Get the free Arizona Form 165pa Schedule K-1(nr)

Get, Create, Make and Sign arizona form 165pa schedule

Editing arizona form 165pa schedule online

Uncompromising security for your PDF editing and eSignature needs

How to fill out arizona form 165pa schedule

How to fill out arizona form 165pa schedule

Who needs arizona form 165pa schedule?

A comprehensive guide to Arizona Form 165PA Schedule Form

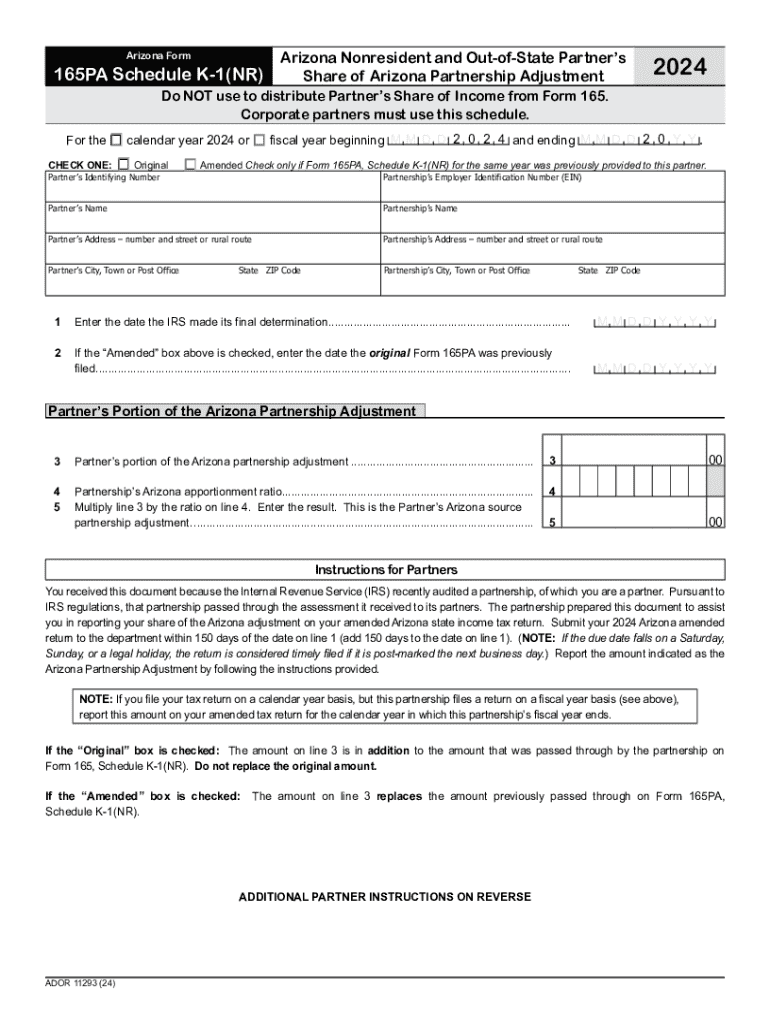

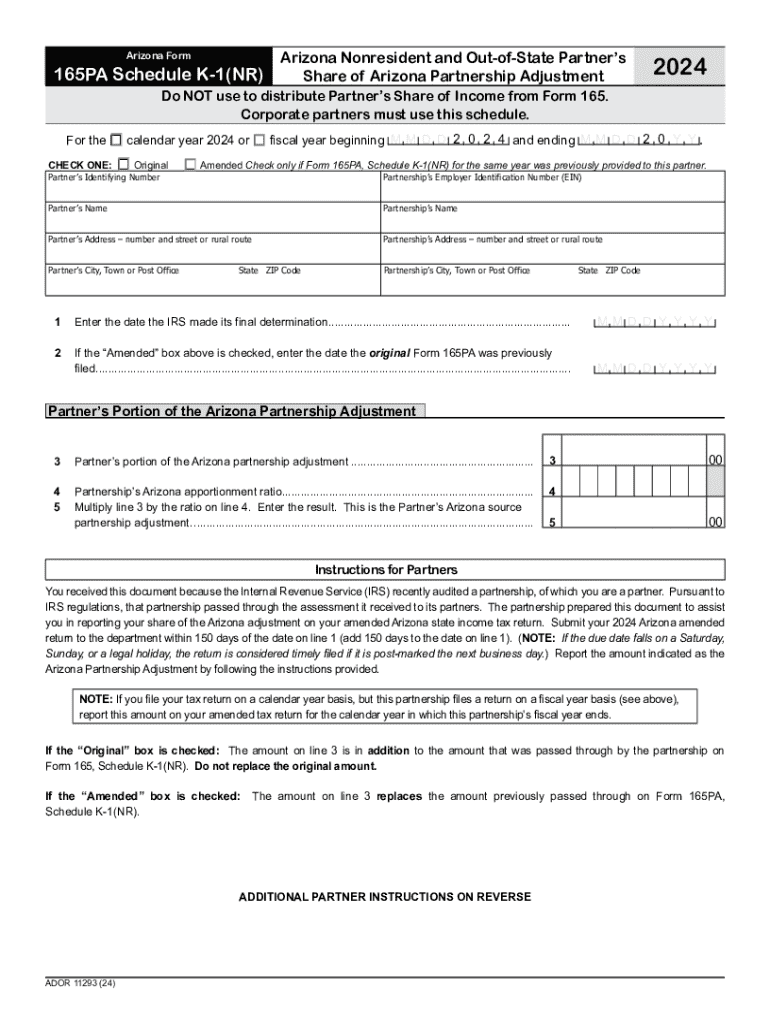

Overview of Arizona Form 165PA

Arizona Form 165PA is a vital document used by partnerships operating within the state of Arizona to report their income, deductions, and tax obligations. The purpose of this form is to facilitate the correct calculation and payment of taxes owed by partnerships.

Filing Form 165PA is essential for partnerships, as it determines tax liabilities at the state level. Failure to file accurately can lead to penalties or interest charges. Understanding this form is crucial not only for compliance but also for effective tax planning.

Detailed walkthrough: filling out Arizona Form 165PA

Completing Arizona Form 165PA can seem daunting, but breaking it down into manageable steps can simplify the process. Here’s a detailed walkthrough.

Step 1: Gather required information

Before starting the form, collect all necessary information. This includes partnership details such as the name and address, as well as income and expense reports that detail financial performance for the tax year.

Step 2: Completing the form fields

Next, you will fill in key fields such as the partnership’s name, address, EIN, and the tax year being reported. Accuracy here is crucial, as any discrepancies can lead to processing delays.

Step 3: Reporting income and deductions

Now, you need to report all types of income. Common income sources might include business sales, interest income, and rental income. Equally, documenting allowable deductions, such as operational costs, can significantly affect your tax obligation.

Step 4: Calculating tax liability

To calculate your tax liability, you must apply the appropriate tax rates established by Arizona. Review the Arizona Department of Revenue's guidelines for current tax rates applicable to partnerships.

Common mistakes to avoid when completing Form 165PA

First-time filers often make several common mistakes when filling out Form 165PA. Awareness of these pitfalls can spare you from unnecessary delays or penalties.

To confirm the accuracy of your information, consider using spreadsheets or tax software to cross-reference figures and calculations before final submission.

Electronic submission of Arizona Form 165PA

Submitting Arizona Form 165PA electronically through the Arizona Department of Revenue’s website is straightforward and efficient. Online submission minimizes paper usage and speeds up processing times.

Benefits of online submission include:

Managing changes and updates to your Form 165PA

If you realize that you've made an error after submitting Form 165PA, don’t panic. The Arizona Department of Revenue allows you to revise a submitted form under certain conditions. Knowing how to address these changes is essential.

Here are key points to remember when making revisions:

For specific FAQs regarding amendments and their implications, refer to the Arizona Department of Revenue’s official guidance or consult a tax professional.

Resources for further assistance

Utilizing the right resources can make your tax filing process smoother. There are various tools and calculators available for Arizona tax preparation. Exploring these resources can significantly aid in filling out Form 165PA.

Consider accessing the following resources:

Related forms and documentation

Understanding related forms can enhance your knowledge of Arizona’s tax filing system. Apart from Form 165PA, partnerships may also need to familiarize themselves with other essential forms.

Understanding the relationship between these forms aids in comprehensive tax planning and compliance.

pdfFiller’s features for convenient document management

At pdfFiller, we empower users to navigate the complexities of Form 165PA with intuitive tools that simplify document management. Features such as online editing, electronic signing, and collaborative tools make it easy to manage your submissions.

Tips for maximizing pdfFiller for Form 165PA include:

Frequently asked questions (FAQ)

Navigating Arizona Form 165PA can raise numerous questions. Here are some common inquiries that may arise during the filing process.

Additional insights and tips from the experts

Navigating tax obligations can be challenging, so it's helpful to learn from the experiences of others. Many users have shared their successful journeys with Form 165PA.

Expert advice emphasizes the importance of staying informed about changes in state tax regulations, as they directly impact compliance for taxpayers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the arizona form 165pa schedule in Chrome?

How can I fill out arizona form 165pa schedule on an iOS device?

How do I complete arizona form 165pa schedule on an Android device?

What is arizona form 165pa schedule?

Who is required to file arizona form 165pa schedule?

How to fill out arizona form 165pa schedule?

What is the purpose of arizona form 165pa schedule?

What information must be reported on arizona form 165pa schedule?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.