Get the free Multiple Sip & Top up Form

Get, Create, Make and Sign multiple sip top up

How to edit multiple sip top up online

Uncompromising security for your PDF editing and eSignature needs

How to fill out multiple sip top up

How to fill out multiple sip top up

Who needs multiple sip top up?

Multiple SIP Top Up Form: A Comprehensive How-to Guide

Understanding SIP top up: Definition and importance

A Systematic Investment Plan (SIP) allows investors to contribute a fixed amount regularly to mutual funds, thereby promoting disciplined investing. The concept of SIP is a preferred choice for many due to its ability to help investors accumulate wealth over time while mitigating market volatility. With a SIP, investors can participate in mutual funds without the need for large initial investments.

SIP top up is an enhanced feature that allows investors to increase their SIP amount periodically. This incremental investment ensures that your savings keep pace with inflation and align with growing financial aspirations, making it a pivotal strategy for maximizing returns.

How multiple SIP top ups work

Utilizing a multiple SIP top up form is a streamlined way to manage and commit additional investments effectively. The process can be broken down into four essential steps.

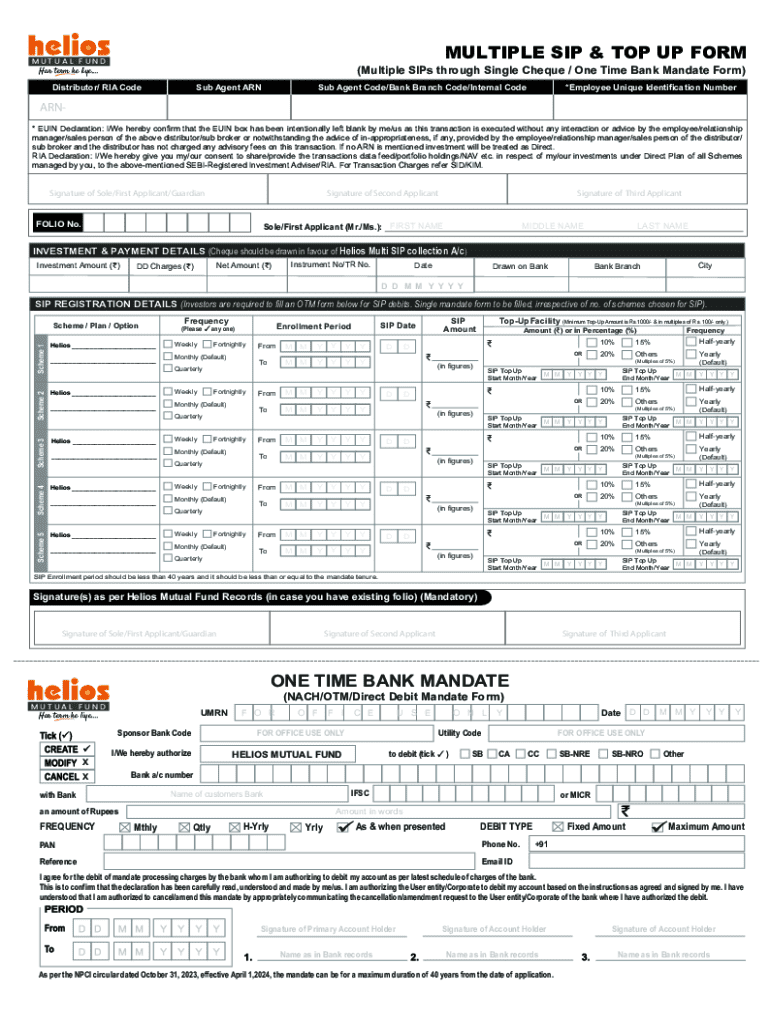

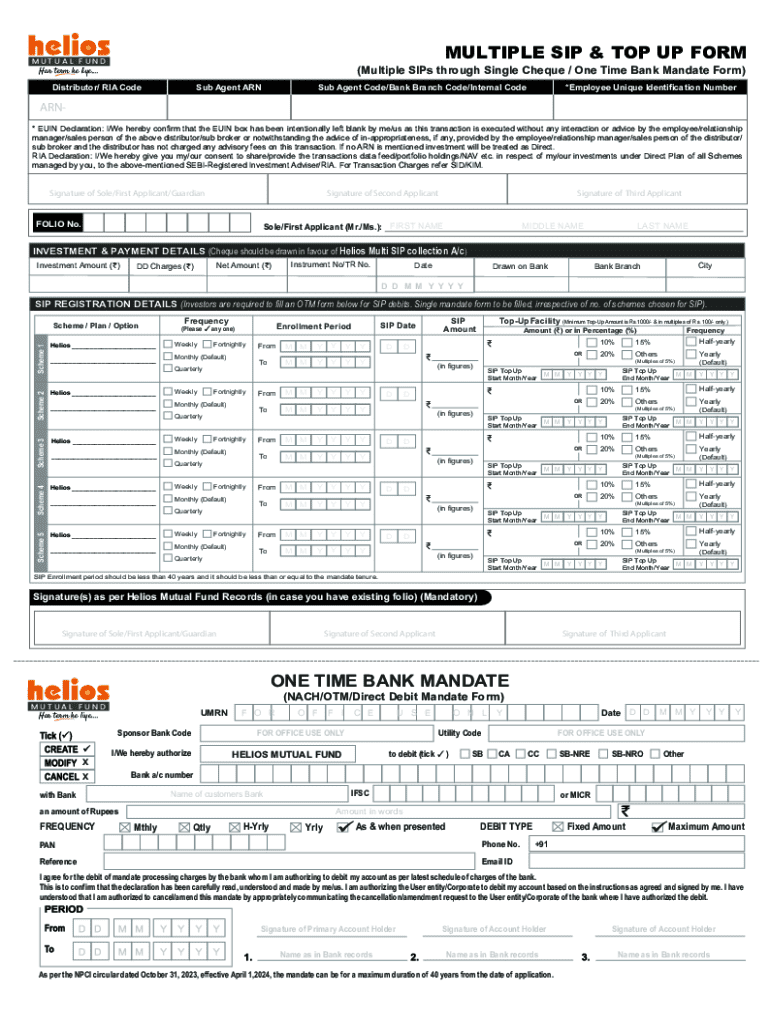

Detailed breakdown of the multiple SIP top up form

The multiple SIP top up form is key in facilitating your increased investment. Understanding each section will ensure a smooth process. Generally, the form is divided into distinct sections, each requiring specific information.

First, you'll need to provide personal information, including your name, contact details, and PAN (Permanent Account Number). It's important to ensure accuracy since these details will be cross-verified against your KYC documents.

Next comes the investment details. Here, you'll outline the mutual fund schemes you’re interested in, specify the top-up amount, and define the frequency, whether monthly, quarterly, or annually. After that, provide your bank details for transaction purposes, ensuring that you specify the preferred payment methods.

One common mistake is neglecting accurate details, so double-check every entry on the form to avoid delays or rejections.

Example scenario: Top up SIP in action

To illustrate the concept of a multiple SIP top up, consider a hypothetical scenario involving an investor named Priya. Initially, Priya invested ₹5,000 monthly in a mutual fund SIP, targeting long-term wealth accumulation.

After assessing her financial situation, Priya decided to plan annual increases of ₹1,000 to her SIP, employing the multiple SIP top up form. By regularly investing this additional amount, she projects her investment to grow significantly over a 10-year horizon.

This strategy not only allows her to maximize her corpus but also makes it possible to enjoy the benefits of compounding returns on her increased contributions.

Let’s break down her potential growth: With an expected annual return of 12%, Priya’s investment, originally ₹5,000, increased to ₹10,000 in the second year and so on, potentially leading to a significant portfolio value by the end of the investment term.

Key advantages of opting for a multiple SIP top up

Investing through a multiple SIP top up offers various advantages that can significantly benefit your financial journey. The most notable advantage is the enhanced potential for wealth creation due to the increased investment amounts.

Additionally, multiple SIP top ups provide flexibility to adjust contributions according to changing financial circumstances. This means if your income increases or you're facing additional expenses, you can tailor your investments accordingly.

Important considerations when top up SIP

When considering a multiple SIP top up, investors must be aware of certain key factors. Each mutual fund may have specific guidelines regarding minimum and maximum top up limits, which can vary widely. Always verify these limits to avoid any issues during submission.

Moreover, the frequency of contributions is essential to consider. If you choose to increase your SIP top up only once a year, assess how that aligns with your overall investment strategy and cash flow. Additionally, reviewing your investment objectives and risk appetite regularly is vital to ensure that your top ups align with your financial goals.

Interactive tools and calculators

Using interactive tools and calculators can significantly assist in SIP planning and execution. SIP calculators allow you to estimate the growth of your investment based on various parameters, such as investment amount, duration, and expected returns. By inputting your values, you can visualize potential future gains, making financial planning more strategic.

Additionally, documents like the multiple SIP top up form can be streamlined using pdfFiller’s tools. With its user-friendly interface, you can fill out, edit, and eSign your forms in a secure cloud-based environment. The ease of access from anywhere means you can manage your investment documents effectively.

Regulatory considerations and compliance

Compliance with regulations is crucial when managing investments. To invest through a SIP and to fill out the top up form, you must comply with KYC (Know Your Customer) norms, which require identity verification through PAN and other documents. Ensure that you have all the necessary paperwork ready to fulfill these requirements swiftly.

Stay updated with any recent regulations regarding SIP investments and their top-ups, as rules and guidelines may change. Being informed helps you avoid compliance issues and ensures that your investments remain secure.

FAQs about multiple SIP top up

Individuals often have questions when it comes to the multiple SIP top up process. Common inquiries include concerns about whether SIP top ups affect the existing arrangement, and how often one can submit the top up form. Clarifying these points is essential to enhance understanding.

It's also crucial to address misconceptions regarding the complexities involved in this process. While some may believe that increasing investments require intricate steps, the reality is that using the multiple SIP top up form streamlines the entire experience. For any specific doubts, customer support is usually available through your financial advisor or mutual fund company.

Feedback and user experiences

Gathering feedback from individuals who've successfully utilized the multiple SIP top up form provides invaluable insights. Many users report positive experiences, noting how the feature has empowered them to enhance their investment strategies effectively.

For instance, one investor shared their story of gradually increasing investments through the form, resulting in a substantial increase in portfolio value within a few years. Such testimonials highlight the real benefits of using multiple SIP top ups, showcasing how they can play a vital role in long-term financial success.

Next steps after filling out your form

Once you've successfully filled out and submitted the multiple SIP top up form, it’s essential to know what to expect next. Typically, the mutual fund house will process your request within a few days, confirming the changes to your SIPs.

Tracking and monitoring investments is the next step. Keep an eye on your portfolio performance compared to your initial goals. Regular reviews will help you adjust your strategy if necessary, ensuring that your financial planning remains on track.

Exploring the benefits of using pdfFiller

Utilizing pdfFiller provides numerous advantages for managing your multiple SIP top up forms and other documents. The platform offers unique features that facilitate document management, ensuring that forms are easy to fill out, edit, and securely share with relevant parties.

Additionally, pdfFiller ensures secure eSign and collaboration functionalities, allowing users to approve documents without the hassles of printing or physical signatures. To maximize your experience, familiarize yourself with all available tools on pdfFiller that can aid in managing your investment documents efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my multiple sip top up directly from Gmail?

How can I fill out multiple sip top up on an iOS device?

How do I complete multiple sip top up on an Android device?

What is multiple sip top up?

Who is required to file multiple sip top up?

How to fill out multiple sip top up?

What is the purpose of multiple sip top up?

What information must be reported on multiple sip top up?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.