Get the free Employee Authorization for Payroll Deduction to Health Savings Account

Get, Create, Make and Sign employee authorization for payroll

How to edit employee authorization for payroll online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employee authorization for payroll

How to fill out employee authorization for payroll

Who needs employee authorization for payroll?

Navigating the Employee Authorization for Payroll Form

Understanding the employee authorization for payroll form

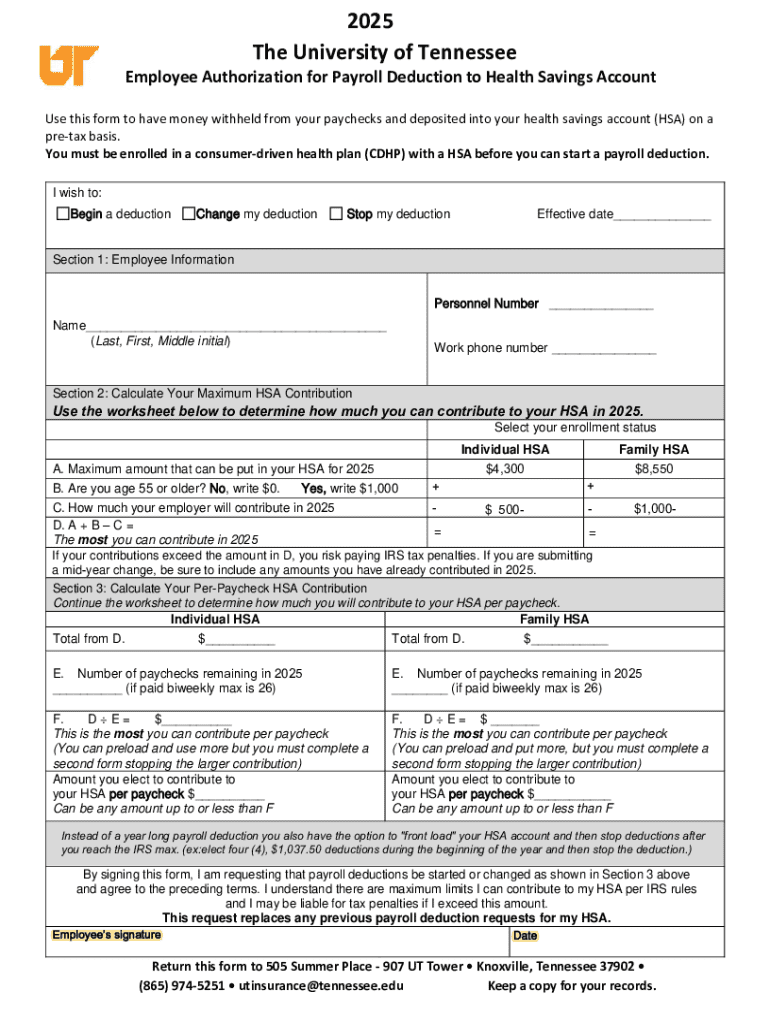

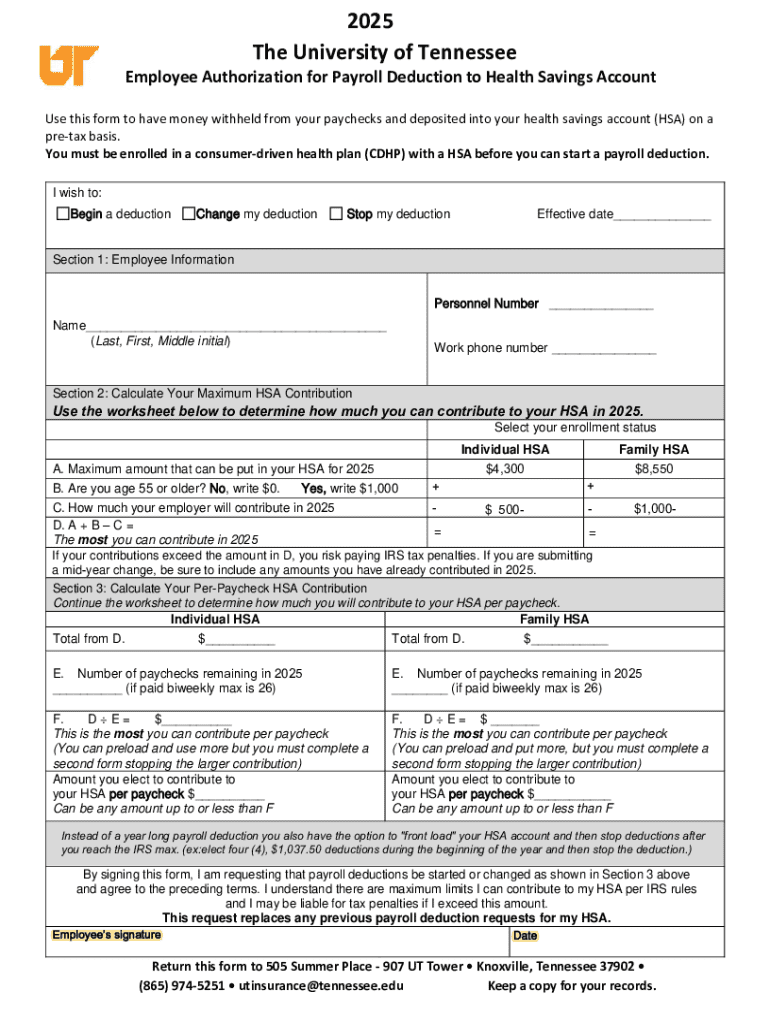

An Employee Authorization for Payroll Form is a critical document that allows an employer to manage payroll accurately and efficiently. This form primarily establishes authorization for salary deductions, including tax withholdings and benefits premiums, ensuring both legal compliance and organizational standards are met. It serves as a binding agreement between the employee and the employer, specifying what deductions are to be made from the employee's paycheck.

The importance of this form cannot be overstated; by clarifying the specifics of payroll deductions, it helps prevent misunderstandings and disputes regarding compensation. Employees need to complete this form promptly to avoid delays in payroll processing, which could directly impact their earnings.

When is the form required?

The Employee Authorization for Payroll Form is necessary in several scenarios. For instance, new employees must complete it during their onboarding process to ensure their payroll information is accurate from day one. Additionally, current employees who wish to change their direct deposit information, adjust charity contributions, or make alterations to their withholding allowances must provide a new or updated authorization form.

Legal considerations also dictate the need for this form. In many jurisdictions, labor laws require employers to obtain written consent before making any deductions from an employee's wages. Failure to comply can result in penalties for employers and can jeopardize the employee's rights regarding compensation.

Key components of the employee authorization for payroll form

Every Employee Authorization for Payroll Form consists of several essential components that ensure clarity and legality. The personal information section is crucial and typically requests details such as the employee's name, address, and Social Security Number. This information is necessary for accurate tax reporting and to link the employee with their payroll records.

The employment details section will further require the employee to specify their job title, department, and date of employment. This information helps categorize the employee correctly within the payroll system. Another critical part of the form is the authorization information, where employees outline their consent for payroll deductions. It’s essential that this section includes signature requirements to affirm the employee's agreement to the deductions specified.

Many companies also offer direct deposit options, allowing employees to choose to have their wages directly deposited into their bank accounts. This segment requests account details and bank information while highlighting the benefits of direct deposit, such as faster access to funds and reduced risk of check loss or theft.

Step-by-step guide to completing the employee authorization for payroll form

Completing the Employee Authorization for Payroll Form doesn’t have to be daunting. Here’s a step-by-step guide to help you navigate this process smoothly.

Once you’ve filled out the form, review it thoroughly. Check for any errors or omissions that could cause delays in processing. Common mistakes include incorrect Social Security Numbers or missing signatures, which can hinder payroll and potentially delay your paycheck.

Editing and customizing your employee authorization for payroll form

With digital tools like pdfFiller, customizing your Employee Authorization for Payroll Form is straightforward. pdfFiller provides users with editing tools that allow you to modify your form to suit your needs. Accessing the editing tools is simple—just upload your PDF form to the platform to get started.

Customization can include adding your company logo or branding elements for a more professional look. Additionally, if your company has unique terms or conditions related to payroll that need to be outlined, pdfFiller allows you to incorporate these directly into the form.

eSigning your employee authorization for payroll form

eSigning your Employee Authorization for Payroll Form is gaining popularity among businesses, mainly due to its convenience and security. The eSigning process via platforms like pdfFiller is user-friendly, allowing you to sign your form digitally without the need for printing, scanning, or faxing.

The benefits of eSigning include saving time and ensuring your documents are submitted promptly. Furthermore, eSigned documents are often more secure, as they can be encrypted and securely stored within the cloud. However, it’s crucial to understand the legal considerations surrounding digital signatures; they are recognized in most jurisdictions as legally binding, provided that the signing process meets security standards.

Submitting your authorization form

Submitting your Employee Authorization for Payroll Form correctly ensures a smooth payroll process. Depending on company protocol, forms can typically be submitted electronically or in paper format. It’s advisable to check with your payroll department regarding preferred submission methods.

Best practices include ensuring your form is complete before submission and obtaining a confirmation of receipt from the payroll department. This provides peace of mind that your information has been received and is being processed. If you encounter a rejection, immediate follow-up with the payroll department is crucial to understand the issues and rectify them promptly.

Managing your employee authorization form with pdfFiller

Managing your Employee Authorization for Payroll Form becomes effortless with pdfFiller. The platform's cloud-based document management feature allows you to store and retrieve your form anytime, anywhere, ensuring that you always have access to your crucial payroll documents.

pdfFiller also offers collaboration features, allowing you to share your form with HR or finance for review. You can directly receive feedback and make revisions in real time, fostering teamwork and transparency in payroll management.

Troubleshooting common issues

If your Employee Authorization for Payroll Form is returned, don’t panic. Rethink the reasons for rejection—common issues include missing information or discrepancies in your personal details. It’s critical to address the mentioned concerns, make the necessary amendments, and resubmit your form quickly to avoid delays in payroll.

Additionally, tech-related issues may arise while using pdfFiller. If you encounter problems with the software, consult the help section or contact support for assistance. Understanding how to navigate these common technical challenges will improve your experience with document management.

Staying compliant with employee authorization forms

To ensure everything runs smoothly with your Employee Authorization for Payroll Form, you need to be aware of employee rights regarding payroll authorizations. Employees have the right to understand what deductions will be made and to have their questions answered transparently. Understanding these rights helps protect employees from errors or unfair practices.

On the other hand, employers have specific responsibilities concerning these forms. They must keep accurate records of signed forms, inform employees about their rights, and handle deductions according to the authorizations provided. Providing training to HR personnel on these matters can foster a compliant and transparent workplace.

Additional features of pdfFiller relevant to payroll management

pdfFiller doesn’t just stop at offering editing and signing solutions. The platform also integrates seamlessly with other financial tools, enabling users to maximize efficiency in payroll management. By linking your forms with financial software, you ensure data accuracy and ease of access.

Moreover, pdfFiller provides tracking changes and version control, allowing you to monitor any updates made to your Employee Authorization for Payroll Form. Utilizing analytics features can also give insight into submission trends, helping you optimize your payroll processes over time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my employee authorization for payroll in Gmail?

How can I edit employee authorization for payroll from Google Drive?

How can I send employee authorization for payroll for eSignature?

What is employee authorization for payroll?

Who is required to file employee authorization for payroll?

How to fill out employee authorization for payroll?

What is the purpose of employee authorization for payroll?

What information must be reported on employee authorization for payroll?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.