Get the free Required Minimum Distribution Form

Get, Create, Make and Sign required minimum distribution form

Editing required minimum distribution form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out required minimum distribution form

How to fill out required minimum distribution form

Who needs required minimum distribution form?

A comprehensive guide to the required minimum distribution form

Understanding required minimum distributions (RMDs)

Required Minimum Distributions (RMDs) are the minimum amounts that retirement account holders must withdraw from their accounts annually after reaching a certain age. The IRS mandates RMDs to ensure that individuals do not defer taxes indefinitely on retirement savings. Typically, individuals must begin taking RMDs from their Traditional IRAs, 401(k)s, and similar accounts starting at age 73, although this age may vary slightly based on your birth year.

For example, if you were born in 1950 or earlier, you must start taking distributions by April 1 of the year following the year you turn 73. If you do not comply with these regulations, you risk facing severe penalties, which can be as high as 50% of the amount that should have been withdrawn. Thus, RMDs are critical not only for tax compliance but also for financial planning in retirement.

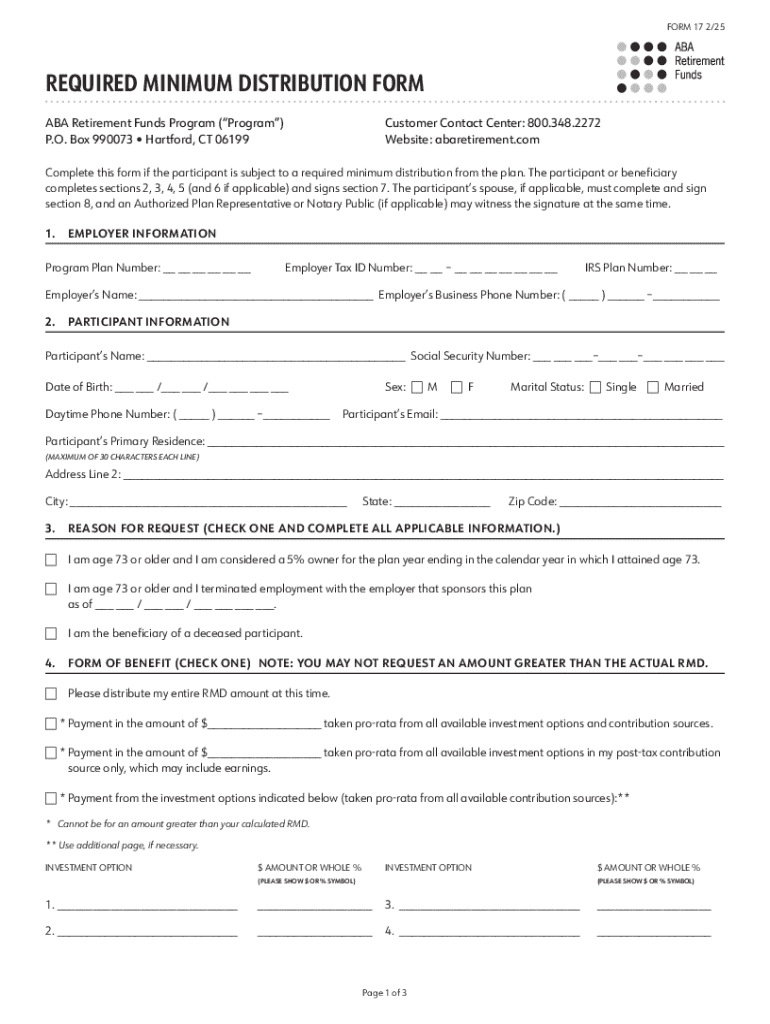

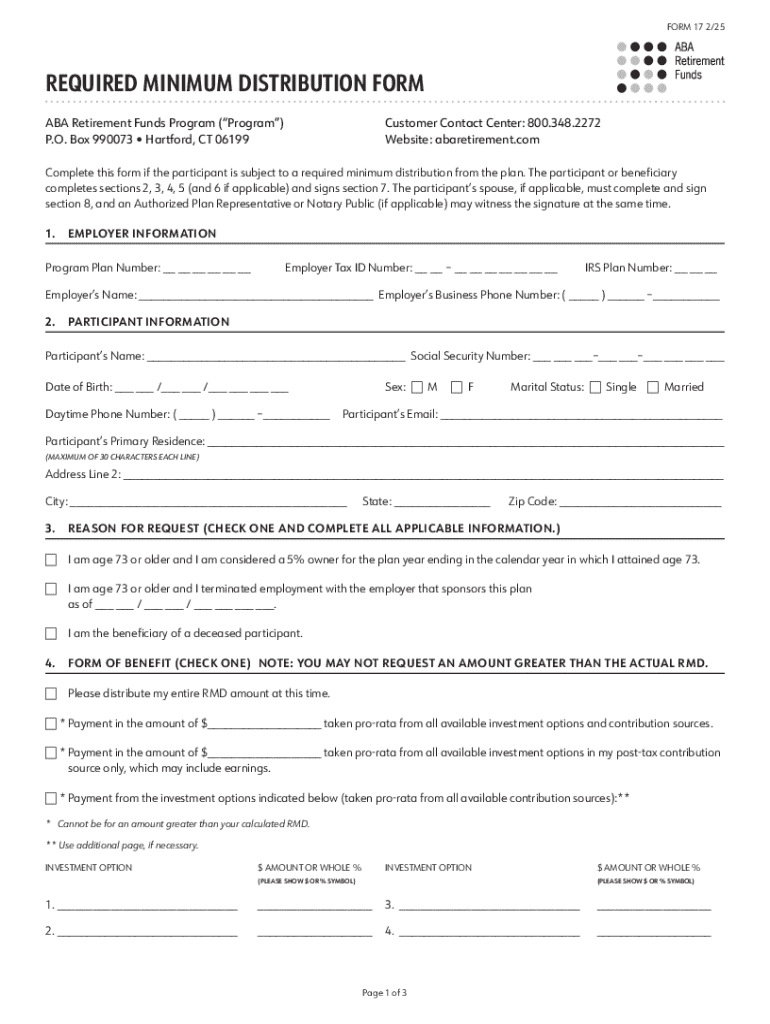

Overview of the required minimum distribution form

The required minimum distribution form is a crucial document for individuals who need to report their withdrawals to the IRS. This form serves the primary purpose of indicating the amount withdrawn to fulfill the IRS RMD requirements. It is vital for ensuring that your financial institutions comply with IRS regulations while providing you a clear record of distributions made.

You will need to submit this form when you are required to take your RMD, typically at the onset of retirement accounts. Additionally, if you are rolling over your retirement accounts or making transfers, you may need to submit this form to outline your recent financial activities. Some common scenarios for filing the RMD form include starting distributions for the first time, adjusting RMD amounts, or ensuring compliance during account transfers.

Step-by-step guide to accessing the required minimum distribution form

Accessing the required minimum distribution form is straightforward, especially with the assistance of digital platforms like pdfFiller. To locate the RMD form, you can search directly on pdfFiller’s website, where a selection of formats is offered, such as PDF, DOCX, or even interactive web forms that simplify the process.

In addition to straightforward document access, pdfFiller provides interactive tools that guide users through various forms, making it easier to find and manage the specific documents you need. Simply navigate to the RMD section on their website, select your preferred format, and follow the prompts to access or create your required minimum distribution form quickly.

How to fill out the required minimum distribution form

Filling out the required minimum distribution form involves several essential sections. Begin by providing your personal information, such as your name, address, and Social Security number. This data helps the IRS maintain accurate records for tax compliance. Next, specify the retirement accounts from which you’re distributing funds. Indicate whether these are Traditional IRAs, 401(k)s, or other qualifying accounts.

The most critical part of the form is calculating your RMD. You can determine this amount by dividing your retirement account balance as of December 31 of the previous year by a life expectancy factor provided by the IRS. To assist with this, pdfFiller offers interactive tools that allow automatic RMD calculations, making the process significantly easier and ensuring accuracy in your filings.

Editing the required minimum distribution form

Once you have filled out the required minimum distribution form, you may find that changes are necessary. pdfFiller enables easy editing of your document, allowing you to make updates without hassle. You can utilize features like text editing, highlighting key points, and adding comments to clarify your intentions or instructions.

After editing your form, consider saving the document for future reference. pdfFiller's cloud storage allows you to keep all modifications in a secure environment, ensuring you can easily retrieve and use updated files as needed.

Signing the required minimum distribution form

Once your RMD form is filled out and ready for submission, it is essential to sign it, as signatures validate the legality of the document. With pdfFiller, you can utilize electronic signatures, which are increasingly accepted for compliance in financial documents. This feature simplifies the signing process and ensures your form is properly authenticated without the need for printing and mailing.

After eSigning, you can verify your signature and ensure it meets all legal requirements. With pdfFiller, you can be confident that your form is signed correctly and submitted to the right authorities, thus fulfilling the compliance demanded by tax regulations.

Submitting the required minimum distribution form

After completing and signing the required minimum distribution form, it’s time to submit it. Typically, this form should be sent to the financial institution holding your retirement accounts. Be sure to confirm the specific submission address, as this can vary by institution. Additionally, understanding relevant submission deadlines is critical, as these deadlines may differ from year to year, especially if they coincide with tax deadlines.

With pdfFiller, you can track the status of your submission, ensuring it was successfully received by your financial institution. This feature provides peace of mind, confirming that your RMD requirements are met and that you remain compliant with IRS regulations.

Managing your required minimum distribution records

Proper record management of your required minimum distributions is vital. Keeping accurate records not only facilitates easier tax filing but also helps in financial planning for future years. Utilizing pdfFiller, you can store and organize your RMD-related documents in one secure place, making access simple and effective when needed.

In case you are working with a team or financial advisor, pdfFiller offers collaboration options that allow multiple stakeholders to manage records collaboratively. This ensures everyone involved has access to necessary documents and can participate in tracking and planning RMDs.

Frequently asked questions about the required minimum distribution form

Individuals often have a multitude of questions regarding the required minimum distribution form. Common inquiries include understanding the stipulations of RMDs, clarifying exceptions to withdrawal amounts, and details regarding what happens if you miss your RMD date. Being informed of these nuances can greatly assist in effective retirement planning.

Many users also seek clarity on the documentation process. If you require additional support, pdfFiller's Help Center provides extensive resources and assistance, ensuring that you have the information needed to navigate these critical financial obligations smoothly.

Tips for staying compliant with RMD regulations

Staying compliant with RMD regulations is crucial for avoiding penalties and ensuring a smooth retirement process. One best practice includes setting reminders for RMD deadlines, which can be easily managed through automated reminder features available on pdfFiller. This prevents any potential oversights, helping you make timely withdrawals every year.

Additionally, keeping abreast of annual changes in RMD rules is beneficial, as policies may evolve based on legislative changes. Staying informed guarantees compliance and minimizes the risk of encountering penalties related to missed distributions.

Exploring additional features on pdfFiller for document management

pdfFiller is not just limited to managing required minimum distribution forms; it offers a plethora of cloud-based benefits for your document accessibility. With a flexible platform that allows you to access documents from anywhere, you can navigate your retirement planning or any other financial needs efficiently.

Moreover, pdfFiller includes collaboration tools enabling teams to effectively work together on document management. This enhances productivity and ensures that everyone can stay aligned with RMD processes and other retirement planning initiatives. Additionally, explore document templates that provide vital support as you plan for your financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit required minimum distribution form from Google Drive?

How do I make changes in required minimum distribution form?

How do I edit required minimum distribution form in Chrome?

What is required minimum distribution form?

Who is required to file required minimum distribution form?

How to fill out required minimum distribution form?

What is the purpose of required minimum distribution form?

What information must be reported on required minimum distribution form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.