Get the free Nhs Pension Scheme: Claim for ‘gp Solo’ Work From 01 April 2025 to 31 March 2026

Get, Create, Make and Sign nhs pension scheme claim

Editing nhs pension scheme claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nhs pension scheme claim

How to fill out nhs pension scheme claim

Who needs nhs pension scheme claim?

NHS Pension Scheme Claim Form: A Comprehensive How-to Guide

Understanding the NHS Pension Scheme

The NHS Pension Scheme is designed to provide a reliable source of income for healthcare professionals after retirement. It offers a variety of benefits that contribute to financial security, ensuring that members can maintain their standard of living once they leave the workforce. With contributions from both employers and employees, this scheme plays a crucial role in rewarding those who have dedicated their careers to healthcare.

Within the NHS Pension Scheme, there are different types of pensions available. Generally, these include the 1995 Section, the 2008 Section, and the 2015 Scheme. Each of these types has specific rules regarding contributions and benefits based on the member's service length and employment status. Understanding these differences is essential for members when navigating their retirement options.

Eligibility for the NHS Pension Scheme typically requires employees to be in a role that qualifies for pension benefits, including permanent and fixed-term contracts. Generally, individual factors like age and length of service play a significant role in determining eligibility, with many members required to accumulate a minimum number of years in the NHS.

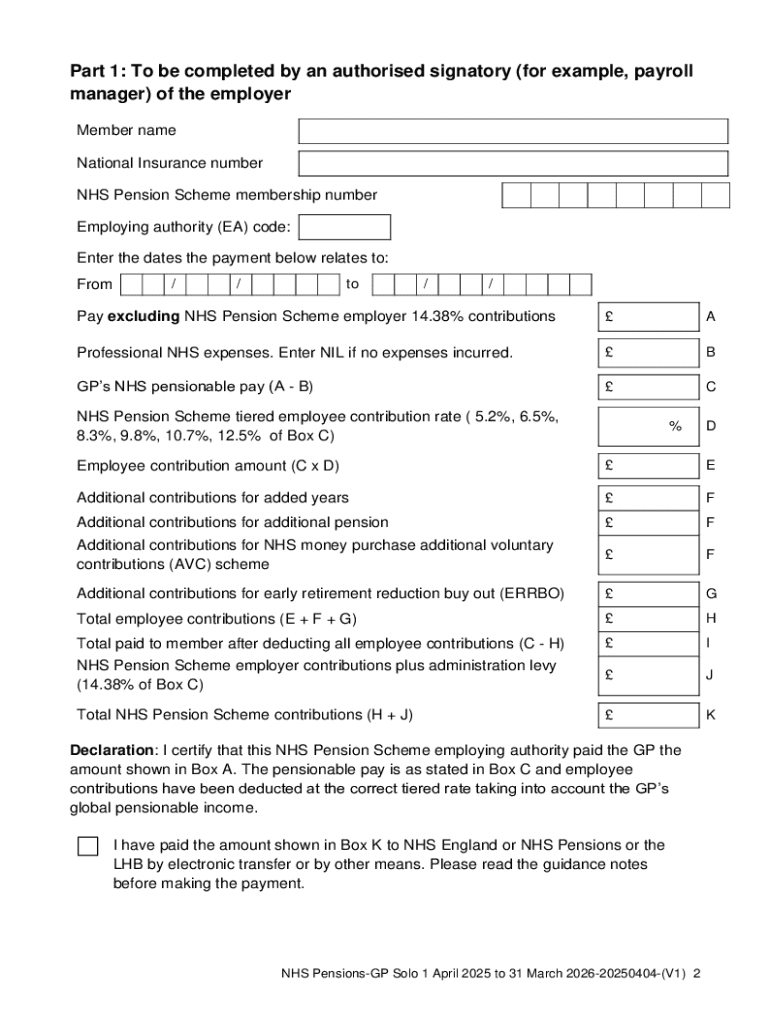

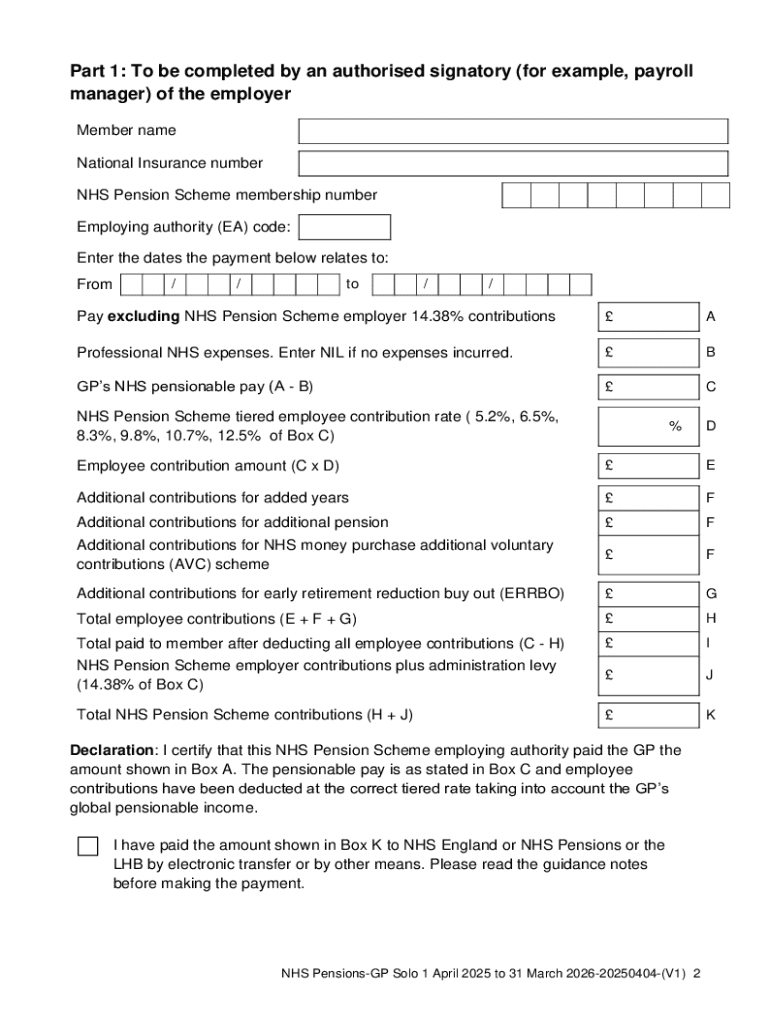

The importance of the claim form

The NHS Pension Scheme Claim Form is a critical step for members seeking access to their pension benefits. This form is not only essential for initiating the process but also plays a pivotal role in documenting your employment history and pension preferences, ensuring you receive the correct payout upon retirement. Without properly completing this form, members may experience delays in accessing their funds or receive incorrect benefit amounts.

Common reasons for submitting a claim include retirement, opting for early retirement, or unexpected circumstances such as serious illness. Each scenario requires accurate record-keeping and detailed completion of the claim form, which outlines your employment history and expected retirement benefits. Members need to be mindful of key deadlines, with varying timeframes based on the type of claim submitted, to avoid potential delays in receiving their, often much-needed, pension payouts.

Preparing to fill out the claim form

Before diving into the NHS Pension Scheme Claim Form, it’s essential to gather all necessary documentation. This includes proof of employment, such as payslips, P60 forms, and any relevant contracts. Having a comprehensive understanding of your pension contributions, employment dates, and any past communications related to your pension will simplify the form-filling process and reduce the risk of errors.

A good tip for gathering this information is to create a checklist. Documenting what you need makes it easier to see if you're missing any pieces. In addition, reaching out to HR or your departmental management can also provide clarity. They can assist with missing documents or any ambiguities about your pension status or contributions.

Step-by-step guide to completing the claim form

Step 1 involves downloading the NHS Pension Scheme Claim Form. It can be accessed online from the official NHS Pension Scheme website. Make sure you're downloading the correct version of the form as policies may change. Reviewing the latest updates to the form ensures that you're working with the most recent guidelines, which can make a difference in how your claim is processed.

Step 2 focuses on filling in the personal information section. This area asks for your name, contact details, NHS employee number, and other related data. It's important to double-check for typographical errors here, as inaccuracies can lead to processing delays. Make sure you use your official name that matches your employment records.

In Step 3, you detail your employment history. This means listing all the NHS positions you've held, including details on start and end dates. The more accurate and comprehensive you are, the smoother your claim process will go. Including part-time contracts as well is crucial, as any service counts toward your retirement benefits.

Step 4 delves into selecting your pension benefits. Understanding what options are available to you is essential before making a choice. For instance, you may need to choose between taking a lump sum vs. regular payments or deciding upon survivor benefits for dependents.

Lastly, Step 5 is the submission process. Most forms can be submitted electronically, and tracking your claim status online is possible through the NHS pension website. Make sure to keep a copy of your submitted claim for your records.

Managing your claim after submission

Once a claim is submitted, it enters a review process. The reviewing team evaluates the information provided to determine eligibility for the claimed benefits. This stage generally takes a few weeks, depending on their workload, but it’s wise to check the NHS Pension website, where regular updates can indicate expected processing timelines.

However, it’s important to be prepared for potential delays or rejections. A common reason for these issues could be missing documentation or discrepancies in employment history. Should complications arise, promptly address any requested information. Keep communication clear and document all interactions for your records.

Interactive tools and resources

Managing documents can be a cumbersome task, but utilizing tools like pdfFiller can significantly streamline the process. With pdfFiller’s interactive features, users can easily edit, sign, and share their claim forms. The platform allows for collaborative efforts, meaning you can involve team members or family members in the preparation process, ensuring all necessary documentation is accounted for.

Beyond this specific tool, it's valuable to explore additional online resources available on the NHS Pension Scheme webpage. Here, there are FAQs and detailed articles, all aimed at guiding you through the complexities of pensions. Bookmarking these pages or subscribing to newsletters for updates can keep you informed about changes or updates regarding the NHS Pension Scheme.

Frequently asked questions

Many individuals have queries regarding the NHS Pension Scheme Claim Form process. Common queries include eligibility requirements that can differ based on length of service and overall contributions. It's essential for members to fully understand these qualification criteria before submitting their claims to avoid future complications.

Complications or issues with your claim can occur, but proactive measures can help navigate these challenges. If a claim is rejected, identifying the specified reasons is crucial. Actionable steps could include seeking clarification directly from NHS Pension Scheme representatives or appealing the decision if applicable.

Real-life experiences & testimonials

Individuals who have successfully navigated the NHS Pension Scheme Claim Form often share their journeys. Many emphasize the importance of beginning preparation early — the earlier you gather your documentation and understand your pension benefits, the smoother the process tends to be. Personal stories reveal that utilizing all available resources, including asking HR questions and regularly checking for updates from the NHS website, positively impacted their experiences.

Testimonials reflect on the emotional weight that comes with planning for retirement; hence it is vital for future retirees to feel confident in their understanding of the claim process. Key lessons learned include persistence and thorough organization of personal documents, which ultimately leads to quicker resolutions and a better grasp of anticipated retirement benefits.

Contact and support options

For direct inquiries or assistance with the NHS Pension Scheme, members can reach out to the dedicated support teams. The NHS Pension Scheme website provides a list of contact numbers and email addresses for different departments, ensuring that members can find the right help for their queries. Providing a strong support network is a key part of a smooth claim process.

Moreover, familiarizing yourself with the various departments will help streamline your inquiries. Whether it’s about contributions, eligibility, or the claim process, having precise questions ready can save time and lead to quicker responses.

Staying informed

Pension policies can evolve, making it crucial for members to stay informed about any developments within the NHS Pension Scheme. This means regularly checking the official website for updates and resources, where you can find insights into potential changes in policies, contribution rates, or eligibility requirements.

Another effective way to stay updated is by subscribing to newsletters or notifications through the NHS Pension webpage. These services often provide members with timely alerts regarding new initiatives or financial advice tailored specifically for NHS workers nearing retirement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete nhs pension scheme claim online?

How do I fill out the nhs pension scheme claim form on my smartphone?

How do I complete nhs pension scheme claim on an iOS device?

What is nhs pension scheme claim?

Who is required to file nhs pension scheme claim?

How to fill out nhs pension scheme claim?

What is the purpose of nhs pension scheme claim?

What information must be reported on nhs pension scheme claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.