Get the free Bermuda captive insurers

Get, Create, Make and Sign bermuda captive insurers

Editing bermuda captive insurers online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bermuda captive insurers

How to fill out bermuda captive insurers

Who needs bermuda captive insurers?

Bermuda Captive Insurers Form: A Comprehensive Guide

Understanding captive insurance in Bermuda

Captive insurance is a specialized form of self-insurance where companies create their own insurance subsidiaries to finance their risks. Instead of purchasing insurance from traditional carriers, businesses can effectively control their insurance costs and tailor their coverage to their specific needs. This model has gained traction worldwide, particularly in Bermuda, a premier domicile for captive insurance.

Bermuda's reputation as a global hub for captive insurance arises from its favourable legislation, robust regulatory framework, and an ecosystem that encourages innovative risk management solutions. Companies from various industries, including healthcare, manufacturing, and financial services, often establish captives in Bermuda to harness these benefits.

The Bermuda Captive Insurers Form: An overview

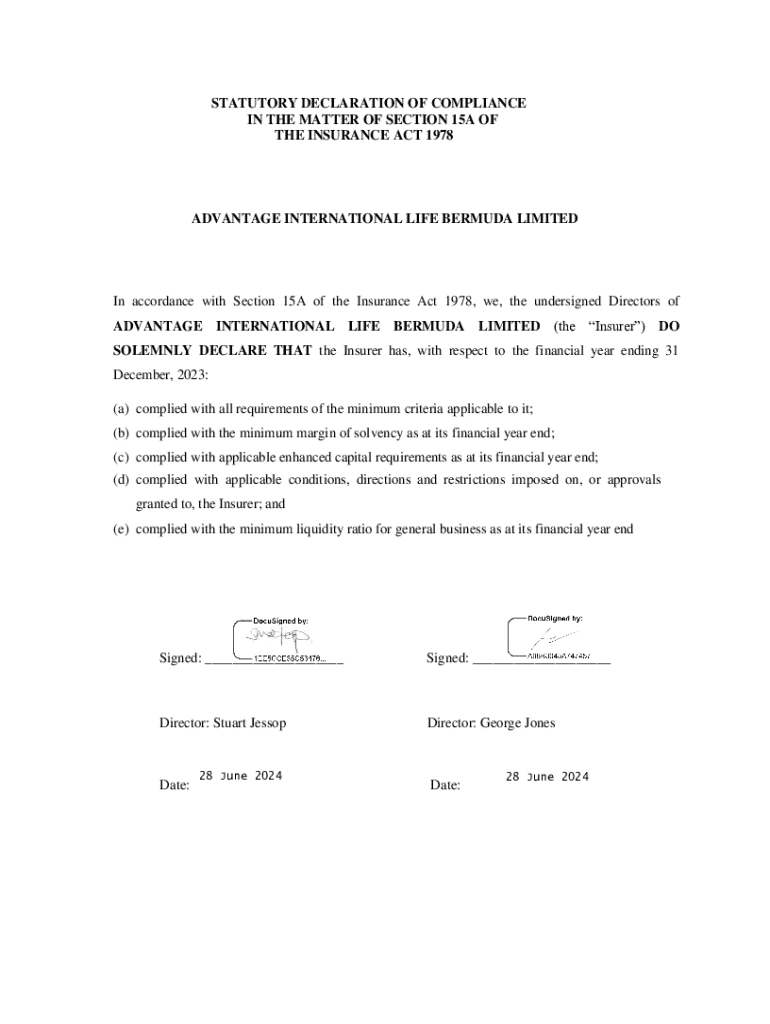

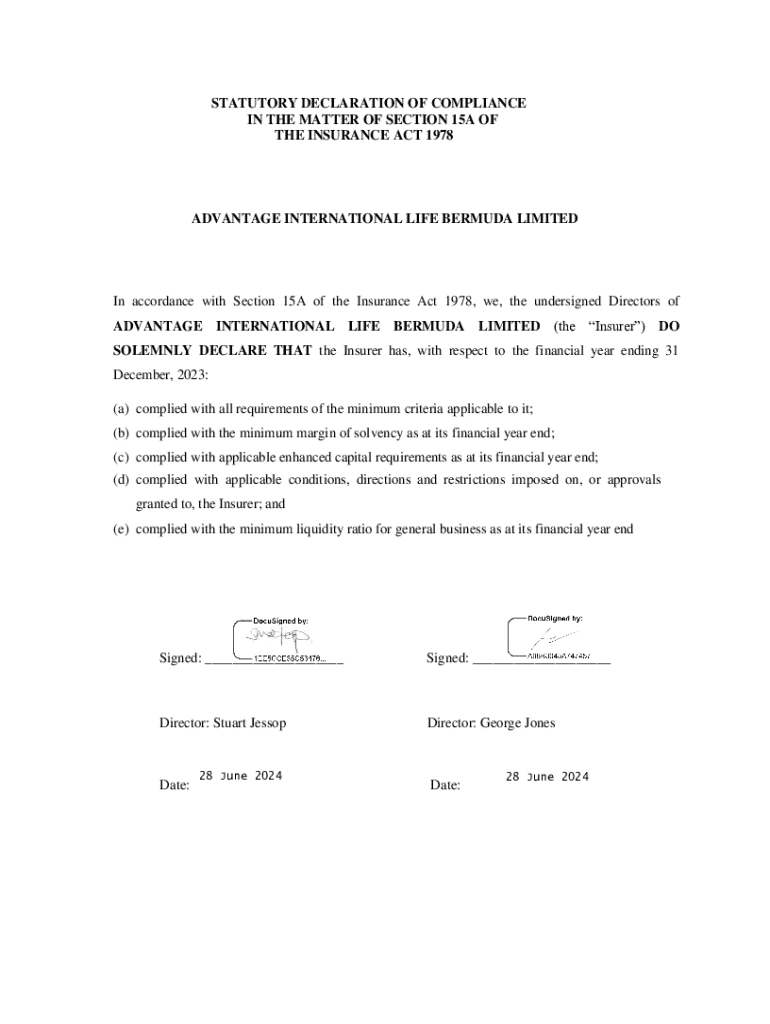

The Bermuda Captive Insurers Form serves as the primary application document for individuals or companies looking to establish a captive insurer in Bermuda. This form is critical in ensuring that all pertinent information relating to the proposed captive is disclosed to the Bermuda Monetary Authority (BMA) for review and approval.

Different types of captive insurers operate in Bermuda, including pure captives, group captives, and association captives. Each type caters to different business models and risk-sharing arrangements. The Bermuda Captive Insurers Form requires key information, such as details about the company's owners, risk management strategies, and financial plans.

Why choose Bermuda for your captive insurance company?

Bermuda’s unique regulatory framework is a primary factor in its appeal as a domicile for captive insurers. The environment is flexible, allowing for various structures to accommodate both large and small businesses. The BMA provides a clear set of guidelines that encourage compliance while supporting business innovation.

Moreover, Bermuda offers strong legal protections for captive insurers, fostering confidence among policyholders. The island has a deep talent pool of experienced professionals knowledgeable in the insurance and reinsurance sectors, making it easier for captives to find qualified experts in risk management and compliance.

Detailed breakdown of the Bermuda Captive Insurers Form

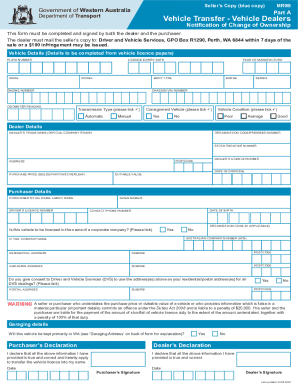

Completing the Bermuda Captive Insurers Form requires careful attention to detail to ensure accuracy and compliance with BMA standards. The form is sectioned to capture distinct categories of information critical for the application review process.

The following sections are typically included in the form:

It’s essential to avoid common mistakes such as incomplete information, inaccuracies in financial projections, and failure to address regulatory standards. Comprehensive preparation can significantly improve the chances of a successful application.

Technology and innovation in Bermuda’s captive insurance sector

As the insurance landscape evolves, insurtech solutions are becoming integral to enhancing operations within the captive insurance framework in Bermuda. These technologies streamline processes related to document management and filing, greatly benefiting users engaged in completing the Bermuda Captive Insurers Form.

Digital tools, such as those offered by pdfFiller, simplify the filing and management of essential documents. Cloud-based solutions facilitate collaboration among teams, allowing users to edit, eSign, and share necessary files instantaneously. Utilizing these innovations not only improves compliance but also maximizes operational efficiency.

Operational considerations for captive insurers in Bermuda

Setting up a captive insurer in Bermuda involves several operational considerations that potential owners must navigate. The formation process typically begins with the submission of the Bermuda Captive Insurers Form, followed by an assessment by the BMA to determine compliance with local regulations.

Ongoing compliance requirements include regular financial reporting, adherence to risk management protocols, and engagement with regulatory authorities. This ensures that the captive operates within the legal framework established in Bermuda, providing confidence to policyholders and stakeholders alike.

Captive solutions: Beyond the basics

While captives primarily serve the purpose of insurance, they can also be tailored to create customized risk management solutions. Businesses can structure their captives to offer various types of insurance coverage and diversify their product offerings based on specific needs.

Additionally, Bermuda captive insurers often have a global reach, allowing companies to provide coverage solutions that extend beyond local markets. This flexibility is vital in addressing international risks and ensuring comprehensive protection for multinational enterprises.

Interactive tools for managing your Bermuda Captive Insurers Form

Managing documents efficiently is paramount in the process of completing the Bermuda Captive Insurers Form. pdfFiller emerges as a go-to solution with its user-friendly interface and powerful editing capabilities that empower users to create, edit, and collaborate on forms from anywhere.

Users can follow a step-by-step guide for editing and signing the form, ensuring they capture all necessary details accurately. The platform also facilitates team collaboration, which is essential for complex applications where multiple stakeholders are involved.

Frequently asked questions about Bermuda captive insurers

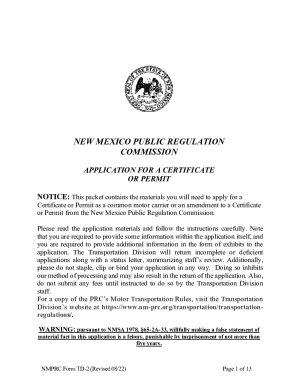

Potential applicants often have numerous questions as they navigate the process of establishing a captive insurer in Bermuda. A few common inquiries include the costs associated with setting up, the anticipated duration of the application process, and whether foreign companies can establish captives in Bermuda.

In terms of costs, initial setup fees, regulatory compliance expenses, and ongoing operational costs should be thoroughly assessed. The timeframe for approval can vary but is typically expedited, thanks to Bermuda’s proactive regulatory approach. Importantly, yes, foreign companies can form captives in Bermuda, provided they comply with relevant regulations and guidelines.

Best practices for managing captive insurers in Bermuda

Managing a captive insurance company effectively requires a proactive approach. Regular reviews of the insurance program and coverage must be conducted to ensure it remains in alignment with the business’s evolving needs. Engaging with local experts and consultants familiar with Bermuda’s regulatory landscape is also essential for informed decision-making.

Leveraging technology plays a crucial role in enhancing operational efficiency. Utilizing platforms such as pdfFiller streamlines the document management process, enabling effective collaboration and compliance with local regulations.

The future of captive insurance in Bermuda

The captive insurance market in Bermuda is poised for growth, driven by emerging trends such as increased enterprise risk within global markets and a heightened focus on risk retention strategies. This forward-thinking approach enables companies to navigate the complexities of modern business challenges while ensuring comprehensive risk coverage.

Bermuda remains a competitive domicile due to its regulatory innovations and supportive ecosystem for captive insurance. Global shifts in the insurance market will continue influencing these captives, making adaptability a key determinant of long-term success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get bermuda captive insurers?

How do I complete bermuda captive insurers online?

How do I edit bermuda captive insurers on an iOS device?

What is bermuda captive insurers?

Who is required to file bermuda captive insurers?

How to fill out bermuda captive insurers?

What is the purpose of bermuda captive insurers?

What information must be reported on bermuda captive insurers?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.