Get the free application form loan personal

Get, Create, Make and Sign application form loan personal

Editing application form loan personal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application form loan personal

How to fill out standard personal loan application

Who needs standard personal loan application?

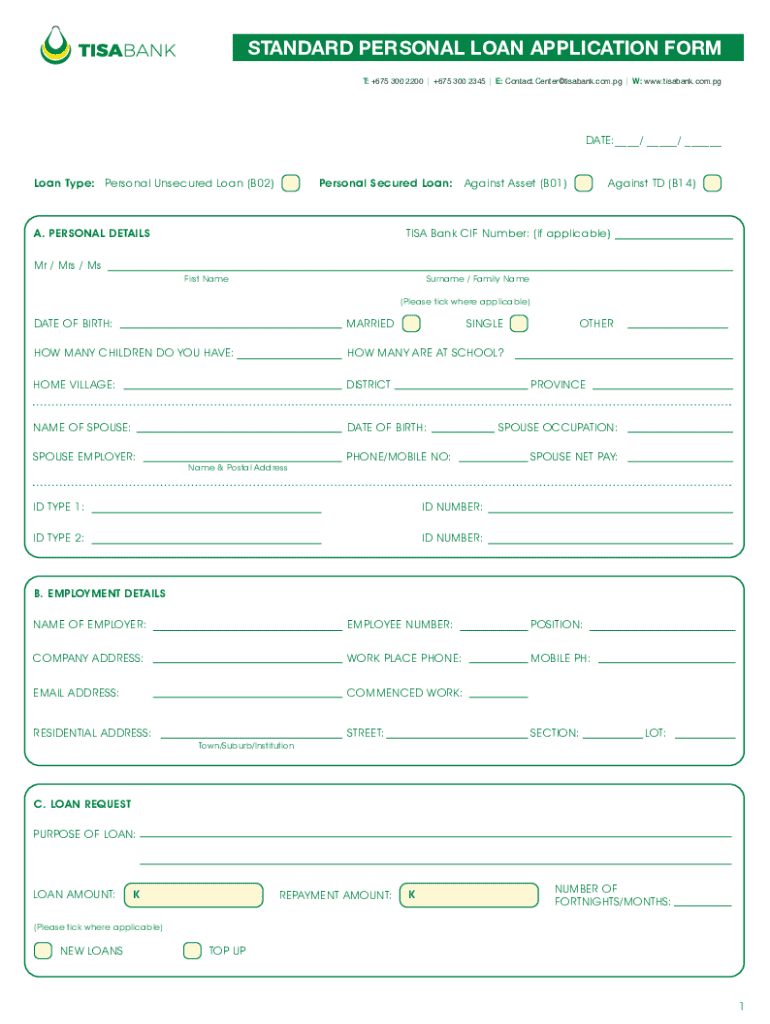

Guide to the Standard Personal Loan Application Form

Understanding personal loans

Personal loans are unsecured financial products that allow individuals to borrow a sum of money for various personal needs without collateral. Unlike secured loans, which require an asset as a guarantee, personal loans assess the borrower's creditworthiness primarily. They are popular for financing significant expenses, such as medical bills, home renovations, debt consolidation, or large purchases.

Obtaining a personal loan can offer several benefits. It provides immediate cash flow for unforeseen expenses and flexibility in repayment terms. Unlike credit cards, which often carry high-interest rates, personal loans tend to offer lower interest rates, especially for those with good credit. This financial solution can also simplify budgeting by consolidating multiple debts into one manageable monthly payment.

Why choose pdfFiller for your loan application?

When it comes to filling out the standard personal loan application form, pdfFiller stands out as a superior tool. It offers seamless editing and collaboration features that simplify the process. Users can easily enter required details, make adjustments, and share the application with co-signers or financial advisors for quick feedback.

The platform’s user-friendly interface makes document management straightforward and efficient. Whether you are accessing the form from a computer, tablet, or smartphone, pdfFiller allows you to fill out your application from anywhere. This access-from-anywhere capability is crucial for busy individuals or teams who need to manage their documents flexibly.

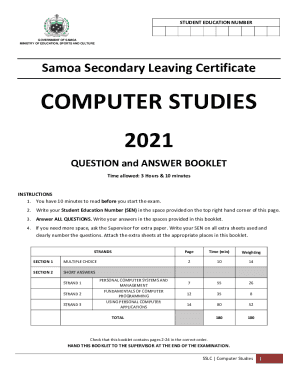

Key features of the standard personal loan application form

The structure of the standard personal loan application form is designed to collect all necessary information in a systematic manner. It typically includes fields for personal information, employment and income details, loan specifics, and an area for review and signatures. Each section is crucial in helping lenders evaluate applications accurately.

Interactive fields in the application form facilitate a smooth user experience. For instance, users can easily select their employment status, input income amounts, and define the loan purpose, making the process intuitive and straightforward. Understanding the importance of each section is vital as it helps ensure all necessary information is provided to avoid potential delays in the application process.

Detailed steps to complete your personal loan application

Step 1: Accessing the application form

Navigating to the loan application page on pdfFiller is the first step in applying for your personal loan. Ensure you have a stable internet connection, and then simply go to the pdfFiller website and search for the 'standard personal loan application form.' You can choose to download the form or fill it out online. Utilizing the online option contributes to a quicker turnaround time, allowing you to submit your application immediately.

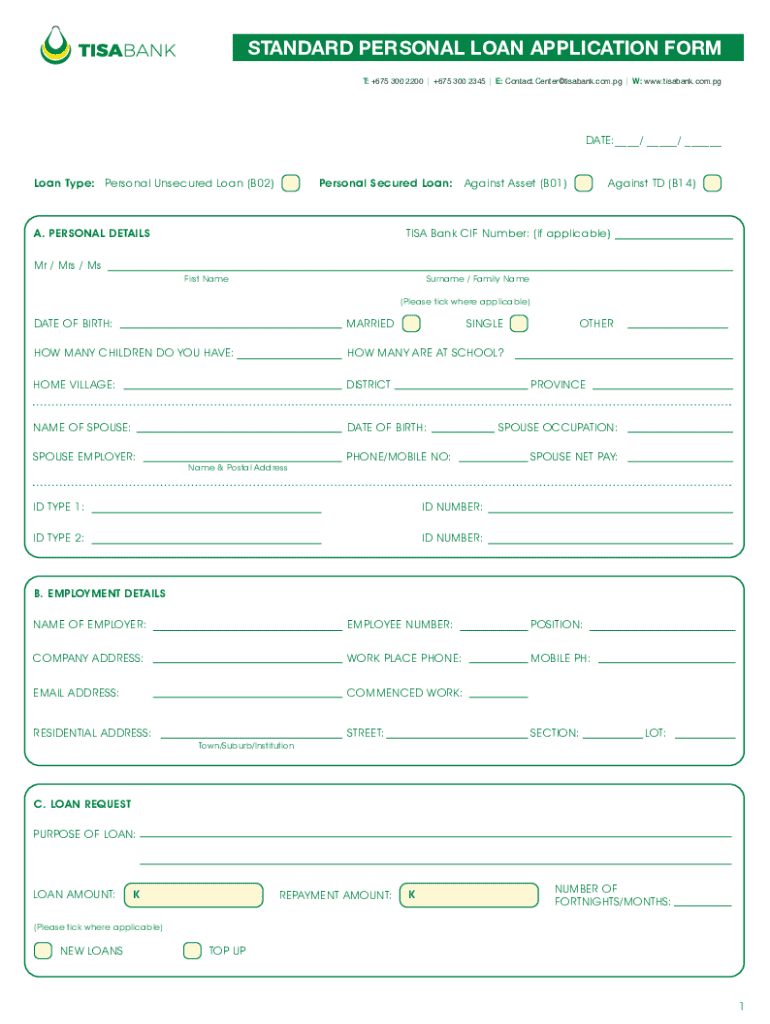

Step 2: Personal information section

Accurately providing the required personal details, such as your name, address, and contact information, is critical. Be sure to double-check spelling and numerical entries. Inconsistencies may lead to delays or rejection of your application. It’s best to have your government-issued ID at hand to ensure all information correlates with your legal documentation.

Step 3: Employment and financial information

In this section, you’ll need to provide your employment history, including the name of your employer, job title, and tenure in your current role. It's also essential to disclose your income and expenses. Lenders want a clear picture of your financial situation. Include all sources of income, such as salary, bonuses, or freelance work. Accurately detailing your expenses helps assess your ability to meet loan repayments.

Step 4: Loan details

Specify the desired loan amount and purpose of the loan in this section. Being clear on why you are borrowing can influence the lender's decision. It's also crucial to understand the interest rates applicable and the repayment terms offered, as these will dictate how much you end up paying over time.

Step 5: Review and sign

Before submission, conduct a final review of all entered information. Confirm that nothing is overlooked or misstated. Once satisfied, you can eSign directly within pdfFiller, making the process efficient and secure.

Common mistakes to avoid when applying

Several common pitfalls can hinder the loan application process. One prevalent mistake is providing incomplete or incorrect information, which can lead to automatic denial. Additionally, candidates may misestimate their financial ability to take on new debt, underestimating monthly repayment impacts. Finally, ignoring the eligibility requirements can lead to unnecessary disappointments. Always ensure you read the loan terms carefully before applying.

What happens after submission?

After assessing your application, lenders typically enter a review process. This may take anywhere from a few minutes to several days, depending on various factors like the complexity of your application and the lender's guidelines. Expect to receive communication from the lender regarding approval or additional information needed. Many institutions provide customer service options should you have questions or need to follow up on the status of your application.

Customizing your loan experience with pdfFiller

pdfFiller not only simplifies the application process but also provides additional tools for document management. Features such as secure storage of completed forms and easy sharing options ensure that you can manage your documents efficiently. If you apply as a team, the collaboration options available allow for shared editing and feedback on the application.

Moreover, should the need arise for revisions or updates to your application after submission, pdfFiller makes the process straightforward. Users can modify their applications as needed, helping address any committee or lender feedback promptly.

FAQs related to personal loan applications

Typical qualifications for a personal loan vary by lender but often include a minimum credit score, proof of income, and residency verification. Using pdfFiller can help eliminate many tedious tasks associated with filling out an application. You can streamline your process through the eSigning feature and interactive form options. If your application is denied, lenders often provide feedback regarding the decision, which can guide future attempts.

Advanced personal loan management

Once you secure a personal loan, implementing effective repayment strategies is essential. Consider options for making higher payments on the principal amount to reduce the total interest paid over time. There are also online tools and calculators that can help track your loan repayment schedules, making budgeting simpler. Additionally, after a while, you may want to explore refinancing options to secure a lower interest rate or better repayment terms.

Case studies: successful personal loan stories

Real-life examples affirm the necessity and benefit of personal loan applications. For instance, one individual consolidated overwhelming credit card debt into a single personal loan, dramatically lowering their monthly expenses and interest rates. Others have financed essential home repairs that increased property value, showcasing the potential of contrasting successful outcomes against inaccurate applications.

Lessons learned from these journeys often point back to the importance of thorough preparation and accurate disclosure of financial situations. The journey reveals that planning and consideration before completing the standard personal loan application form lead to satisfying financial resolutions.

Engaging with pdfFiller: your document management partner

To maximize your use of pdfFiller beyond just the loan application process, consider leveraging its useful features for overall financial planning. Utilize the platform’s secure cloud capabilities to store all financial documents, making retrieval easy for future needs. Whether you are submitting future loan applications or needing to keep track of other significant documents, having a centralized system puts you in control.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my application form loan personal in Gmail?

How do I complete application form loan personal online?

Can I create an eSignature for the application form loan personal in Gmail?

What is standard personal loan application?

Who is required to file standard personal loan application?

How to fill out standard personal loan application?

What is the purpose of standard personal loan application?

What information must be reported on standard personal loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.