Get the free Matching Gift Request Form

Get, Create, Make and Sign matching gift request form

How to edit matching gift request form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out matching gift request form

How to fill out matching gift request form

Who needs matching gift request form?

Matching Gift Request Form: A Comprehensive Guide

Understanding matching gifts

Matching gifts represent a unique opportunity for donors to maximize the impact of their charitable contributions. When a donor makes a gift to a nonprofit, many corporations offer to match that donation, thereby doubling the financial support received by the organization. This initiative not only strengthens the funding capabilities of nonprofits but also encourages employees to engage in philanthropic efforts, creating a culture of giving within a company.

The importance of matching gifts in nonprofit fundraising cannot be overstated. In 2020, matching gifts accounted for approximately $2-3 billion in additional funding for nonprofits in the United States alone. Therefore, understanding how matching gifts work and how to effectively request them is crucial for both donors and the organizations they support.

Types of matching gift programs

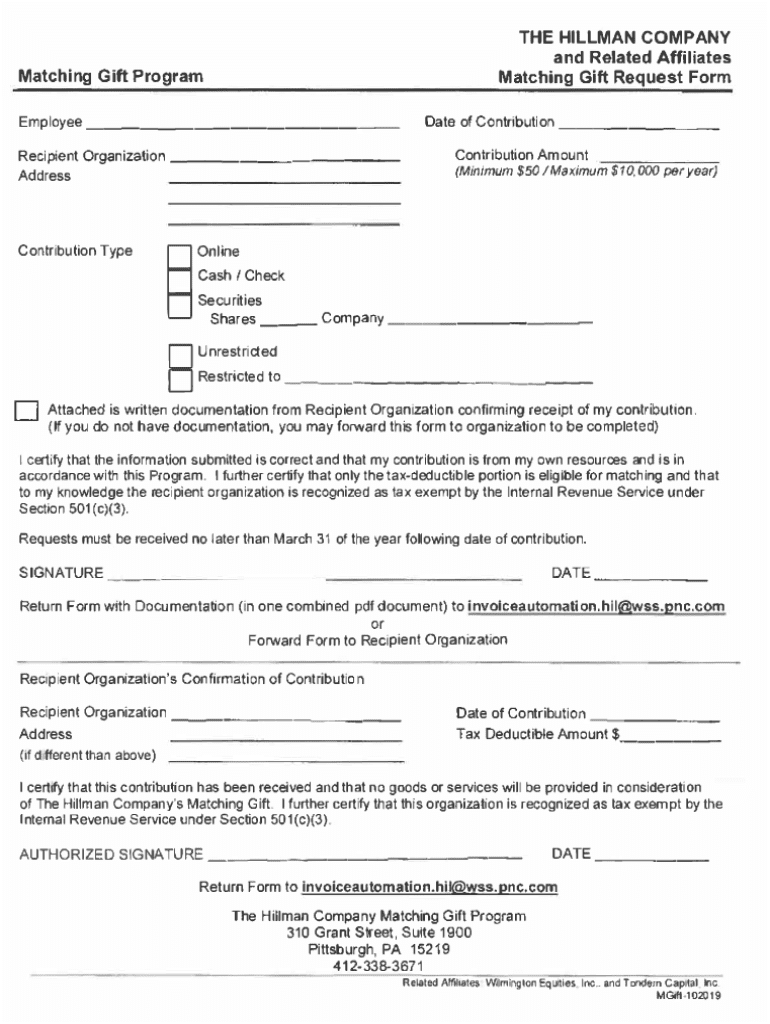

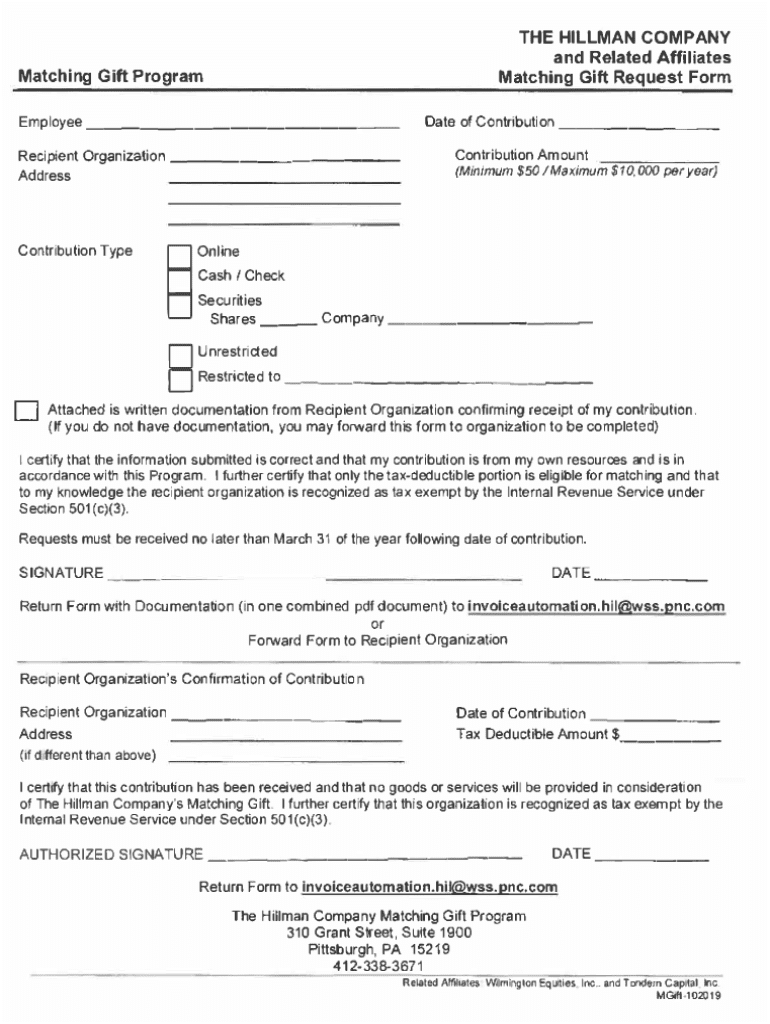

The matching gift request form explained

A matching gift request form is a crucial document that enables donors to initiate the matching gift process with their employers. This form is fundamental as it formally indicates that a donation has been made and requests the matching contribution from the company. Understanding the significance of this form is essential in ensuring that donations are effectively maximized through employer participation.

Both donors and nonprofits play significant roles in the process surrounding the matching gift request form. Donors must accurately complete the form, providing necessary details about their donations, while nonprofits must ensure that they have the required Documentation and Verification processes in place to confirm donor eligibility.

Key components of a matching gift request form

To successfully submit a matching gift request form, certain key components must be included. Essential information begins with the donor's personal details, such as their name and contact information, which establishes their identity within the organization. Additionally, it is important for the form to capture comprehensive employer company information to confirm eligibility.

Moreover, donation details are critical to the matching process. This includes specifics such as the amount donated, the date of the donation, and the designated program or purpose for the donation within the nonprofit's outreach initiatives. Finally, documentation and verification play a pivotal role; this aspect requires supporting documents, such as receipts or confirmations, along with authorization requirements as mandated by the employer to facilitate accurate processing of the request.

Filling out the matching gift request form

Filling out a matching gift request form may seem straightforward, but it requires attention to detail to ensure accurate submissions. Start by gathering all necessary information before you begin completing the form. This includes details about your donation, personal information, and your employer's specifics.

Next, complete each section of the form diligently. Pay close attention to instructions and fill out all required fields to avoid delays in the submission process. Common pitfalls include skipping sections or providing incorrect donation amounts. For those who prefer electronic submissions, many companies have transitioned their forms into digital formats, which can streamline the inputting process, or even automate the overall matching gift request.

How to submit the matching gift request form

Once the matching gift request form is completed, the next step involves submission, which can vary based on company policies. Donors may submit directly to their employer's HR department or utilize nonprofit platforms that facilitate electronic submissions. Being aware of submission methods is crucial, as some companies may have specific platforms for processing these forms.

Understanding deadlines and timelines is equally important. Employers may have clear submission deadlines, especially at the end of the year, and it is vital to submit within these timeframes to ensure that the matching gift is recognized and processed. Additionally, some companies might allow grace periods for submissions made shortly after the donor's donation date.

Enhancing the matching gift process

Utilizing a matching gift database can significantly enhance and simplify the matching gift process for both donors and nonprofits. These databases not only house information about various companies’ matching gift programs but also assist in identifying eligible employers for individual donors. This resource minimizes research time, helping donors quickly ascertain their employers' matching gift policies.

In addition, automating matching gift requests can significantly alleviate administrative burdens. Solutions that allow for auto-submission or integration of matching gift requests into donor communication strategies improve efficiency and reduce the possibility of errors. By leveraging technology, both donors and organizations can ensure a smoother process and encourage greater participation in matching gift programs.

Special considerations

Understanding match eligibility is critical, as certain factors may affect the ability of a donation to be matched. Donors need to be aware of their employer's specific eligibility rules, which can involve restrictions regarding the types of nonprofit organizations that qualify for matching gifts, or the minimum and maximum match amounts set by the employer.

In cases where the matching gift request is rejected, there could be common reasons, including inaccuracies in completion or failure to comply with documentation requirements. Donors should not hesitate to appeal if they believe their submission was valid; following up with the employer allows for clarification and potential resolution of issues.

Resources for nonprofits and donors

For nonprofits, accessing support and guidance when navigating matching gifts is essential. There are many tools available that assist in fundraising and awareness campaigns. Materials such as template samples for effective communication can streamline interactions with donors, making it easier to explain matching gift processes and encourage participation.

Moreover, additional promotional tools to raise awareness include informational brochures and digital flyers that emphasize the importance of matching gifts. Implementing strategic digital marketing efforts can effectively engage potential donors and remind current supporters of available matching programs, contributing to a broader culture of giving.

Advanced tips for maximizing matching gifts

Promoting matching gift awareness can be achieved through effective strategies, particularly using social media. Highlighting matching gift opportunities across various platforms not only informs supporters but can also increase engagement levels. Utilizing targeted campaigns in email communication reiterates the significance of matching gifts and keeps the topic top-of-mind for donors.

Moreover, employing best practices for donor engagement is vital. Personalized communication approaches, which cater to individual donor interests and donation history, enhance relationships. Following up with donors post-donation submission can provide reassurance about the process and demonstrate appreciation, thereby fostering a positive giving experience.

Final insights on matching gift request forms

Trends in matching gift programs indicate a growing awareness and adoption of these initiatives among companies aiming to enhance employee engagement in charitable giving. Emerging practices include the automation of matching gift requests, which provides a seamless experience for both donors and nonprofits. Innovative technologies are being integrated to facilitate faster processing and communication regarding matching gifts.

Success stories often highlight how effective matching gift campaigns have positively impacted nonprofits. Detailed case studies reveal how strategic implementations of matching gift requests not only increased funding but also built deeper connections within communities. Feedback from donors showcases the appreciation for companies that support their philanthropic endeavors, emphasizing the value of these programs in strengthening community bonds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find matching gift request form?

Can I edit matching gift request form on an Android device?

How do I complete matching gift request form on an Android device?

What is matching gift request form?

Who is required to file matching gift request form?

How to fill out matching gift request form?

What is the purpose of matching gift request form?

What information must be reported on matching gift request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.