Get the free Ct-31

Get, Create, Make and Sign ct-31

How to edit ct-31 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-31

How to fill out ct-31

Who needs ct-31?

Complete Guide to the CT-31 Form: Understanding, Filing, and Managing Your Tax Obligations

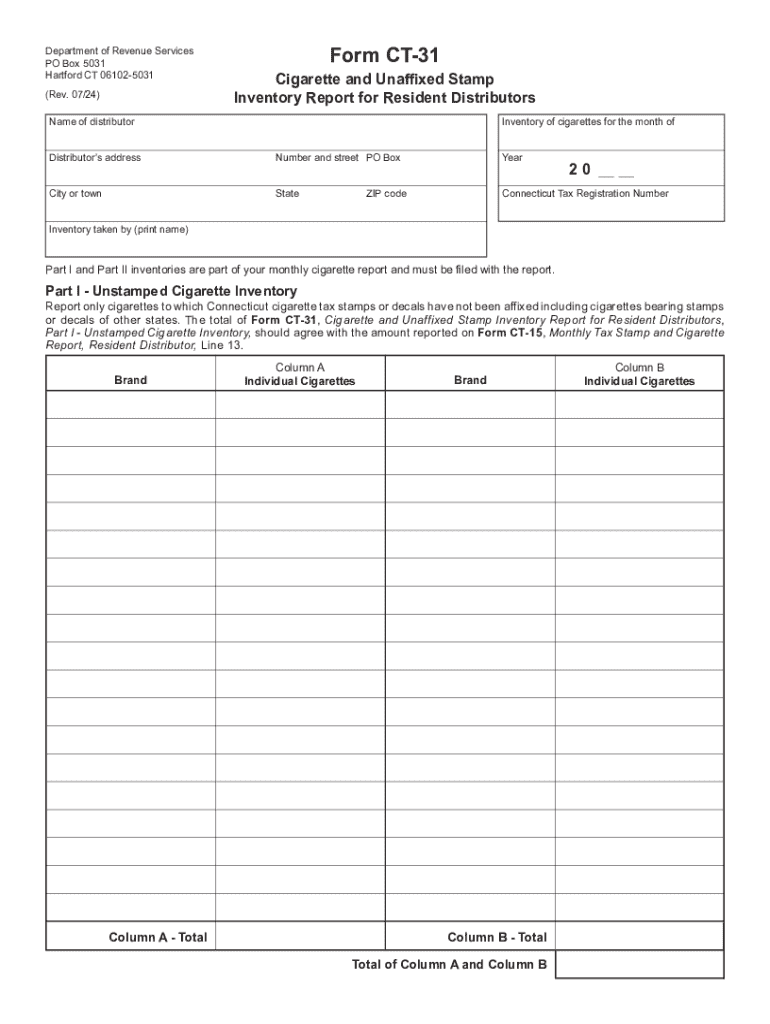

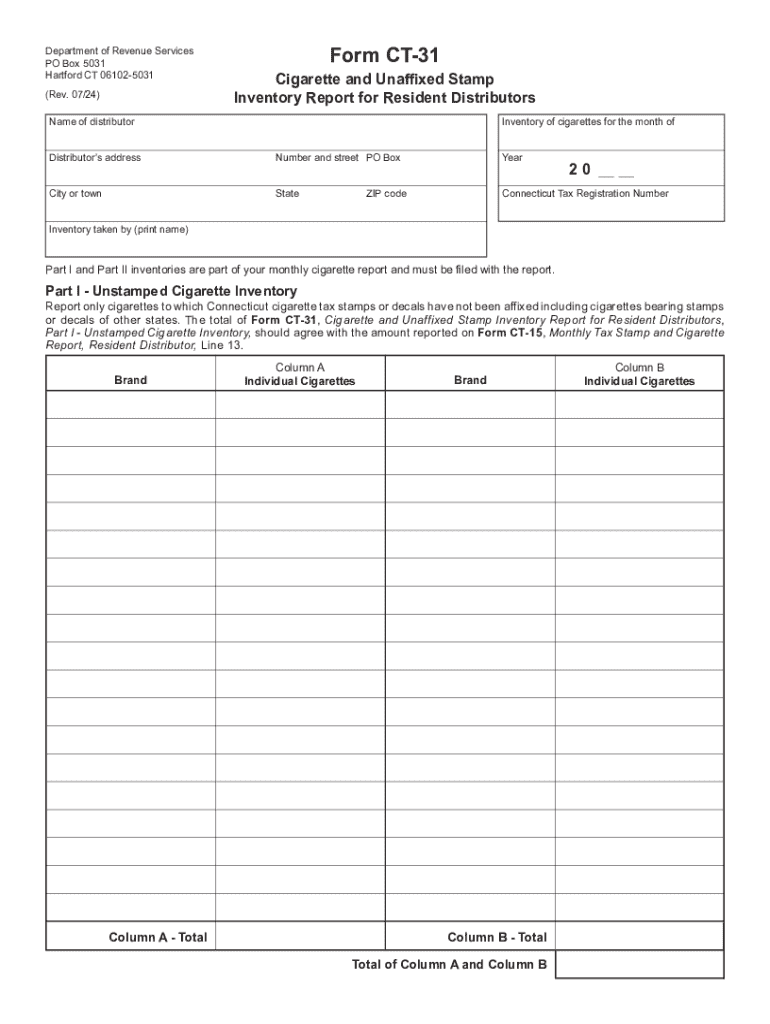

Overview of the CT-31 Form

The CT-31 form represents a crucial document for corporations operating in New York State, specifically designed for those seeking preferential tax treatment based on their qualifying activities. This form allows businesses to report their income while taking advantage of tax reductions that encourage investment and growth within the state.

Key features of the CT-31 form include the ability for domestic, foreign, and alien corporations to demonstrate eligibility for lower tax rates. It plays a pivotal role for businesses, as failing to utilize this form can lead to significantly higher tax liabilities.

The importance of the CT-31 form cannot be overstated; it not only ensures compliance with state tax regulations but also incentivizes corporate growth by offering reduced tax rates to those engaged in qualifying activities in sectors such as sales, manufacturing, and service industries.

Understanding the requirements for filing CT-31

Filing the CT-31 form is required for specific types of entities within New York State, encompassing domestic corporations created under the laws of New York, foreign corporations established in other jurisdictions, and alien corporations not defined under the state laws. Each type must be aware of their obligations and exemptions under New York tax laws.

When considering your eligibility, ensure you understand the specific conditions for filing. These conditions often require businesses to engage in qualifying activities that meet the threshold for preferential tax treatment. This can include operational thresholds based on business capital, revenue generation, or employment levels.

When and how to file the CT-31 form

Filing deadlines for the CT-31 form vary based on a corporation’s tax year. Typically, corporations must file their CT-31 by the 15th day of the third month after the end of their fiscal year. Staying ahead of these deadlines can help avoid penalties and ensure compliance with the New York State Department of Taxation.

Filing methods also play a critical role in the efficiency and speed of the process. Companies can submit their CT-31 forms via electronic means, which is often the preferred method due to its faster processing times. Alternatively, businesses may opt for mail-in submissions, keeping in mind that such methods could lengthen the overall approval timeline.

Detailed instructions for filling out the CT-31 form

The CT-31 form is divided into several sections, each designed to capture key information about your corporation's income and the activities it engages in. Section A focuses on general information, where you will need to provide your business name, address, and Employer Identification Number (EIN). This section establishes your corporation's identity within the tax system and is foundational for the remaining sections.

In Section B, corporations must demonstrate how they qualify for preferential tax rates by detailing their qualifying activities. This may involve the submission of additional materials or evidence that shows the nature of the business activities conducted during the tax year.

Section C is critical as it involves the calculation of your tax obligations. Corporations will need to reference specific tax rates and utilize the provided worksheets for calculating their tax liability accurately. Having a firm grasp of your numbers here is imperative to prevent any potential underpayment penalties.

Line-by-line guidance on filling out key sections

Each line of the CT-31 form has particular instructions designed to ensure compliance and accuracy. Section A requires businesses to accurately fill in their corporation details, including name and address in specific formats. Providing incorrect information at this stage can lead to processing delays. For instance, be sure to enter your business address exactly as registered with the state.

In Section B of the form, it is important to clearly state the qualifying activities that justify your preferential tax rate. Common mistakes in this section involve vague descriptions or incomplete information. It is crucial to provide ample detail about your business operations to substantiate your claim.

Lastly, in Section C, businesses can encounter complex tax calculations. Common pitfalls include miscalculating percentages or misapplying tax schedules. Always double-check your entries against the worksheets provided in the documentation to ensure you've accounted for all income sources.

Interactive tools for completing the CT-31 form

Utilizing interactive tools, such as those available at pdfFiller, can streamline the completion of your CT-31 form. pdfFiller offers advanced PDF editing capabilities, allowing users to fill out forms easily and effectively from any device. This flexibility is especially important for teams and individuals who may not be located at the same physical location.

Beyond simple editing, pdfFiller also provides electronic signature capabilities, which expedites the submission process. Collaborators can sign documents without the hassle of printing and scanning, simplifying the workflow considerably. Additionally, the platform supports collaborative features where team members can contribute to the completion of forms, ensuring that all necessary input is included.

Penalties and consequences for incorrect filing

Filing the CT-31 form incorrectly can lead to various penalties for non-compliance. Common penalties include fines that can accrue over time, particularly if a business fails to file on time or inaccurately reports their earnings. It is vital for businesses to understand the implications of late or incorrect submissions to mitigate financial risks.

In addition to fines, corporations may face increased scrutiny from tax authorities, resulting in audits or additional tax obligations. It is important to file amendments as soon as errors are identified within the CT-31 form. Understanding how and when to file amended returns is crucial for maintaining compliance and minimizing future penalties.

Managing your CT-31 filing and tax obligations

Managing deadlines and ensuring compliance with your CT-31 filing is critical for maintaining good standing as a corporation. Utilizing document management solutions like pdfFiller can help keep track of important dates and submissions, allowing for timely filings.

Proper record-keeping practices further support compliance efforts. Corporations should keep detailed records of all forms submitted, payments made, and correspondence with tax authorities. Using pdfFiller’s features to store documents in a cloud-based platform makes accessing and organizing this information easier.

Additional forms you may need

While the CT-31 form is crucial for corporations seeking preferential tax rates, other forms may also be relevant depending on your specific business operations. Forms like the CT-3 for general corporation tax reporting or the CT-3-S for S Corporations might come into play based on how your business is structured.

Understanding the differences and key points of each form ensures that businesses remain compliant and leverage any potential benefits from various tax statuses. Cross-referencing these forms with your CT-31 filing can further streamline your tax compliance strategy.

Common questions about the CT-31 form

As businesses navigate the complexities of filing the CT-31 form, several common questions arise. Understanding the filing process, the requirements for qualifying activities, and how to amend submitted forms are essential for compliance. The clarity in these areas can alleviate confusion and reduce the anxiety associated with tax season.

Many businesses often worry about what to do if they encounter difficulties during the filing process. Resources are available through the New York State Department of Taxation and various tax professional services to provide assistance and guidance. This support can be invaluable in ensuring accurate submissions.

Expert tips for a successful CT-31 filing

To ensure a successful CT-31 filing, consider implementing best practices such as meticulous preparation of your documents. Engaging all relevant stakeholders and ensuring that information is accurate can streamline your filing process. Utilize tools such as pdfFiller to facilitate efficient document handling and enhance accuracy.

Additionally, regularly reviewing your prior filings and financial documents can surface any potential inconsistencies before filing. Fostering a culture of documentation can prevent mistakes and ultimately save your organization money on penalties and encourage compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ct-31 without leaving Google Drive?

Can I sign the ct-31 electronically in Chrome?

Can I create an electronic signature for signing my ct-31 in Gmail?

What is ct-31?

Who is required to file ct-31?

How to fill out ct-31?

What is the purpose of ct-31?

What information must be reported on ct-31?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.