Understanding the Business Privilege License Tax Form

Overview of business privilege license tax

The business privilege license tax is a mandatory obligation for many businesses, allowing them to legally operate within a specific jurisdiction. This tax is often levied by local municipalities or states as a form of revenue generation. It is essential for business owners to recognize the significance of compliance with this tax, as failing to obtain a license or pay the associated fees can lead to fines and penalties. Moreover, a business privilege license not only affirms that a business is legitimate but also serves as a means to regulate the local economy.

Most businesses that engage in commercial activities within a locality are required to obtain a business privilege license. This includes a wide range of entities, from retail stores to service providers, and even online businesses operating in a specific area. By acquiring this license, business owners take a proactive step towards legal compliance and community engagement.

Understanding the business privilege license tax form

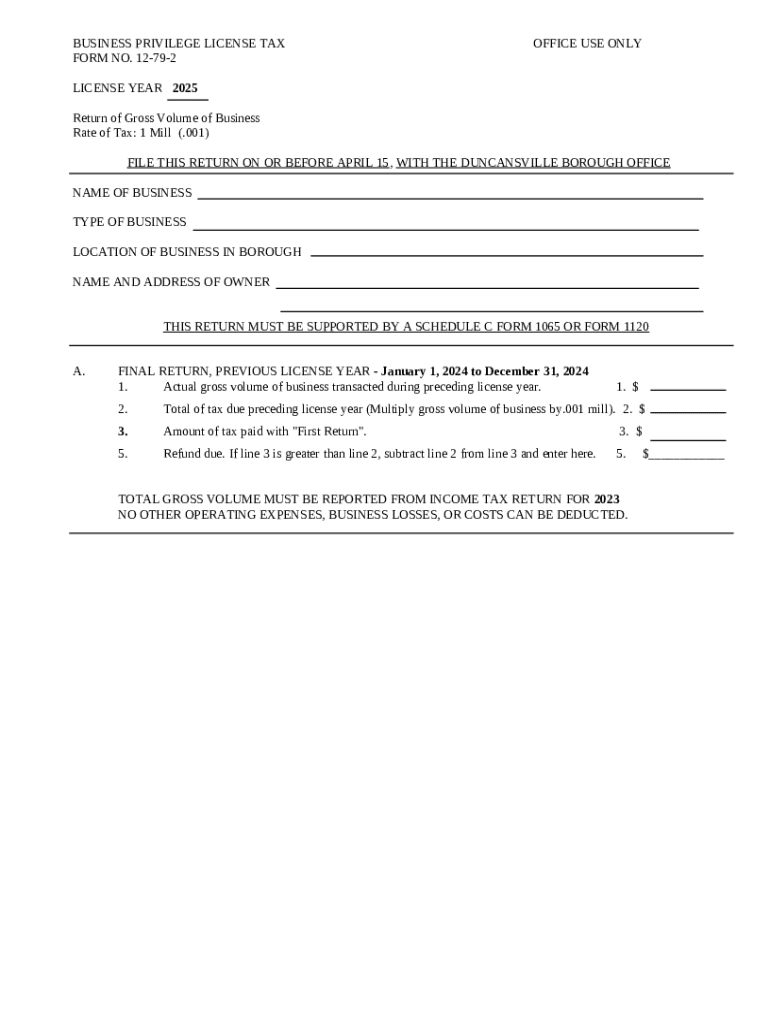

To obtain a business privilege license, owners must complete a specific form depending on the nature of their business activities. There are several types of business privilege license tax forms, including the General Business Privilege License Form, the Amusement and Mechanical Device License Form, and the Mercantile License Tax Form. Each of these forms caters to distinct business categories, ensuring the correct tax collection and regulation.

The key information required on these forms typically includes essential business details such as the legal business name, the structure (whether it's a sole proprietorship, partnership, or corporation), the owner's contact information, and a comprehensive description of the nature of business activities. Providing accurate and complete details is crucial, as any discrepancies can delay the approval process.

Step-by-step guide to filling out the business privilege license tax form

Filling out the business privilege license tax form can seem daunting, but by following a structured approach, the process can be manageable. First, gather all necessary documentation, including business registration documents and valid identification for verification. This preliminary step sets the stage for completing the form accurately.

Here’s a detailed guide for each section of the form:

Business Name and Structure: Clearly state the name of your business and its legal structure.

Owner and Contact Information: Provide the personal details of the business owner including name, address, and phone number.

Description of Business Activities: Offer a concise description of what your business does and its operational scope.

Estimated Gross Revenue: This section requires realistic estimates based on past income or projected earnings.

Avoid common mistakes like providing inaccurate information or neglecting to sign the form, as either can result in rejection or delays in processing your application.

Digital tools for managing your business privilege license tax form

Utilizing digital tools can significantly streamline the process of completing and submitting your business privilege license tax form. For instance, pdfFiller offers a user-friendly interface that allows business owners to fill out the form effortlessly, and it includes necessary features like eSignature capabilities, which facilitate quick signing without the need for printed documents.

Additionally, pdfFiller provides document collaboration features that enhance teamwork when multiple individuals need to review or contribute to the form. With interactive tools such as real-time editing and cloud storage integration, users can manage their forms efficiently and access them from anywhere.

Submitting your business privilege license tax form

Once the form is completed, you have several options for submission. Online submission via platforms like pdfFiller allows for immediate processing, while in-person submissions require adhering to specific local procedures. For those opting to mail in their forms, following precise mailing instructions is critical to ensure timely receipt and processing.

Be aware of established deadlines for submission and payment, as late filings may incur additional penalties. After submission, expect to receive confirmation or further instructions, which may take several days depending on the local government's processing times.

Managing your business privilege license tax

Proper management of your business privilege license tax includes keeping a schedule of payment deadlines to ensure compliance. Understanding the renewal process is equally essential, as many jurisdictions require annual renewals of the license, accompanied by the necessary fees. It is advisable to mark these dates on your calendar to avoid last-minute rush.

Additionally, if there are any changes to your business information, such as moving to a new location or changes in ownership, it is vital to update your license accordingly. This can usually be done through the same form or additional documentation as required by local regulations.

FAQs regarding the business privilege license tax form

It’s common for business owners to have questions about the business privilege license tax form. For instance, if you make a mistake on your submitted form, the best approach is to contact your local licensing authority to understand the correction process promptly. Similarly, you may want to check the status of your license application, which can typically be done via the same office or online if your state offers such resources.

Additionally, understanding the penalties for non-compliance is crucial. Failing to secure the appropriate license or timely renewals can result in fines, restrictions on business operations, or even legal action.

Additional considerations

When managing your business privilege license tax, also consider potential tax deductions and credits that may reduce your overall tax burden. Many jurisdictions offer provisions that can benefit small businesses or new entrepreneurs. It’s advisable to keep informed of these opportunities and consult with tax professionals to maximize your tax strategy.

Furthermore, various resources are available for small business owners seeking support and guidance on regulatory compliance. Utilizing forums, local business associations, and even government resources can provide invaluable information on best practices for managing your business, including how to handle your business privilege license tax.

Success stories and testimonials

Many business owners have successfully navigated the process of acquiring their business privilege license tax by leveraging tools and resources effectively. For instance, a local café owner reported how pdfFiller's digital tools simplified their renewal process, allowing them to save time and avoid unnecessary errors. Another entrepreneur shared that the collaborative features enabled their team to finalize the application in record time.

These testimonials underline the importance of adopting the right strategies and tools to ensure compliance and successful license management, ultimately contributing to the success of businesses.

Connecting with pdfFiller

Besides helping you manage your business privilege license tax form, pdfFiller offers additional document solutions to streamline your overall document management processes. Whether it's tax forms, contracts, or other essential paperwork, pdfFiller empowers users with features that simplify editing, signing, and collaborating on various document types.

For inquiries or assistance regarding your documents, pdfFiller’s customer support team is readily available to provide guidance and support, ensuring that your business can focus on what it does best — serving its customers.