Get the free 2016 D-40b Nonresident Request for Refund

Get, Create, Make and Sign 2016 d-40b nonresident request

How to edit 2016 d-40b nonresident request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2016 d-40b nonresident request

How to fill out 2016 d-40b nonresident request

Who needs 2016 d-40b nonresident request?

Understanding the 2016 -40B Nonresident Request Form

Understanding the 2016 -40B Nonresident Request Form

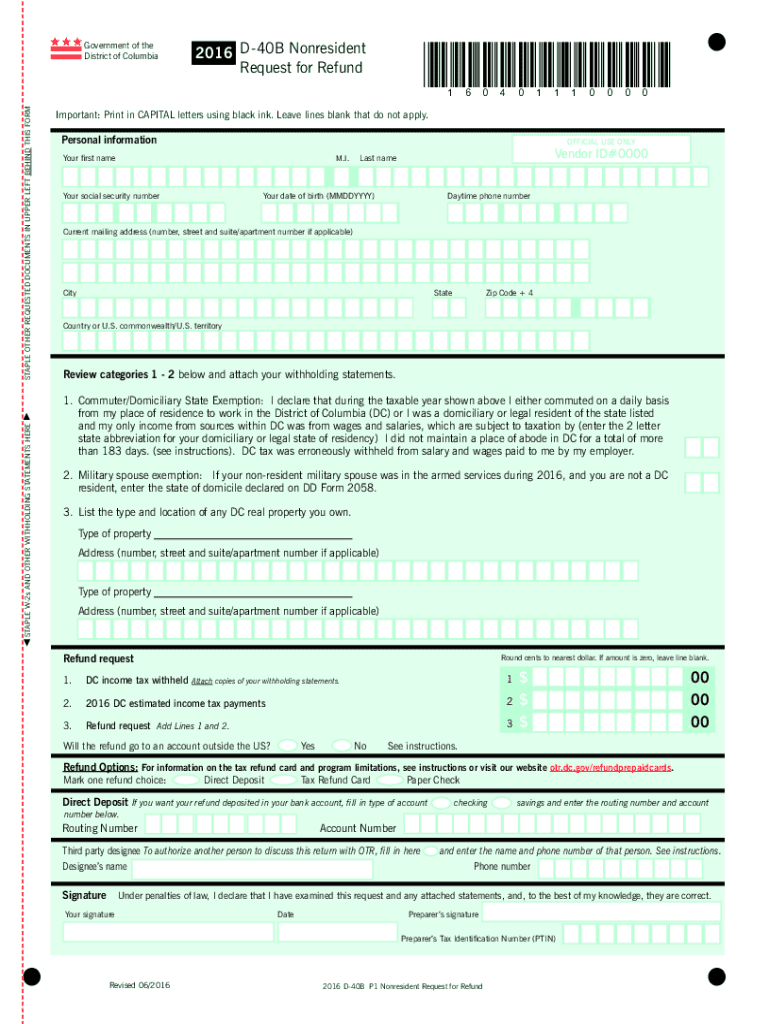

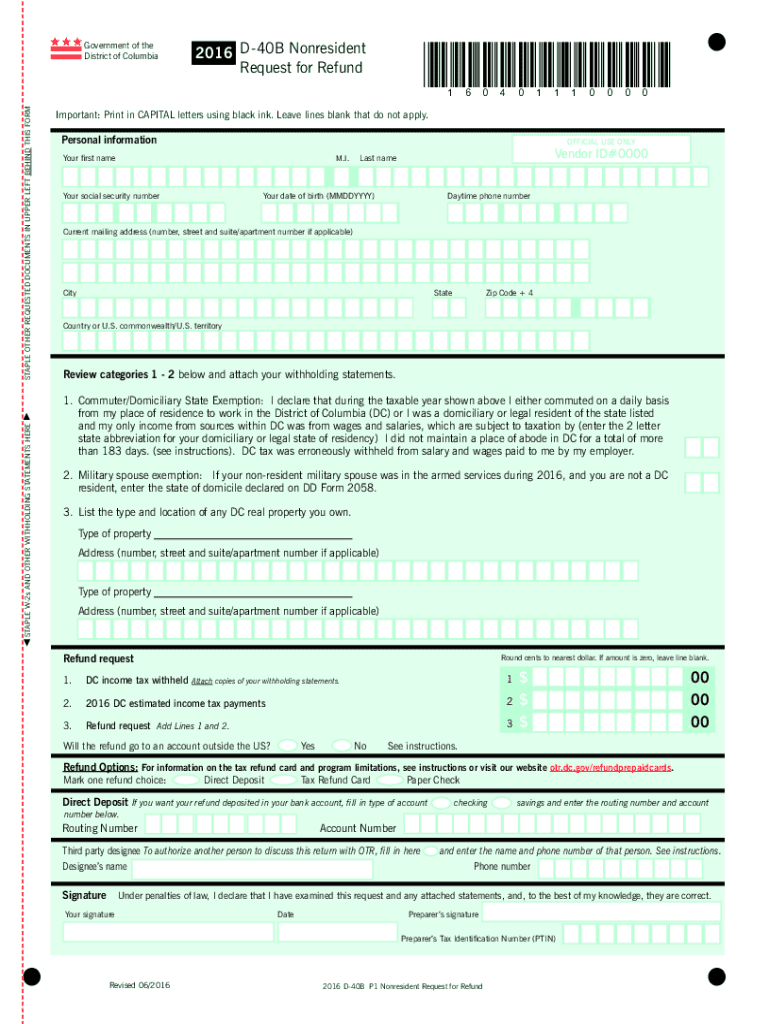

The 2016 D-40B Nonresident Request Form is essential for individuals who earn income in Washington, D.C., but claim residency elsewhere. This form allows nonresidents to request a tax refund or exemption if they either overpaid their taxes or are entitled to a credit based on specific circumstances. It’s crucial to understand its purpose, especially when preparing your tax submissions.

A key difference between the D-40B and other tax forms, such as the D-40 or D-30, is that the D-40B caters specifically to nonresidents, focusing on income earned within D.C. while preventing them from being taxed on out-of-state income. This distinction is important to note for legal and financial implications, especially for freelancers and remote workers who engage with D.C.-based clients or companies.

Understanding the tax implications for nonresidents filing in Washington, D.C., involves recognizing that you often won’t be liable for taxes on income earned outside of D.C. However, it’s vital to correctly report any D.C.-sourced income, as failure to do so could result in penalties or missed refunds.

Accessing the 2016 -40B Nonresident Request Form

Accessing the 2016 D-40B Nonresident Request Form is straightforward—it's readily available online through the D.C. Office of Tax and Revenue website. Users can easily navigate to the tax forms section and locate the D-40B form for their needs.

To download and print the form, follow these steps:

Important links can enhance your experience: utilize the [Official Office of Tax and Revenue]() to find resources and additional tax-related information.

Preparing to complete the 2016 -40B Form

Preparation is crucial when completing the 2016 D-40B Nonresident Request Form. This involves gathering required information and supporting documentation to streamline the process. Key details such as personal identification, income statements, and copies of previous tax returns will be necessary.

Personal identification may include your name, address, and Social Security number. Furthermore, proper income statements, such as W-2s and 1099s, will also be pivotal, as they reflect the income earned within Washington, D.C. Accumulating these documents beforehand helps avoid mistakes and ensures accuracy in your reporting.

During preparation, avoid common mistakes such as incorrect calculations, failing to include all income earned in D.C., and neglecting to sign the form. By double-checking your entries and ensuring that every section is complete, you set yourself up for a successful filing.

Step-by-step guidance for filling out the 2016 -40B Form

Filling out the 2016 D-40B Nonresident Request Form can be simplified with a step-by-step approach. This breakdown will clarify each section, ensuring all necessary information is included accurately.

1. Personal Information: In this section, you will provide your name, address, and Social Security number. It’s essential to ensure all information matches your identification documents to prevent discrepancies.

2. Income Reporting: Detail your income from all sources, particularly those earned in D.C. Include workplace income, freelance earnings, and any other applicable financial inflows. Be mindful of tax credits and deductions available to nonresidents, which can significantly affect your taxable income.

3. Tax Computation: Now, calculate your tax based on the income reported. This involves considering any exemptions that apply to your situation. Ensure you are familiar with current tax rates and how they specifically pertain to nonresidents.

4. Signature and Date: Finally, before submitting, sign the form and date it correctly. This step reinforces the legal validity of your submission and indicates that all provided information is accurate and complete.

Submitting the 2016 -40B Nonresident Request Form

After completing the 2016 D-40B Nonresident Request Form, your next step is submission. You can submit it via different methods: traditional mail or e-filing through the online portal.

To ensure a timely and accurate submission, consider the following tips:

Beware of deadlines for submission, usually falling on April 15th of the tax year unless extended due to weekends or holidays. If you miss this deadline, penalties may apply, and it may complicate your tax situation further. Knowing key dates can alleviate stress during tax season.

Common FAQs about the 2016 -40B Form

Tax-related queries often arise, especially concerning forms like the 2016 D-40B. Here are some common questions and clarifications:

Tools for editing and managing the 2016 -40B Form

Editing and managing your 2016 D-40B Nonresident Request Form can be efficiently handled with tools like pdfFiller. Its user-friendly interface allows for easy form editing, ensuring all entries are accurate and up-to-date.

Some of the notable features include the ability to collaborate with team members. This is particularly beneficial for those working in groups to streamline tax submissions or professional tax preparers managing multiple clients.

Additionally, eSigning capabilities simplify the submission process. The feature allows users to sign documents digitally, eliminating the need for paper and enhancing efficiency.

Benefits of using pdfFiller for the 2016 -40B Nonresident Request Form

Leveraging pdfFiller for your 2016 D-40B Nonresident Request Form maximizes convenience through access-from-anywhere capabilities. This is particularly advantageous in today’s increasingly remote working landscape, where you can manage your tax documents anywhere, anytime.

With a cloud-based document management system, users benefit from real-time collaboration, ensuring all team members can contribute to the submission process seamlessly. The enhanced document sharing capabilities further simplify workflows and reduce potential errors.

Furthermore, the platform’s integrated editing features heighten accuracy, allowing users to make corrections swiftly and efficiently, reducing the likelihood of costly mistakes in crucial tax submissions.

Troubleshooting common issues with the 2016 -40B Form

Despite thorough preparation, issues may crop up during your preparation or submission of the 2016 D-40B Nonresident Request Form. Seeking assistance through tax professionals can often provide clarity and help resolve complex questions efficiently.

Technical problems while filling out the form online are occasionally encountered. If you face such challenges, ensure your browser is up-to-date or try accessing the form from another device. If problems persist, customer support from pdfFiller or D.C. Tax Office can guide you.

Best practices for document handling before and after submission include maintaining digital copies of everything and checking your form status post-submission. This diligence mitigates risk during tax audits or inquiries.

Exploring additional tax support in Washington, ..

Recognizing other forms and resources essential to tax filing in Washington, D.C., can significantly streamline the overall process. Beyond the D-40B, forms like the D-40 and D-30 can impact your overall tax strategy and assist in comprehensive tax management.

Navigating the e-file help section and the D.C. business licensing portal will provide further insights into remaining compliant with local tax laws and regulations. Useful online resources for general tax assistance and inquiries will also bolster your preparation efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2016 d-40b nonresident request in Gmail?

How do I make edits in 2016 d-40b nonresident request without leaving Chrome?

How do I fill out 2016 d-40b nonresident request using my mobile device?

What is d-40b nonresident request?

Who is required to file d-40b nonresident request?

How to fill out d-40b nonresident request?

What is the purpose of d-40b nonresident request?

What information must be reported on d-40b nonresident request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.