Get the free Nfu Mutual Select Investments Stop Regular Payment Out Form

Get, Create, Make and Sign nfu mutual select investments

Editing nfu mutual select investments online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nfu mutual select investments

How to fill out nfu mutual select investments

Who needs nfu mutual select investments?

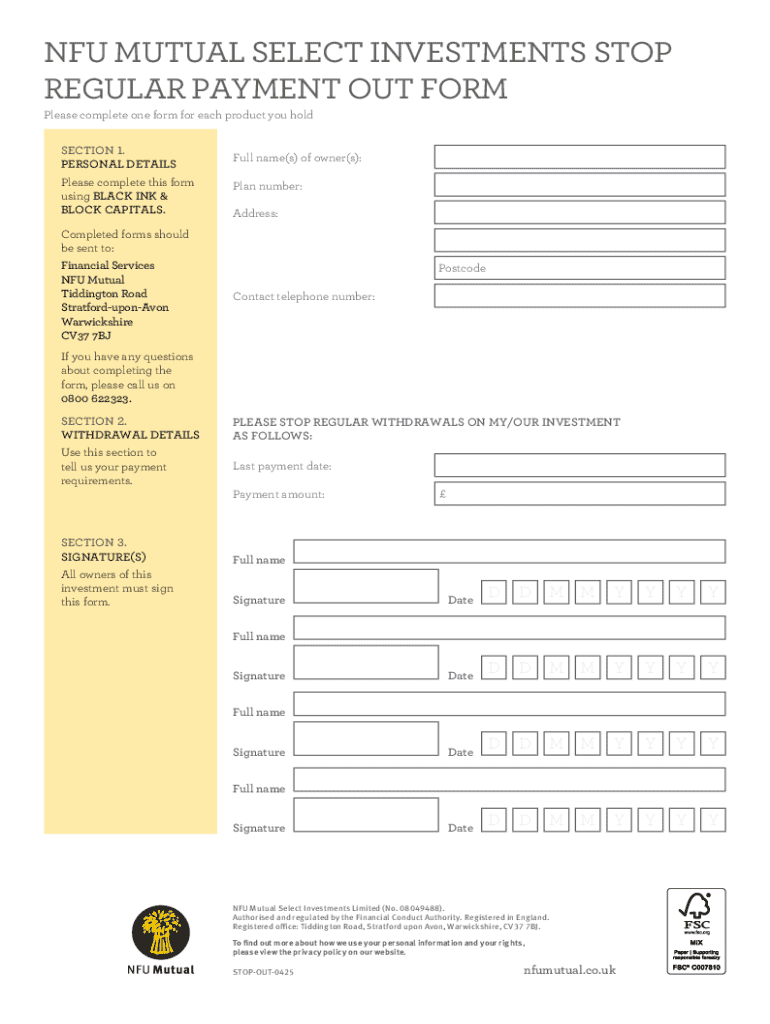

Comprehensive Guide to the NFU Mutual Select Investments Form

Understanding the NFU Mutual Select Investments Form

The NFU Mutual Select Investments Form is a crucial document for individuals looking to make informed investment decisions. This form is designed to gather essential information necessary for team advisors and individuals alike to tailor investment strategies based on personal financial goals and preferences. Clients often find this form invaluable, as it allows for an organized assessment of their financial situation, investment experience, and future aspirations.

Utilizing the NFU Mutual Select Investments Form is important for several reasons. It captures vital details that enable financial planners to propose suitable investment routes, ensuring that investors can make decisions aligned with their risk appetite and capital growth ambitions.

Key features of the NFU Mutual Select Investments Form

The NFU Mutual Select Investments Form's design focuses on collecting comprehensive data required for a smooth investment process. This includes personal information, investment history, and insights into your risk tolerance and preferences. Understanding your investment goals is a key aspect of this process, making this form a vital tool.

Moreover, interactive tools are available within the submission environment that enhance the form-filling experience. Users can utilize investment calculators that help in estimating future returns based on different scenarios and risk assessment tools that gauge their comfort level with various investment options.

Step-by-step guide to filling out the NFU Mutual Select Investments Form

Filling out the NFU Mutual Select Investments Form can appear daunting, but by following a structured approach, you can simplify the process immensely. Start by gathering necessary information, such as identification details and financial background, as this will prepare you for the details required later.

Next, you'll access the form, typically through pdfFiller. Search for the NFU Mutual Select Investments Form in the template section and utilize the search functions to locate it efficiently. Completing the form requires you to follow detailed instructions for each section; be mindful of common pitfalls, such as leaving required fields blank.

Once filled, it’s crucial to review your submission. Verifying accuracy and checking that all required fields have been completed can save you from future complications.

Editing and managing your NFU Mutual Select Investments Form

After filling out your NFU Mutual Select Investments Form, you may need to make edits or adjustments. pdfFiller offers many editing tools that let you add or remove content with ease, ensuring that your document remains accurate and up-to-date.

In addition, cloud-based storage allows you to save and store your forms securely. You can benefit from version control options, which give you easy access to previous iterations of your documents, ensuring you always know which version you're working from.

Signing the NFU Mutual Select Investments Form

An electronic signature is a requisite for the NFU Mutual Select Investments Form, as it ensures speed and legal compliance in the digital age. Using pdfFiller, signing your document electronically is a straightforward process that maintains the integrity and security of your submission.

Submitting the NFU Mutual Select Investments Form

Once your NFU Mutual Select Investments Form is completed and signed, the next step is submission. You can submit the form via various methods, such as email or directly uploading it to your investment platform. Understanding these methods helps ensure that your submission aligns with your investment goals in a timely manner.

After submission, seeking confirmation is essential. Keep an eye out for receipts or confirmation numbers to document that your form has been received without issues.

Frequently asked questions (FAQs)

As you navigate using the NFU Mutual Select Investments Form, it’s common to encounter questions. For instance, knowing what to do if you face issues while filling out the form is essential. If any trouble arises, utilizing the help resources available within pdfFiller can guide you through these challenges.

Popular searches related to investment forms

When utilizing the NFU Mutual Select Investments Form, it may be beneficial to explore related searches in investment documents. Knowing the types of investment documents you should be aware of, as well as alternative investment strategies, creates a more comprehensive understanding of what you may need.

Maximizing the benefits of using pdfFiller for investment documentation

Using pdfFiller for your NFU Mutual Select Investments Form not only simplifies the completion process but also encourages seamless collaboration among teams. This platform allows you to access and manage documents from anywhere, whether on mobile devices or desktops, which is a significant advantage in today's fast-paced financial landscape.

Additionally, enhancing document security options provided by pdfFiller ensures that sensitive information within your investment forms is protected, making it a reliable tool.

User testimonials and case studies

Real-world success stories highlight the effectiveness of the NFU Mutual Select Investments Form in helping individuals and teams achieve their investment goals. Feedback on improvements brought by using pdfFiller for investment management is overwhelmingly positive, with many users reporting a higher level of clarity and confidence in their investment decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my nfu mutual select investments in Gmail?

How do I make changes in nfu mutual select investments?

Can I create an electronic signature for signing my nfu mutual select investments in Gmail?

What is nfu mutual select investments?

Who is required to file nfu mutual select investments?

How to fill out nfu mutual select investments?

What is the purpose of nfu mutual select investments?

What information must be reported on nfu mutual select investments?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.