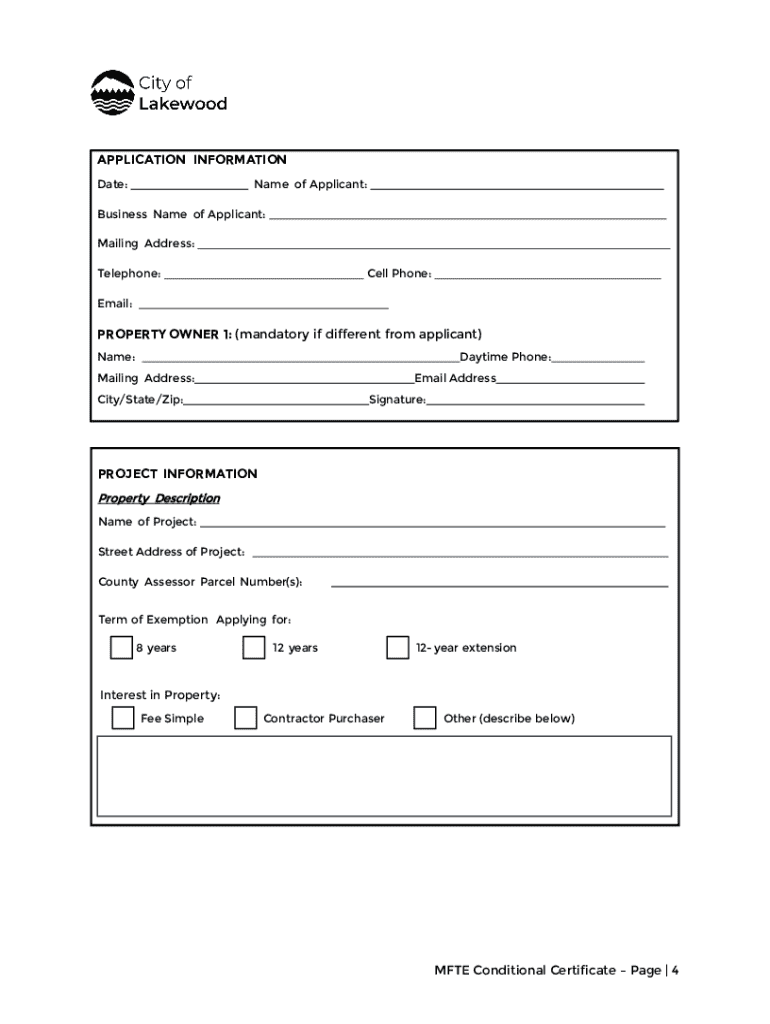

Get the free Application - Multifamily Tax Exemption (mfte)

Get, Create, Make and Sign application - multifamily tax

How to edit application - multifamily tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application - multifamily tax

How to fill out application - multifamily tax

Who needs application - multifamily tax?

How to Complete the Multifamily Tax Form: A Comprehensive Guide

Understanding the multifamily tax form

Multifamily tax forms play a pivotal role in the realm of affordable housing financing. They are instruments used by developers and investors to provide essential information needed to access financial incentives, including housing bonds and tax credits. The multifamily tax form is designed to facilitate the development of housing projects that serve lower-income families, thereby enhancing the availability of affordable housing in various states.

The importance of the multifamily tax form cannot be overstated. It ensures that developers present their projects in a structured manner, making it easier for state authorities to evaluate and approve these developments. When completed accurately, these forms not only secure necessary funds but also ensure compliance with federal and state regulations, thus promoting responsible development.

Key benefits of utilizing multifamily tax forms

Utilizing multifamily tax forms offers numerous advantages to developers. Firstly, they pave the way for significant financial incentives such as Low-Income Housing Tax Credits (LIHTC) and housing bonds. These benefits are instrumental for those looking to finance projects in a cost-effective manner. With the proper backing from housing bonds, developers can allocate more resources towards creating affordable apartments that meet the needs of low-income families.

In addition to financial incentives, completing the multifamily tax form promotes enhanced compliance with regulatory frameworks. By understanding and adhering to specific guidelines, developers can avoid penalties or project delays due to non-compliance, ultimately leading to smoother project execution and approval processes.

Step-by-step instructions for completing the multifamily tax form

Before diving into the form, preparation is crucial. Proper pre-application preparation sets the foundation for a successful submission. Start by gathering all necessary documents, including financial statements, project budgets, and information on anticipated funding sources. Understanding eligibility requirements is equally important as various states may have differing criteria for LIHTC and other financial products.

Pre-application preparation

Ensure you have documents like your organizational structure—whether it's a form LLC, partnership, or corporation—ready and accessible. Familiarize yourself with your local Qualified Allocation Plan (QAP), which outlines how tax credits are allocated in your state. Knowing this can provide insights into the critical factors that your project needs to focus on to stand out in the application process.

Detailed breakdown of form sections

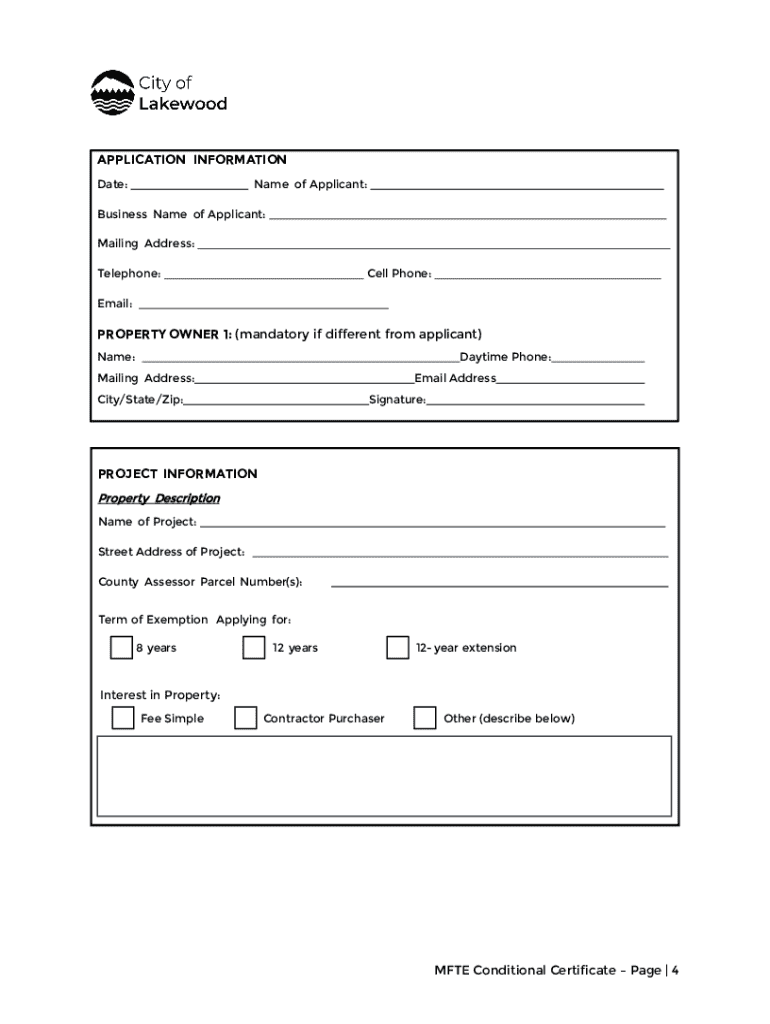

The multifamily tax form itself consists of several important sections. In the General Information section, you’ll provide essential details about your entity, including your name, address, and the specific project description. This is where you’ll set the stage for the evaluators to understand the nature and scope of your development.

Moving on to the Financial Information section, you will include your project's budget and anticipated funding sources. Clearly outline expected costs and potential revenue, as precise financial projections are key to convincing authorities of your project's viability.

The Project Details section further digs into the specifics, such as unit counts, configurations, and target demographics. Consider accessibility excellence and how your project caters to various community needs, as this insight can enhance your submission's appeal.

Common pitfalls and tips for successful submission

One common pitfall when filling out the multifamily tax form is submitting an incomplete application. This can delay or even result in rejection of your project. Ensure that every section is meticulously completed and that all necessary documentation is attached.

It's also vital to understand submission deadlines. Familiarizing yourself with these timelines allows for ample time to address any unforeseen issues that may arise. Moreover, leverage resources such as workshops or recordings related to the multifamily tax form to stay ahead of changes and updates in guidelines.

Editing and reviewing the multifamily tax form

Revisions and proofreading are critical steps in the multifamily tax form application process. Errors in your submission can lead to lost time and resources, potentially derailing your project before it even begins. Therefore, prioritizing a thorough review can save you from significant setbacks.

Utilize tools like pdfFiller to enhance your editing process. The platform provides easy-to-use features for document editing, allowing you to revise your application effectively. Furthermore, collaborative feedback mechanisms enable team members to review and comment on the form' content collectively. Consider scheduling a dedicated review session to ensure all stakeholders are aligned before submission.

Signing and submitting your multifamily tax form

With your form finalized, it’s time to sign and submit. eSigning the application is advantageous; it not only speeds up the signing process but also provides a more secure and environmentally friendly alternative to traditional paper-based methods. Prepare to eSign your multifamily tax form using pdfFiller’s step-by-step guide, which makes the process intuitive and straightforward.

When it comes to submission methods, consider the differences between online submissions and physical mailing. Online submissions can be faster and provide immediate confirmation of receipt, while physical mailing can serve as a backup unless specified otherwise by your state's requirements. Don't forget to track your submission status and manage follow-up communications with authorities to stay informed about your application's progress.

Post-submission strategies

Once you have submitted your multifamily tax form, it’s essential to understand what to expect. The review process can vary based on state and project complexity, but there are generally established timelines for feedback. Be prepared for potential outcomes, including approval, requests for additional information, or outright denial. Developing a timeline for these stages of review can help you plan your next steps.

Specifically, if your application is not approved, use the feedback to improve future submissions. Lessons learned from the current application can shape your approach in upcoming developments. Creating a roadmap that outlines each project stage, including potential adjustments based on previous results, aids in crafting successful future applications.

Additional insights and resources

Examining case studies of successful multifamily developments can provide valuable insights into effective application strategies. These case studies often highlight the best practices observed by developers who successfully navigated the multifamily tax form and the challenges they faced. Analyzing these examples may offer inspiration and practical knowledge that can refine your own application.

Moreover, having a thorough understanding of frequently asked questions surrounding multifamily tax forms can clarify common concerns and missteps. Whether it's about eligibility criteria or specifics on state LIHTC, familiarizing yourself with expert answers ensures that you remain informed throughout the process. Stay updated on legislative changes affecting multifamily tax forms and explore resources for ongoing education and training to keep ahead of the curve.

Support and documentation management

Utilizing platforms like pdfFiller for document management simplifies the multifamily tax form process. From maintaining cloud storage and ensuring easy access to features for tracking changes and managing version histories, pdfFiller streamlines the often cumbersome process of paperwork involved in multifamily housing developments. This efficiency can significantly benefit project teams working collaboratively on complex applications.

Connecting with experts can also provide vital support for particularly complex cases. Engaging local resources such as consultants or legal advisors proficient in multifamily developments can ensure rigorous compliance and efficiency. Identifying these resources early can provide a critical advantage when navigating rigorous application processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my application - multifamily tax directly from Gmail?

How do I make edits in application - multifamily tax without leaving Chrome?

Can I create an electronic signature for signing my application - multifamily tax in Gmail?

What is application - multifamily tax?

Who is required to file application - multifamily tax?

How to fill out application - multifamily tax?

What is the purpose of application - multifamily tax?

What information must be reported on application - multifamily tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.