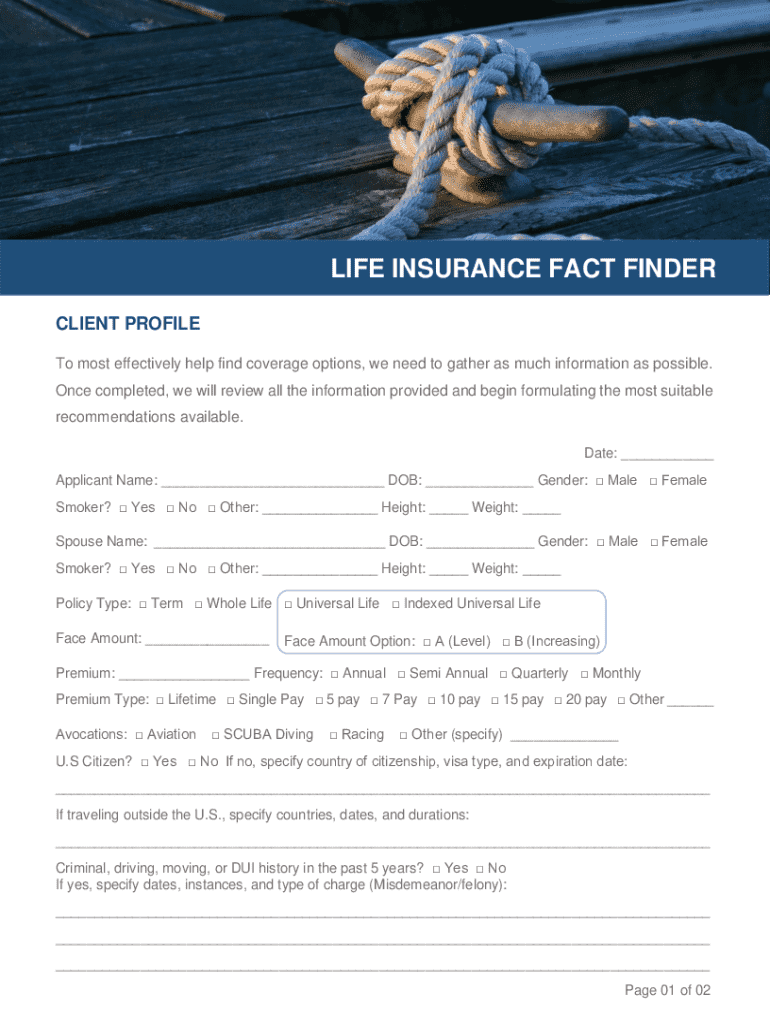

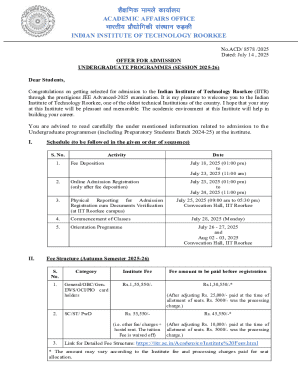

Get the free Life Insurance Fact Finder

Get, Create, Make and Sign life insurance fact finder

How to edit life insurance fact finder online

Uncompromising security for your PDF editing and eSignature needs

How to fill out life insurance fact finder

How to fill out life insurance fact finder

Who needs life insurance fact finder?

Understanding the Life Insurance Fact Finder Form: A Comprehensive Guide

Understanding the life insurance fact finder form

The life insurance fact finder form serves as a foundational tool in the life insurance planning process. It collects critical information about your financial situation, health status, and personal circumstances, ensuring that you receive tailored insurance advice that aligns with your needs and goals.

By utilizing a comprehensive fact finder, agents and advisors can better understand the unique aspects of your life, enabling them to recommend the most appropriate coverage options. This not only simplifies the decision-making process but also helps to build a tailored insurance policy that meets your specific requirements.

Key components of the form

Life insurance fact finder forms typically include several key sections designed to cover essential areas of inquiry. These sections allow you to provide crucial insights that can directly influence the types of products and policies that may be recommended to you.

The form generally collects the following data points:

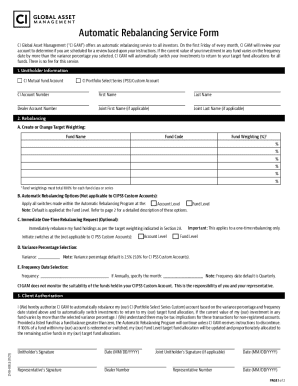

How to access and utilize the form on pdfFiller

One of the easiest ways to access a life insurance fact finder form is through pdfFiller. This platform offers a cloud-based solution that allows users to obtain and manage documents with ease. To access the form, follow these steps:

The cloud-based nature of pdfFiller ensures that your documents are accessible from any device, allowing flexibility in how and when you complete your fact finder.

Interactive tools available on pdfFiller

pdfFiller enhances user experience with several interactive tools aimed at simplifying the completion of the life insurance fact finder form. Features such as fillable fields allow users to input data effortlessly while ensuring that every section of the form is completed.

Additionally, auto-calculation fields can be included where necessary, ensuring accuracy in financial information reporting. Further, pdfFiller allows for collaboration, enabling you to share your document with others, such as a financial advisor or spouse, for input before finalizing it.

Detailed instructions for filling out the form

When filling out the life insurance fact finder form, careful attention to detail is crucial. Start with the personal information section, where you will be prompted to provide essential details. It's vital to ensure accuracy in your name and address, as errors can lead to confusion later.

For the financial information section, summarize your current income sources, detailing employment income, rental income, or investment returns. Listing your assets and liabilities comprehensively provides a snapshot of your financial health, making it easier for advisors to understand your insurance needs.

The health information section often includes questions about pre-existing conditions or ongoing treatments. Being honest and thorough in this area is vital, as any undisclosed conditions can lead to complications or invalidation of your policy.

Editing and signing the form digitally

Once the life insurance fact finder form is filled out, you may need to make edits or digital annotations. pdfFiller allows you to easily modify pre-filled information by selecting any text field and entering new data. This feature is particularly useful if you discover errors or wish to update your financial data.

Moreover, pdfFiller enables users to eSign documents without any hassle. To eSign the form, simply navigate to the signature field, select 'Sign,' and follow the prompts to create or insert a signature. This method not only expedites the signing process but also provides legal validity to your digital document.

Managing the fact finder form post-completion

After completing the life insurance fact finder form, it's essential to manage this document effectively. PDF Filler offers several options for saving and organizing your files in the cloud. You can create folders for different categories, making it easy to retrieve documents when needed.

When sharing the form with insurance agents or financial advisors, prioritize security. Utilize encrypted sharing options provided by pdfFiller to protect your sensitive information.

Common pitfalls and tips for accurate completion

Completing the life insurance fact finder can be straightforward, but common pitfalls often lead to inaccuracies. It's crucial to take your time and consider each question carefully before answering. Rushing through the form can lead to missed information or errors.

Following these best practices can enhance transparency and accuracy, empowering you to make the most informed decisions about your life insurance needs.

Additional features of pdfFiller worth exploring

Using a cloud-based platform like pdfFiller comes with numerous advantages. The flexibility of accessing your documents from any location is invaluable, particularly for those who may need to complete or modify forms while on the go.

Another notable feature is the ability to integrate with other tools, such as Google Drive, Dropbox, and various CRM systems. These integrations can streamline your document management process, ensuring that everything is centralized and easily accessible.

FAQs about the life insurance fact finder form

As you navigate the life insurance fact finder process, you may have some questions about specific aspects. Here are a few common queries that can assist you in maximizing your experience:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get life insurance fact finder?

How do I edit life insurance fact finder straight from my smartphone?

How do I complete life insurance fact finder on an iOS device?

What is life insurance fact finder?

Who is required to file life insurance fact finder?

How to fill out life insurance fact finder?

What is the purpose of life insurance fact finder?

What information must be reported on life insurance fact finder?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.