Get the free Vp Form 1083a

Get, Create, Make and Sign vp form 1083a

How to edit vp form 1083a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out vp form 1083a

How to fill out vp form 1083a

Who needs vp form 1083a?

Understanding the VP Form 1083A: A Comprehensive How-to Guide

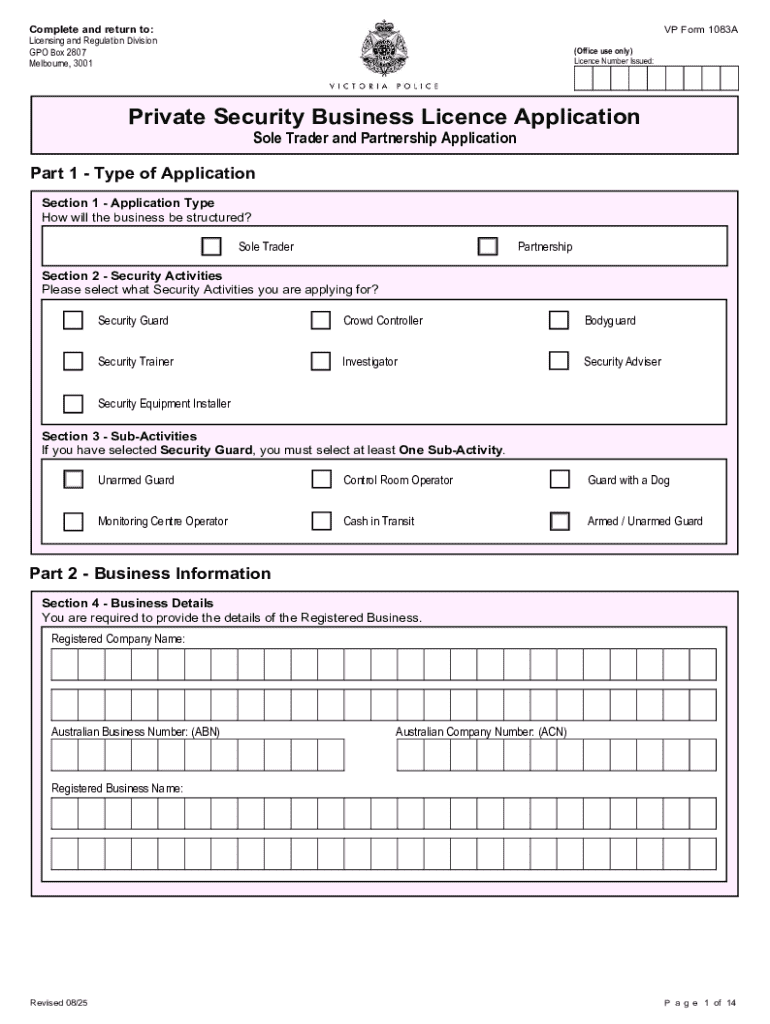

Overview of VP Form 1083A

The VP Form 1083A is an essential document used primarily in the context of specific financial applications. Designed to cater to both individual and team submissions, it plays a crucial role in facilitating various processes within administrative and financial frameworks. This form serves multiple purposes, including providing a detailed report of financial information, verifying eligibility for benefits, or applying for various forms of assistance.

Individuals eligible to use the VP Form 1083A include applicants seeking financial aid, those applying for loans, or individuals in need of supporting their income verification processes. It is crucial for the applicant to ensure that the VP Form 1083A is filled out accurately and submitted on time, as it affects the approval and funding processes.

Preparing to fill out the VP Form 1083A

Before diving into the actual filling of the VP Form 1083A, it's imperative to gather all necessary information to ensure a seamless process. Start by collecting personal identifiable information such as full name, address, and contact details. This foundational data is crucial to verify identity and facilitate communication regarding the application.

Along with personal details, applicants should prepare financial information. This could include income statements, bank details, and any relevant documents that verify financial status, such as tax returns or pay stubs. Each piece of information plays a pivotal role in building a complete and compelling application.

Understanding the key sections of the form

The VP Form 1083A is divided into specific sections aimed at collecting comprehensive details. Understanding these sections helps in filling out the form accurately. Key sections include Personal Information (where applicants provide identification details), Income Details (which captures financial specifics), and Additional Information (for any supplementary documentation).

Utilizing the right tools ensures effective form completion. Leveraging application platforms such as pdfFiller offers significant advantages such as easy editing, automated corrections, and submission tracking.

Step-by-step instructions for filling out the VP Form 1083A

Begin with Section 1, Personal Information. It requires accurate entry of your full name, current address, and primary contact number. Ensure all details are current to avoid any issues with communication.

Next, move to Section 2, which involves Income Details. Here, it’s critical to report your income accurately. Include all sources of income to present a complete financial picture. Common pitfalls include omitting a secondary income or misreporting figures due to confusion around tax deductions.

Finalizing additional information

The last part of the form, Section 3, asks for any Additional Information. This could include notes on your financial situation or documentation that supports your claims. Ensure all supplementary documents are clear and easily referenced, enhancing the strength of your submission.

Editing and reviewing your VP Form 1083A

After completing the form, utilize pdfFiller's editing tools to refine your submission. This includes options for inserting or removing text, adding annotations, or commenting on specific sections needed for clarification.

One of the most crucial steps involves checking for errors. Common pitfalls such as typos or miscalculations can lead to significant delays or rejections. Leverage built-in validation tools within pdfFiller to spot discrepancies and ensure your form meets all required standards.

Secondly, pdfFiller offers collaborative review options that allow you to share your form with colleagues. This enhances communication and improves the accuracy of the document.

Signing the VP Form 1083A

The VP Form 1083A requires a signature for validation. Electronic signatures are legally accepted and recognized in many jurisdictions. pdfFiller simplifies the signing process by providing users with straightforward options to create and apply an eSignature within the document.

If your form requires signatures from others, pdfFiller allows you to invite reviewers to sign electronically. This method not only expedites the signing process but also includes features to track the status of signatures to ensure everything is in place.

Submitting the VP Form 1083A

Understanding the guidelines for submission is essential. Depending on your specific context, the form may need to be submitted to various entities, such as financial institutions or government agencies. Check on the submission methods, whether via email, electronic portal, or postal services.

Keeping track of important deadlines is another critical factor to ensure your application doesn’t fall through the cracks. Late submissions can lead to denied applications, so create a reminder system that aligns with these dates.

After submission, hold onto records and confirmation emails to safeguard against any issues that may arise.

Managing your VP Form 1083A after submission

Once your VP Form 1083A has been submitted, monitoring its status becomes critical. pdfFiller provides users with a dashboard to track application progress and updates effectively. This visibility ensures applicants stay informed about their application's fate without delays.

In some cases, amendments may be necessary post-submission. If errors are identified or if there's a change in financial status, it’s crucial to understand the steps for revising your initial submission. Keeping backup copies of your forms prevents any chaos during amendments.

Utilizing cloud storage systems contributes to better organization, allowing easy access to documents when required.

Frequently asked questions (FAQs)

Common inquiries regarding the VP Form 1083A typically revolve around its purpose and the information required for submission. Many users require clarity on whether supporting documentation is necessary and what specific criteria must be met to ensure acceptance.

It’s beneficial to compile a list of frequently asked questions as a reference. Addressing these concerns proactively can mitigate confusion and foster a smoother application process for all stakeholders involved.

User testimonials and case studies

Real-life success stories often illustrate the practical benefits of using the VP Form 1083A efficiently. Many users have reported smooth experiences when utilizing pdfFiller's features, noting specifically the ease felt when sharing documents within teams.

Case studies show how various teams have succeeded in securing funding or grants afterward due to efficiently completing the VP Form 1083A without hiccups, attributed directly to their organized document management through platforms like pdfFiller.

Interactive tools available on pdfFiller

pdfFiller offers a range of interactive tools designed to enhance user experience and streamline the VP Form 1083A workflow. Features such as automatic text completion, easy integration with cloud storage services, and direct email submission options transform the document handling experience.

These tools not only help in managing the form efficiently but also provide a user-friendly interface that encourages collaboration, making document handling less of a chore and more of a seamless activity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit vp form 1083a online?

How can I edit vp form 1083a on a smartphone?

How do I edit vp form 1083a on an iOS device?

What is vp form 1083a?

Who is required to file vp form 1083a?

How to fill out vp form 1083a?

What is the purpose of vp form 1083a?

What information must be reported on vp form 1083a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.