Get the free Business Insurance Proposal Form

Get, Create, Make and Sign business insurance proposal form

How to edit business insurance proposal form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business insurance proposal form

How to fill out business insurance proposal form

Who needs business insurance proposal form?

Business Insurance Proposal Form - How-to Guide

Understanding Business Insurance

Business insurance serves as a safety net, protecting a company from unforeseen risks and liabilities. It provides crucial financial support in the event of accidents, theft, or damages, making it an essential component of any successful business strategy.

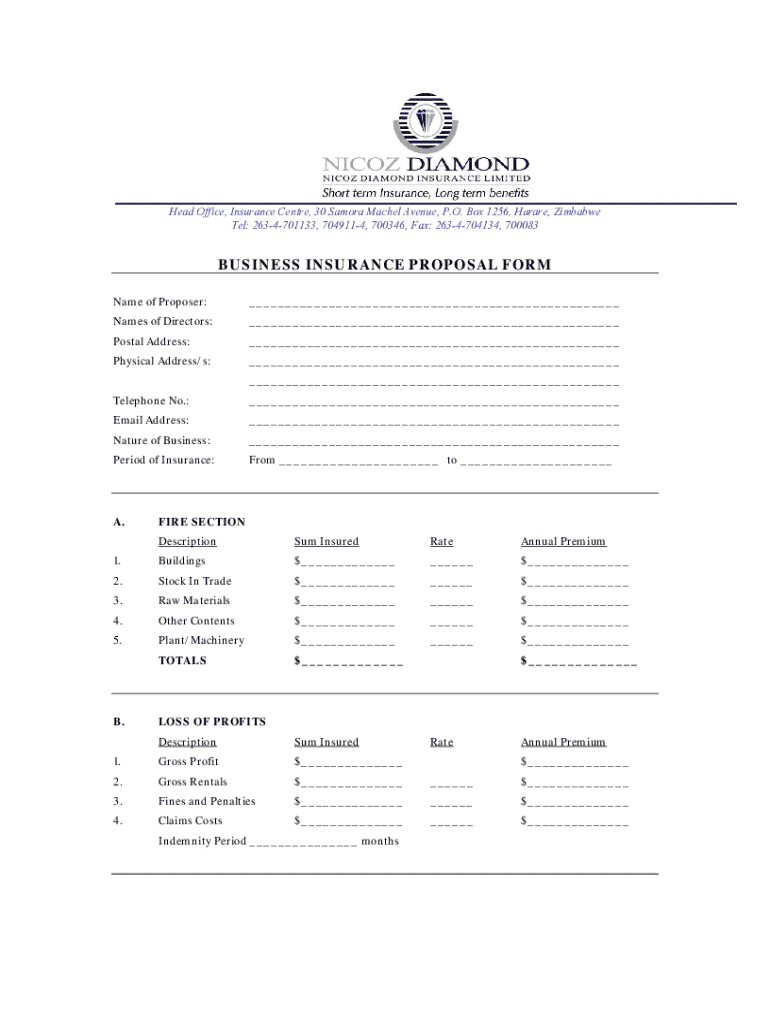

A business insurance proposal form is a structured document that outlines your business needs regarding insurance coverage. Completing this form accurately is critical for determining the right policies for your specific risks and can influence your premiums and coverage options.

Overview of the business insurance proposal form

The business insurance proposal form plays a pivotal role in assessing the unique risks associated with your business type and operational activities. This form enables insurance providers to determine the coverage options that best fit your business requirements.

By evaluating the information you provide in this form, insurers can accurately assess potential liabilities and the necessary measures that need to be in place. Understanding its key components is essential to ensure that you represent your business accurately.

Preparing to fill out the proposal form

Gathering the required information before filling out the business insurance proposal form is fundamental for its successful completion. This preparation ensures that you present your business and its requirements clearly, helping insurers to tailor the coverage to your needs.

Here’s what you need to collect:

Step-by-step instructions for completing the business insurance proposal form

Filling out the business insurance proposal form can be daunting, but following a structured approach can ease the process. Here’s a breakdown by sections:

Managing and editing your business insurance proposal form

After completing the business insurance proposal form, managing it properly is equally important. Utilizing pdfFiller's editing tools can help you refine the proposal before submission. This platform allows you to make necessary changes seamlessly, ensuring that all details are accurate.

Collaboration with team members can also simplify this process. By sharing the form within your organization, you can gather additional insights, ensuring comprehensive coverage for your business’s needs.

Frequently asked questions about business insurance proposals

Understanding common questions about the business insurance proposal can help demystify the process. Below are some frequently asked questions that may provide clarity.

Comparing different business insurance proposals

Once you receive multiple proposals from different providers, it’s essential to evaluate them carefully. Each proposal may offer varying coverage options at different prices.

When comparing proposals, look beyond just the premium costs to understand the value provided.

Additional insights on business insurance

Staying abreast of trends in business insurance proposals can significantly impact your decision-making process. New risks emerge frequently, and so do solutions from insurance providers.

The role of technology cannot be understated in administering modern business insurance applications, as many providers leverage AI and data analytics to refine evaluation processes.

Interactive tools and resources for business insurance proposals

Utilizing interactive tools can facilitate the insurance proposal process. With solutions like pdfFiller, you can access several resources tailored to augment your insurance management.

Final considerations

Regularly updating your business insurance proposal is crucial as your business evolves. Changes in operations or expansions may significantly alter your insurance needs.

Staying informed about changes in insurance regulations also ensures compliance and coverage adequacy. Consider working closely with an insurance agent or broker who can offer valuable insights and help navigate the complexities of your insurance proposal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find business insurance proposal form?

How do I edit business insurance proposal form in Chrome?

How do I fill out business insurance proposal form on an Android device?

What is business insurance proposal form?

Who is required to file business insurance proposal form?

How to fill out business insurance proposal form?

What is the purpose of business insurance proposal form?

What information must be reported on business insurance proposal form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.