Get the free Notice of Action Taken

Get, Create, Make and Sign notice of action taken

How to edit notice of action taken online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of action taken

How to fill out notice of action taken

Who needs notice of action taken?

Comprehensive Guide to the Notice of Action Taken Form

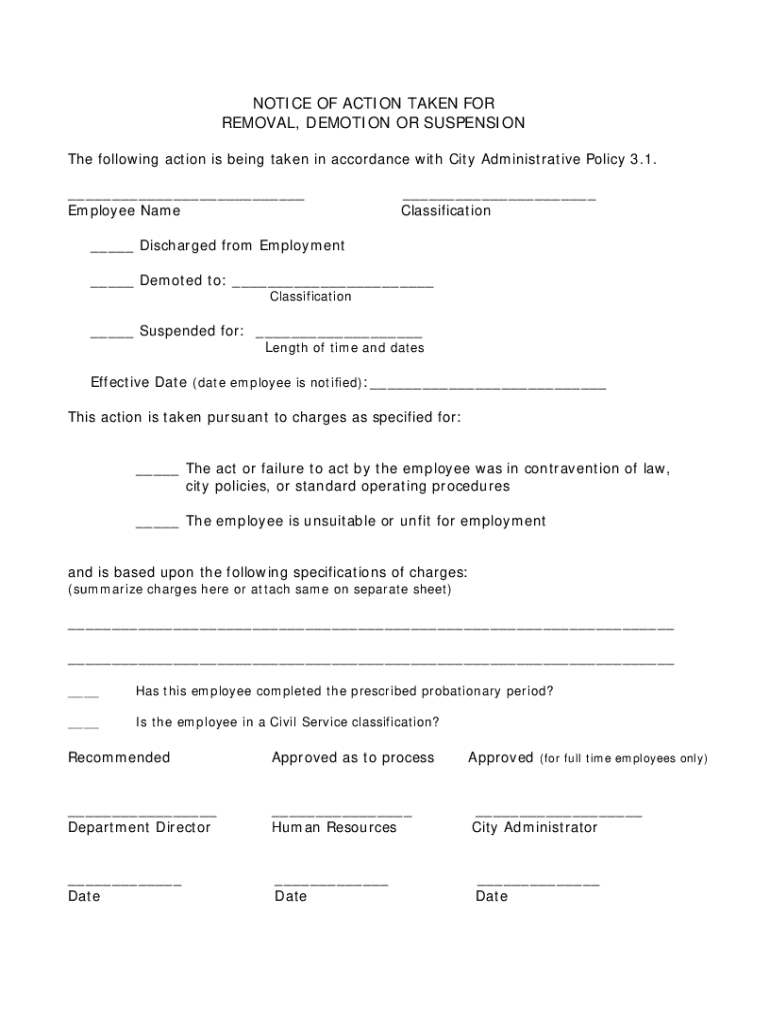

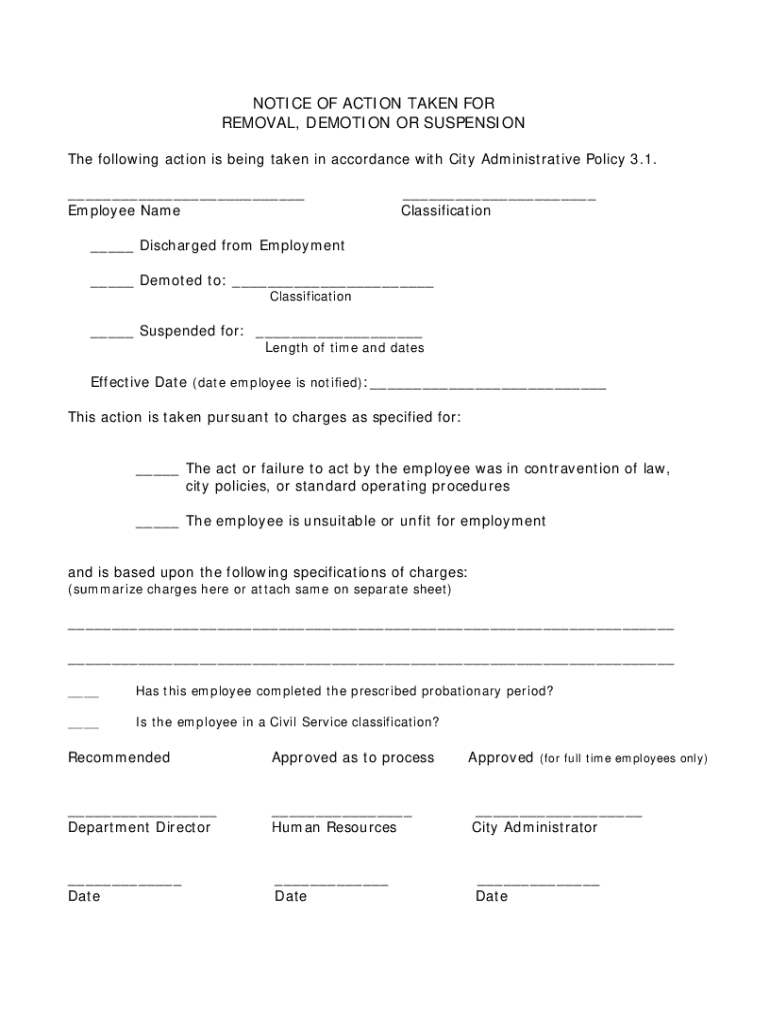

Understanding the notice of action taken form

A Notice of Action Taken Form is a mandatory document issued by lenders to notify applicants about the outcome of their credit applications or loan requests. This form plays a crucial role in ensuring transparency and fairness in the lending process, whereby applicants are informed whether their request was approved, denied, or if additional information is needed to make a decision.

The importance of this form spans various financial processes, including credit and loan applications. If an applicant's request is denied, for instance, the form not only informs them of the decision but also outlines the reasons behind the lender's action, thereby helping individuals understand their credit situation.

Legally, the issuance of the Notice of Action Taken Form is governed by regulations such as the Equal Credit Opportunity Act (ECOA) and the Fair Credit Reporting Act (FCRA). These laws mandate that lenders provide timely notices to applicants, generally requiring a response within 30 days of the application. Failure to comply can lead to legal repercussions and loss of trust from potential clients.

Key components of the notice of action taken form

Understanding the components of the Notice of Action Taken Form is essential for both lenders and applicants. It's not just about filling out a form; the details contained within are a reflection of regulatory compliance and customer relations. A well-structured form typically includes several required pieces of information.

Essential information on the form includes:

Moreover, lenders have a legal obligation to ensure the disclosures made within the notice are clear and accurate. Inaccurate or vague details can lead to confusion or feelings of frustration on the part of the applicant. Therefore, lenders must prioritize clarity when drafting these notices.

Steps to fill out the notice of action taken form

Filling out the Notice of Action Taken Form requires accuracy and attention to detail. The first step is gathering the necessary information, including the applicant's name, address, and contact details. This ensures that communication is direct and goes to the right individual.

In addition, document the reasons for the action taken. A thoughtful reflection on the applicant's credit history and the context of their application can provide invaluable insights that help inform both the lender and the applicant.

The following steps outline how to complete the form:

After the form is filled out, consider signing it electronically using options available through pdfFiller. When sending the notice, best practices suggest that email is often faster and more efficient than postal mail, but ensure to maintain a record of the communication regardless of the medium used.

Editing and customizing your form with pdfFiller

One of the standout features of pdfFiller is its ability to facilitate the editing and customization of forms such as the Notice of Action Taken. Whether you’re working with a sample form or starting from scratch, the tools available can help tailor the notice to your specific business needs.

Users can edit existing templates, adding branding elements or personal touches that reflect the values of their business. Customizing forms not only enhances professionalism but also strengthens brand identity in communications with applicants.

In addition to personalization, pdfFiller offers collaboration tools that allow teams to share the form. These features enable streamlined discussions around changes, ensuring that all stakeholders can make real-time edits and provide feedback on the document. Tracking changes and comments fosters a collaborative environment for document preparation.

Frequently asked questions (FAQ)

Despite the clarity that a Notice of Action Taken Form aims to provide, questions do arise among applicants regarding the application process. One common query is, 'What to do if you don’t receive a notice?' It's essential for applicants to understand their rights. If no notice is received within the regulatory timeline, they should contact the lender to inquire about the status of their application.

Another frequent concern is whether applicants can contest the action taken by lenders. Yes, applicants have the right to dispute actions perceived as unjust. They can request a review of their application or seek clarification on the reasons for denial.

Lastly, if an applicant discovers that the information on their notice is incorrect, they should notify the lender immediately. Providing documentation to rectify any errors will facilitate a quicker resolution.

Use cases of the notice of action taken form

The Notice of Action Taken Form is often required in various common situations, such as credit applications and loan evaluations. For example, when an applicant submits a request for a mortgage or other financial products, the lender must carefully assess the creditworthiness of the applicant and issue the notice based on their findings.

A case study could involve a borrower applying for an open-end credit loan. If the loan application were denied due to insufficient credit history, the lender would issue a timely Notice of Action Taken Form detailing the reasons for the decision. Here, having an accurate and transparent notice not only supports compliance but also fosters trust.

Compliance and risks

Understanding the compliance requirements surrounding the Notice of Action Taken Form is critical for lenders. Non-compliance can result in legal repercussions, including penalties and loss of reputation. Regularly reviewing the requirements set out by the ECOA and other relevant regulations is key to maintaining proper documentation practices.

Moreover, lenders should remain updated on changes in legislation that may affect notice requirements. Resources such as industry news, legal advisors, and platforms like pdfFiller can help organizations stay informed and prepared to adjust their forms as necessary.

Conclusion

In summary, a Notice of Action Taken Form is an essential document within the lending process, serving to inform applicants of decisions made concerning their credit requests. By understanding the key components, completing the form correctly, and utilizing tools like pdfFiller, both lenders and applicants can ensure a smoother experience. The seamless management of documents promotes clarity, compliance, and professionalism.

Utilizing services like pdfFiller can significantly streamline the creation and management of essential documents, allowing users to edit PDFs, eSign, collaborate, and manage their forms from anywhere.

Contact support

For any inquiries related to the Notice of Action Taken Form or assistance with pdfFiller, you can reach the customer service team directly. Whether you have questions about filling out the form or need help with customization options, the customer service representatives are available to ensure your needs are met, guiding you through the process smoothly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute notice of action taken online?

Can I create an electronic signature for signing my notice of action taken in Gmail?

How can I edit notice of action taken on a smartphone?

What is notice of action taken?

Who is required to file notice of action taken?

How to fill out notice of action taken?

What is the purpose of notice of action taken?

What information must be reported on notice of action taken?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.