Get the free Application for Interbank Giro - nushigh edu

Get, Create, Make and Sign application for interbank giro

Editing application for interbank giro online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for interbank giro

How to fill out application for interbank giro

Who needs application for interbank giro?

Application for interbank giro form: A comprehensive guide

Understanding the interbank giro form

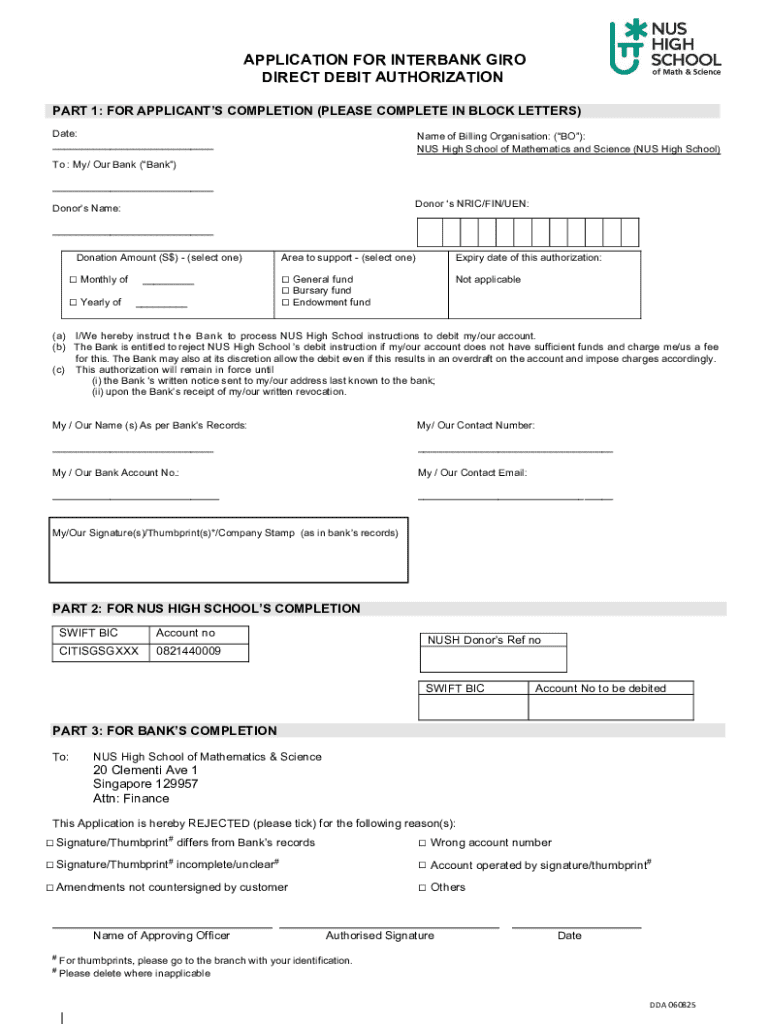

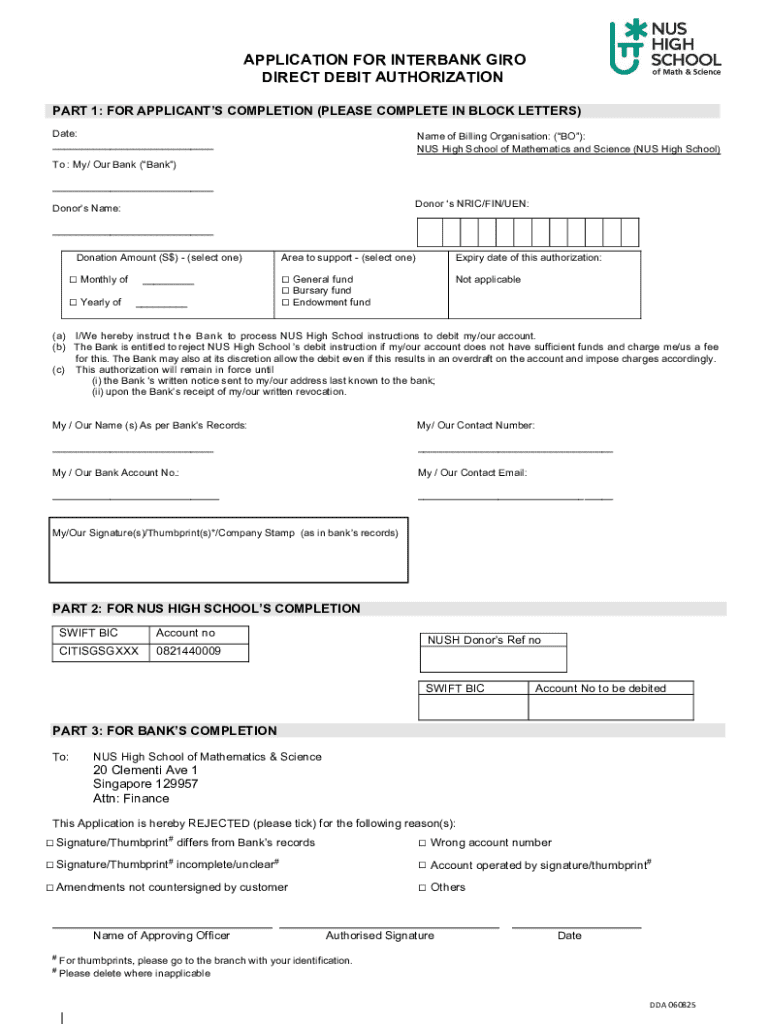

The Interbank Giro (IBG) is a system that facilitates electronic fund transfers between different banks. Introduced to streamline payments and improve efficiency in transactions, the Interbank Giro Form is a crucial tool for individuals and organizations looking to automate their payments. This form outlines the necessary details to authorize your bank to transfer funds directly from your account to another bank's account without the need for physical checks.

Understanding the application for interbank giro form is vital, as it enables efficient financial management. The form is especially important for recurring transactions such as rent payments, salary disbursements, or utility bill payments, simplifying these processes and reducing the risk of late payments.

The application for interbank giro form is used widely across various sectors, making it an essential form for businesses, individuals, and teams. Whether you're an employee setting up direct deposit for your paycheck or a small business owner automating supplier payments, this form is a must-have.

Preparing to complete the interbank giro form

Completing the interbank giro form requires adequate preparation to ensure that all necessary information is accurately provided. This involves gathering essential data and preparing the required documentation. Without attention to detail, you risk delays or rejections in processing your application.

Essential information required on the application for interbank giro form typically includes personal identification details like your full name, identification number, and contact details. You will also need to provide specific bank account information—your bank’s name, account number, and the beneficiary bank's details. Importantly, indicating the amounts to be transferred and their frequency is crucial to executing the transactions correctly.

Step-by-step guide to filling out the interbank giro form

Filling out the interbank giro form is a straightforward process if you follow the steps carefully. Start by accessing the official form, which is available on your bank’s website or can be obtained through pdfFiller. This platform aids users by providing an interactive way to access and fill forms seamlessly.

Once you have the form, begin with Step 1: access the interbank giro form. You can find this document on your banking institution's website or easily navigate to pdfFiller for an efficient experience.

Managing the interbank giro form after submission

Once the interbank giro form is submitted, management of your application is essential. Keeping track of the status of your application allows you to stay informed about the processing time and any issues that may arise. With pdfFiller, you have the advantage of tracking application statuses seamlessly.

If you need to edit any submitted form, pdfFiller provides the tools for easy adjustments. Alternatively, if circumstances change, you can cancel or modify existing payments effortlessly through the same platform. Common issues with interbank giro transactions may include transfer delays or discrepancies in amounts, which can typically be resolved by contacting your bank directly or reviewing your submitted documents.

Security and compliance considerations

When dealing with financial transactions, safeguarding personal information is paramount. The application for interbank giro form involves accessing sensitive data, making it crucial to utilize secure platforms that adhere to stringent compliance standards. pdfFiller takes security seriously, ensuring that all your data remains protected throughout the process.

Compliance with financial regulations also plays a significant role in the effectiveness of interbank transactions. Using a reliable platform like pdfFiller not only ensures security but also promotes adherence to these regulations, thus preventing potential legal issues. Recognizing the importance of using secure digital tools can safeguard your information while enhancing your operational efficiency.

Frequently asked questions (FAQs)

As users approach the application for interbank giro form, various questions often arise. An important concern for many is how to manage mistakes on the form. It is best practice to address errors promptly, either through the original bank or pdfFiller's editing tools.

Another common question pertains to processing times. Factors like your bank's policies may influence timelines, but usually, interbank giro transactions are expedited. Users also frequently ask about the versatility of pdfFiller and its ability to function across devices, enabling easy management no matter where you are.

Advantages of using pdfFiller for the interbank giro form

Employing pdfFiller for completing the application for interbank giro form significantly enhances user experience. This platform is designed to simplify the document creation process, allowing users to fill out and manage forms quickly and efficiently. The benefits span various dimensions, bringing together usability, functionality, and security.

One of the primary advantages is the easy access to document creation tools that pdfFiller offers, making the process seamless. Users can edit and collaborate on documents collaboratively, which streamlines the workflow. Furthermore, the secure eSigning capabilities reduce friction in signing forms, ensuring legal compliance with all transactions. Additionally, cloud-based management provides the flexibility to access your forms from anywhere, catering to mobile needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find application for interbank giro?

How do I fill out application for interbank giro using my mobile device?

How do I edit application for interbank giro on an Android device?

What is application for interbank giro?

Who is required to file application for interbank giro?

How to fill out application for interbank giro?

What is the purpose of application for interbank giro?

What information must be reported on application for interbank giro?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.