Get the free Brokerage/branch Office Membership Application

Get, Create, Make and Sign brokeragebranch office membership application

How to edit brokeragebranch office membership application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out brokeragebranch office membership application

How to fill out brokeragebranch office membership application

Who needs brokeragebranch office membership application?

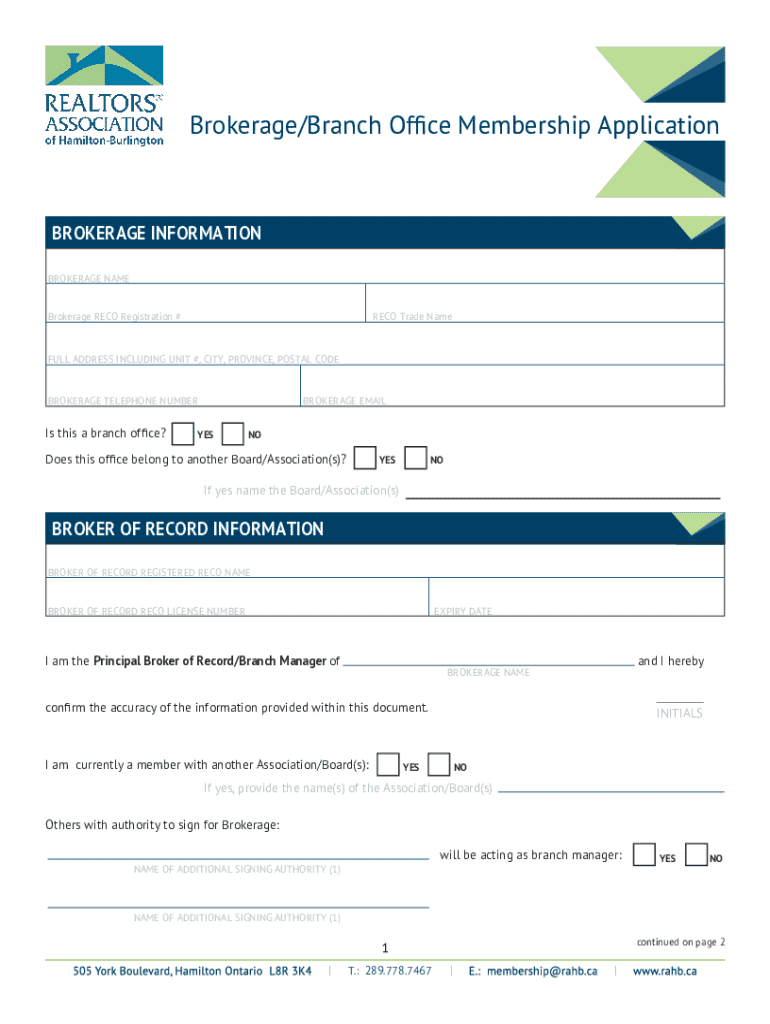

Comprehensive Guide to Brokerage Branch Office Membership Application Form

Understanding the brokerage branch office membership

Brokerage branch office membership is a formal recognition granting a brokerage the ability to operate a branch office under its existing license. This membership is vital for brokerages aiming to expand their reach, enhance client services, and strengthen their market presence.

Establishing a branch office not only allows a firm to tap into new client demographics but also streamlines operations by decentralizing services. With local offices, brokerages can cater to specific regional needs, providing tailored services that resonate more effectively with clientele.

The benefits of branch membership include:

Eligibility requirements for brokerage branch membership

To qualify for a brokerage branch office membership, applicants must meet specific eligibility criteria designed to ensure that only qualified individuals and firms can operate within the market. These criteria encompass various aspects, such as age, education, and financial readiness.

Basic eligibility criteria include:

Financial requirements also play a crucial role in the application process. Applicants need to demonstrate:

Additionally, compliance and regulatory obligations involve obtaining necessary licenses and adhering to industry regulations.

Preparing for the application process

Successful completion of the brokerage branch office membership application form requires thorough preparation. Understanding what documents to submit and adhering to timelines is crucial for expediting the process.

Begin by gathering the documentation required for application, which typically includes:

Important deadlines also play a significant role. Be mindful of the following:

Completing the application form

The brokerage branch office membership application form is a comprehensive document requiring meticulous attention to detail. Each section must be filled out accurately to avoid potential delays in processing.

A step-by-step guide to filling out the application includes:

Common mistakes to avoid include:

Submitting your application

Once you have completed the brokerage branch office membership application form, the next step is submission. Understanding how to submit the application correctly will facilitate its processing.

You can submit your application through:

Understanding the typical processing timeline for application approval is essential. Expect a wait period that often spans anywhere from several weeks to a few months, depending on the regulatory body and completeness of your application.

Interacting with regulatory bodies

Successful interactions with regulatory bodies can significantly impact your application experience. Familiarizing yourself with the key organizations involved in branch office regulation is crucial.

Regulatory bodies might include local financial authorities, national securities regulators, and other relevant agencies that oversee broker operations. Understanding their roles will help you prepare for any inquiries.

Best practices for communicating with regulators include:

Managing and maintaining your branch office membership

Once your brokerage branch office membership is approved, ongoing management and compliance with regulations is paramount. This ensures long-term operational success and adherence to industry standards.

Renewal of membership typically involves:

Regular reporting obligations to regulatory bodies also play a crucial role in maintaining compliance. These reports may include financial performance, audit results, and operational updates.

If significant changes occur, such as in management, location, or structure, know the steps to update rather than jeopardize your membership.

Additional resources and tools

Leveraging online platforms can dramatically streamline document management relating to the brokerage branch office membership application form. pdfFiller offers tools that simplify the editing, signing, and management of essential documents.

Moreover, interactive tools for calculating fees associated with application costs assist applicants in budgeting for their operations.

Common questions that emerge throughout the application and membership process often arise around documentation requirements, eligibility, and timelines. Ensuring access to a FAQ section can help clarify any uncertainties.

Success stories and case studies

Learning from established branch members can provide insights into best practices and common pitfalls. Testimonials often highlight the importance of preparedness and thoroughness during the application process.

Case studies of successful branch offices not only showcase triumphs but also the unique challenges each faced while navigating regulatory frameworks, ultimately providing valuable lessons for new applicants.

Industry trends and insights

Understanding current trends in brokerage operations can significantly shape how firms approach branch membership. For instance, the rapid shift towards digital platforms has redefined client interactions and operational strategies.

Predictions for the future of brokerage memberships suggest an increased emphasis on compliance, technological integration, and client-centric approaches as market dynamics evolve.

Adapting to market changes is not optional; brokerages must remain agile and informed to thrive in this competitive landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the brokeragebranch office membership application in Gmail?

How do I fill out the brokeragebranch office membership application form on my smartphone?

Can I edit brokeragebranch office membership application on an iOS device?

What is brokerage branch office membership application?

Who is required to file brokerage branch office membership application?

How to fill out brokerage branch office membership application?

What is the purpose of brokerage branch office membership application?

What information must be reported on brokerage branch office membership application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.