Get the free Client Acknowledgement of Risk Form

Get, Create, Make and Sign client acknowledgement of risk

How to edit client acknowledgement of risk online

Uncompromising security for your PDF editing and eSignature needs

How to fill out client acknowledgement of risk

How to fill out client acknowledgement of risk

Who needs client acknowledgement of risk?

Understanding the Client Acknowledgement of Risk Form

Understanding the client acknowledgement of risk form

A Client Acknowledgement of Risk Form is a crucial document that outlines the potential risks a client might face when engaging in a service or activity. This form not only serves to inform clients about these risks but also establishes a mutual understanding between the service provider and the client. It is essential for businesses and clients alike to have clear communication regarding risks, as this can minimize legal liability and enhance trust.

The importance of such a form lies not just in risk communication but also in legal protection. By acknowledging the form, clients essentially agree that they are aware of the risks involved and, therefore, cannot hold the organization responsible in case of unforeseen circumstances. For businesses, this act significantly reduces the likelihood of litigation stemming from service-related incidents.

Who needs to use the client acknowledgement of risk form?

Individuals and organizations across various industries should implement the Client Acknowledgement of Risk Form as part of their operational protocol. For individual clients, understanding their liabilities and risks associated with services is critical, especially when making decisions concerning their health, finances, or safety. For organizations, it serves to formalize the communication of these risks within a team or client interactions.

Different scenarios necessitate the use of this form, particularly in industries that inherently involve risks such as finance, healthcare, and construction. In the finance sector, clients need to be aware of market volatility, whereas, in healthcare, understanding treatment risks can prevent misunderstandings. Similarly, construction companies must ensure that clients are apprised of site-specific hazards before tasks commence.

Features of the client acknowledgement of risk form on pdfFiller

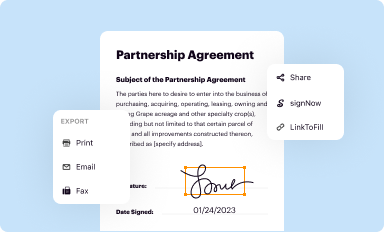

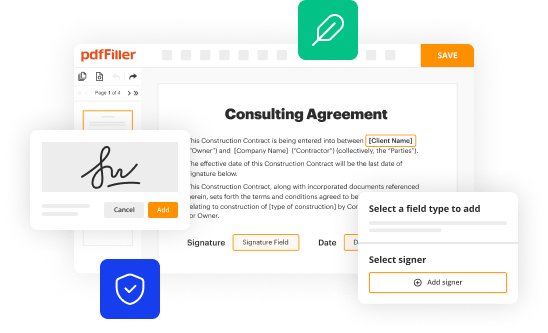

pdfFiller simplifies the process of creating and managing the Client Acknowledgement of Risk Form with its plethora of robust features. One of the standout capabilities is seamless editing, allowing users to customize the form based on specific business needs efficiently. This is particularly useful for tailoring risk descriptions relevant to particular services or industries.

Another significant feature is the user-friendly eSigning tool. Signing forms digitally not only expedites the process but also enhances convenience for clients who may be remote or unable to sign in person. Furthermore, collaboration tools permit teams to share and edit forms, improving efficiency in documentation. With cloud-based management, users can access forms anytime, anywhere, thus overcoming geographical limitations and ensuring all parties have the latest version.

Step-by-step instructions for creating a client acknowledgement of risk form

Creating a Client Acknowledgement of Risk Form on pdfFiller is a straightforward process. Start by accessing the form template available on pdfFiller. Navigate to the templates section and search for the Client Acknowledgement of Risk Form. The easy-to-use interface will guide you to select the relevant template.

Once you have access, start filling out the essential information required. Your name, contact details, the name of the company, and a detailed description of the risks involved are critical sections to complete. Be concise but clear in conveying the type of risks clients should be aware of.

After entering the main details, consider adding additional notes or clauses specific to your situation. Custom clauses can help clarify particular concerns or unique risks relevant to your services. When finalizing the document, save it in the preferred format, and utilize the sharing options to disseminate it to clients. This method ensures that clients have received the form comprehensively.

Tips for effective risk acknowledgment

Creating an effective Client Acknowledgement of Risk Form involves adhering to best practices that enhance clarity and transparency. Always ensure that the language used is straightforward and jargon-free, so clients fully understand the risks they’re acknowledging. It’s also helpful to summarize complex risk information at the beginning or end of the document to reinforce understanding.

Avoid common mistakes, such as leaving out critical details or making assumptions about what the clients already know. Misleading clients can lead to disputes and undermine trust. Be prepared to address client questions proactively by providing a brief overview of each risk listed in the form. This approach can engage clients in a meaningful conversation about the risks, enhancing their comprehension and your professional rapport.

Legal aspects of the client acknowledgement of risk form

The Client Acknowledgement of Risk Form does more than communicate potential hazards; it carries significant legal weight. Understanding liability is crucial for both clients and service providers. By signing, clients acknowledge their acceptance of risks, which can limit the service provider’s liability should an incident occur. However, it’s critical that the risks stated are legitimate and not written in a way that could be considered deceptive or overly broad.

Compliance considerations also arise, particularly related to regulations in specific industries such as healthcare or finance. Organizations must ensure that their forms align with industry standards and local laws governing risk disclosure to avoid allegations of negligence or malpractice. Thus, legal guidance is advised when drafting a risk acknowledgment form to ensure comprehensive compliance.

Frequently asked questions (FAQs)

When dealing with the Client Acknowledgement of Risk Form, clients may encounter several questions. For instance, if a client doesn’t understand a section of the form, it's important to encourage them to ask for clarification instead of signing without full comprehension. Providing an accessible explanation can bridge gaps in understanding.

Modifying the form is also a common query. It’s acceptable to customize the form to fit specific needs, provided that the essential components outlining risk acknowledgment remain intact. Finally, if a client refuses to sign the form, it's advisable to engage in an open dialogue about their concerns to address any fears they may have, ensuring they feel informed and comfortable.

Examples of client acknowledgement of risk scenarios

Real-world applications of the Client Acknowledgement of Risk Form can be observed in various sectors. In the finance sector, clients may face investment risks related to market fluctuations; thus, a risk acknowledgment should highlight these elements. A well-crafted form can help both clients and advisors manage expectations prior to proceeding with financial projects.

In healthcare, a client acknowledgment is essential when patients are informed about the risks linked to procedures. Here, the form could detail potential side effects or recovery issues associated with treatments, emphasizing the importance of informed consent. Lastly, in the construction industry, a risk form might identify site hazards, reinforcing safety protocols and making sure clients have a clear understanding of their environment before project commencement.

User experience: feedback and iterations

Utilizing pdfFiller has allowed many users to improve their risk acknowledgment processes significantly. By streamlining the creation and signing of the Client Acknowledgement of Risk Form, users have reported a faster turnaround time and improved client relationships. Feedback indicates that the customization features empower organizations to adapt the acknowledgment forms to better suit their operational contexts, enhancing clarity in communication.

Furthermore, users have suggested continuous improvements based on their experiences. Regular updates to the platform ensure that features evolve to meet changing user needs, making pdfFiller a reliable tool for document management related to risk acknowledgment processes. This responsiveness to feedback illustrates pdfFiller's commitment to maintaining a user-centric approach.

Interactive tools and resources on pdfFiller

The pdfFiller platform offers a suite of interactive tools and resources designed to optimize the creation and management of the Client Acknowledgement of Risk Form. The form customization tools allow users to easily adjust templates to meet their needs, including changing text, adding logos, or modifying sections for clarity.

Moreover, the document tracking features enable users to monitor the usage and access of forms, providing valuable insights into client engagement. Integration capabilities with other services, such as email and cloud storage options, further enhance the user experience, creating a seamless workflow for managing risk acknowledgment documents in one centralized location.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit client acknowledgement of risk in Chrome?

Can I create an electronic signature for the client acknowledgement of risk in Chrome?

How can I edit client acknowledgement of risk on a smartphone?

What is client acknowledgement of risk?

Who is required to file client acknowledgement of risk?

How to fill out client acknowledgement of risk?

What is the purpose of client acknowledgement of risk?

What information must be reported on client acknowledgement of risk?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.