Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

A Comprehensive Guide to SEC Form 4

Understanding SEC Form 4

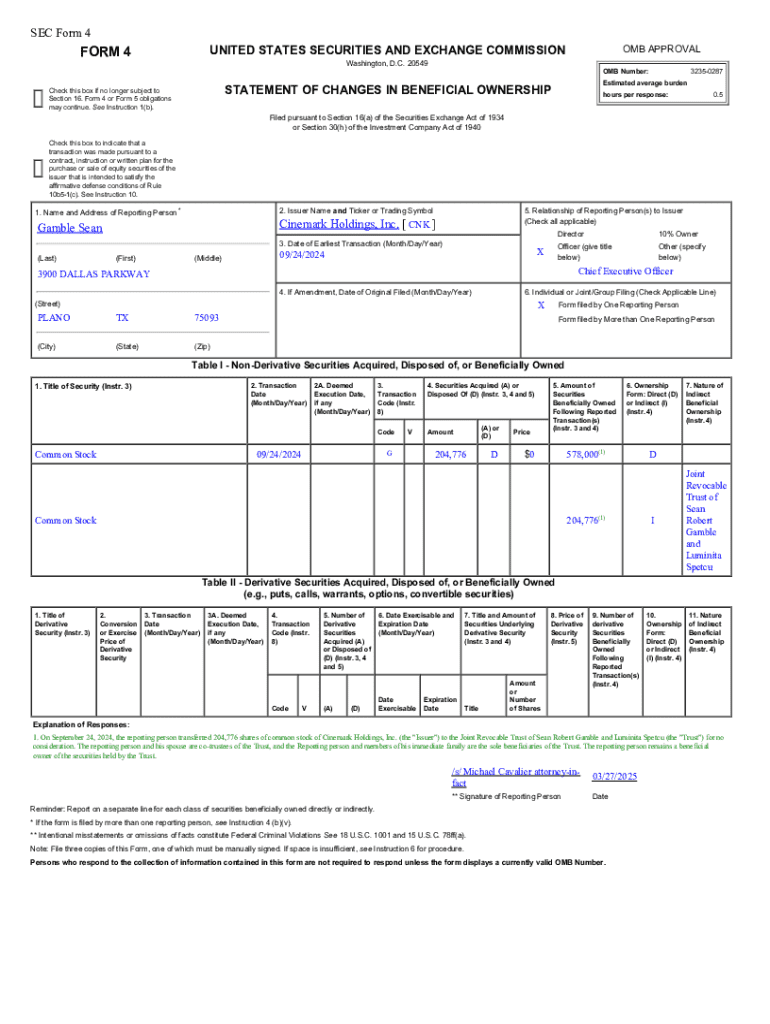

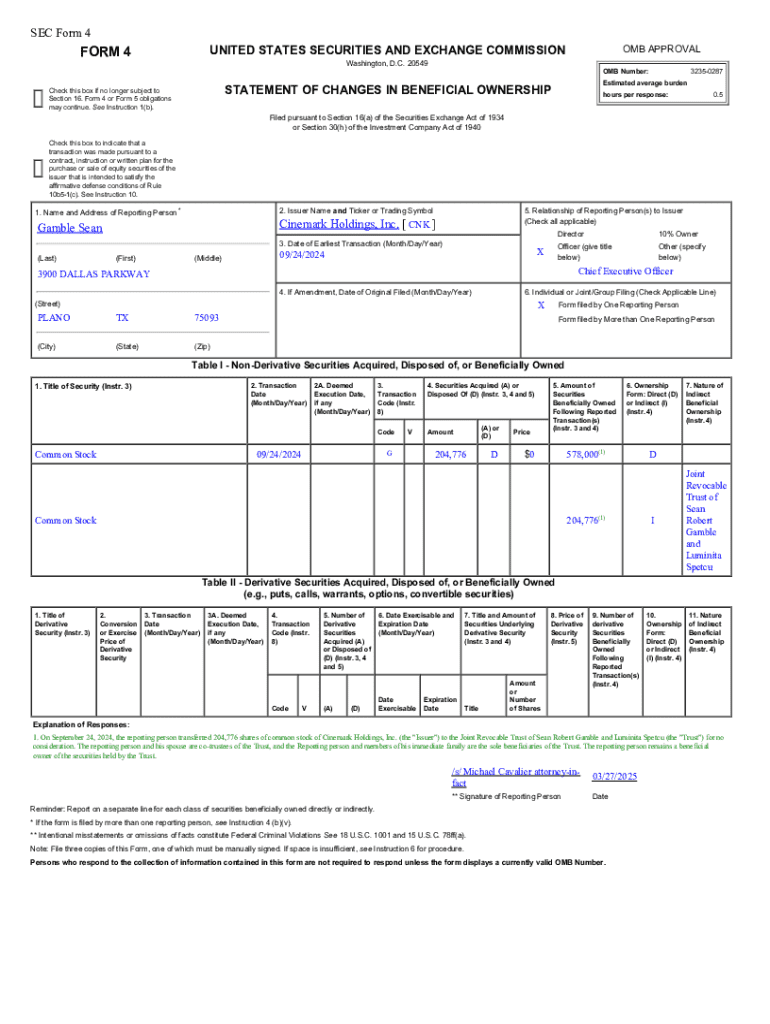

SEC Form 4 is a critical reporting tool used by company insiders to disclose their transactions involving the company's securities. The form serves the dual purpose of enhancing transparency in the securities market and ensuring compliance with regulatory requirements. It allows the investing public to keep track of the activities of corporate executives, board members, and other insiders, creating a level playing field in the industry.

Filing SEC Form 4 is essential for regulatory compliance and contributes to market integrity. By requiring insiders to report their trades, the SEC helps mitigate potential insider trading activities, promoting an atmosphere of trust in financial markets. Insiders gain insights into the company's strategic movements, making informed investment decisions while holding themselves accountable to the public.

Who must file SEC Form 4?

According to securities laws, individuals deemed 'insiders' are required to file SEC Form 4. An 'insider' typically includes executives, directors, and significant shareholders of the company, those who have access to material non-public information that could influence their decisions in the marketplace.

Key components of SEC Form 4

Understanding the structure of SEC Form 4 is crucial for accurate filings. The form is divided into several sections, each of which captures essential details about the transactions undertaken by insiders. Let's break down these sections for clarity.

Common terminology explained

Several key terms frequently pop up in the context of SEC Form 4. Understanding these is beneficial for both insiders and investors looking to interpret the filings accurately.

Filing requirements and deadlines

Filing SEC Form 4 comes with specific timelines and requirements that insiders must adhere to. Failure to file on time can lead to penalties and complications.

Form 4 must be filed within two business days following a transaction. This quick turnaround ensures that the market remains informed in near real-time about insider trading activities. For those who miss the deadline, the consequences can include fines and potential scrutiny from regulatory bodies.

How to submit SEC Form 4

The submission process for SEC Form 4 is straightforward, especially with the SEC's electronic filing system, EDGAR. Insiders must create an account to submit the form digitally, streamlining the tracking and management of filings.

Examples of when SEC Form 4 must be filed

There are a variety of situations which necessitate the filing of SEC Form 4. Identifying these scenarios is crucial for compliance.

Case studies

Real-life case studies can provide additional context for the importance of Form 4 filings. For example, if a corporate officer sells a significant portion of shares right before unfavorable company news, this could signal to the market undervalued insights, leading to a drop in stock prices.

Understanding the impact of SEC Form 4

Insiders file SEC Form 4 for various reasons, aiming to maintain a transparent market environment. By publicly disclosing their transactions, insiders not only comply with regulations but also foster trust among investors.

Transparency around insider trades can significantly affect market perception. For instance, if executives are consistently purchasing shares, it may signal confidence in the company's future, enticing more investors. Conversely, a series of insider sales may trigger concerns about the company's profitability or strategic direction.

Reading between the lines: What filings suggest

Interpreting SEC Form 4 transactions requires careful analysis. Investors should look beyond the mere presence of transactions and consider the broader context, such as the timing and frequency of trades. A spike in insider buying can indicate that executives believe the stock is undervalued, whereas a pattern of selling may reflect burgeoning challenges within the company.

Tools and resources for managing SEC Form 4

To mitigate the complexities associated with SEC Form 4, several tools exist, including interactive document management solutions like pdfFiller. These applications allow individuals and teams to fill out, edit, sign, and manage documents from anywhere in a cloud-based environment.

Interactive tools for filing

pdfFiller provides a user-friendly platform where users can create and eSign SEC Form 4 diligently. Following a straightforward and guided process streamlines the submission experience, reducing the potential for errors.

Keeping track of filings

Staying organized is critical, especially with filing deadlines approaching. Setting reminders for these crucial deadlines and regularly monitoring insider trades through the SEC website can keep fiduciaries compliant and informed.

Common mistakes to avoid when filing SEC Form 4

Submitting SEC Form 4 comes with its own set of challenges. Ensuring that all information is accurate and complete is paramount for compliance and avoiding penalties.

Tips for accurate submission

Best practices for filing SEC Form 4 include maintaining meticulous records of all transactions as they occur, regularly checking for updates on filing requirements, and using tools like pdfFiller which can ease the process significantly. Always double-check for accuracy, and have another set of eyes review the forms when possible.

Frequently asked questions (FAQs) about SEC Form 4

When dealing with SEC Form 4, many individuals have recurring queries that need addressing. Answering these can enhance understanding and compliance.

Complex scenarios

When multiple transactions occur on the same day or if transactions are performed in different capacities, insiders need to take special care to ensure that each transaction is accurately reported on the correct Form 4.

Additionally, foreign insiders must consider the regulations applicable in their home jurisdictions while filing Form 4. Familiarity with these requirements may be critical in avoiding compliance risks.

Advanced topics related to SEC Form 4

Understanding the implications of SEC Form 4 on corporate governance helps to contextualize its regulatory underpinnings. Insiders wield considerable power in shaping company policies and directions, and their trading activities can substantially influence shareholder relations.

Recent statistics indicate that fluctuations in insider trading activity can correlate with market movements. Investors should pay close attention to these trends when making investment decisions, as they often reflect insider sentiment regarding the company's future profitability and operational strategy.

Engagement and updates

Staying informed about changes in SEC filing requirements is vital for compliance. Continuous education regarding evolving regulatory landscapes ensures that insiders can adapt their strategies effectively.

Connecting with communities focused on insider trading and compliance through forums or online groups can provide insights and shared experiences that enhance the understanding of SEC Form 4. Collaboration can lead to better compliance strategies and enhanced market insight.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sec form 4 in Gmail?

How do I execute sec form 4 online?

Can I create an eSignature for the sec form 4 in Gmail?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.