Get the free Corporate Account Opening Form

Get, Create, Make and Sign corporate account opening form

Editing corporate account opening form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate account opening form

How to fill out corporate account opening form

Who needs corporate account opening form?

Corporate Account Opening Form: A Comprehensive How-to Guide

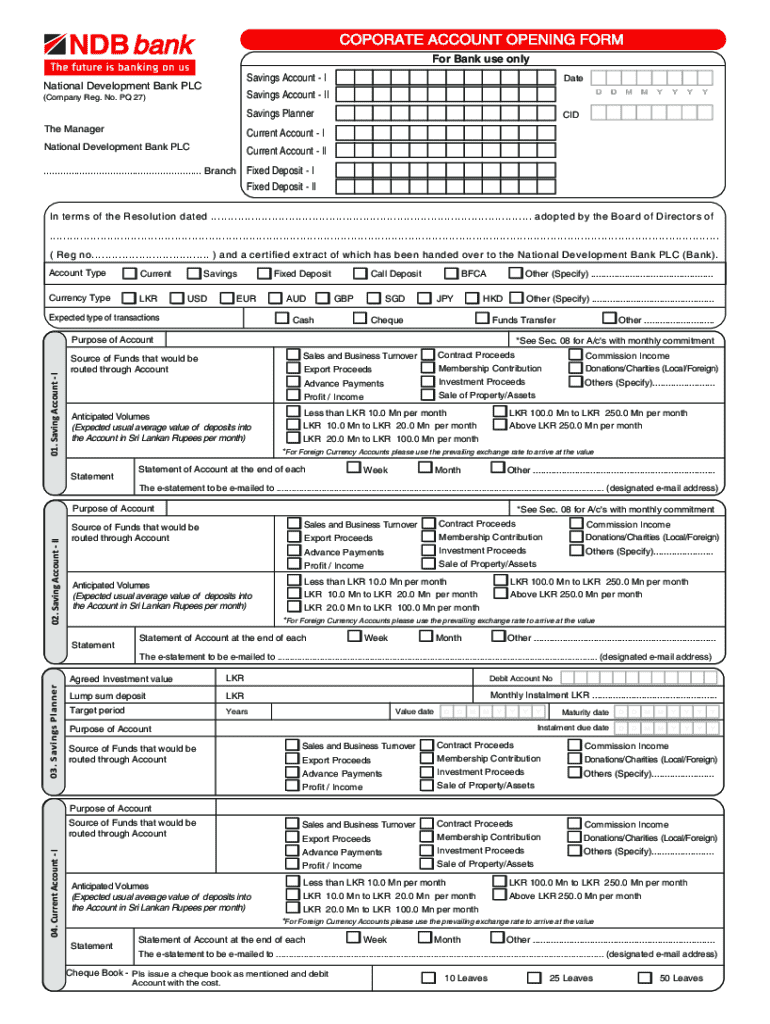

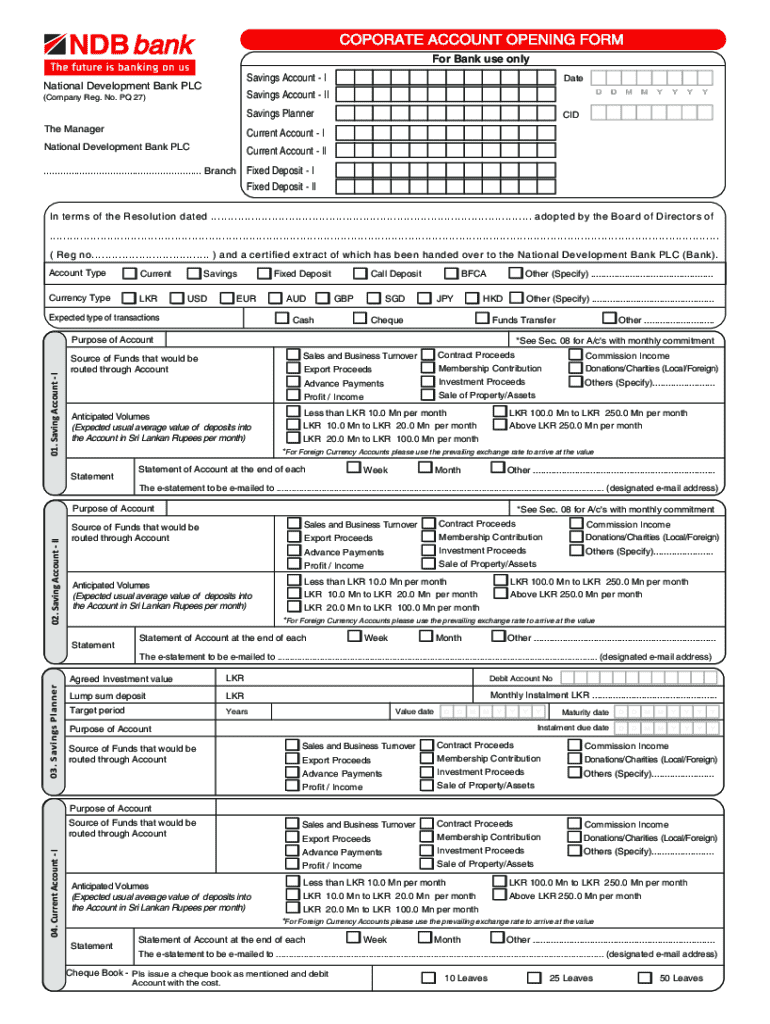

Understanding corporate account opening forms

A corporate account opening form is the starting point for businesses seeking to establish a formal banking relationship. This document serves as an application to open a corporate bank account, allowing companies to manage their finances seamlessly. The need for such a form arises in various situations, including new business setups, financial restructurings, or merely switching banking institutions. A corporate account can significantly enhance a company's credibility and operational efficiency.

Corporate accounts come in several types, each designed to cater to different business needs. Common types include checking accounts, savings accounts, and merchant accounts. The benefits of having a corporate account are substantial: businesses can easily manage cash flow, access loans, and integrate with accounting software, thus streamlining their financial processes.

Essential components of the corporate account opening form

Filling out a corporate account opening form involves providing critical information that financial institutions rely on to assess eligibility. The personal information section typically requires details about the owner or authorized signatories, including their names, addresses, and contact information.

Business information, such as the company’s name, address, and legal structure like LLC or Corporation, is also necessary. Additionally, a Tax Identification Number (TIN) must be provided for tax purposes. Financial information, including the amount of the initial deposit and sources of funding, helps banks evaluate the business's financial health. Corporate documents such as Articles of Incorporation and an Operating Agreement are usually required to verify the legitimacy of the business.

Step-by-step guide to filling out the corporate account opening form

The first section of the corporate account opening form typically focuses on business details. When inputting this information, ensure all entries are factual and up-to-date. Common pitfalls include typographical errors or outdated company information that could delay processing times.

Next, the owner information section necessitates identity verification. Prepare identification documents such as a driver's license or passport to support your application. In some cases, financial statements are required to provide insight into your business's monetary position. When presenting this data, utilize a consistent format to enhance readability, like using tables or bullet points to organize figures.

Compliance and legal acknowledgments must also be understood. Depending on the type of business—be it a corporation or a partnership—specific regulations may apply that the institution will want to verify before opening the account.

Editing and customizing your corporate account opening form with pdfFiller

Accessing and customizing the corporate account opening form via pdfFiller is a straightforward process. Users can easily navigate to the required form through the platform’s search functionality to find the corporate account opening form tailored to their needs.

Once accessed, pdfFiller provides various editing options. Users can add text, create signature fields, and adjust formatting. Ensuring clarity and accuracy during this stage is vital; errors can lead to delays. Take advantage of the collaboration tools that pdfFiller offers, allowing team members to contribute and review the form, with version tracking available to monitor any changes made.

Signing and submitting your corporate account opening form

Before submitting your corporate account opening form, conduct final checks to ensure all required fields are filled accurately. Double-check that all supplementary documentation is attached, as incomplete forms usually result in processing delays or denials.

Using pdfFiller for electronic signature verification makes the signing process efficient. The platform allows users to e-sign documents easily, with electronic signatures holding the same legal validity as handwritten ones. Be sure to familiarize yourself with the electronic signing process to prevent any last-minute issues.

Managing your corporate account post-submission

Once the corporate account opening form is submitted, tracking the status of the application is crucial to managing expectations. pdfFiller offers tools to monitor submission status, keeping you updated on progress.

After a corporate account is opened, you’ll need to understand what comes next. Timelines for account approval can vary; be prepared for communication from the bank regarding next steps. Maintaining your corporate account also requires regular reporting and compliance check-ins. Utilizing pdfFiller for ongoing document management simplifies this, allowing you to keep track of all necessary documentation and due dates.

Frequently asked questions about corporate account opening forms

During the application process, many businesses encounter common challenges with corporate account opening forms. This could range from inadequate documentation to misunderstanding the bank's requirements. To mitigate these challenges, it's essential to read all instructions carefully and ensure all necessary documents are attached.

Additionally, if mistakes are made on the form, promptly rectifying them can prevent delays. Most financial institutions allow for amendments, but being proactive is key to avoiding complications.

Interactive tools to simplify your corporate account opening process

pdfFiller is equipped with interactive features that simplify the corporate account opening process, including form templates and wizards designed to guide users step-by-step. These tools can significantly enhance document management and ensure compliance with banking requirements.

Numerous case studies demonstrate how pdfFiller has facilitated successful corporate account openings. By offering users robust resources and intuitive editing capabilities, businesses can navigate the complexities of banking documentation effectively.

Conclusion and next steps

In conclusion, the corporate account opening form is a vital component for any business looking to establish its financial footing. Utilizing pdfFiller for this process empowers users to efficiently fill out, edit, and manage their forms. Take advantage of the tools offered, and begin filling out your corporate account opening form today to streamline your path to effective business banking.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send corporate account opening form to be eSigned by others?

Where do I find corporate account opening form?

How do I make edits in corporate account opening form without leaving Chrome?

What is corporate account opening form?

Who is required to file corporate account opening form?

How to fill out corporate account opening form?

What is the purpose of corporate account opening form?

What information must be reported on corporate account opening form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.