Get the free Form Adv

Get, Create, Make and Sign form adv

How to edit form adv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form adv

How to fill out form adv

Who needs form adv?

Understanding and Navigating Form ADV: A Comprehensive How-to Guide

Understanding Form ADV

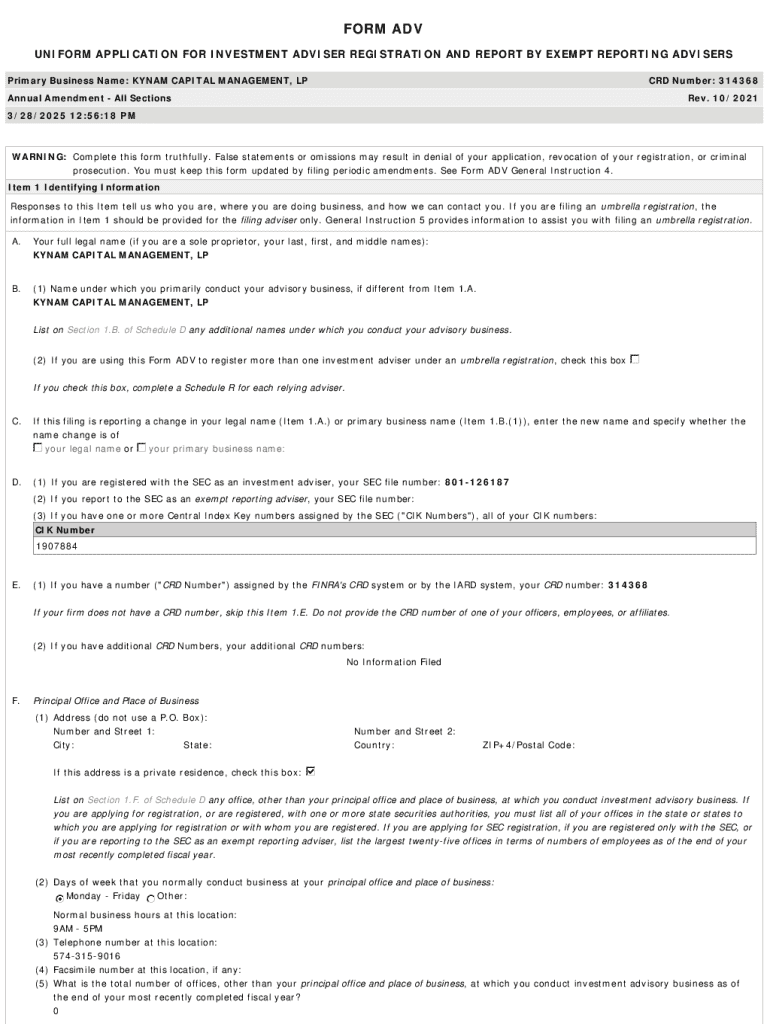

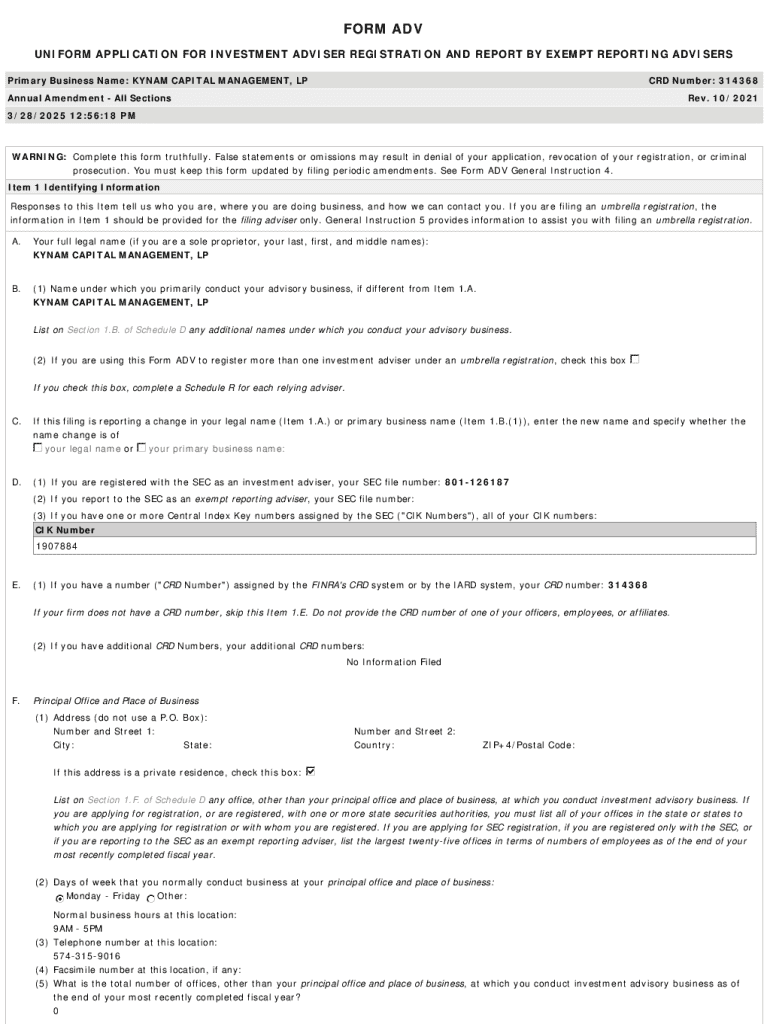

Form ADV is a crucial document for investment advisors, serving as a registration form with the Securities and Exchange Commission (SEC) and state regulators. Designed to provide transparency, this form requires investment firms to disclose key information regarding their business practices, services offered, fees charged, and potential conflicts of interest. Its legal significance cannot be understated, as an accurate and complete Form ADV is essential for ethical operation within the investment advisory industry.

Form ADV is divided into two primary sections: Part I and Part II. While Part I gathers basic information about the advisor, including firm ownership and assets under management, Part II is a narrative brochure aimed at clients, detailing the firm's services and fee structures. Understanding the nuances of these parts is vital for both advisors and clients, as it enhances comprehension and fosters trust.

Why Form ADV Matters

The primary importance of Form ADV lies in its role as a tool for transparency in the investment advisory profession. By mandating detailed disclosures, it empowers investors to make informed decisions, fostering trust between advisors and their clients. When investors understand the fees and services that advisors provide, they can better evaluate their options and ensure that their interests are aligned.

Moreover, Form ADV is a cornerstone of regulatory compliance. It serves to protect investors from fraudulent practices by holding advisors accountable for their representations. Regulatory bodies, such as the SEC and state regulators, enforce strict filing requirements, and failure to comply can result in significant penalties, including fines and suspension from practice.

Accessing and reading Form ADV

Accessing a firm's Form ADV is straightforward. Investors can find this document online through various resources like the SEC's EDGAR database or FINRA's website. Simply navigate to the appropriate section and search for the firm's name. Once found, the form can be viewed and downloaded for thorough analysis, ensuring that potential clients have easy access to the information they need.

When reading Form ADV, focus on several key items, such as the types of fees charged, the services offered, and any disclosures related to conflicts of interest. Each section of the form provides insights that can help gauge an advisor's suitability. Pay special attention to the 'fees and services' section in Part II, as this is instrumental in understanding the financial relationship between the investor and the advisor.

Breaking down Form ADV Part

Part I of Form ADV covers essential firm information, including its structure, ownership, and types of advisory services provided. This section provides a clear overview of the firm's registration status, assets under management, and the geographic areas they serve. Understanding these components allows investors to assess whether a firm meets their investment needs and levels of desired expertise.

Recent updates to Form ADV Part I have further refined these disclosures, enhancing clarity and relevance. Keeping abreast of these changes is crucial for investment firms to maintain regulatory compliance, ensuring all information remains current, accurate, and reflective of the firm's operational vision.

Breaking down Form ADV Part

Part II of Form ADV is often considered the most critical for clients as it is designed as a narrative disclosure document. This section clarifies services offered, fees charged, and various policies that might affect client relationships. For instance, various items detail fee structures, illustrating the true cost of advisory services and promoting informed decision-making.

In addition to fees and services, Part II addresses possible conflicts of interest and provides other vital disclosures that shed light on the advisory firm's practices. Aspects such as whether the advisor receives any external compensation, or engages in activities that might affect their impartiality, are essential for building an understanding of the advisor's operational ethos.

Ensuring your firm's compliance with Form ADV

Filing Form ADV is a crucial step for any investment advisory firm. Preparing for these filings requires meticulous documentation and an accurate representation of services and fees. A best practice is to establish a systematic process for collecting required information and regularly updating records to reflect changes in practice, services, or the regulatory landscape.

Common mistakes can occur in filling out Form ADV, including inaccuracies in client disclosures and failure to update the form in a timely manner. Firms should remain vigilant, as oversight can lead to regulatory penalties. Maintaining an accurate, up-to-date Form ADV not only aids compliance but also enhances the firm's reputation, signaling commitment to ethical practices.

Popular tools and resources for managing Form ADV

Using efficient tools like pdfFiller can simplify the process of managing Form ADV. This user-friendly platform offers a range of interactive tools specifically designed for filling out, editing, and signing Form ADV documents. Collaboration features allows teams to work seamlessly, making it easier to ensure all information is accurate and timely.

Additionally, pdfFiller provides access to compliance documentation and regulatory guidelines, which equip firms with necessary information to navigate the complexities of Form ADV. By leveraging such resources, firms can enhance their compliance journey, ensuring they continue to reflect diversity, equity, and inclusion in their practices.

Finding the right financial advisor

When searching for a financial advisor, leveraging Form ADV is invaluable. Potential clients should ask specific questions regarding the disclosures available, focusing on fees, services, and potential conflicts. By doing so, individuals can analyze the trustworthiness and expertise of an advisor, ensuring they choose a partner aligned with their investment goals.

Furthermore, using Form ADV can help identify top-rated financial advisors by city and state. This feature ensures clients can find professionals not only qualified but also recognized for their commitment to ethical standards in advising. Such accessibility is crucial in today's complex financial landscape, where informed choices lead to better investment outcomes.

Conclusion

Navigating Form ADV is not just about filling out a document; it's a journey towards transparency, clarity, and informed investing. As both firms and clients engage with this pivotal form, embracing the guidelines and updates is essential for building a successful advisory relationship. Tools like pdfFiller can help streamline this process, ensuring that all documentation is managed efficiently and accurately.

In conclusion, by understanding Form ADV and utilizing available resources effectively, investors can enhance their understanding of the financial landscape, empower themselves with knowledge, and make informed choices. This proactive management of investment decisions ultimately supports a mission of equity and success for all participants in the financial advisory ecosystem.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the form adv form on my smartphone?

Can I edit form adv on an iOS device?

How do I edit form adv on an Android device?

What is form adv?

Who is required to file form adv?

How to fill out form adv?

What is the purpose of form adv?

What information must be reported on form adv?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.