Get the free Micro Credit Application

Get, Create, Make and Sign micro credit application

Editing micro credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out micro credit application

How to fill out micro credit application

Who needs micro credit application?

Micro Credit Application Form: A How-to Guide Long-Read

Understanding micro credit: A brief overview

Micro credit refers to small loans provided to individuals or small businesses that lack access to traditional banking services. The purpose of micro credit is to empower entrepreneurs, particularly in developing regions, by providing them with the necessary capital to start or expand their businesses. This financial innovation can lead to improved economic conditions and personal growth, as it enables underprivileged individuals to break the cycle of poverty.

Unlike traditional loans, which often come with extensive eligibility requirements and higher collateral needs, micro credit is designed to be accessible. The amounts are typically lower and the terms more flexible, making it easier for borrowers to meet their obligations. This access to finance can produce significant social and financial returns, contributing to the broader community's well-being.

What is a micro credit application form?

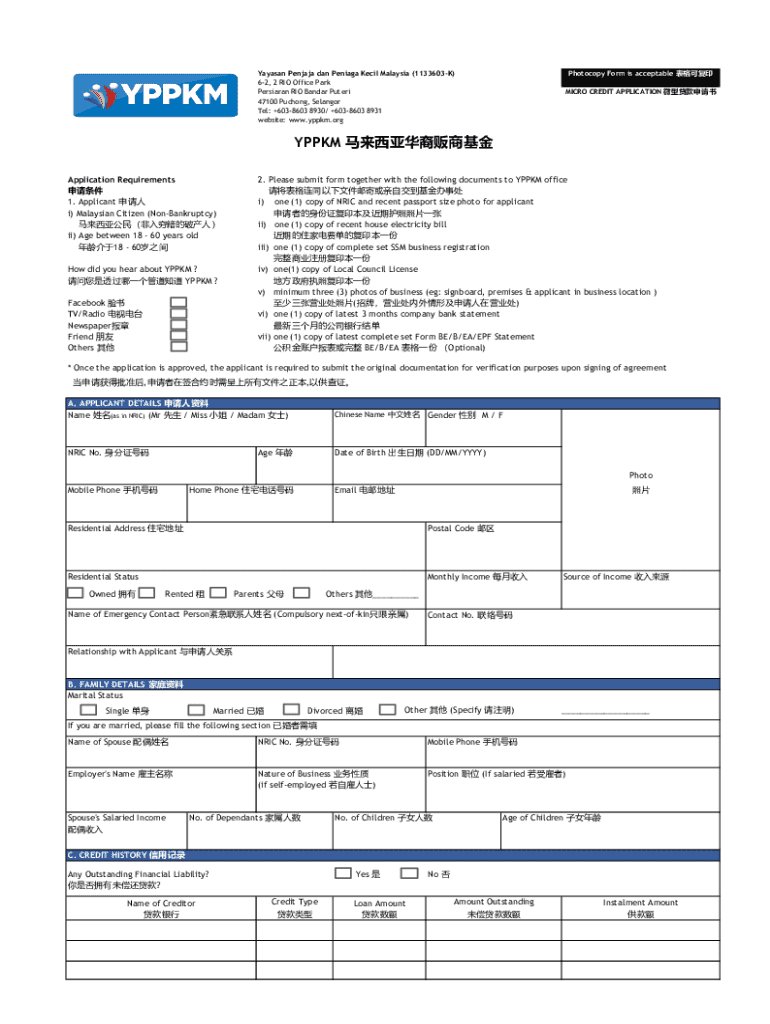

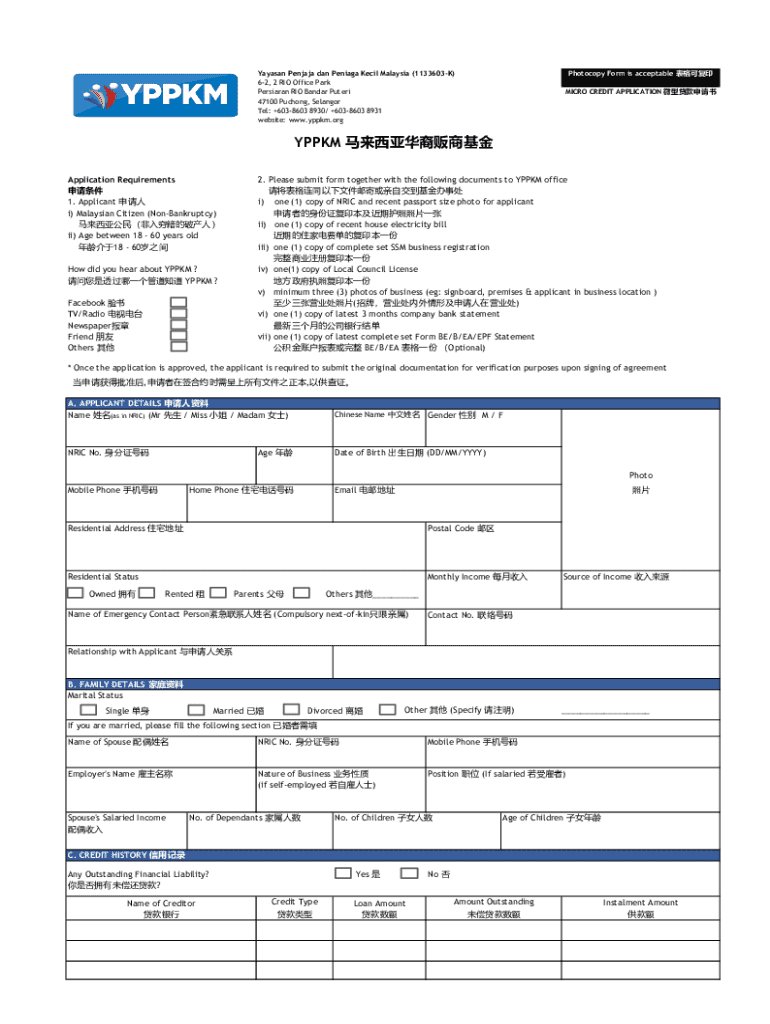

The micro credit application form is a crucial document used by individuals to apply for micro loans. Its primary purpose is to collect essential information regarding the applicant's personal circumstances, financial needs, and plans for using the loan funds. Understanding what information is required helps streamline the application process and increases the chances of approval.

Typically, this form includes several key elements that must be filled out accurately, such as personal identification details, financial statements, and a clear purpose for the requested loan. Providing precise information is vital; inaccuracies can lead to delays or even denials of the application.

Components of a micro credit application form

Filling out a micro credit application form correctly is vital for ensuring a smooth application process. Each section of the form plays a significant role in assessing your creditworthiness and intended use of funds. Below is a detailed breakdown of the main components you'll encounter.

Personal information section

This section requires your full name, contact details, and identification documentation like a national ID or utility bill. These details help the lender verify your identity and residence.

Financial information section

You will need to provide information about your income sources, including salary, business profits, or any additional earnings. Moreover, detail any existing debts or obligations you have, as this information helps the lender determine your repayment capacity.

Loan purpose section

Clearly describe how you plan to use the loan. This can range from purchasing inventory for a small business to funding educational expenses. A well-articulated purpose reflects your commitment and seriousness towards the loan.

Consent and signatures

Lastly, the application will require your signature as a form of consent. This typically includes authorization for credit checks and acknowledges that the information provided is true and accurate.

Step-by-step guide to filling out the micro credit application form

To ensure a thorough and successful submission for your micro credit application, here’s a step-by-step guide. This process will help you gather and present all necessary information effectively.

Tips for a successful micro credit application

Enhancing your chances of a successful micro credit application can often hinge on how well you present your information. Here are common pitfalls to avoid and strategies to employ.

How to edit and manage your micro credit application form using pdfFiller

Using pdfFiller, you can easily edit and manage your micro credit application form electronically. This platform provides seamless solutions for editing PDFs, making the entire process more efficient.

Here are the steps to upload and modify your application:

eSigning your micro credit application form

The modern application process often includes eSigning as a convenient and efficient way to authorize your micro credit application. Utilizing this feature not only saves time but also ensures that your agreement is legally binding.

To eSign your application using pdfFiller’s feature, follow these steps:

Managing your application after submission

After submitting your micro credit application, it’s vital to stay proactive. Understanding the next steps and anticipating potential inquiries can significantly smooth the process.

Here’s what to expect post-submission:

Frequently asked questions about micro credit applications

As potential applicants often have several questions, here are some common queries answered regarding the micro credit application process.

Conclusion: The empowering experience of applying for micro credit

Applying for a micro credit can be an empowering experience, enabling individuals to seize opportunities for entrepreneurship and self-improvement. Utilizing resources such as pdfFiller can greatly enhance your application management, ensuring a smooth and organized process.

As you embark on this journey, remember that preparation is key. Take the time to gather all necessary documentation and learn about what lenders seek. Your efforts will not only facilitate a successful application but also contribute to achieving your financial goals and fostering valuable economic growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send micro credit application for eSignature?

How do I fill out the micro credit application form on my smartphone?

How do I fill out micro credit application on an Android device?

What is micro credit application?

Who is required to file micro credit application?

How to fill out micro credit application?

What is the purpose of micro credit application?

What information must be reported on micro credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.