Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

Editing campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Campaign finance receipts expenditures form: A comprehensive guide

Understanding campaign finance forms

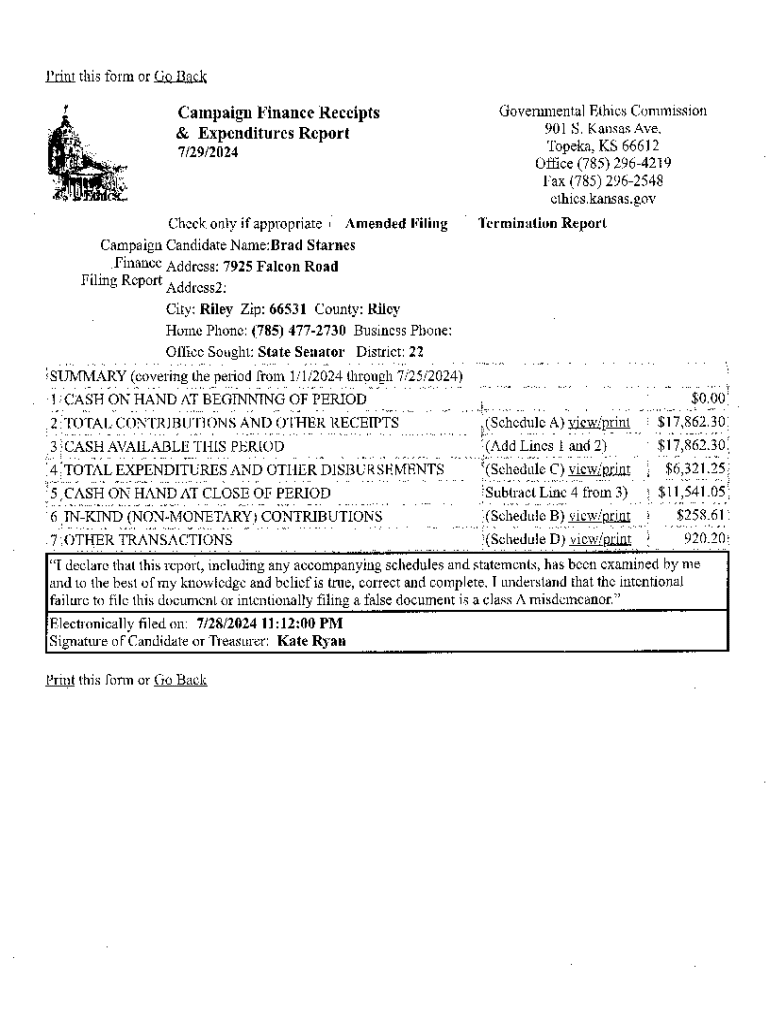

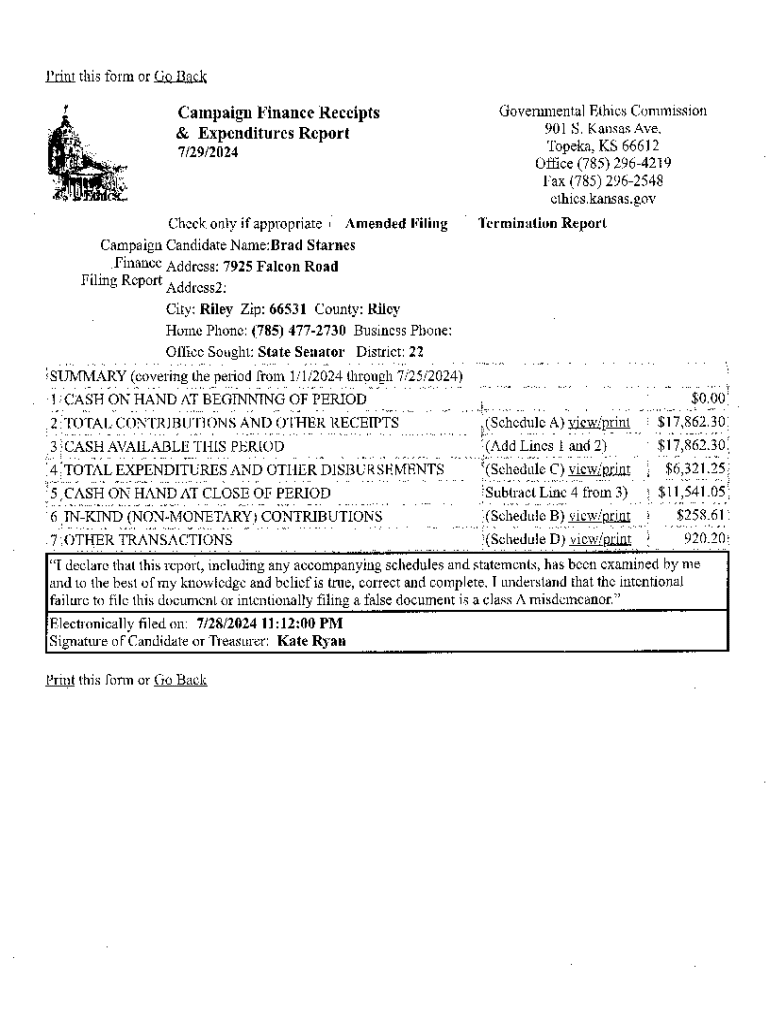

Campaign finance receipts and expenditures forms are a vital component of the electoral process, ensuring transparency and accountability in political financing. These forms require detailed reporting of both the money received and spent during a campaign. The significance lies in their role in preventing corruption and maintaining a fair playing field for all candidates.

Legally, various federal and state regulations govern how campaign finance is managed, including the Federal Election Commission (FEC) requirements. Compliance with these laws helps build trust among voters and can influence election outcomes. It's essential for candidates and campaign teams to familiarize themselves with key terminology, such as 'contributions,' 'expenditures,' and 'disclosure periods,' to effectively navigate this regulatory landscape.

Overview of campaign finance receipts

Receipts refer to the money collected by a political campaign, which can come from various sources. Understanding what constitutes receipts is crucial for maintaining accurate financial records. The major types of receipts in campaign finance include monetary contributions, which are direct financial gifts, and in-kind contributions, which encompass non-cash donations such as goods and services.

Campaigns receive these contributions from diverse sources, including individual donors and corporate entities. Individual donations often provide the backbone of funding for many campaigns, while corporate contributions can bring significant support. Keeping thorough records of all receipts is vital to ensure compliance and transparency. Utilizing tools and templates for organizing receipts can facilitate accurate record-keeping, ultimately helping candidates and committees meet their legal requirements.

Navigating expenditures in campaign finance

Expenditures in campaign finance refer to the funds that campaigns spend during their efforts. These are broadly categorized into allowed and prohibited expenditures. Allowed expenditures include advertising costs, staffing expenses, venue rentals, and other necessary costs to promote the candidate. Conversely, prohibited expenditures might involve personal expenses that do not directly contribute to the campaign's goals.

To maintain clarity, expenditures can be further categorized into fixed and variable costs. Fixed costs remain consistent, such as rent for office space, while variable costs fluctuate based on campaign activity, such as flyer printing. Tracking and reporting these expenditures is vital, and forms and documentation are often required to substantiate claims made in financial reports. Keeping meticulous records ensures campaigns can defend their financial decisions and avoid potential legal pitfalls.

Step-by-step: completing the campaign finance receipts and expenditures form

Completing the campaign finance receipts and expenditures form requires attention to detail and a thorough understanding of requirements. Preliminary steps include gathering necessary documentation, such as receipts for contributions and itemized summaries of expenditures, and familiarizing yourself with relevant legal frameworks. This foundational knowledge is critical in accurately reporting financial data.

When filling out the form, begin with Section 1, which captures personal and campaign information. Next, in Section 2, report receipts by listing contributions, ensuring to distinguish between monetary and in-kind donations. For accuracy, utilizing interactive tools can aid in validating figures before submission. In Section 3, report expenditures, categorizing each expense effectively to provide clarity. Finally, complete Section 4 with a final review and checklist to ensure that all parts are complete and compliant.

Interactive tools for managing campaign finance forms

Managing the campaign finance receipts expenditures form can be simplified through the use of interactive tools offered by platforms like pdfFiller. This cloud-based solution allows users to upload their documents, edit forms seamlessly, and leverage signature and collaboration features. It streamlines the process, enabling candidates or campaign teams to manage their forms easily and efficiently.

A cloud-based management system also ensures that all documents are accessible anytime, anywhere, which is especially crucial for busy campaign teams. This capability allows sharing with team members and advisors, facilitating collaboration on financial reporting and compliance while fostering a transparent environment among donors and stakeholders.

Common mistakes to avoid when filing

Filing the campaign finance receipts expenditures form is a meticulous process, and there are several common pitfalls to watch for. One significant mistake includes overlooking key reporting requirements, which can lead to inconsistencies and potential legal impacts. Accurate calculations of receipts and expenditures are vital; errors can misrepresent the financial standing of the campaign, damaging trust with voters.

Moreover, missing filing deadlines can result in penalties or loss of reputation. Maintaining a calendar of filing deadlines and ensuring timely submission is wise for compliance. Regular audits can also help identify and rectify any discrepancies before they become problematic. Being proactive in these areas can significantly enhance a campaign's credibility and operational success.

Best practices for maintaining compliance

To maintain compliance within campaign finance, regular updates and monitoring of receipts and expenditures are paramount. Engaging in a diligent record-keeping system allows campaigns to stay ahead of any potential issues. Utilizing PDFs for documenting receipts provides transparency and reassurance to both donors and regulators, enhancing trust.

Developing a comprehensive work plan for future campaigns is also beneficial. This plan should include a framework for organizing finances, a timeline for deadlines, and a strategy for communication with stakeholders about financial matters. Encouraging transparency and open communication will foster a positive relationship with voters and minimize the risk of compliance-related hurdles.

FAQs about campaign finance receipts and expenditures forms

When dealing with the campaign finance receipts expenditures form, several frequently asked questions arise. Many candidates want to know about filing deadlines, as these can differ depending on the jurisdiction. Clarification on what to report as receipts and expenditures is also crucial, especially with in-kind donations that may not be as straightforward.

Understanding auditing processes and requirements is another area of concern. Candidates often seek information on how audits are conducted and what documentation is necessary to survive scrutiny. Clear guidance on these topics will empower campaign teams to meet all obligations and coexist within the complex landscape of campaign finance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify campaign finance receipts expenditures without leaving Google Drive?

How do I complete campaign finance receipts expenditures online?

How do I edit campaign finance receipts expenditures on an iOS device?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.