Get the free Mutual Funds Redemption Form

Get, Create, Make and Sign mutual funds redemption form

Editing mutual funds redemption form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mutual funds redemption form

How to fill out mutual funds redemption form

Who needs mutual funds redemption form?

Mutual Funds Redemption Form - How-to Guide

Understanding mutual funds redemption

Mutual funds redemption refers to the process of selling mutual fund shares back to the fund company. Investors engage in this to access cash or reallocate their investments. It's a crucial aspect of mutual fund investing, allowing investors to liquidate their holdings and realize returns based on the fund's performance.

The redemption process is important as it provides liquidity, allowing investors to turn their investments into cash. Common scenarios for redemption include changing investment objectives, needing cash for expenses, or taking advantage of better investment opportunities elsewhere.

Types of mutual funds redemption forms

There are generally two major types of mutual funds redemption forms: individual and joint account forms. Individual accounts typically require fewer details, while joint accounts may require signatures from all account holders. Additionally, retirement accounts have specific forms tailored to comply with tax regulations and account types.

Preparing to fill out the redemption form

Before you start filling out your mutual funds redemption form, it’s essential to gather all necessary documents. You'll need your account information, such as your account number and fund details. Identification proof, like a government-issued ID, is also necessary to verify your identity, especially if you haven’t used the form before.

In addition to identity documents, tax-related documents can be helpful, particularly if you expect to pay taxes on the capital gains from your redemption. Understanding the redemption terms and conditions, like any penalties or waiting periods, is equally important to avoid unexpected fees.

Step-by-step guide to completing the mutual funds redemption form

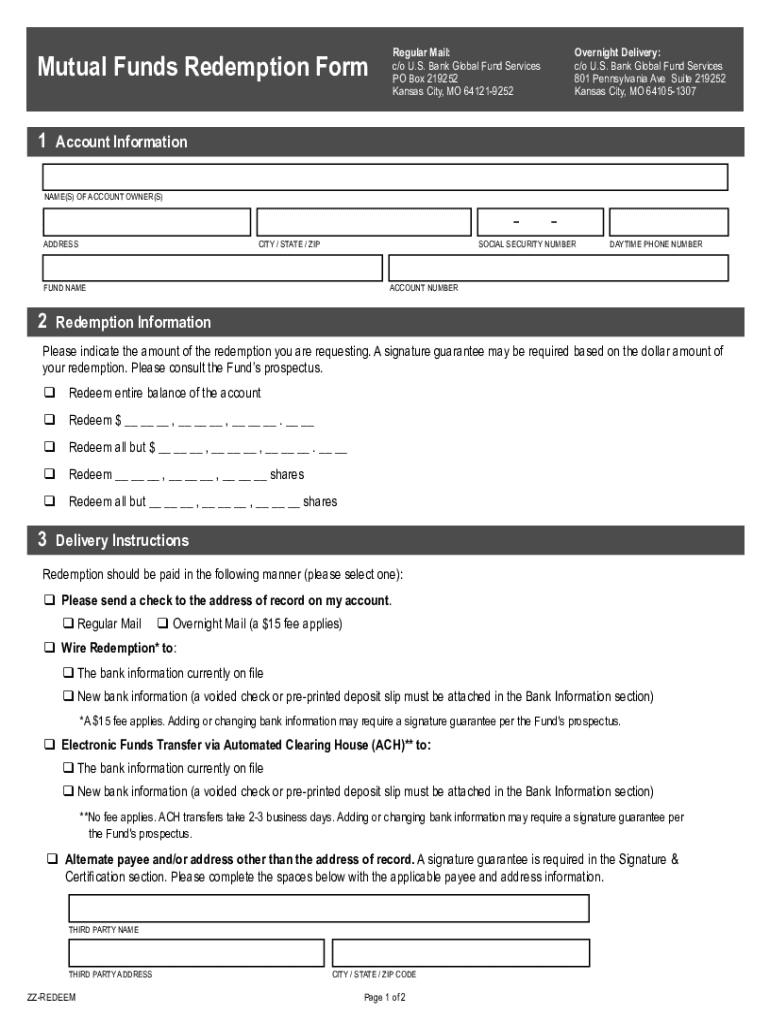

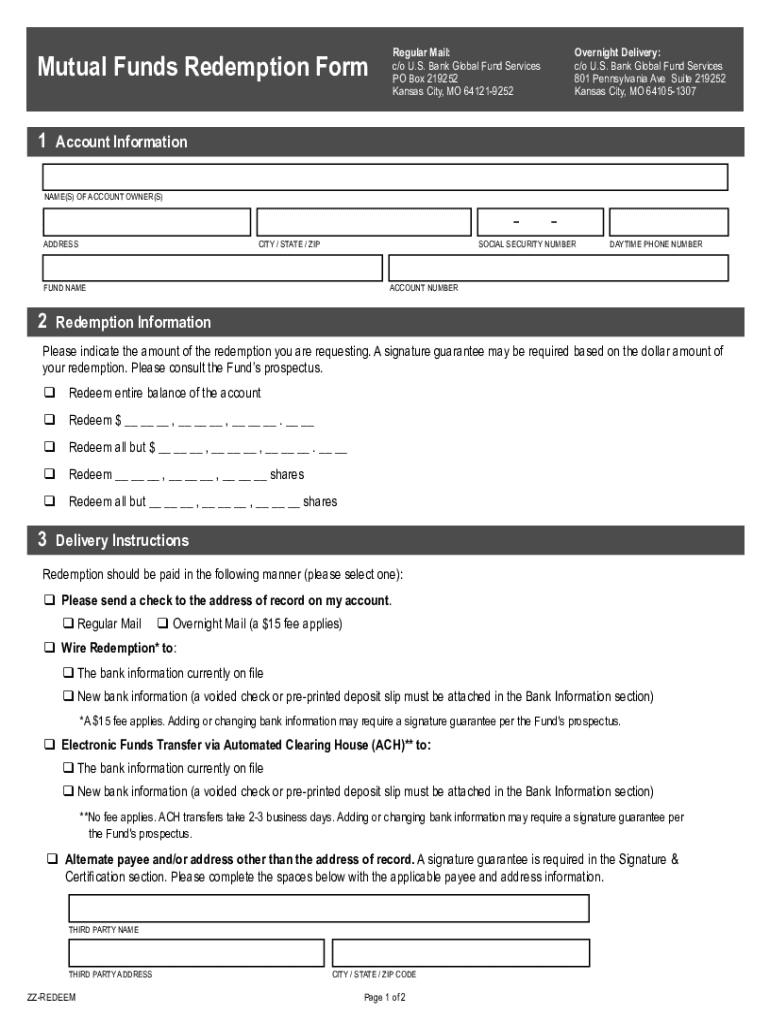

The first section of the mutual funds redemption form typically requires your personal information. You’ll need to accurately fill in your name, address, and contact details. While some fields may be optional, providing them ensures smoother processing of your request.

In the next section, you'll select which funds you wish to redeem. It’s crucial to understand how much of your investment you want to liquidate. Financial advisors often recommend not redeeming all shares at once, as remaining invested can yield better long-term benefits. Finally, the payment instructions section allows you to specify how you'd like the funds delivered, such as via check or direct deposit.

Reviewing and finalizing your redemption form

After filling out your form, take a moment to review all information for accuracy. Common errors include typos in account numbers or contact details, which can delay processing. Always ensure your signature is included, along with the date, as these are often mandatory for the form to be valid.

Remember, double-checking your form before submission can save you from unnecessary back-and-forth and potential rejections. If submitting jointly, ensure that all parties have signed the form where required.

Submitting the mutual fund redemption form

Once your form is complete, you’ll need to submit it to the fund company. Check the form for where it should be sent—some companies allow electronic submissions through their website, while others may require mailed forms. If you’re mailing your form, consider using a trackable mail service to ensure it arrives safely.

After submitting, you can verify the progress of your redemption request by contacting the fund company. Many provide online portals for tracking your submission and processing status, offering peace of mind as you wait.

What to expect after submission

The timeline for processing redemption requests can vary. Typically, mutual funds will process redemptions within a few business days, but it may take longer depending on the fund's policies and market conditions at the time of your request. It’s crucial to remain aware of fees and taxes that might accompany your redemption, particularly if you’ve held your investment for less than a year.

You should receive a notification confirming your redemption and detailing any applicable fees. Keeping records of your redemption confirmations is wise, especially for tax purposes come filing time.

Troubleshooting common issues

Sometimes, redemption requests can experience delays. If you find your request hasn’t been processed within the expected timeframe, reach out to customer support for updates. Additionally, if your circumstances change after submission and you need to cancel or modify your request, contact the fund company as soon as possible to see if this is viable.

Most funds have dedicated customer support teams ready to assist with issues related to redemption, so don't hesitate to utilize these resources if needed.

Leveraging pdfFiller for effortless redemption process

Using pdfFiller can significantly simplify the mutual funds redemption process. This platform empowers users to edit PDFs, eSign documents, and collaborate seamlessly. You can fill out your mutual funds redemption form directly online, ensuring accuracy and efficiency without the need for printing.

pdfFiller also offers features like document tracking and management, providing you real-time updates on the status of your redemption request. This smart document management solution is ideal for both individuals and teams, making the redemption process as streamlined as possible.

FAQs about mutual funds redemption

A common question among investors is how often one can redeem mutual funds. Generally, there are no limitations; however, certain funds may have restrictions on frequent trading, which could incur penalties. Additionally, investors often wonder about penalties associated with early redemptions—many mutual funds impose fees if shares are sold within a short holding period.

Final thoughts on managing mutual funds redemptions

Managing mutual funds redemptions effectively involves understanding your investment strategy and keeping track of your holdings after redemption. Be aware of market trends to ensure that your future redemption decisions align with your financial goals. It's beneficial to maintain communication with your financial advisor to navigate complexities in your portfolio.

Lastly, remember to document your redemptions and maintain records for tax purposes. This documentation will aid in better managing your finances and provide clarity on your investment decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit mutual funds redemption form online?

How do I edit mutual funds redemption form in Chrome?

Can I edit mutual funds redemption form on an Android device?

What is mutual funds redemption form?

Who is required to file mutual funds redemption form?

How to fill out mutual funds redemption form?

What is the purpose of mutual funds redemption form?

What information must be reported on mutual funds redemption form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.