Get the free Tax Organizer

Get, Create, Make and Sign tax organizer

Editing tax organizer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax organizer

How to fill out tax organizer

Who needs tax organizer?

Your Essential Guide to the Tax Organizer Form

Overview of tax organizer forms

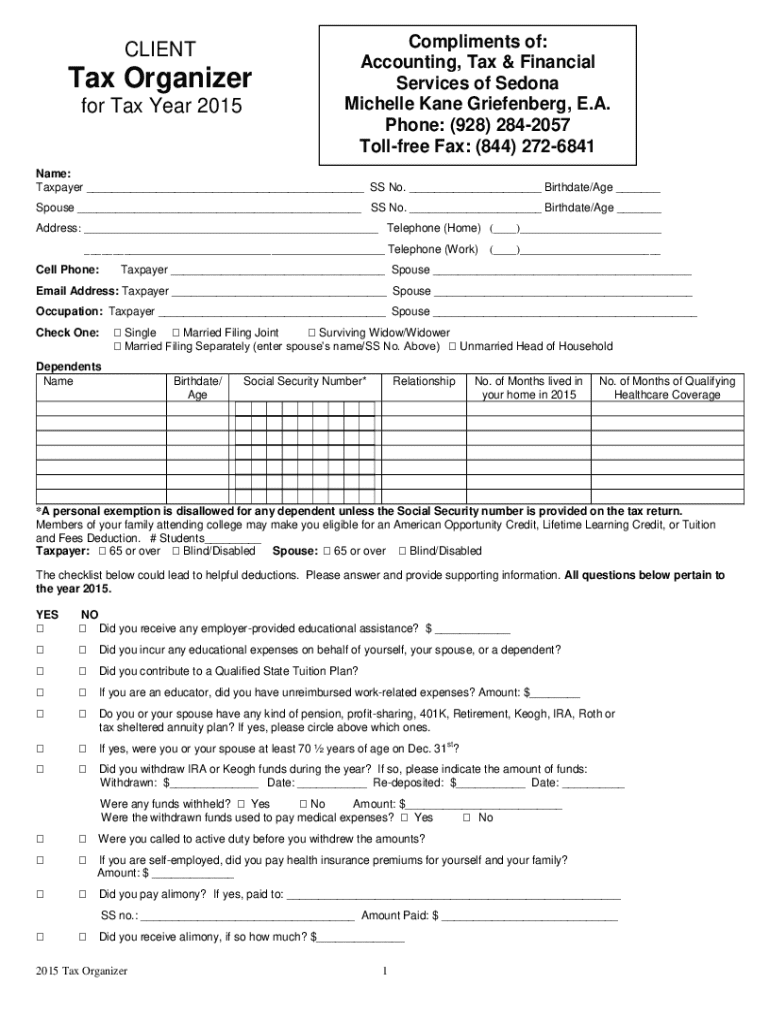

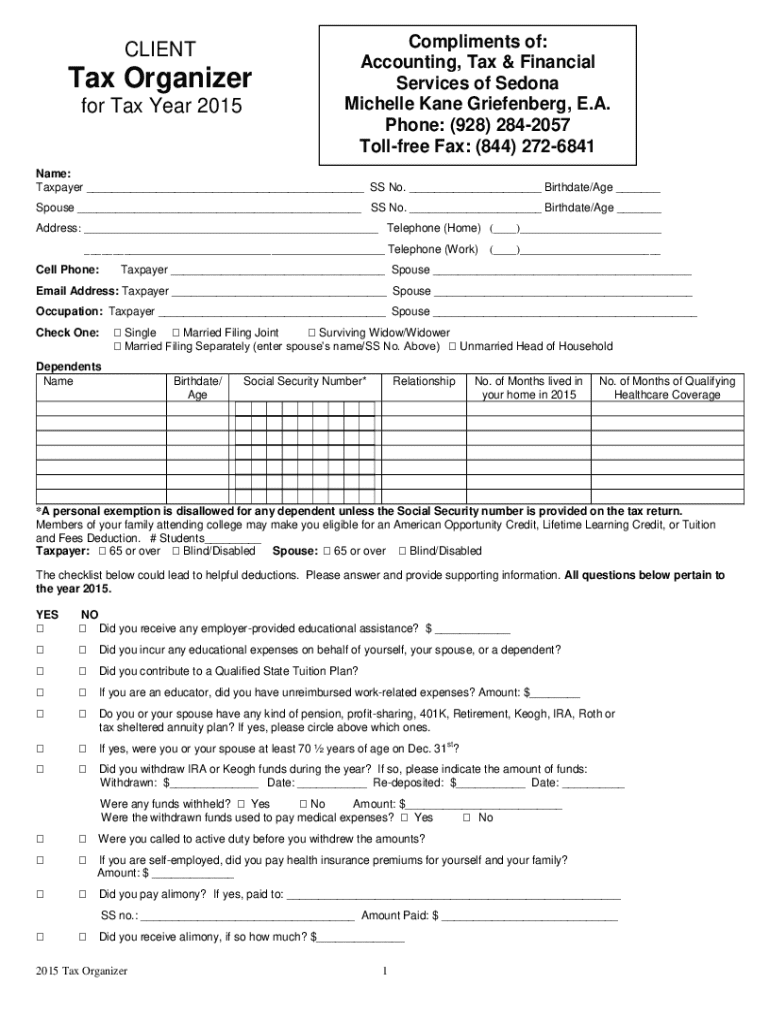

A tax organizer form is a vital document designed to compile relevant financial information for tax preparation. It helps taxpayers categorize their income, deductions, credits, and significant expenses in an organized manner. The primary purpose of this form is to facilitate a comprehensive overview of one's financial year, making it easier to file accurate tax returns.

Utilizing a tax organizer form is crucial for effective tax management. By collecting all necessary documentation in advance, individuals and teams can minimize errors, reduce stress during the tax season, and ensure they do not miss out on potential deductions or credits. This not only saves time but also maximizes potential tax refunds.

The tax organizer form is beneficial for a wide audience, including independent contractors, small business owners, and families who manage multiple income sources. By using this form, anyone can better prepare themselves for tax filing, whether working with a tax professional or filing independently.

Key features of the tax organizer form

Tax organizer forms boast several key features that make them an invaluable tool during tax season. A central aspect is their comprehensive nature, designed to collect detailed information across various categories, ensuring no financial details are overlooked.

Another key feature is the availability of interactive tools designed for easy form completion. Digital help prompts and pre-filled fields can guide users through complicated processes. Furthermore, compatibility with digital signing capabilities allows users to sign and share their forms securely, enhancing collaboration between individuals and tax professionals.

How to access the tax organizer form

Accessing the tax organizer form via pdfFiller is simple and efficient. Start by navigating to the pdfFiller platform, where you can utilize various features tailored specifically for tax preparation.

To download the form, simply search the available forms section and locate the tax organizer form. Once found, you can initiate a download directly to your device. Additionally, if you already have existing documents, pdfFiller offers seamless uploading and importing options for editing, allowing you to work on your tax organizer in one central location.

Step-by-step guide to filling out the tax organizer form

Completing a tax organizer form begins with thorough preparation. Gather all necessary documents that pertain to your income, expenses, and potential deductions. This includes W-2 forms, 1099 forms, receipts for business expenses, and documentation for any other income.

Begin with filling out your personal information, like your name, address, and contact numbers. It's also important to select the correct filing status, such as single, married, or head of household, as it directly influences your tax calculation.

Next, detail your various income sources, ensuring you accurately report all wages, salaries, investment income, and business earnings. Be meticulous in this step as these figures form the basis of your taxable income.

Outline your deductions and credits in the next section. Decide whether to claim standard deductions or itemize your taxes, depending on which yields the best tax benefit. Additionally, be sure to claim any relevant credits to reduce your tax liability.

Finally, before submitting, take the time to review and finalize the form. Double-check for any missing entries, and confirm that all numbers are accurately recorded, helping to avoid common errors like incorrect Social Security numbers or miscalculated deductions.

Editing and signing the tax organizer form

pdfFiller offers intuitive editing tools that make modifying the tax organizer form straightforward. Users can add annotations and comments as needed, ensuring topics are highlighted or details are clarified for tax professionals reviewing the form.

Additionally, modifying text fields to include correct numbers or adjust information is seamless, promoting accuracy throughout the document. Signing the tax organizer form electronically is another feature worth exploring. Users can follow step-by-step processes to eSign securely, providing an efficient way to finalize the form while ensuring the validity of signatures through encryption.

Managing your tax organizer form through pdfFiller

Once completed, managing your tax organizer form is crucial for record-keeping and accessibility. pdfFiller allows users to save and store completed forms securely on the platform, making future reference easy.

Moreover, sharing the form with tax professionals or family members can be done effortlessly through the platform. This feature facilitates collaboration, ensuring everyone involved has access to the necessary information. Tracking changes and revisions is also helpful as it allows users to see the history of edits, making it easier to manage and review previous versions of the form.

Frequently asked questions

Exploring additional features of pdfFiller

Beyond the basic functionalities, pdfFiller offers users the ability to integrate the tax organizer form with other essential forms related to tax preparation. This ensures that users can efficiently manage multiple documents without hassle.

Furthermore, utilizing templates for other tax-related documents can save valuable time and effort. Collaborating with teams becomes straightforward with pdfFiller’s shared workspaces, enhancing communication and efficiency during tax preparation.

Testimonials and success stories

Users have shared numerous real-life experiences highlighting the effectiveness of the tax organizer form. Many have transformed their tax filing processes by ensuring they were organized and prepared, greatly reducing the stress often associated with tax season.

For instance, small business owners have noted that the tax organizer form allowed for better tracking of their expenses, ultimately resulting in higher refunds. These testimonials underline the importance of comprehensive preparation and utilizing tools like pdfFiller to simplify the process.

Next steps for efficient tax preparation

To set yourself up for efficient tax preparation, consider creating a personal account on pdfFiller. This enables you to utilize and save various documents, including your tax organizer form, while providing access to additional features that can streamline document management.

As you explore pdfFiller, be sure to stay updated on new tools and resources. Subscribing for tax tips can provide ongoing insights and best practices that further enhance your document preparation, ensuring you’re well-equipped for tax season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax organizer from Google Drive?

Can I sign the tax organizer electronically in Chrome?

How do I edit tax organizer on an Android device?

What is tax organizer?

Who is required to file tax organizer?

How to fill out tax organizer?

What is the purpose of tax organizer?

What information must be reported on tax organizer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.