Builders Risk Quote Sheet Form: Comprehensive Guide

Understanding builders risk insurance

Builders risk insurance provides essential coverage for properties under construction. This insurance protects against various risks that can occur during the building process, ensuring financial stability and peace of mind for project owners, contractors, and builders.

Key coverage areas include protection against damage from fire, theft, vandalism, and certain weather events. Each policy can vary based on the specific needs of the project, making it a flexible option for various construction types.

Contractors, homeowners, and real estate developers are among those who most often need builders risk insurance. Whether you're constructing a custom home or renovating a commercial property, having this coverage is crucial to mitigate potential losses.

Financial protection against unforeseen events.

Fulfillment of lender requirements for insured construction.

Peace of mind during the construction phase.

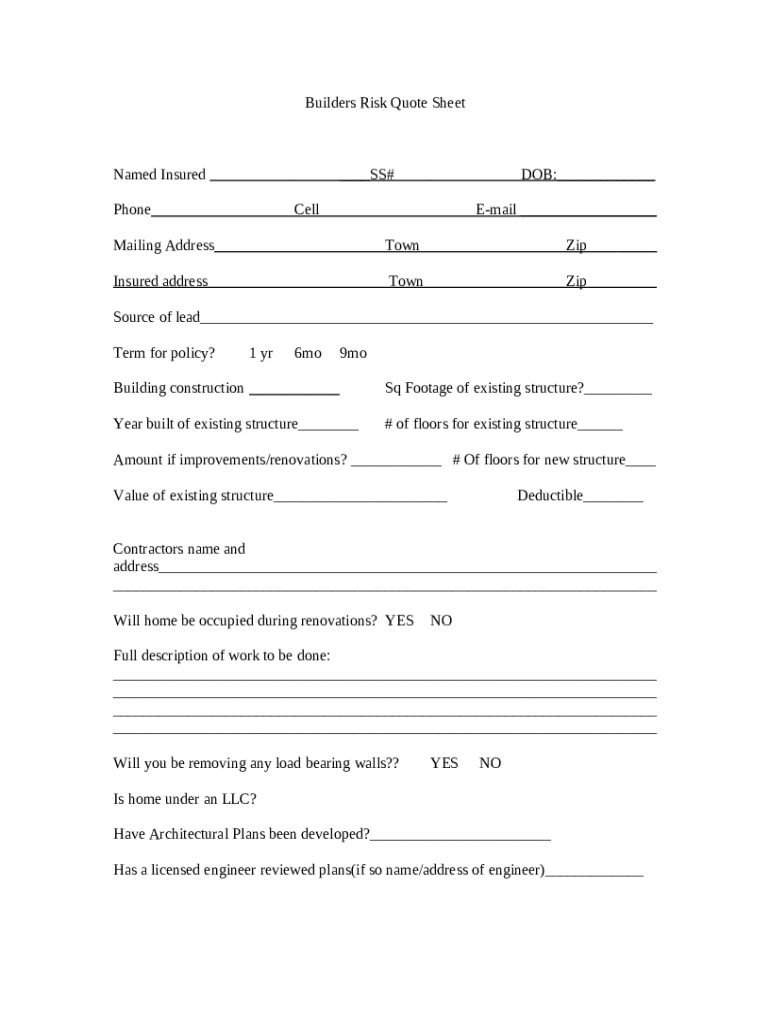

Builders risk quote sheet overview

A builders risk quote sheet is a standardized form used to gather essential information about a construction project to obtain an insurance quote. This form helps insurers assess the risks associated with the project and determine appropriate coverage options, premium rates, and policy terms.

Having a quote sheet is vital for ensuring that all necessary details are collected at the outset. It streamlines communication with insurance providers, minimizing back-and-forth inquiries and facilitating timely processing of quote requests.

Key components of the builders risk quote sheet typically include the project location, expected completion date, total estimated project cost, and specific coverage selections.

Step-by-step guide to filling out the builders risk quote sheet form

Filling out the builders risk quote sheet accurately is crucial for obtaining the right coverage. This step-by-step guide will help you ensure you're providing all necessary information.

Step 1: Gather required information

Document the address, type of construction, and expected completion timeframe.

Provide the owner’s name, contact details, and any special characteristics about the site.

Estimate the total cost of construction to ensure adequate coverage.

Step 2: Understand specific sections of the form

Each section of the quote sheet serves a specific purpose. For example, the applicant's information is where you'll input your contact details, ensuring that the insurer can reach you with any questions or quotes.

Coverage selection is vital; you'll need to choose the types of risks you want covered, such as theft or fire. Similarly, deductible choices will affect your premiums and out-of-pocket costs in the event of a claim.

Step 3: Assessing coverage needs

It’s essential to analyze the type of project you're undertaking. Different construction types carry different risks and coverage requirements. For instance, a residential construction project may have different insure needs than a commercial facility.

Step 4: Key terms and conditions

Understanding policy terms and important definitions can be tricky but is imperative when reviewing your builders risk quote sheet. Terms such as depreciation, replacement cost, and coverage limits need your attention.

Interactive tools for builders risk insurance

Several online interactive tools are available to help streamline the process of obtaining builders risk insurance. These tools can enhance your understanding of your coverage needs.

Use it to derive estimates based on inputted project details.

Evaluate different policies to find what best suits your project.

Simulate various risks to see how your policy would perform.

Common questions and answers

The builders risk insurance space raises several common questions. Many inquire about the duration of coverage, applicability after project completion, and what specific risks are covered under typical policies.

Another frequent concern is the difference between builders risk and standard property insurance. Understanding these nuances helps clarify coverage needs.

If you receive a quote and find it doesn’t meet your expectations, it's advisable to reach back to your insurer for clarifications before deciding.

Tips for managing your builders risk insurance

Effective management of your builders risk insurance policy can lead to significant cost savings and fewer headaches during construction. Maintain regular communication with your insurer and update them as project details evolve.

Review your policy regularly to ensure all aspects of your project are covered.

Keep the insurer informed of any delays or changes to your project to avoid coverage lapses.

Incorporate changes to your insurance based on upgrades and expansions.

Legal and compliance considerations

Navigating legalities associated with builders risk insurance can be daunting but is crucial for compliance. You must ascertain that all necessary permits are in place to avoid any insurance disputes post-construction.

It's also vital to be aware of state-specific requirements, as regulations often vary. Local laws can significantly affect your coverage decisions.

Related topics and resources

Further reading on risk management can illuminate related insurance products and solutions you may not have considered. Tools for collaboration among teams managing construction projects can enhance efficiency.

Finalizing your builders risk quote

Once you have filled out the builders risk quote sheet, understanding the issuance process comes next. Typically, insurers will review your submission and provide a quote that outlines coverage details and terms.

You'll receive communication about what to expect after submitting your quote, which may include questions from the insurer regarding the details provided. Reviewing and confirming your coverage before signing any agreement is essential.

Customer tools and support

pdfFiller offers various customer support avenues for users with queries regarding the builders risk quote sheet form. Accessing online resources for assistance can expedite your document management and submission processes.

Engaging in community forums can connect you with others who have successfully navigated the insurance landscape, providing insights and tips.

Claims and risk mitigation strategies

In the unfortunate event of a claim, knowing the steps to take can significantly affect outcomes. Documenting the project's progress with photos, dates, and records of expenditures is vital for any future claims.

Implementing risk mitigation techniques during construction — such as securing equipment, employing surveillance systems, and ensuring proper site management — further enhances your project's safety.