Understanding Your Myretiree Plan Benefits Application Form

Overview of Myretiree Plan Benefits

The Myretiree Plan offers a comprehensive suite of benefits designed to support individuals during their retirement years. This plan includes various features aimed at ensuring financial security and access to essential services. To fully leverage the Myretiree Plan, understanding its key attributes is essential.

What is the Myretiree Plan? It's a retirement benefits program targeting retirees, ensuring they have access to necessary financial aid and health services. This plan helps members manage life after retirement with reduced stress concerning everyday expenses.

Healthcare coverage options including preventive care and emergency services.

Financial assistance for housing, utilities, and groceries.

Access to community services such as transportation and emotional wellness programs.

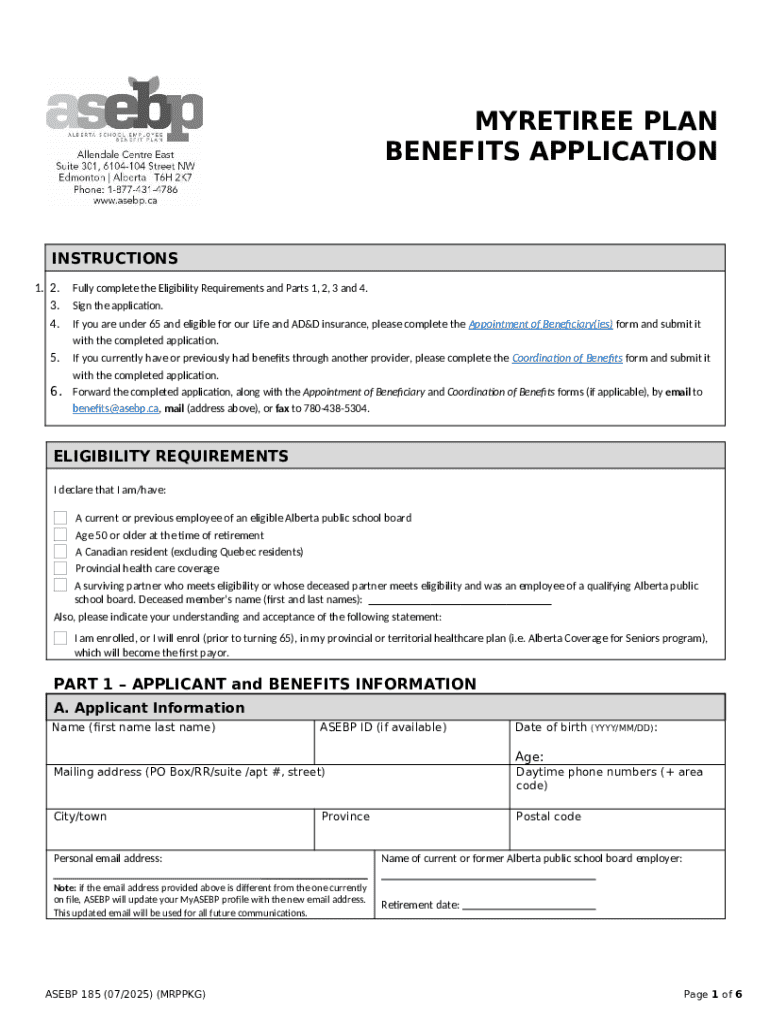

Eligibility requirements for application generally include age restrictions and residency status within the Myretiree Plan’s defined geographic areas. Members must also submit proof of prior employment or income sources to validate their eligibility.

Navigating the Application Process

Applying for the Myretiree Plan benefits takes a structured approach. Breaking down the application process into manageable steps ensures you can complete it without confusion. Here’s a step-by-step guide to successfully fill out the Myretiree Plan Benefits Application Form.

Step 1: Gather required documentation

Before even accessing the application form, it's crucial to gather the necessary documents that validate your application. This typically includes proof of identity, income statements, and previous employment records.

Government-issued ID (e.g., passport or driver's license).

Proof of income, such as tax returns or pension statements.

Employment verification documents if applicable.

If you’re missing any of these documents, try reaching out to the issuing agency well ahead of the application deadline to avoid delays.

Step 2: Accessing the application form

The Myretiree Plan Benefits Application Form can be found easily through pdfFiller. This platform simplifies the process, providing a user-friendly interface to access the necessary forms without any hassle.

Step 3: Filling out the application

Filling out the Myretiree Plan benefits application requires attention to detail. Each section of the form asks for specific information that must be accurately provided to avoid processing delays.

Personal Information: Full name, address, social security number.

Employment History: Past jobs, duration of employment, and job titles.

Benefit Selections: Choose the types of benefits required.

Additional Information: Any other relevant details that may support your application.

Thoroughly completing each section while ensuring all information is accurate is vital for a smooth application process.

Step 4: Reviewing your application for accuracy

After filling out the Myretiree Plan benefits application form, take a moment to review your entries. Ensure that all details are accurate to avoid common mistakes, such as incorrect social security numbers or incomplete sections.

Cross-check all entries with the gathered documents.

Look out for typos or incorrect information.

Ensure signatures are included where necessary.

Editing and managing your application

Once you have completed the Myretiree Plan benefits application form, managing any potential edits is crucial. Using pdfFiller’s online tools, editing is straightforward, allowing for corrections or updates to your application efficiently.

Should your circumstances change, you may need to add or remove information from your application. pdfFiller allows you to adjust your form seamlessly, maintaining control over your submission.

Easily edit text using the pdfFiller interface.

Utilize collaboration features if applying as a team.

Track changes made to the document for transparency.

Signing the application

Once your Myretiree Plan benefits application is completed and reviewed, it’s time to sign the form. pdfFiller offers an efficient eSigning feature, which simplifies adding your electronic signature.

The eSignature process is not only straightforward but also legally binding in most jurisdictions. This feature allows you to securely sign documents without the need for physical paperwork, speeding up the entire process.

Follow the prompts within pdfFiller to create a unique eSignature.

Place your signature in the required section of the application form.

Confirm and finalize your application with your signature.

Submitting your application

With your application signed, you can move on to the submission phase. The Myretiree Plan allows for flexibility in how you submit your application, whether online or via traditional mail.

Online submission typically offers faster processing times, so it is the recommended method. Also, pdfFiller provides features for tracking your application's status throughout the review process.

Submit directly through pdfFiller for immediate processing.

If mailing, ensure you have the correct address for your application.

Use tracking services to confirm receipt of your mailed application.

FAQs about the Myretiree Plan

Navigating the application process can raise several questions. Here are some common inquiries related to the Myretiree Plan benefits application.

What to do if you haven’t received a response? Follow up with the Myretiree Plan customer service.

How to handle application denials or issues? Review the given feedback and consider appealing if valid.

Tips on contacting support for further assistance include checking online help resources first.

Additional resources and tools

For those who prefer visual learning, pdfFiller offers a variety of tutorials to aid in completing forms and understanding features.

Video tutorials for visual learners covering the entire application process.

User guides that explain how to navigate all available features in pdfFiller.

Join community support forums to engage with others who have similar queries.

Related forms and templates

The Myretiree Plan is not the only form you may need during this transitional period of life. Familiarizing yourself with related forms can streamline your experience.

Other forms may include health insurance applications or pension enrollment forms.

Comparisons with similar applications can give insight into requirements and processes.

Links to additional forms relevant to Myretiree benefits and how they relate to your situation.

Contact information for assistance

If you encounter issues during your application process or have specific questions, support is available through multiple channels.

Live chat, email, and phone support options for immediate assistance.

A comprehensive help center offers self-help resources and guides.

Maximizing your Myretiree benefits

Once your Myretiree Plan benefits application has been submitted, it’s essential to actively monitor your benefits and coverage options. Keeping track of documentation using PDF management tools helps ensure you remain organized and informed.

Review your benefits and check for updates or changes periodically.

Utilize pdfFiller’s features for managing all your important documentation.

Consider regular evaluations of your benefit needs to adapt to changing circumstances.