Get the free Buyer's Estimated Closing Statement

Get, Create, Make and Sign buyers estimated closing statement

Editing buyers estimated closing statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out buyers estimated closing statement

How to fill out buyers estimated closing statement

Who needs buyers estimated closing statement?

Buyers Estimated Closing Statement Form - A Comprehensive How-To Guide

Understanding the Buyers Estimated Closing Statement Form

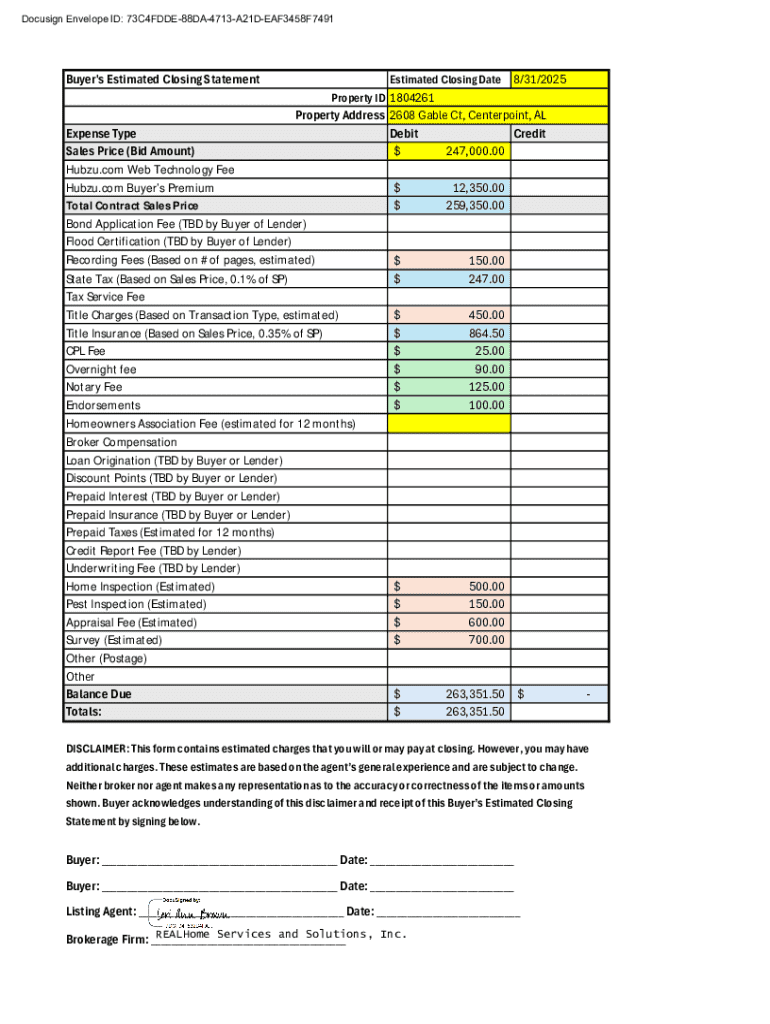

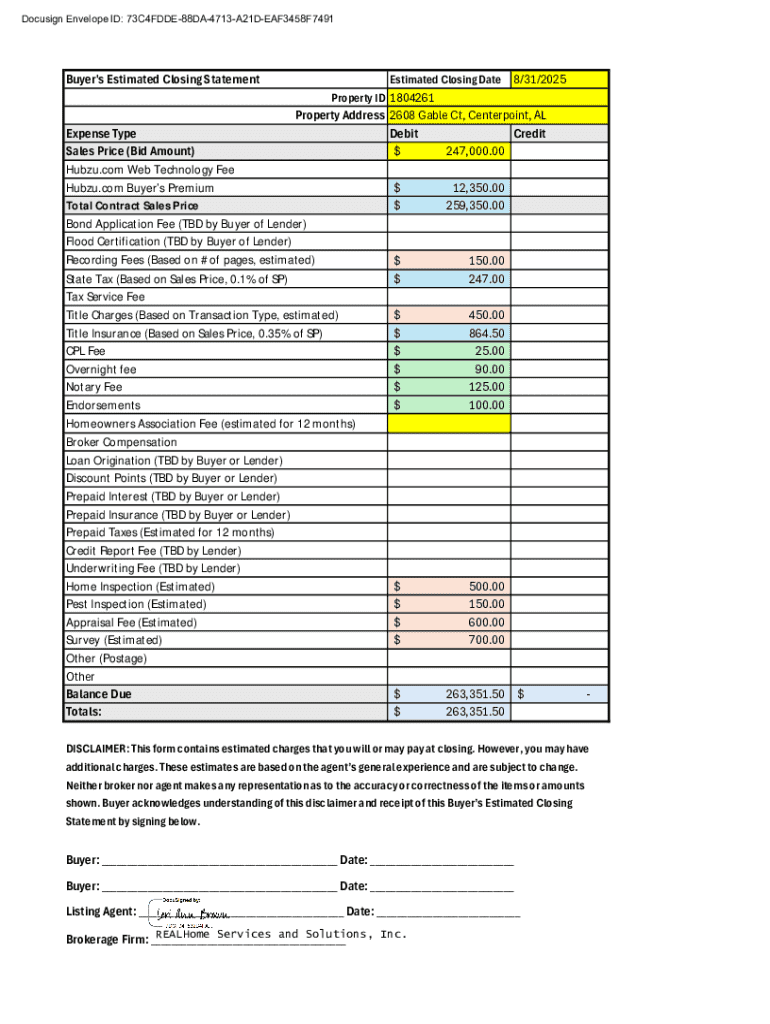

The Buyers Estimated Closing Statement Form is a crucial document for anyone engaged in a real estate transaction. This form outlines the anticipated expenses associated with closing the sale of a property, enabling buyers to prepare financially for the closing day.

The purpose of this statement is to provide a clear summary of the costs that the buyer will incur at closing. This includes everything from loan-related fees to closing costs and prepaid expenses. It helps buyers understand their financial responsibilities, ensuring they are well-informed before finalizing the transaction.

Overview of the closing process

Understanding the closing process is vital for buyers as it allows them to navigate the complexities involved in buying a home. The closing process typically involves several steps, starting from when an offer is accepted until the property's title is officially transferred to the buyer.

A standard timeline includes the following key events: securing a loan, conducting inspections, completing an appraisal, and finalizing the loan approval. Each of these milestones leads up to the closing day.

Buyers must also be aware of all parties involved in this process: sellers, real estate agents, lenders, escrow staff, and potentially lawyers. Each plays a significant role in ensuring the transaction proceeds smoothly.

Key elements of the Buyers Estimated Closing Statement

The Buyers Estimated Closing Statement comprises several key elements designed to provide an itemized overview of the costs associated with closing. This clarity is crucial for buyers, who need to budget effectively.

The statement includes an itemized list of costs related to the loan, closing, and prepaid expenses. Moreover, it summarizes the buyer's financial responsibilities, detailing the down payment, total loan amount, and any credits that might apply.

Detailed breakdown of common fees included

When reviewing the Buyers Estimated Closing Statement, it's crucial to have a solid understanding of the common fees listed. These may seem overwhelming at first, but they each serve a specific purpose.

Loan estimates might include origination fees, which are the lender's charges for processing the loan application. Discount points can also be included, allowing buyers to lower their interest rates by prepaying some of the interest upfront, resulting in savings over time.

Other fees to consider are appraisal fees, which cover the cost of the property’s valuation. Title insurance ensures legal protection against potential disputes regarding property ownership. Settlement and recording fees are also typically included, which cover administrative costs of completing the transaction.

Miscellaneous costs may also be present, including inspection fees to identify any potential issues with the property, prepaid interest that covers the period before the first mortgage payment is due, and HOA fees that ensure access to community amenities.

How to fill out the Buyers Estimated Closing Statement form

Filling out the Buyers Estimated Closing Statement Form requires careful preparation and attention to detail. Begin by gathering all necessary documents, including your loan paperwork and essential identification. Communicating with your lender and real estate agent can provide additional clarity on the items you must include.

Once prepared, start by providing all pertinent identifying information, such as your name, contact details, and the property address. Next, input the itemized costs, ensuring that each fee is accurately recorded. Review the calculations for total estimated closing costs, and be sure to account for any credits you may be eligible for.

Conduct a thorough review to ensure accuracy, as errors in this statement can lead to significant issues at closing.

Editing and managing your estimated closing statement

Once the Buyers Estimated Closing Statement Form is filled out, it may need adjustments as new costs arise or changes are made in the transaction. Utilizing tools like pdfFiller can make this process seamless. Its cloud-based functionality allows you to edit PDF forms effortlessly from any device, ensuring your information is always up to date.

Additionally, pdfFiller offers collaborative editing features that enable real estate teams to work together on documents. This is especially useful as multiple parties, such as escrow staff, buyers, and sellers, need to collaborate to finalize closing details.

Frequently asked questions about estimated closing statements

Buyers often have questions regarding the Buyers Estimated Closing Statement form. One of the most common inquiries is about discrepancies between estimated closing costs and actual costs. If there's a difference, it's essential for buyers to discuss this with their lender or real estate agent to clarify the reasons and determine their options.

Another frequent question involves negotiating fees. Yes, it’s possible to negotiate lower fees, especially with certain service providers such as lenders or title companies. Additionally, if errors are detected on the estimated closing statement, it's crucial to address them immediately with your real estate agent and involved parties to correct any inaccuracies.

Closing the deal: Finalizing your Buyers Estimated Closing Statement

As you approach closing day, understanding the final steps is critical. On closing day, buyers must be prepared to sign numerous documents. This is the time when the funds are transferred, and the title officially changes hands.

It's vital to bring certain key documents to the closing meeting, including identification, proof of homeowner's insurance, and any required paperwork from your lender. Last-minute considerations also include reviewing all final figures and ensuring all details match what was discussed in your Buyers Estimated Closing Statement.

Additional tips for first-time homebuyers

First-time homebuyers should prioritize understanding the financial aspects of home buying. This includes being aware of not only the purchase price but also the associated closing costs detailed in the Buyers Estimated Closing Statement. A comprehensive understanding can help avoid costly surprises at closing.

Additionally, thoroughly reviewing all documents before signing is essential. Ensure you comprehend every fee listed in the closing statement and feel free to ask questions of your lender or realtor. Utilizing resources and tools aimed at first-time homebuyers can also provide essential support throughout the process.

How pdfFiller can enhance your document management experience

pdfFiller serves as a transformative platform for buyers managing their real estate documentation, especially the Buyers Estimated Closing Statement Form. Its cloud-based accessible nature ensures that users can edit and manage their documents from anywhere, easing the burden often associated with paperwork.

In addition, pdfFiller allows users to create custom templates for future transactions. This eliminates the repetitive process of starting from scratch with each new purchase. Effective collaboration is further enhanced with interactive tools, ensuring that all team members—whether they are buyers, agents, or escrow individuals—can contribute effectively to document preparation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find buyers estimated closing statement?

How do I fill out buyers estimated closing statement using my mobile device?

How do I edit buyers estimated closing statement on an iOS device?

What is buyers estimated closing statement?

Who is required to file buyers estimated closing statement?

How to fill out buyers estimated closing statement?

What is the purpose of buyers estimated closing statement?

What information must be reported on buyers estimated closing statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.