Get the free Moa Funds Individual Retirement Account (ira) Distribution Request Form

Get, Create, Make and Sign moa funds individual retirement

Editing moa funds individual retirement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out moa funds individual retirement

How to fill out moa funds individual retirement

Who needs moa funds individual retirement?

MOA Funds Individual Retirement Form: A Comprehensive Guide

Understanding MOA Funds and individual retirement accounts (IRAs)

MOA Funds play a crucial role in helping individuals build retirement savings effectively. They provide a range of mutual funds and investment vehicles designed to cater to various financial goals, allowing investors to manage their portfolios according to their unique needs. An Individual Retirement Account (IRA) is a significant option within the retirement landscape, offering tax advantages that enhance savings potential. Choosing MOA Funds for your retirement savings typically brings tailored investment strategies aligned with specific risk and return objectives.

One of the significant benefits of MOA Funds is the array of IRA types available, each tailored to different investor profiles. These options include Traditional IRAs, which provide tax-deferred growth; Roth IRAs, allowing for tax-free withdrawals during retirement; and SEP IRAs, which are ideal for self-employed individuals and small business owners. Utilizing these funds wisely can potentially minimize expenses, maximize returns, and ensure that your investment strategy aligns with your retirement plans.

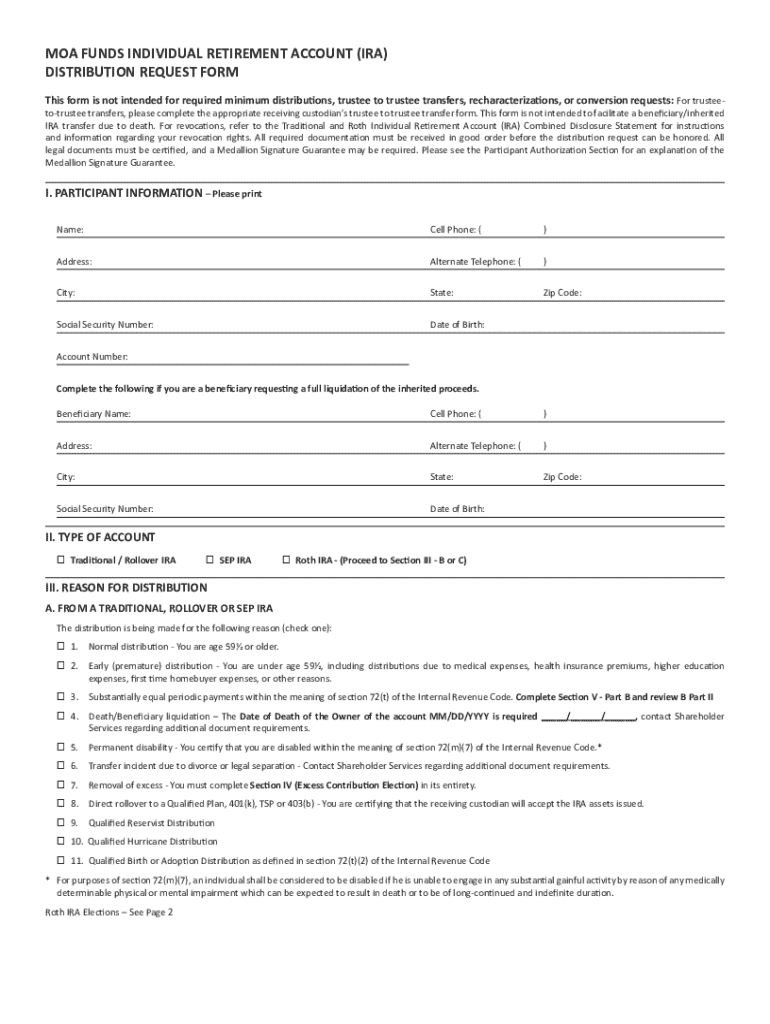

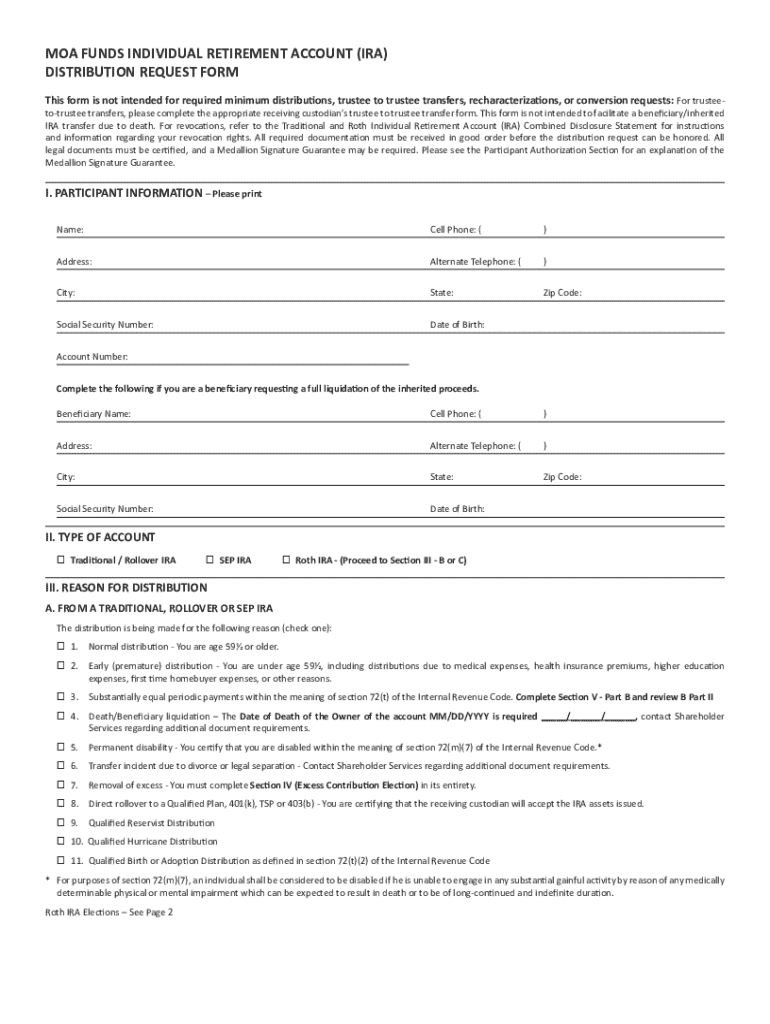

The MOA Funds Individual Retirement Form: A step-by-step guide

The MOA Funds Individual Retirement Form serves as a foundational document for setting up your retirement account. This form is crucial for informing the fund management about your investment choices and retirement goals. Individuals must fill out this form when they are ready to establish or modify their Individual Retirement Account, ensuring that all information is aligned with their financial aspirations.

It's advisable for individuals seeking to invest in retirement funds to complete this form early in the financial year or when their financial situation changes. Filling it out correctly helps streamline the investment process and avoids potential delays in capitalizing on available market opportunities. Ensuring every detail is accurate can prevent future complications as you navigate your investment journey.

Preparing to complete the Individual Retirement Form

Before diving into the completion of the MOA Funds Individual Retirement Form, it’s essential to gather relevant personal and financial information. This preparation phase is vital for ensuring a smooth and efficient experience as you fill out the form. Start by compiling your personal identification details, along with your Social Security Number, to verify your identity.

Additionally, assess your current financial situation to determine the appropriate contributions and investment choices that align with your retirement goals. Understand the terms and definitions used in the form, such as ‘investment objectives’, ‘contribution limits’, and ‘fund selection’. This knowledge will make form completion more straightforward and less daunting.

Detailed instructions for filling out the MOA Funds Individual Retirement Form

Each section of the MOA Funds Individual Retirement Form is designed to capture critical information efficiently. Start by filling in your personal information accurately to establish your identity within the fund management system. This section typically includes your name, address, and date of birth, which are used to verify your eligibility.

Next, move to contribution information. Detail how much you plan to contribute annually, ensuring you stay within the IRS-recommended limits. Then, select investment options and funds that match your risk appetite and performance expectations. Take your time when designating beneficiaries, as this choice impacts future distributions. Remember, even minor errors can lead to complications, so double-check your entries before submission.

Editing and managing your completed Individual Retirement Form

Once you've completed the MOA Funds Individual Retirement Form, it’s crucial to review it carefully. pdfFiller offers an intuitive platform where you can easily edit and manage your forms. Steps include checking each section for accuracy and utilizing available tools to make any necessary adjustments without hassle. This feature is particularly useful if you find errors after submission.

Utilizing cloud-based tools can enhance your document management experience. By storing your form online, you not only keep it accessible from anywhere but also secure it against potential loss. Electronic signing options streamline the process further, allowing you to finalize your retirement form conveniently. You can save and share your completed form confidently, knowing that pdfFiller prioritizes security.

Submitting your Individual Retirement Form

Once the MOA Funds Individual Retirement Form is complete, it’s time to submit it. There are online and offline options available, but filing online through pdfFiller often offers quicker processing times. Ensure you understand the submission timeline and prepare for confirmation, which indicates your form has been received and processed.

After submission, be proactive in following up. Keep any confirmation emails or receipts, as these serve as proof of your submission. Knowing the status of your form can help prevent any potential issues down the line and ensure that your retirement savings strategy is on track.

Utilizing interactive tools for retirement planning

pdfFiller provides a range of interactive tools designed to enhance your retirement planning experience. Many of these tools include calculators that help you project potential savings based on your current contributions and expected returns. They allow for quick adjustments based on changes in your financial landscape or investment objectives.

In addition to calculators, you can access various resources aimed at improving your financial literacy. Seminars, webinars, and articles help keep you informed about current market trends and retirement strategies that align with your goals. The collaboration features available on pdfFiller also enable teams to work seamlessly, ensuring that all stakeholders are aligned on retirement plans.

FAQs on MOA Funds Individual Retirement Form

As you navigate the MOA Funds Individual Retirement Form, it's common to have questions. For instance, many potential investors inquire about contribution limits and eligibility requirements for each IRA type. Understanding this information is crucial, especially when planning your retirement strategy.

Additionally, clarifications on the types of investments allowed and how they align with your risk profile are common among users. Knowing when to contact MOA Funds support can alleviate any confusion and provide vital assistance in resolving issues or inconsistencies you may encounter during the process.

Staying informed on retirement and financial opportunities

Navigating the complexities of retirement planning requires continuous learning. Engaging with educational resources will arm you with knowledge regarding the rapidly changing retirement landscape. Subscribing to newsletters, joining upcoming webinars, or participating in community discussions can keep you both informed and motivated.

Access to market insights and economic updates relevant for retirement investors ensures that you can make informed decisions. By actively participating in available learning opportunities, you can better align your investment strategies with changing economic conditions, ultimately enhancing your likelihood of achieving desired retirement outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the moa funds individual retirement electronically in Chrome?

How do I complete moa funds individual retirement on an iOS device?

How do I fill out moa funds individual retirement on an Android device?

What is moa funds individual retirement?

Who is required to file moa funds individual retirement?

How to fill out moa funds individual retirement?

What is the purpose of moa funds individual retirement?

What information must be reported on moa funds individual retirement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.