Get the free Beneficiary Designation Form

Get, Create, Make and Sign beneficiary designation form

How to edit beneficiary designation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation form

How to fill out beneficiary designation form

Who needs beneficiary designation form?

Understanding the Beneficiary Designation Form: Your Comprehensive Guide

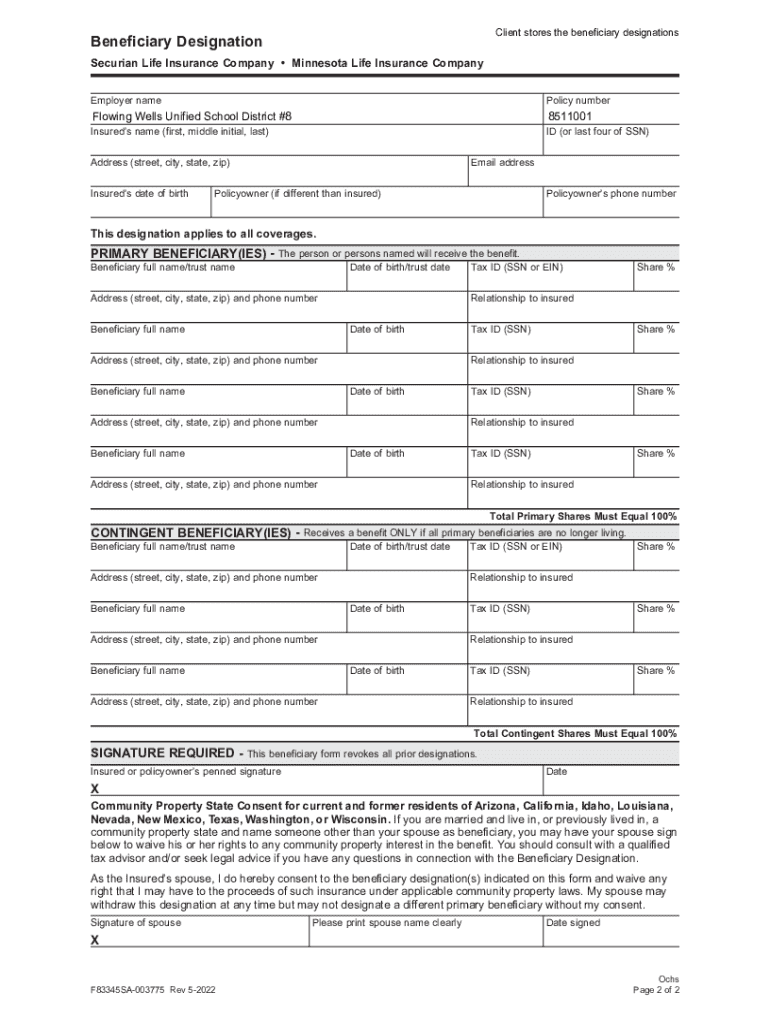

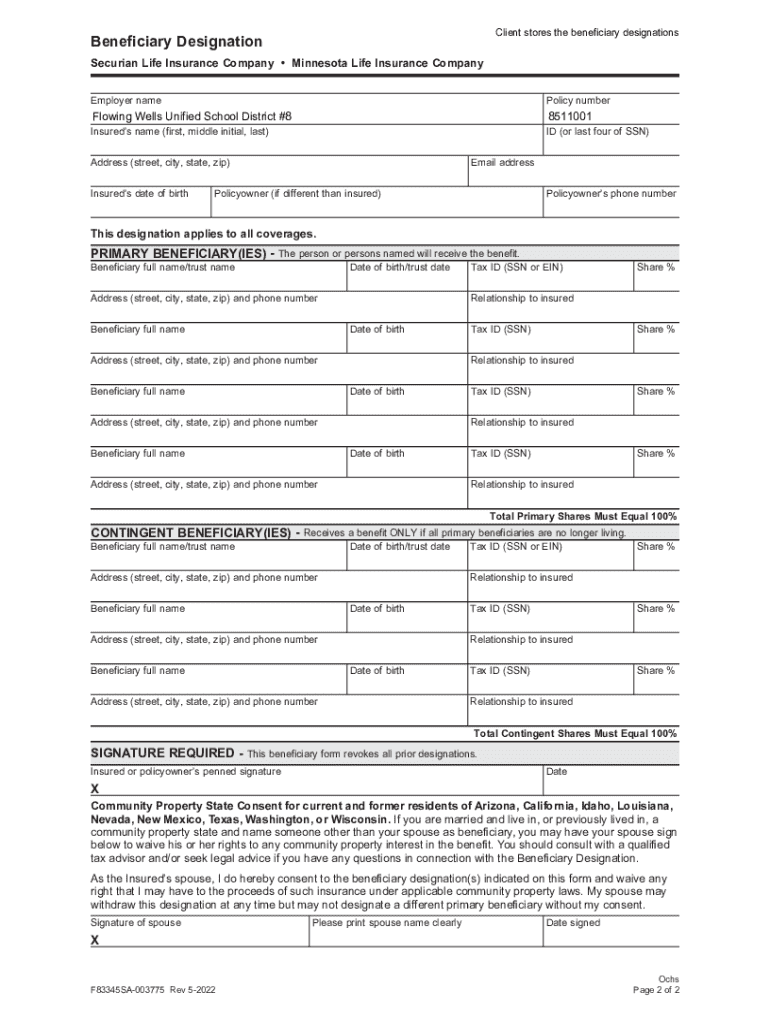

Understanding the beneficiary designation form

A beneficiary designation form is a vital legal document that specifies who will receive your assets upon your passing. This form plays a critical role in estate planning, helping to ensure that your wishes are honored and that your assets are distributed according to your desires. Not only does this process simplify the transfer of your wealth, but it also prevents disputes among potential heirs.

Different types of beneficiary designation forms cater to various assets. Common examples include those for life insurance policies, retirement accounts such as IRAs and 401(k)s, and trusts.

Types of beneficiary designation forms

A life insurance beneficiary designation form specifies who will receive the policy's death benefit. This is often straightforward but requires careful thought to ensure that it reflects your intentions. For retirement accounts, the designation form may allow for both primary and contingent beneficiaries, ensuring beneficiaries are accounted for even if the primary is unavailable. The trust beneficiary designation form outlines how assets held in trust are to be divided among beneficiaries, which can vary based on the terms set by the grantor.

Key components of a beneficiary designation form

Filling out a beneficiary designation form involves including essential personal details about the account holder, such as name, address, and contact details. Equally important is the beneficiary information, which includes their name, relationship to you, and contact information. It's crucial to ensure the accuracy of these details to prevent any legal disputes or complications during the claim process.

Step-by-step guide to filling out the beneficiary designation form

To ensure your beneficiary designation form is completed accurately, follow these essential steps:

Editing and managing your beneficiary designation form

After filling out your beneficiary designation form, you may find that circumstances change. Using pdfFiller, users can easily edit their forms to add or remove beneficiaries as needed. The platform also provides digital signature options to ensure the form complies with legal requirements.

Legal considerations

Each state has specific laws governing beneficiary designations. Understanding these rules is crucial to ensure that your forms are compliant. For instance, some states may have unique requirements regarding the designation of beneficiaries, which could be affected by marital status or divorce. Failing to designate a beneficiary can have dire consequences, leaving your assets to be divided according to state laws rather than your personal wishes.

Frequently asked questions (FAQs)

Profit from insights on common questions regarding the beneficiary designation form. Here's a rundown of typical queries among users:

Additional tools and resources

pdfFiller offers a suite of interactive tools, including document templates for various assets and financial calculators for effective estate planning. Access to customer support can guide you through the complexities of document editing and management, ensuring you understand each step of the process.

Related topics of interest

For those seeking to deepen their understanding of estate planning, exploring related topics can be invaluable. For example, differentiating between trusts and wills is crucial for effective estate management. Additionally, understanding the role of a power of attorney can provide further clarity in your financial planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit beneficiary designation form from Google Drive?

Can I edit beneficiary designation form on an iOS device?

How do I complete beneficiary designation form on an Android device?

What is beneficiary designation form?

Who is required to file beneficiary designation form?

How to fill out beneficiary designation form?

What is the purpose of beneficiary designation form?

What information must be reported on beneficiary designation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.