Get the free CHANGES TO THE CALIFORNIA FAMILY RIGHTS ACT

Get, Create, Make and Sign changes to form california

Editing changes to form california online

Uncompromising security for your PDF editing and eSignature needs

How to fill out changes to form california

How to fill out changes to form california

Who needs changes to form california?

Understanding Changes to California Form: A Comprehensive Guide

Overview of form changes

Recent modifications to California tax forms can be particularly impactful for those navigating the complexities of state taxes. The California tax system undergoes regular revisions, and the recent changes for the upcoming year are no exception. These modifications address evolving tax regulations, promote compliance, and make filing a more streamlined process for individuals and businesses alike. Understanding these updates is crucial for ensuring accurate submissions and maximizing potential refunds.

Navigating these alterations requires awareness of what has changed and how it may affect your tax return. It’s essential to stay informed about the latest updates to California forms as they can influence several aspects of your tax filing process. From adjusted line instructions to entirely new forms, staying current with these changes is essential for a smooth filing experience.

Key changes to California forms

The 2024 tax season brings a series of notable adjustments, particularly affecting personal income tax returns and various other forms utilized by Californians. It's vital to examine these changes in detail to fully grasp their significance.

Understanding these changes is significant; it can impact various stakeholders differently. Businesses may face stricter requirements as they navigate the complexities of compliance, while individual filers should prioritize accuracy to avoid delays in processing.

Navigating the form changes

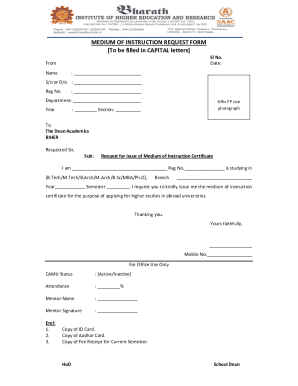

Adapting to the new forms and their requirements may seem daunting at first. However, approaching this systematically can simplify the transition. Here is a step-by-step guide on how to effectively navigate these changes.

By proactively addressing form changes, you can ensure a smoother filing process and reduce the likelihood of discrepancies or rejections when submitting your tax documents.

Specific instructions for filling out updated forms

When filling out the updated forms, clarity and precision are of utmost importance. Here’s an overview of each section in the new forms and how to correctly complete them.

Additionally, take advantage of pdfFiller’s tools for editing and signing forms. The platform allows you to utilize interactive features that simplify document management while ensuring you have the latest updates integrated directly into your submissions.

Resources for assistance

When faced with questions regarding the recent updates or if you run into any issues while filling out your forms, numerous resources are available to assist you. First and foremost, the California Department of Tax and Fee Administration provides the most reliable and up-to-date information directly through their official website.

If you find yourself needing personalized assistance, consider contacting support directly via phone or email. Tax professionals specializing in California's tax codes can also help interpret complicated requirements and ensure compliance.

Understanding your rights and responsibilities

As a taxpayer, understanding your rights is essential, especially in the context of form compliance. Your rights include the ability to request clarification on any aspects of the forms and how they were created. If you encounter discrepancies or issues with your submitted forms, knowing how to address them is critical.

Understanding your responsibilities helps create a more informed taxpayer base. Take the time to read through instructions and guidelines provided to safeguard yourself against potential issues down the line.

Future considerations

Looking beyond 2024, it’s prudent to consider what further changes may arise in the tax filing landscape of California. The state regularly revises regulations, and ongoing changes may shift the way forms are completed, impacting future tax obligations. Keeping an eye on proposed regulations helps prepare filers for potential shifts.

Maintaining a proactive approach regarding anticipated changes will help smooth the transition for you and your financial team.

Related content and useful links

Taking advantage of connected resources can significantly enhance your understanding and management of tax forms, particularly with the ongoing changes. The California Department of Tax and Fee Administration provides extensive resources about various forms.

By leveraging these resources, you'll be better equipped to navigate California's evolving tax landscape.

Feedback and improvements

The development of tax forms is often guided by user feedback. Your experiences shape future updates to California forms, encouraging improvements that make them clearer and more accessible. Engaging with local tax forums can also help impact how tax information is presented to Californians.

When users voice their needs, it ensures forms are continually refined to meet the evolving landscape of taxation.

Closing remarks on accessibility and user support

pdfFiller is committed to providing comprehensive solutions that empower users to manage documents effortlessly. By offering a cloud-based platform, individuals and teams can edit PDFs, eSign, collaborate, and manage documents from anywhere, which is invaluable in adapting to form changes.

The adaptability of pdfFiller ensures all users can access the updated forms and instructions as they are introduced. This commitment to user support enhances the experience of navigating changes to California forms, making the tax filing process less stressful and more efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit changes to form california from Google Drive?

How can I send changes to form california for eSignature?

How do I complete changes to form california on an iOS device?

What is changes to form california?

Who is required to file changes to form california?

How to fill out changes to form california?

What is the purpose of changes to form california?

What information must be reported on changes to form california?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.