Get the free Beneficiary Designation

Get, Create, Make and Sign beneficiary designation

Editing beneficiary designation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation

How to fill out beneficiary designation

Who needs beneficiary designation?

Beneficiary designation form: How-to guide

Understanding beneficiary designation forms

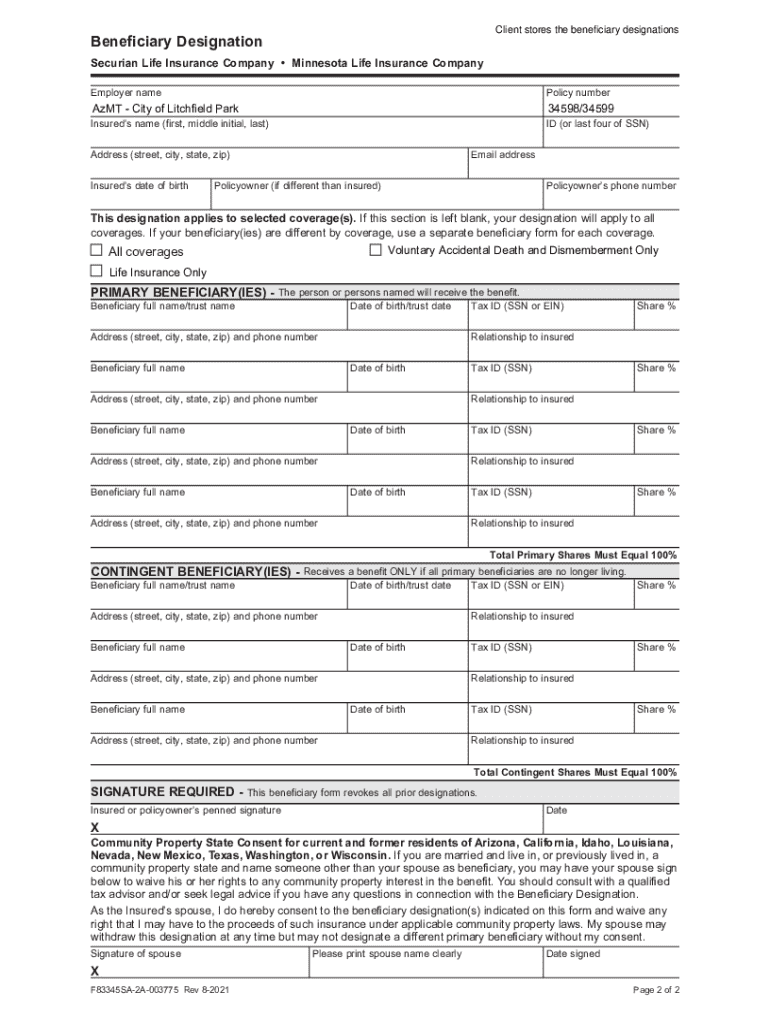

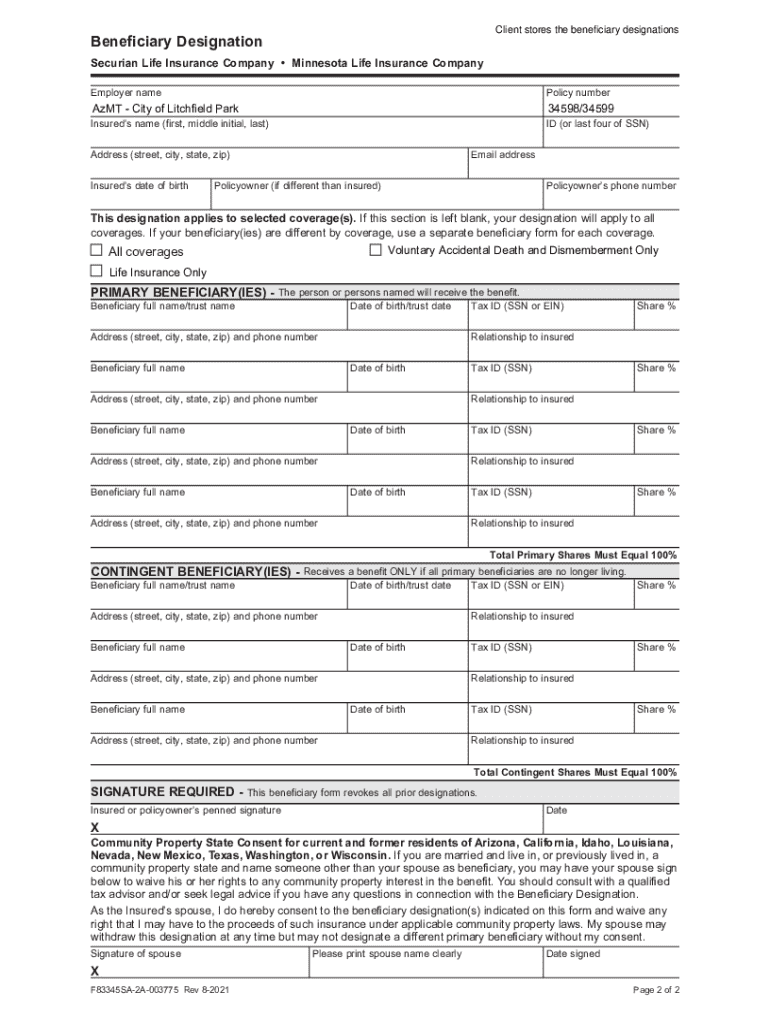

A beneficiary designation form is a document that allows individuals to name who will receive their assets upon their passing. This form is crucial in the realm of estate planning, providing clarity and direction on how one's financial assets are distributed after death.

Beneficiary designations are vital for multiple reasons. First, they play a significant role in estate planning, ensuring that assets transfer smoothly and in accordance with the account holder's wishes. Moreover, these designations can profoundly impact financial assets, as they typically bypass the probate process, allowing beneficiaries to access funds quicker. Furthermore, understanding the legal implications is essential; improper or outdated designations can lead to disputes or unintended consequences, making regular updates necessary.

Types of beneficiary designation forms

Different types of assets require specific beneficiary designation forms. Common forms include those for life insurance policies, retirement accounts like IRAs and 401(k)s, bank accounts and trusts, as well as investment accounts. Each of these forms has unique features that cater to the specific needs of the associated financial vehicle.

It's crucial to recognize the specificity of each form. For instance, life insurance policies may allow for multiple beneficiaries, while retirement accounts might allow only one primary and one contingent beneficiary. Common mistakes to avoid include failing to update beneficiary information after major life events, such as marriage or divorce, and neglecting to sign the form correctly, which can invalidate designations.

Steps to complete a beneficiary designation form

Completing a beneficiary designation form involves several key steps. First, gather necessary information, which typically includes the personal information of the account holder, such as their full name, date of birth, and Social Security number, along with details of the beneficiaries, including their names, relationships to the account holder, and contact information.

Next, fill out the form carefully. Ensuring accurate entries is critical; even minor mistakes can lead to significant issues down the line. It's also essential to distinguish between primary and contingent beneficiaries, where the primary beneficiary takes precedence, but contingent beneficiaries will inherit if the primary beneficiary cannot.

Once the form is filled, take the time to review it thoroughly. Double-checking for errors can prevent headaches later on. Additionally, confirming beneficiary insights—like potential future changes or their understanding of their responsibilities—ensures everyone is on the same page.

Electronic vs. paper forms: Choosing the right option

Choosing between electronic and paper beneficiary designation forms depends on personal preference and comfort with technology. Electronic forms, especially PDFs, offer benefits like ease of editing and secure eSigning capabilities, making it simpler to update information as life circumstances change.

On the contrary, paper forms come with their own considerations. They often require physical signatures and have specific submission requirements depending on financial institutions. Moreover, it's essential to store paper documents securely to protect against misplacement or theft. Understanding both options' pros and cons will allow you to choose the best form based on your situation.

Editing and managing beneficiary designation forms

Editing beneficiary designations should not be a daunting task. If using a PDF editor like pdfFiller, users can easily revise beneficiary information. The steps involve opening the document, making necessary changes using the user-friendly interface, and ensuring to save the updated form for future reference. Keeping a version-controlled document aids in tracking changes, which is especially helpful during significant life events.

Following up on designations after updates is equally important. Confirming changes with financial institutions ensures the alterations are recognized and honored. It's prudent to schedule periodic reviews—at least yearly—to ensure your designations accurately reflect your current wishes and life circumstances.

Collaborating with others on designations

Collaboration can be an essential component when it comes to beneficiary designations. Sharing forms with financial advisors or legal counsel can provide insights that help optimize your benefits and understand potential tax implications. Utilizing collaboration tools on pdfFiller streamlines this process, allowing for secure sharing while respecting confidentiality.

Including family members in the conversation about designations can cultivate transparency and prevent future disputes. A team approach to estate planning—where every member has a role in understanding and updating designations—ensures that all parties are informed and that the process transitions smoothly.

Common questions and troubleshooting

When it comes to beneficiary designation forms, many people have questions. For example, what should be done if a designated beneficiary predeceases you? Generally, it's crucial to have a backup plan, such as naming contingent beneficiaries, to ensure that the assets go to someone else in accordance with your wishes. Failure to address this matter might result in confusion or legal complications.

Changing beneficiaries after a divorce presents another common scenario. It's vital to update your designation promptly to avoid inadvertently bestowing assets on an ex-spouse. Troubleshooting common issues is essential; this includes fixing errors on submitted forms or addressing lost or misplaced documents by directly contacting the institution holding the financial asset. Taking proactive steps can mitigate complications and ensure that beneficiaries are up to date.

Resources for further information

For those interested in exploring beneficiary designation forms further, numerous resources are available to facilitate this process. Websites like pdfFiller provide downloadable beneficiary designation forms tailored for various assets, allowing you to find the specific forms needed based on your financial situation.

Accessing tools for document management—including editing, signing, and sharing—is easy with pdfFiller’s platform, which simplifies the form creation and management process. Furthermore, those seeking personalized assistance can connect with experts in legal and financial fields, enabling informed decisions regarding their designations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send beneficiary designation for eSignature?

Can I create an electronic signature for signing my beneficiary designation in Gmail?

How do I fill out beneficiary designation on an Android device?

What is beneficiary designation?

Who is required to file beneficiary designation?

How to fill out beneficiary designation?

What is the purpose of beneficiary designation?

What information must be reported on beneficiary designation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.