Get the free Monthly Remittance Form

Get, Create, Make and Sign monthly remittance form

How to edit monthly remittance form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly remittance form

How to fill out monthly remittance form

Who needs monthly remittance form?

Monthly remittance form: A how-to guide

Understanding the monthly remittance form

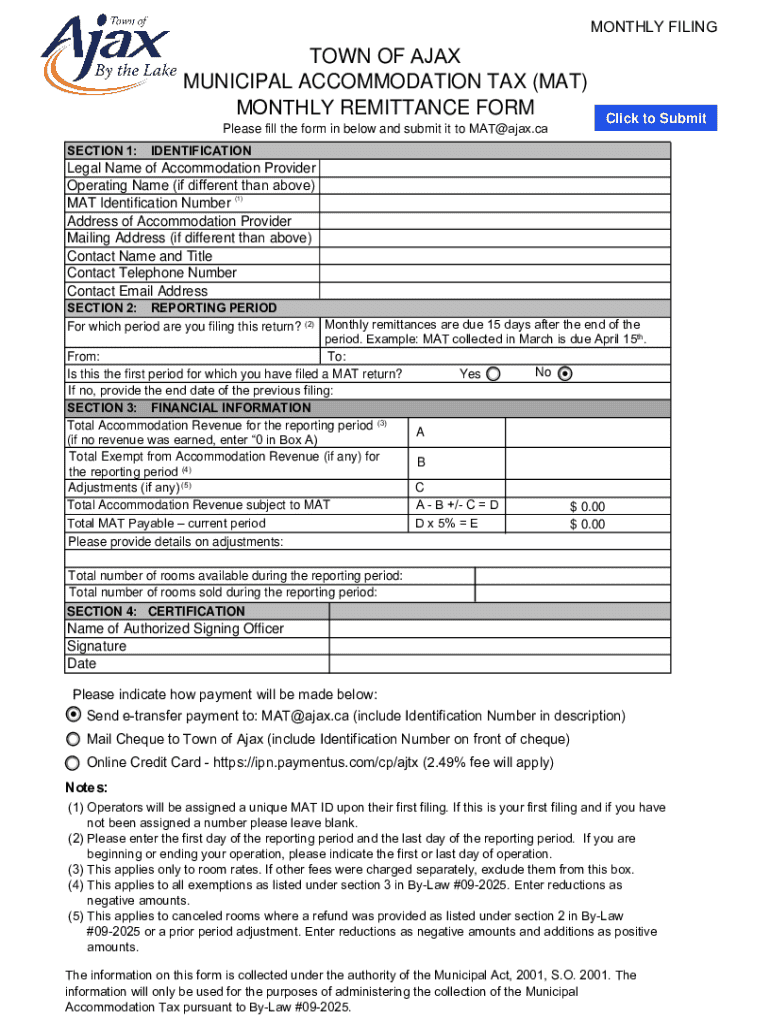

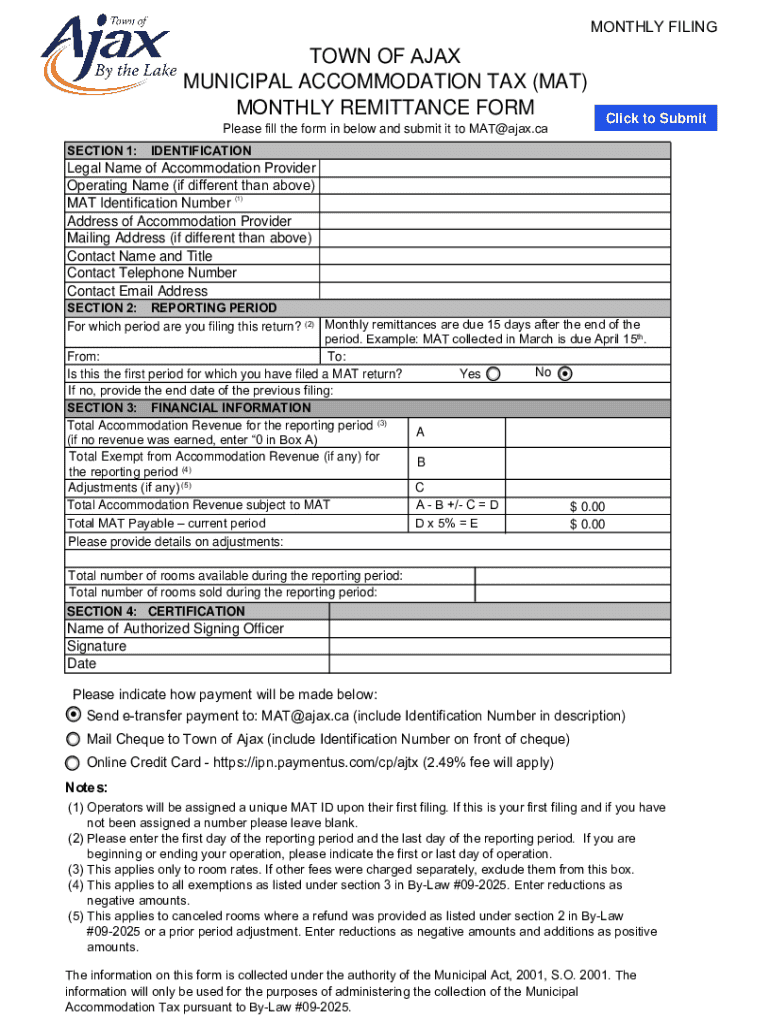

A monthly remittance form is a crucial document that allows individuals and organizations to report and submit various payments such as taxes, employee wages, and benefits. Its primary purpose is to ensure that all relevant payments are accurately documented and submitted to the appropriate authorities in a timely manner. This form is vital in various sectors, including finance, non-profits, and small businesses, as it helps maintain compliance with regulatory requirements.

The monthly remittance form typically includes key details such as the payee's information, amounts owed, payment dates, and any other specifications relevant to the payment being submitted. Accurate submission is of utmost importance as errors may result in penalties, miscommunication with the authorities, or a delay in the processing of the remittances.

Who needs to file a monthly remittance form?

The target audience for the monthly remittance form includes a variety of entities such as freelancers, contractors, small businesses, corporations, and nonprofit organizations. Each of these groups has specific requirements and reasons for utilizing the form. For instance, freelancers may need to submit monthly tax remittances based on their earnings, while businesses must report payroll taxes and employee benefits accurately.

Timely filing offers numerous benefits, including the avoidance of penalties, interest charges, and additional fees. Furthermore, maintaining a consistent filing schedule helps protect the organization’s financial standing, ensuring that both individuals and businesses can focus on their core operations without the stress of compliance issues.

When to file the monthly remittance form

Filing deadlines for the monthly remittance form may differ depending on jurisdiction. Typically, these forms are due monthly, although some regions may allow quarterly submissions. It’s crucial to be aware of local requirements to prevent missing deadlines, as late submissions can lead to penalties and complications with compliance.

To manage filing timelines efficiently, set up reminders using calendar applications or task management tools. Consider creating a list of due dates relevant to your activities to ensure that all submissions are completed promptly, keeping your organization in good standing.

How to prepare for filing the monthly remittance form

Preparation for filing the monthly remittance form involves gathering necessary documentation, such as previous forms, invoices, receipts, and any other financial records pertinent to the payments you need to report. Having everything organized will facilitate the filling process and ensure that you have access to up-to-date information.

Additionally, creating a checklist for information accuracy can significantly reduce errors typically associated with data entry. Review each section meticulously to ensure complete, correct, and relevant information is provided. Remember to double-check for common mistakes, such as entering incorrect amounts or failing to sign the document.

Step-by-step guide to filling out the monthly remittance form

To get started, access the monthly remittance form online. Many jurisdictions offer downloadable PDFs accessible through official websites. However, to streamline the process, using tools like pdfFiller can help fill out the form swiftly in a user-friendly interface, allowing you to complete the required details without hassle.

When filling out each section, follow the specified guidelines and ensure that all required fields are properly addressed. For example, accurately inputting your entity or individual's name, along with the payment amount, will help avoid unnecessary complications. Utilize the editing features available on pdfFiller to make corrections if needed, and take advantage of tools that allow you to save drafts and ensure data is entered flawlessly.

Submitting the monthly remittance form

Once the form has been completed, the next step is submission. Options typically include online submission through platforms like pdfFiller, mailing the document to the appropriate address, or delivering it in person. Online submission is often the fastest and most efficient way to ensure that payments are processed promptly.

Having proof of submission is crucial, as it can protect you in case of any discrepancies. When you use pdfFiller, you can instantly receive confirmation of submission via email, providing a secure digital record. This step is essential for maintaining comprehensive documentation and adherence to compliance standards.

Common challenges and solutions

When dealing with the monthly remittance form, various challenges may arise, including errors in submission or rejections due to incorrect data. If a form is rejected, promptly take steps to correct any issues identified by the recipient agencies. This may involve gathering additional documentation or clarification on mistakes made.

Utilizing pdfFiller tools can significantly expedite this process, allowing you to easily make changes to the form and resubmit it without heavy administrative burdens. For further assistance, refer to FAQs and support materials provided by pdfFiller to clarify any uncertainties that could hinder your filing process.

Managing future monthly remittance filings

Effective management of future filings involves setting up recurring reminders in your calendar or task management tools. Tools like pdfFiller offer calendar features that can help you keep track of your submission deadlines, ensuring that you never miss an important due date.

Moreover, maintaining a clear record of past submissions using management features within pdfFiller can help you easily reference previous filings for future submissions. This practice not only aids in tracking compliance but also creates an audit trail that may be useful for tax purposes or financial reviews.

Utilizing pdfFiller for enhanced document management

pdfFiller offers a range of features specifically tailored for managing monthly remittance forms, such as online editing and eSigning capabilities. Utilizing these features allows for seamless adjustments to documents while ensuring that all necessary signatures are captured efficiently.

For teams, collaboration tools available on pdfFiller foster effective communication and sharing of forms. This enhances the overall workflow, allowing multiple users to work on the same document without the typical issues associated with email attachments or version control.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get monthly remittance form?

How do I make edits in monthly remittance form without leaving Chrome?

Can I edit monthly remittance form on an Android device?

What is monthly remittance form?

Who is required to file monthly remittance form?

How to fill out monthly remittance form?

What is the purpose of monthly remittance form?

What information must be reported on monthly remittance form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.