Get the free Gift and Loan Disclosure

Get, Create, Make and Sign gift and loan disclosure

How to edit gift and loan disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out gift and loan disclosure

How to fill out gift and loan disclosure

Who needs gift and loan disclosure?

Gift and Loan Disclosure Form: Your Comprehensive How-to Guide

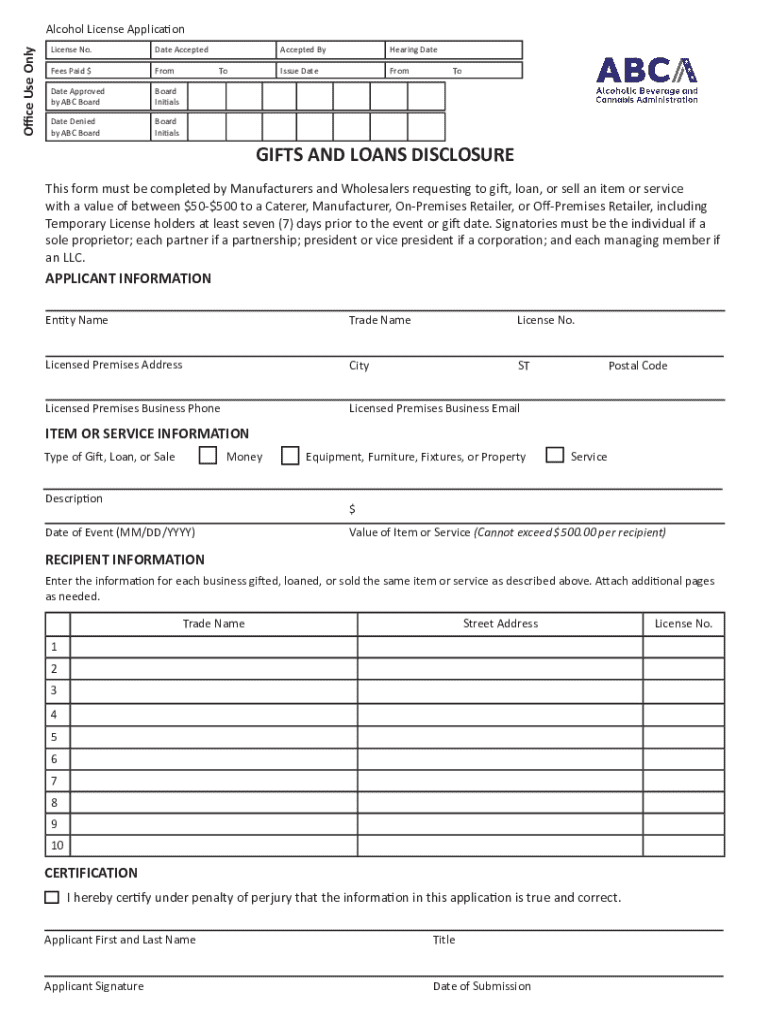

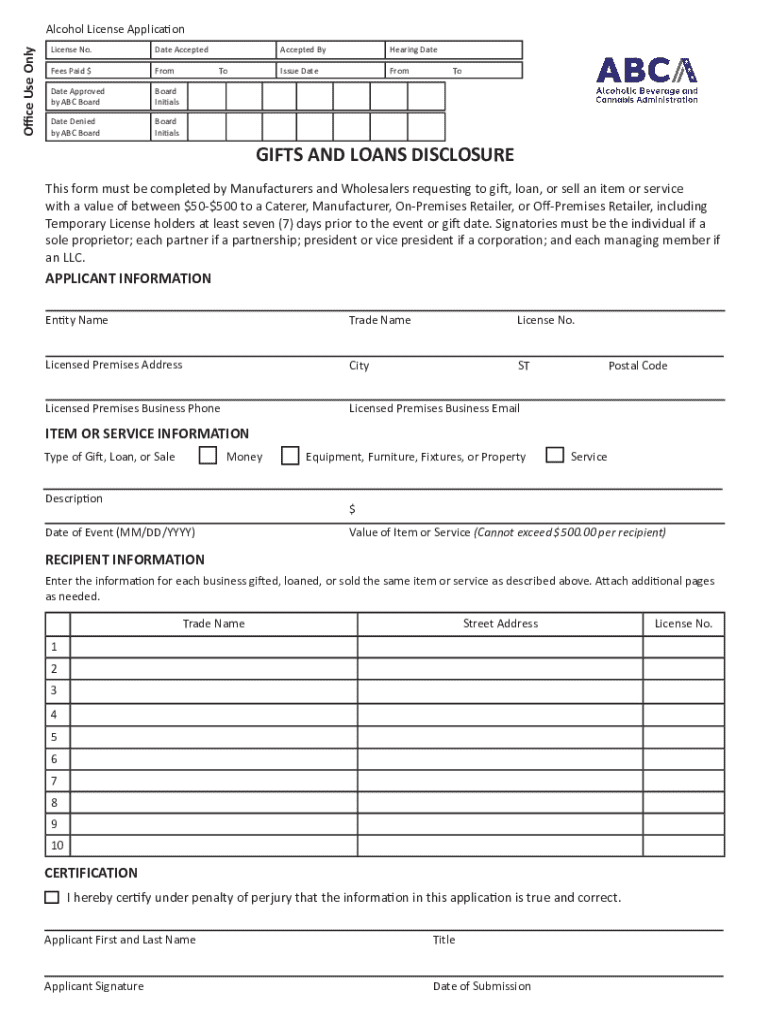

Overview of the gift and loan disclosure form

The gift and loan disclosure form is a critical document used primarily in the mortgage application process. This form is important because it helps lenders ascertain the financial sources that are being utilized for down payments and closing costs. In real estate transactions, transparency related to financial support is essential, as lenders require a thorough understanding of the borrower’s financial landscape.

Situations that necessitate the completion of a gift and loan disclosure form typically include home purchases, refinancing, or any major financial transaction where gifts or loans are a part of the funding. The key components of this form include details about the donor, info about the recipient, the nature of the financial assistance, and acknowledgments regarding the gift or loan status.

Understanding lender requirements

Lenders have specific criteria that they evaluate when reviewing the gift and loan disclosure form. These include the legitimacy of the funding source, the relationship between the donor and the recipient, and verification of funds. Providing accurate and honest information is paramount, as discrepancies can lead to severe consequences, including loan denial or legal implications.

Inaccurate disclosures can result in not only financial loss but can also jeopardize the borrower’s integrity in the eyes of the lender. Thus, understanding and adhering to lender requirements is crucial for successful transaction approval.

Eligibility for gift and loan assistance

Gift assistance can come from various sources, which include family members, friends, or even charitable organizations. Each source comes with specific financial guidelines and limitations set by lenders. For example, first-time homebuyers often receive more leniency in terms of qualifying for gift assistance due to their limited financial backgrounds.

It's also essential to be aware of the monetary limits regarding gifts. Many lending institutions outline how much can be gifted without triggering tax implications or needing to be documented in a specific manner.

How to complete the gift and loan disclosure form

Completing the gift and loan disclosure form requires a methodical approach. The first section covers donor information, where the person or organization offering the funds must be identified. Next is the recipient information where the borrower’s details are inputted, followed by a section detailing the specifics of the gift or loan, such as amount and purpose.

The final section typically includes signatures from both donor and recipient, affirming the authenticity of the transaction. Common pitfalls include misrepresenting relationships or failing to provide complete information, which can lead to delays or rejections.

Documentation and evidence required

Supporting documentation is crucial for substantiating the gift and loan disclosure form. Key items include bank statements showing the transfer of funds, and often a gift letter that articulates the nature of the assistance. Lenders typically request these documents to verify the source and legitimacy of the funds.

Collecting these documents can require patience and organization. Ensuring that all documentation is current and accurately reflects the transaction will save time and help facilitate approval.

The gift letter: essential details

A gift letter is a formal statement from the donor that outlines the terms of the gift. It's critical for fulfilling mortgage requirements and securing loan approval. Elements to include in a gift letter consist of the donor's signed statement confirming that the funds are indeed a gift, their relationship to the borrower, the amount being given, and the date when the funds were transferred.

Providing a sample gift letter with accurate details can expedite the approval process and give both lenders and borrowers peace of mind. Ensuring clarity and honesty in the contents of the letter is also essential to avoid misunderstandings down the line.

Tax implications of gifts

Understanding the tax responsibilities associated with gifts is paramount for both donors and recipients. Current regulations stipulate specific gift tax limits and exclusions, which differ annually. Failing to report gifts above the set threshold can lead to penalties for the donor and complications for the recipient.

Awareness of the reporting requirements and any exceptions that may apply can significantly alleviate financial stress for both parties. Consulting with a tax advisor is highly recommended to navigate this complex terrain effectively.

Navigating different loan types

The requirements for gift and loan disclosures can significantly vary between loan types, including but not limited to conventional loans, FHA loans, USDA loans, and VA loans. Each type has its own stipulations regarding gift assistance.

For example, FHA loans may allow gifts from a broader network of donors compared to conventional loans. Understanding these nuances can lead to a smoother application process and ensure compliance with specific lender guidelines.

Important rules and regulations

Federal and state laws govern how gift disclosures must be handled, and being aware of these regulations is vital for compliance. Lenders may have additional specific conditions, each with unique guidelines dictating the documentation and disclosure.

Staying updated on legislative changes that influence gift disclosures can be a game changer for both borrowers and lenders. Utilizing resources from the ABC board or other regulatory bodies can help ensure all actions are compliant.

Managing multiple gift and loan scenarios

When funds are received from multiple donors, it becomes essential to accurately document each source. This includes varying amounts, which necessitates clarity in the disclosure form to avoid confusion.

In situations involving larger sums or unique circumstances, additional explanations may be required. Therefore, clear communication and thorough documentation practices are paramount for seamless processing.

Utilizing interactive tools for document management

pdfFiller offers a myriad of interactive features that simplify the process of managing the gift and loan disclosure form. Users can effortlessly edit, eSign, and collaborate within the same platform, ensuring all changes are streamlined.

Thanks to features like secure sharing capabilities and version tracking, managing the documentation becomes efficient. This allows for better organization and ensures all parties involved stay updated throughout the entire process.

Final steps before submission

Before submitting the gift and loan disclosure form, it's crucial to conduct a thorough checklist verification. This includes ensuring that all sections are filled out correctly and that all necessary documentation is attached.

Being mindful of important deadlines is also critical; timely communication with lenders regarding submission status can help in managing expectations and preventing unnecessary delays.

FAQs regarding gift and loan disclosure forms

Several common questions arise when dealing with the gift and loan disclosure form. For instance, many users wonder about the overall need for detailed financial disclosure or the type of support documentation required.

Quick access to answers to these questions can facilitate understanding and help smoothen the process for users. It's beneficial for borrowers and lenders alike to keep an FAQ section handy for rapid troubleshooting.

Additional considerations and best practices

During the mortgage process, approaching lenders with a clear understanding of potential funding options is essential. Being prepared for possible audits or further investigations will further establish transparency.

Building a sturdy case for using gifted funds responsibly can also significantly influence lender perception and approval rates. Transparency and thorough preparation will go a long way in securing necessary financing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete gift and loan disclosure online?

How do I make edits in gift and loan disclosure without leaving Chrome?

Can I edit gift and loan disclosure on an Android device?

What is gift and loan disclosure?

Who is required to file gift and loan disclosure?

How to fill out gift and loan disclosure?

What is the purpose of gift and loan disclosure?

What information must be reported on gift and loan disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.