Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out homestead exemptions

Who needs homestead exemptions?

A Comprehensive Guide to Homestead Exemptions Form

Understanding homestead exemptions

A homestead exemption is a legal provision that reduces the amount of property taxes that homeowners can be taxed on their primary residence. This exemption not only lowers the property tax burden but can also offer protection against certain creditors. It's essential for homeowners to understand the various aspects of homestead exemptions to take full advantage of these benefits.

The purpose and benefits of homestead exemptions vary across the United States. Primarily, they serve to assist homeowners by making homeownership more affordable through tax relief. Additionally, many jurisdictions offer special exemptions for particular groups like senior citizens, veterans, and individuals with disabilities.

Eligibility requirements for homestead exemptions

Eligibility for homestead exemptions generally requires property ownership and residency in the home for which the exemption is being claimed. Most states specify that the property must be occupied as the homeowner's primary residence on a continuous basis. It's crucial to check the specific regulations in your state, as they may vary.

In addition to basic eligibility criteria, specific states might have unique regulations that determine who qualifies for these exemptions. Often, homeowners must file for these exemptions during a specific timeframe, which typically coincides with property tax assessment deadlines. Missing these deadlines can lead to losing potential benefits.

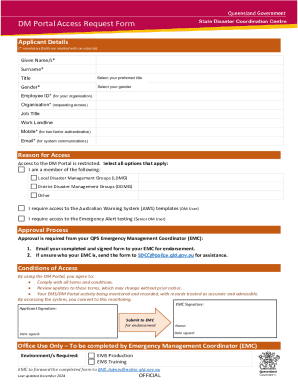

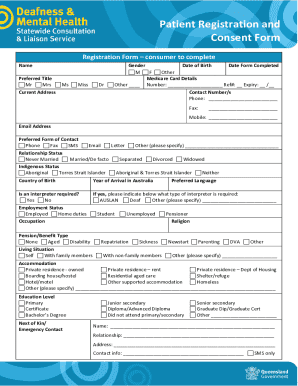

Preparing to fill out your homestead exemptions form

Before sitting down to fill out your homestead exemptions form, gathering the necessary documents is essential. Proof of residency might include utility bills or lease agreements that clearly indicate your name and address. Additionally, you should keep your identification documents accessible, such as a driver's license and your Social Security number.

Understanding the application process can significantly lessen anxiety. Different states may have distinct procedures for submitting homestead exemptions forms. Familiarize yourself with common requirements and avoid common pitfalls by reading instructions carefully and keeping track of submission deadlines to ensure a smooth filing experience.

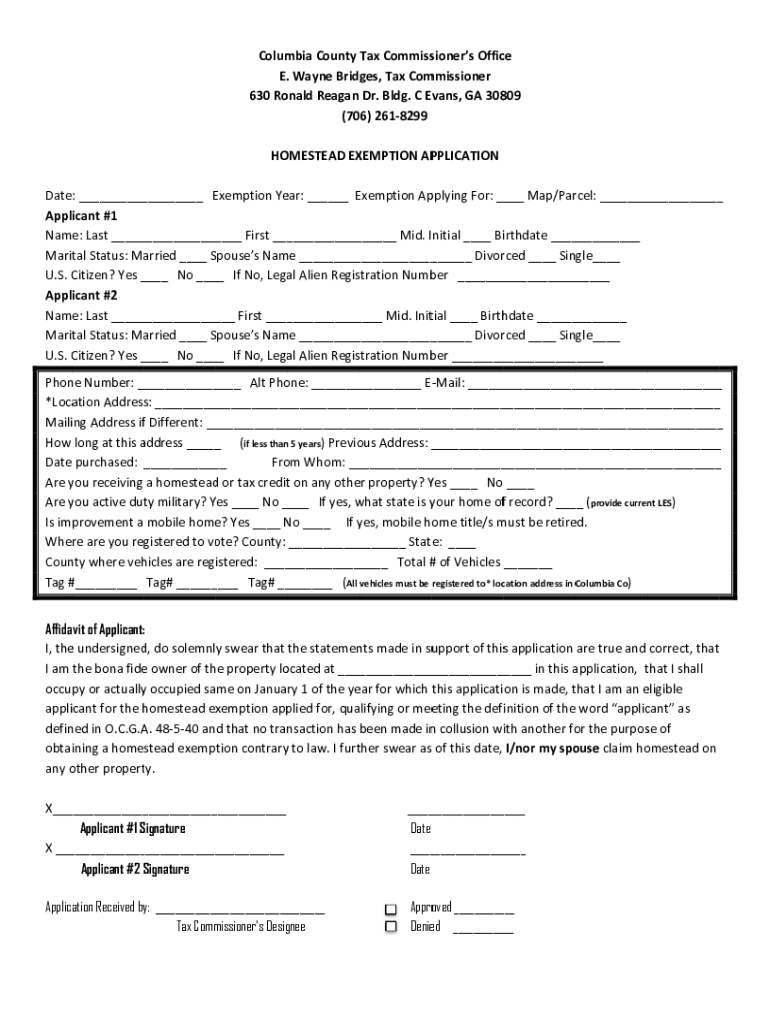

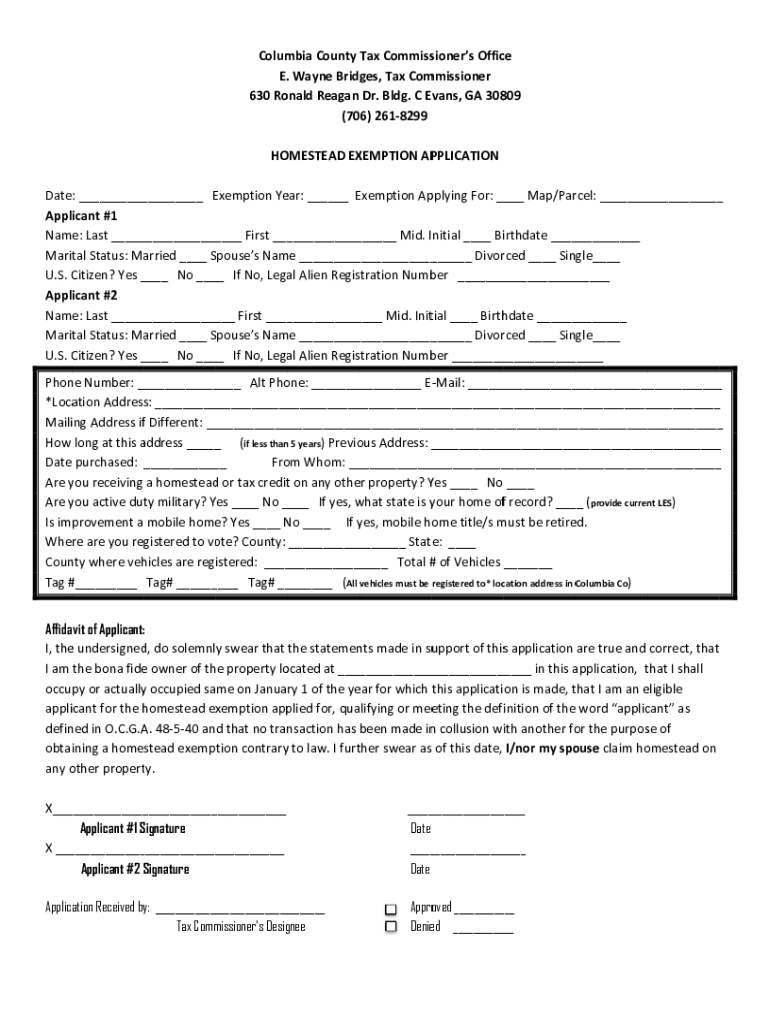

Step-by-step guide to filling out the homestead exemptions form

Filling out the homestead exemptions form may initially seem daunting, but breaking it down into manageable sections can help. The form typically begins with personal information, where you’ll provide details like your name, address, and contact information. Next, the property details section requires specifics like property value, ownership type, and property identification number.

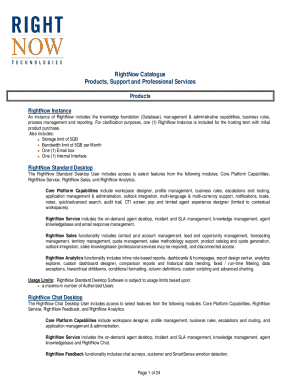

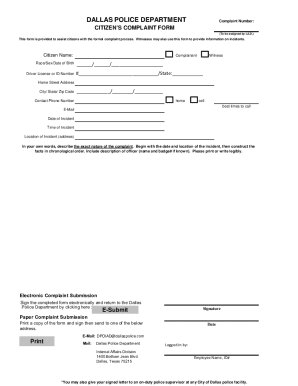

In the claims for exemptions section, you must specify which exemptions you’re eligible for, such as age-related exemptions or disability qualifications. To ensure clarity and accuracy in your submission, review your answers multiple times. Utilizing tools like pdfFiller can simplify your process, as its editing features enable easy adjustments to your form.

Editing and customizing your homestead exemptions form

pdfFiller shines when it comes to editing PDFs, including your homestead exemptions form. To begin, simply upload your completed form to pdfFiller. Once uploaded, you can leverage various editing features to add text, insert signatures, or annotate changes directly onto the document.

Collaboration is another significant feature of pdfFiller. By inviting team members or family members to review and edit your document, you can incorporate feedback and corrections before finalizing your submission. The ability to track changes and comments further enhances teamwork, ensuring all opinions are considered and the document is polished before sending it off.

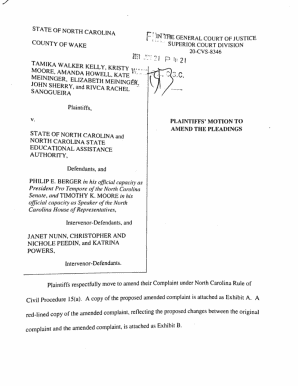

Signing and submitting your homestead exemptions form

Submitting your homestead exemptions form has become easier with the advent of electronic signatures. pdfFiller allows you to eSign your document directly, ensuring a legally binding signature in a matter of seconds. Make sure to double-check that all required sections are fully completed before finalizing your eSignature to avoid any miscommunication.

Best practices when submitting your form include choosing the correct submission method. Depending on your state’s regulations, you might be able to submit online, via mail, or in person at local tax offices. After submission, always seek confirmation that your application has been received and keep a record of any correspondence.

Managing your homestead exemptions after submission

After submitting your homestead exemptions form, it's important to monitor the status of your application. Procedures may vary statewide, but most counties will allow you to check the status either online or by contacting local tax offices. Familiarize yourself with the expected timelines for approvals in your state, as knowing when to expect a response can help you stay ahead of any issues.

If your exemption is denied, understanding common reasons can help in reapplying or appealing the decision. Common issues include failure to meet residency requirements or submission of incorrect or incomplete documentation. You have the right to appeal a denial, and knowing how to do so effectively can help you secure your exemption.

Additional resources and tools

Many interactive tools can aid you in understanding homestead exemptions, such as calculators that determine potential savings based on assessed value and local tax rates. Moreover, online eligibility quizzes can help clarify whether you qualify for specific exemptions tailored to your unique situation.

For further assistance, contact local property appraiser offices, where you can receive guidance tailored to your state. If you encounter difficulties or need legal assistance regarding a denied exemption, organizations exist in many areas that provide support in these challenging situations.

Frequently asked questions about homestead exemptions

Homeowners often have numerous questions regarding homestead exemptions. Many are concerned about their eligibility or what exemptions apply to them. Common queries include whether renting a room in their home disqualifies them and how often they must reapply. Many myths surround these exemptions; for instance, some believe they must be elderly to qualify, which is not always true.

Clarifying misunderstandings regarding the application process is crucial. It’s important for homeowners to know that exemptions do not transfer automatically; they often require active applications each fiscal year or at defined periods. Awareness of these details can ensure that homeowners do not miss out on potential savings and benefits.

Using pdfFiller for your document management needs

pdfFiller provides a comprehensive platform for not only creating and editing your homestead exemptions form but also for managing all of your document needs. With cloud-based access, users can enjoy seamless editing, eSigning, and collaboration on various forms without needing to print anything out.

In addition to homestead exemption forms, pdfFiller offers solutions for organizing, sharing, and securely storing essential documents, making it ideal for individuals and teams. Utilizing these features empowers users to maintain a streamlined and effective document management experience that meets their specific requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pdffiller form in Gmail?

Can I create an electronic signature for the pdffiller form in Chrome?

Can I edit pdffiller form on an Android device?

What is homestead exemptions?

Who is required to file homestead exemptions?

How to fill out homestead exemptions?

What is the purpose of homestead exemptions?

What information must be reported on homestead exemptions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.