Get the free Business Expense Reimbursement Form

Get, Create, Make and Sign business expense reimbursement form

How to edit business expense reimbursement form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business expense reimbursement form

How to fill out business expense reimbursement form

Who needs business expense reimbursement form?

Business Expense Reimbursement Form: Comprehensive Guide

Understanding business expense reimbursement forms

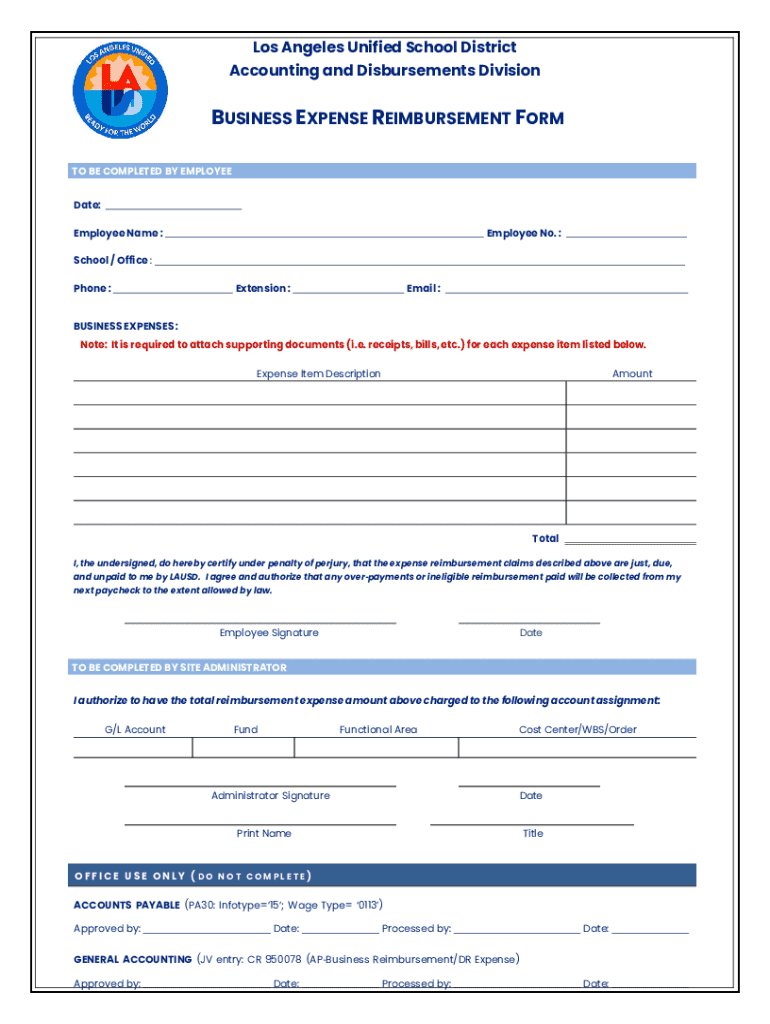

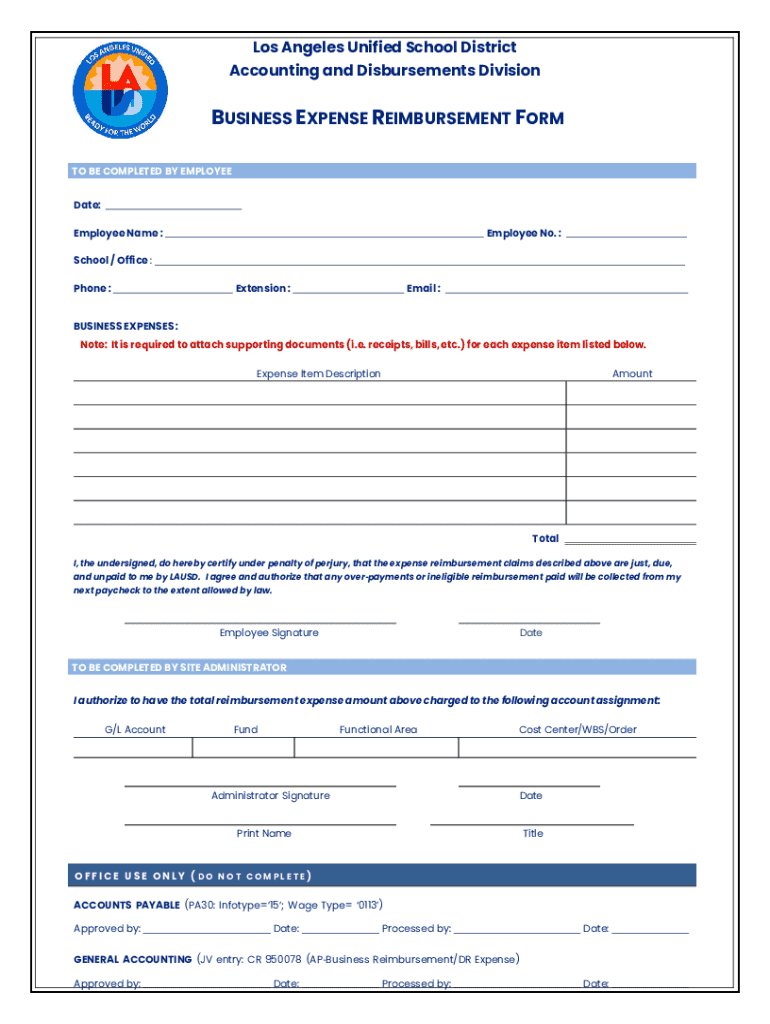

A business expense reimbursement form is a document used by employees to request reimbursement from their employer for out-of-pocket expenses incurred while performing business-related tasks. This can encompass a wide range of expenses, including travel costs, meals, mileage, office supplies, and software necessary for job functions. It's essential for companies to have a standard procedure for employees to get reimbursed fairly and transparently, which strengthens trust and productivity within the workplace.

Reimbursement is crucial for maintaining employee morale and ensuring that staff do not bear the financial burden of business costs. Completing the form accurately allows for proper tracking of expenditures, aids in budget planning, and can even be vital for tax purposes. Employees might find themselves using this form in various scenarios, such as attending conferences, meeting clients, or purchasing supplies—all activities necessary to fulfill their job responsibilities.

Key components of a reimbursement form typically include the employee's name, date of the expense, details about the expense, and a total amount being requested. Some forms may also require an explanation or purpose of the expense, along with pertinent receipts attached.

Types of business expense reimbursement forms

Business expense reimbursement forms can vary significantly based on type and requirements. Most organizations utilize a standard business expense reimbursement form to encapsulate all potential expenses under one template; however, there are specialized forms available for specific expenditures like travel or meals. The choice between digital and paper forms also impacts how employees submit their requests. Often, online forms expedite the process, allowing for immediate submission and tracking.

Digital forms often come equipped with functionalities that enhance the user experience, such as the ability to attach electronic copies of receipts or access pre-populated information. In contrast, traditional paper forms might be easier for employees who prefer a tactile approach, yet they can add delays in processing time. Companies might opt for specialized forms tailored to particular types of expenses, ensuring that all relevant details are captured efficiently. Examples include forms strictly for travel expenses or those dedicated to office supplies.

Step-by-step guide to completing a business expense reimbursement form

Completing a business expense reimbursement form can seem daunting, but following a systematic approach can streamline the process for both employees and employers. Below is a step-by-step guide to ensure successful completion.

Completing each step thoroughly increases the chances of receiving your reimbursement promptly and helps maintain an accurate record of company spending.

Employer responsibilities regarding reimbursement forms

Employers play a significant role in the reimbursement process. Establishing clear company policies is vital. These policies should articulate the types of expenses that are eligible for reimbursement, the required documentation, and the timelines for submission and approval. Having defined guidelines ensures consistency and fairness among employees seeking refunds for their expenses.

The review and approval of reimbursement claims is another crucial responsibility. Employers or designated administrators must carefully examine submitted forms to ensure compliance with both company policies and legal obligations. This includes adhering to local and federal regulations, which entails validating that claimed expenses are indeed legitimate business costs. Employers must set a standard for turnaround time and communicate this effectively to employees.

Tips for employees submitting expense reimbursement requests

Submitting a business expense reimbursement request can often be streamlined with a few best practices. Firstly, ensure that all receipts are legible and clearly state the purchases made. It may be beneficial to organize receipts chronologically, making it easier to itemize expenses in the form. Many employers have a specific timeframe within which employees can submit their requests, so adhere to these deadlines.

By following these best practices, employees can significantly expedite the reimbursement process, ensuring they are compensated in a timely manner.

Frequently asked questions (FAQs)

When it comes to business expense reimbursement forms, employees often have questions regarding their use. Understanding what constitutes a valid business expense is fundamental. Valid expenses are typically those directly related to business activities and may include travel costs, materials, and meals while working. However, personal expenses or entertainment not related to work are generally excluded.

By addressing these common inquiries, employees can navigate the reimbursement process more effectively, ensuring they remain informed throughout.

Resources and tools for managing business expenses

Managing business expenses efficiently involves utilizing the right tools and resources. pdfFiller offers customizable business expense reimbursement templates that make the documentation process smoother. Employees can easily adapt these templates to suit their needs and make any necessary adjustments. This is particularly beneficial for businesses looking to standardize their reimbursement processes—ensuring uniformity across the board.

Using these resources empowers teams to handle expense reporting more effectively and helps keep the workflow intact, even in a decentralized work environment.

Related forms and resources

Navigating the landscape of business expenses means being familiar with a variety of related forms. Understanding the company's travel policy, including allowances for meals and lodging, is crucial for ensuring compliance. Likewise, having a solid grasp of the vehicle use policy may be essential for employees who frequently operate company vehicles or use personal cars for business purposes.

Having access to these related resources ensures employees are well-informed and prepared throughout the reimbursement request process.

Conclusion

Efficient management of business expenses begins with a clear understanding of the business expense reimbursement form. By following best practices and utilizing comprehensive resources, both employers and employees can streamline the reimbursement process. Establishing standards not only promotes transparency but enhances overall workplace satisfaction. As organizations continue to evolve, adhering to these guidelines will remain vital for effective expense management, fostering a culture of responsibility and accountability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit business expense reimbursement form in Chrome?

Can I create an eSignature for the business expense reimbursement form in Gmail?

Can I edit business expense reimbursement form on an Android device?

What is business expense reimbursement form?

Who is required to file business expense reimbursement form?

How to fill out business expense reimbursement form?

What is the purpose of business expense reimbursement form?

What information must be reported on business expense reimbursement form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.