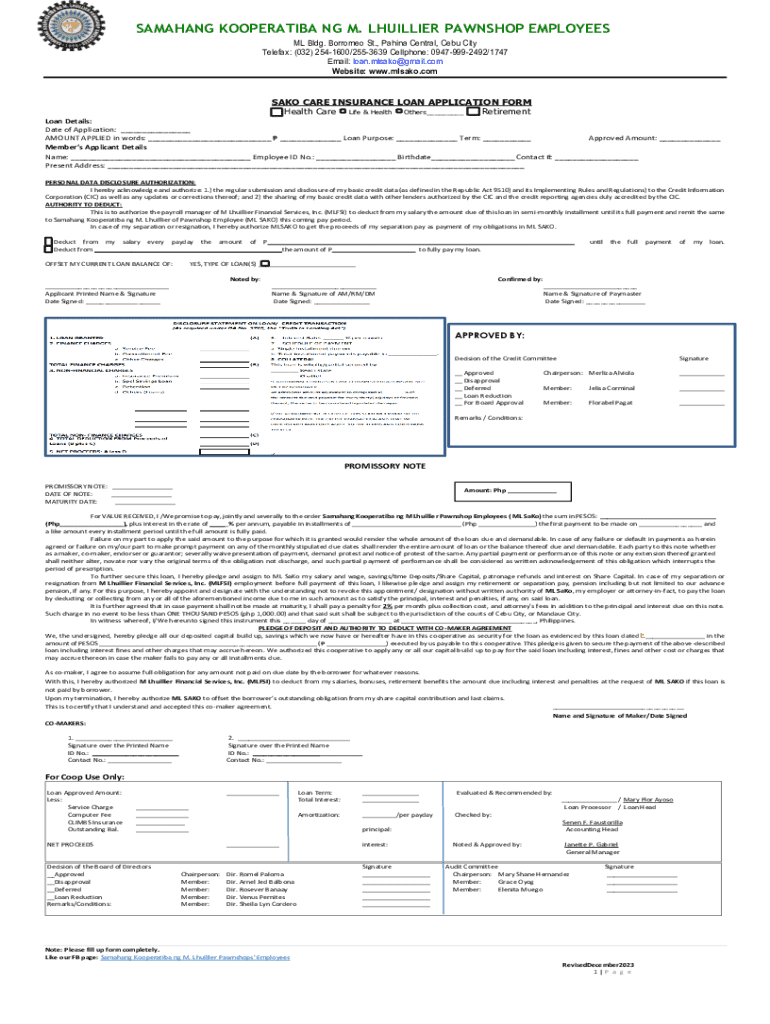

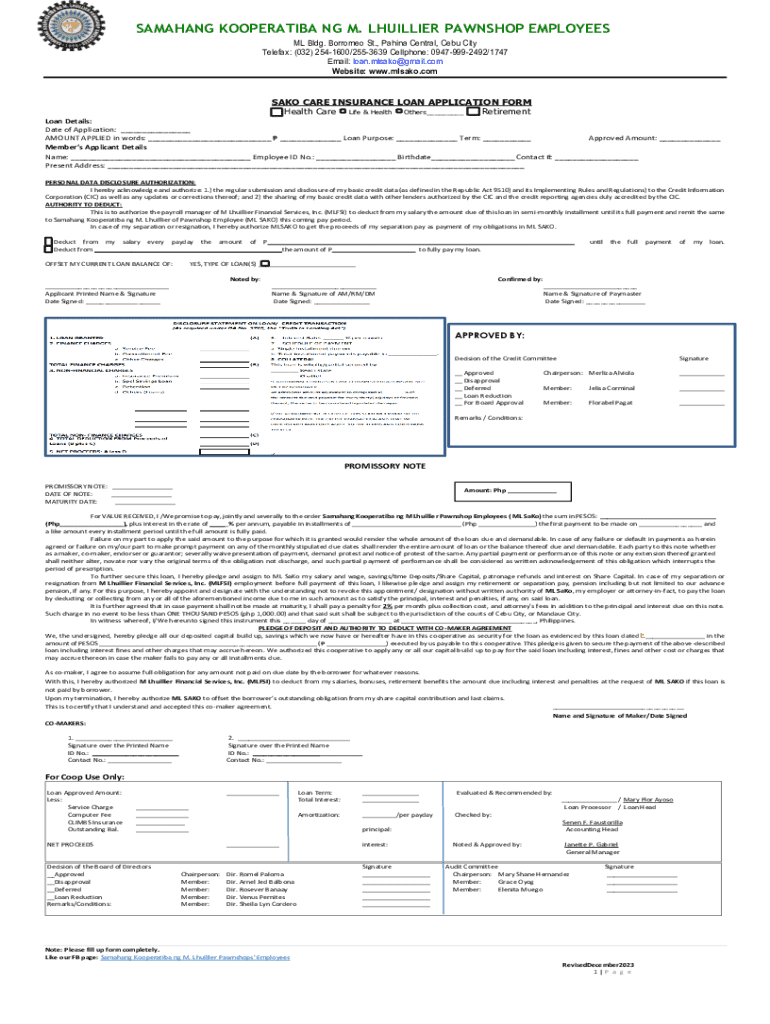

Get the free Sako Care Insurance Loan Application Form

Get, Create, Make and Sign sako care insurance loan

How to edit sako care insurance loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sako care insurance loan

How to fill out sako care insurance loan

Who needs sako care insurance loan?

Navigating the Sako Care Insurance Loan Form: A Step-by-Step Guide

Understanding the Sako Care Insurance Loan product

Sako Care Insurance Loans are designed to provide financial assistance to individuals needing funds for medical emergencies, treatments, or other urgent healthcare-related expenses. This product combines the benefits of insurance and loans, allowing a smoother financial path. By securing a Sako Care Insurance Loan, borrowers can easily manage their medical expenses while ensuring their healthcare needs are met without delay.

Key features of Sako Care Insurance include flexible repayment terms, competitive interest rates, and service options tailored to the specific needs of the client. The versatility of the loan allows borrowers to focus on their health while managing their financial obligations efficiently. Understanding the importance of filling out the Sako Care Insurance Loan Form correctly is critical because it represents the initial step towards acquiring the necessary funds.

Benefits of using the Sako Care Insurance Loan Form

Using the Sako Care Insurance Loan Form harnesses the efficiency of pdfFiller’s document management capabilities. The integrated features of pdfFiller not only facilitate the filling process but also ensure that all necessary details have been included, thereby reducing errors and omissions. This streamlining enhances the overall application process, making it faster and more straightforward.

Increased chances of loan approval are another significant benefit of the Sako Care Insurance Loan Form. A well-completed application, aided by pdfFiller’s interactive tools, can boost your creditworthiness in the eyes of lenders. This user-friendly experience encourages applicants to fill in their forms accurately, significantly influencing the entire approval journey.

Preparing to fill out the Sako Care Insurance Loan Form

Before diving into the details of the Sako Care Insurance Loan Form, it's vital to gather the necessary documentation required to support your application. This documentation includes valid identification for identity and address verification, proof of income that confirms your ability to repay the loan, and relevant credit history information that lenders will use to assess your financial circumstances.

Common mistakes applicants make when gathering documents involve not having the correct or updated information. For instance, individuals might forget to include the latest bank statements or may neglect to obtain the necessary identification that confirms their current address. Ensuring that all documents are complete and up to date enhances the chances of a successful application.

Step-by-step instructions for filling out the form

Accessing the Sako Care Insurance Loan Form via pdfFiller is straightforward. Start by visiting pdfFiller's website and navigating to the loan form section. Once there, you will find the Sako Care Insurance Loan Form ready for editing. Here's a detailed breakdown of each section you'll encounter while filling out the form.

The first section typically asks for personal information. Ensure you input your name, address, and contact details accurately. Next, you'll need to provide employment details, which include your employer's information and your job title. Following this, the form requests information about your existing insurance coverage. It’s essential to provide complete and accurate data concerning your current plans. Finally, specify the amount you wish to borrow based on your needs.

Editing your Sako Care Insurance Loan Form

One of the standout features of pdfFiller is its editing tools that allow users to make quick changes to their documents. After filling out the Sako Care Insurance Loan Form, it’s essential to review and edit as necessary. You might want to adjust details or correct any minor mistakes before finalizing your submission.

Making changes is simple; pdfFiller provides an intuitive interface where you can click into fields to edit your information. It's crucial to double-check all entries to ensure accuracy and completeness because even a minor error can lead to unnecessary delays in your loan approval process.

Signing and submitting the Sako Care Insurance Loan Form

Once you've completed and edited your Sako Care Insurance Loan Form, the next step involves signing and submitting it. pdfFiller simplifies this process with eSigning capabilities, enabling users to sign their documents electronically without requiring printing or scanning. This feature saves time and effort, making the overall application process more efficient.

After signing, you’ll choose from various submission options. You can submit directly to Sako or save the form for later review. Regardless of the option you choose, it’s essential to know what happens after submission. Your application will undergo a review process, where loan officers assess your details, and they will likely follow up for any additional information if necessary.

Managing your Sako Care Insurance Loan application

Once you have submitted your Sako Care Insurance Loan Form, the management of your application is crucial for tracking its status. With pdfFiller, you can easily monitor the progression of your application, which provides peace of mind. Keeping in touch with your loan officer is equally essential, and you may need to respond to requests for additional documentation or clarification, so being organized is key.

To facilitate this, pdfFiller allows you to keep all related documents organized within its platform. This means you can quickly refer back to any documents you've submitted or need to supply further, streamlining communication with your lender.

FAQs about the Sako Care Insurance Loan Form

When filling out the Sako Care Insurance Loan Form, many applicants have common queries that can affect their application process. One frequent question involves how long it takes to receive a response after submission. Typically, applicants can expect feedback within a few business days, but this may vary based on the loan officer's workload and the completeness of your application.

Another common query deals with what happens if you make an error in the form. If you realize a mistake post-submission, it’s crucial to contact customer service or your loan officer directly to rectify any inaccuracies. Moreover, if you're struggling with any part of the form, pdfFiller offers troubleshooting tips and resources to ensure you can navigate the form effectively.

Customer testimonial: success stories with Sako Care Insurance loans

Many individuals have benefitted from Sako Care Insurance Loans, showcasing real-life examples of how these loans have transformed lives. For instance, one applicant reported that the loan allowed her to receive critical surgery without financial stress. By promptly completing the Sako Care Insurance Loan Form through pdfFiller, she emphasized how the integrated tools made the process seamless and efficient.

Testimonials highlight the importance of a streamlined application process. With pdfFiller’s capabilities, borrowers have shared their experiences of being able to track their applications with ease, ultimately leading to positive loan approval outcomes. These success stories emphasize the critical role that both Sako and pdfFiller play in facilitating a smooth borrowing experience.

Related financial products and services

In addition to Sako Care Insurance Loans, Sako offers a range of financial products and services tailored to meet diverse customer needs. Other loan options may cater to personal expenses, vehicle purchases, or home improvement projects. Understanding all the available offerings is crucial for individuals seeking to consolidate their financial needs appropriately.

Furthermore, Sako's insurance options extend to various categories, such as life, auto, and health insurance, providing comprehensive financial protection. Explore these alternatives to find the best fit for your circumstances, ensuring that your financial decisions align with your long-term goals.

User-defined tools and resources for enhanced experience

At pdfFiller, users gain access to an array of interactive tools and resources designed to enhance the document preparation experience. For instance, users can utilize interactive checklists that ensure all required documentation is gathered before completing the Sako Care Insurance Loan Form, minimizing the risk of errors.

Additionally, pdfFiller offers online calculators that can assist potential borrowers in analyzing their loan options and calculating potential repayments. Webinars and tutorials also provide ongoing education about maximizing the capabilities of pdfFiller, ensuring that users are equipped to navigate the document management process confidently.

Explore more services with pdfFiller

Beyond document management, pdfFiller provides a variety of additional services that enhance user experience. One of the key features includes document collaboration, allowing multiple parties to work together in real-time on the same document. This particular aspect is essential for teams dealing with complex applications like the Sako Care Insurance Loan Form, where accuracy and efficiency are paramount.

Additionally, users benefit from customizable templates that cater to diverse needs across various industries. The overall benefits of choosing pdfFiller include a streamlined experience that emphasizes efficiency, organization, and ease of access, making it a superior choice for document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in sako care insurance loan?

How do I make edits in sako care insurance loan without leaving Chrome?

How do I fill out the sako care insurance loan form on my smartphone?

What is sako care insurance loan?

Who is required to file sako care insurance loan?

How to fill out sako care insurance loan?

What is the purpose of sako care insurance loan?

What information must be reported on sako care insurance loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.