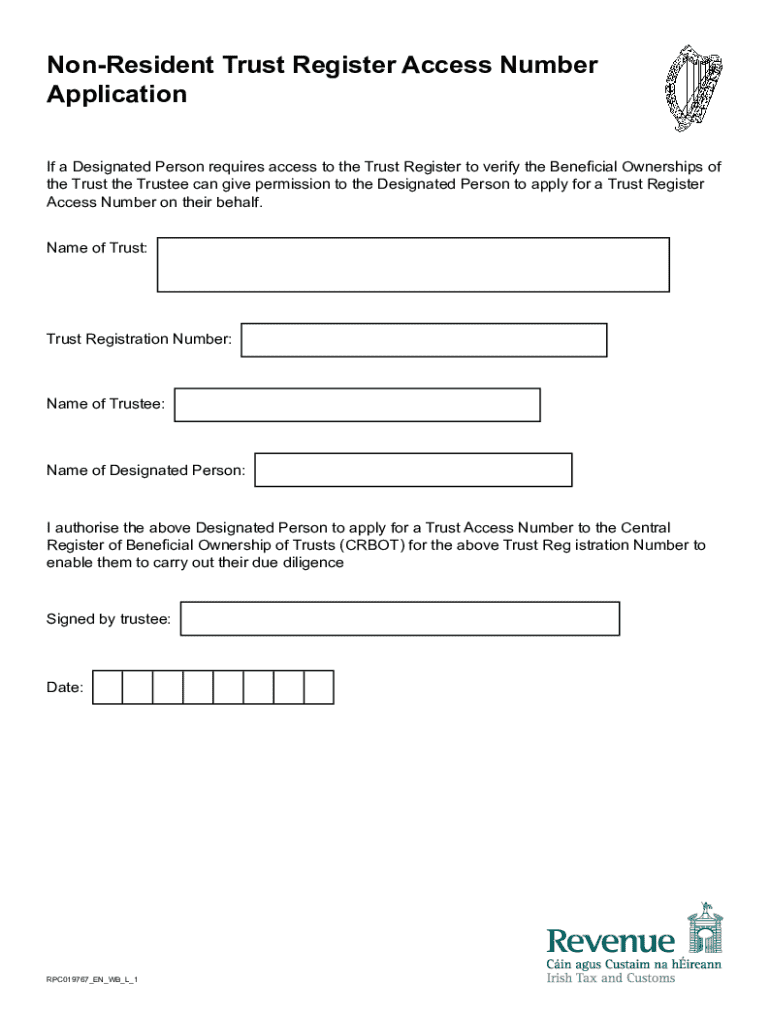

Get the free Non-resident Trust Register Access Number Application

Get, Create, Make and Sign non-resident trust register access

Editing non-resident trust register access online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-resident trust register access

How to fill out non-resident trust register access

Who needs non-resident trust register access?

Non-resident trust register access form - How-to guide

Understanding the non-resident trust register

The Non-Resident Trust Register is a vital component of jurisdiction tax compliance, aimed at enhancing transparency regarding the beneficiaries and owners of trusts that may influence local taxation. Registering a non-resident trust helps to ensure that trust owners are fulfilling their obligations and allows tax authorities to monitor compliance effectively. The significance of this register lies not only in legal compliance but also in building trust with tax authorities and society.

By registering a non-resident trust, individuals and entities can safeguard themselves from potential legal issues. Key benefits include greater security against fraud, an organized record of trust details, and improved management of financial responsibilities. Additionally, compliance might lead to potential tax benefits or incentives depending on local regulations.

Who is required to register?

Trusts that engage with non-resident individuals or entities must register to comply with local regulations. Each trust's requirement for registration may depend on factors such as the nature of assets, where the administrative control is held, and the requirements specific to the jurisdiction.

Certain exemptions exist that could allow some non-resident trusts to bypass registration obligations, but these exemptions usually come with strict criteria. Institutions such as banks and financial services that manage these trusts might also have specific obligations to report, and individuals with connections to such institutions need to stay informed of their responsibilities in trust management.

Exploring the central register of beneficial ownership of trusts (CRBOT)

The Central Register of Beneficial Ownership of Trusts (CRBOT) provides a framework aimed at identifying the individuals and entities who ultimately benefit from various trusts. The CRBOT serves as a means for regulators to better understand trust ownership structures and enhance transparency, which is vital for both legal compliance and the prevention of financial crime.

The relationship between the Non-Resident Trust Register and CRBOT is crucial, as the information filed in both registries should align to ensure consistency in reporting and compliance. This connection ensures authorities can effectively track ownership and tax obligations, reinforcing global standards for financial transparency.

Step-by-step guide to submitting your application

To submit your non-resident trust register access form, following these steps will ease the process significantly.

Role and responsibilities of the designated person

A Designated Person plays a crucial role in managing the registration and compliance of trusts. This individual, often a trustee or a professional advisor, is responsible for ensuring accurate filing and maintaining updated records. The responsibilities include acting as the point of contact with tax authorities and facilitating communication regarding any inquiries related to the trust.

Effective management of trust information falls upon the Designated Person, as their actions can streamline compliance and reduce risks associated with non-compliance. Appointing a trustworthy and knowledgeable Designated Person ensures the trust’s obligations are met efficiently and timely.

Managing your trust record

Once your non-resident trust is registered, maintaining an accurate record is essential. Changes in trust details, such as beneficiary changes, must be reported promptly. To make updates, you can refer back to the original registration process, and any related forms need to be submitted to the relevant authority.

Additionally, it’s vital to keep evidence of registration accessible. This documentation may be required for tax compliance checks, and updated records ensure you can respond to inquiries efficiently without delays.

Compliance and penalties for non-compliance

Non-compliance with the non-resident trust registration can lead to severe penalties. This could range from monetary fines to legal actions, which highlight the necessity for diligent record-keeping and timely submissions. It is not merely about registration but also about ensuring that the trust continues to meet its obligations over time.

Keeping records updated is paramount as incomplete or incorrect records could trigger compliance audits, increased scrutiny, and additional penalties. In severe cases, non-compliant trusts may face restrictions that could endanger asset protection strategies originally intended by the trust.

Special considerations for non-resident trusts

When managing non-resident trusts, several tax implications should be taken into account. For instance, many jurisdictions have specific regulations in place regarding the tax treatment of foreign income generated from trusts. Proper understanding of inheritance tax reforms is also vital to navigate potential liabilities carefully.

Engaging in strategic planning can mitigate risks related to complex tax scenarios. Consulting with tax professionals who understand the nuances of non-resident trusts is essential to ensure compliance while maximizing tax efficiency and protection of trust assets.

Frequently asked questions (FAQs)

Individuals often have many queries regarding the non-resident trust registration process. Common questions include what criteria make a trust eligible for registration and which types are exempt. Moreover, some trusts may seek clarification on how to access their registration information conveniently.

Being proactive in addressing these questions can simplify the process significantly. Clear guidance on eligibility and ongoing support can enhance user experience as they navigate the complexities of trust registration.

Interactive tools and resources

pdfFiller offers a variety of online tools to simplify the completion of the non-resident trust register access form. From customizable templates to easy-to-use editing tools, users can efficiently prepare their documents for submission.

Accessing customer support for additional guidance can help strengthen the document management process. Users can rely on pdfFiller as a valuable resource for educative videos, which provide detailed steps on filling out specific forms accurately.

Latest updates and changes in trust registration

Trust registration laws frequently undergo revision, impacting non-resident trusts. Recent reforms have focused on increasing transparency and reducing tax evasion, compelling individuals and entities involved in trust management to stay informed of changes that may affect compliance.

Anticipating future changes is equally important, allowing trust managers to adapt strategies proactively. Engaging with resources available on pdfFiller can ensure you are up to date with the latest developments in trust regulation, equipping you with information necessary for effective trust management.

About pdfFiller’s document management solutions

pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform. Their solutions are designed to enhance the efficiency of document preparation, making complex processes like non-resident trust registration straightforward.

With user-friendly tools and authoritative support, pdfFiller assists customers in navigating their document needs confidently. Client testimonials highlight numerous success stories where individuals and teams have effectively managed their trust documentation with ease through pdfFiller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit non-resident trust register access online?

Can I create an electronic signature for the non-resident trust register access in Chrome?

How do I edit non-resident trust register access on an iOS device?

What is non-resident trust register access?

Who is required to file non-resident trust register access?

How to fill out non-resident trust register access?

What is the purpose of non-resident trust register access?

What information must be reported on non-resident trust register access?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.