Application for Credit Facilities Form: Detailed How-to Guide

Understanding credit facilities

Credit facilities are financial arrangements provided by banks and other lending institutions that allow borrowers to access funds for various needs. These funds can be in the form of a loan, line of credit, or credit card. Understanding credit facilities is essential for both individuals and businesses, as they can significantly impact financial health and operational capacity.

The importance of credit facilities cannot be overstated. They provide a means for individuals to manage personal expenses, such as unexpected medical bills or home improvements, and for businesses to fund operations, expand, or invest in new projects. Access to credit can provide necessary liquidity, allowing for better cash flow management and the ability to seize opportunities as they arise.

There are several types of credit facilities offered by financial institutions, including:

Personal loans: Unsecured or secured loans for personal use.

Business loans: Funds provided to businesses for various operational needs.

Lines of credit: Flexible borrowing options that allow users to withdraw funds as needed.

Credit cards: Revolving credit that can be used for purchases or cash advances.

Overview of the application process

Applying for credit facilities involves a structured process that can vary by institution. However, there are general steps that most applicants will follow. First, it’s crucial to assess your financial needs and determine the type of credit facility that best suits your requirements. Next, potential borrowers must gather necessary financial information, including income, debts, and credit history.

The application process typically involves the following steps:

Research various financial institutions and their offers.

Complete the application form carefully, ensuring all information is accurate.

Submit required documentation, such as proof of income and identification.

Await feedback; lenders will review your application based on their criteria.

Negotiate terms if approved, including interest rates and repayment schedules.

Providing accurate information is paramount to ensure a smooth application process. Errors or omissions can lead to delays or even denials, so applicants should review their submitted information thoroughly.

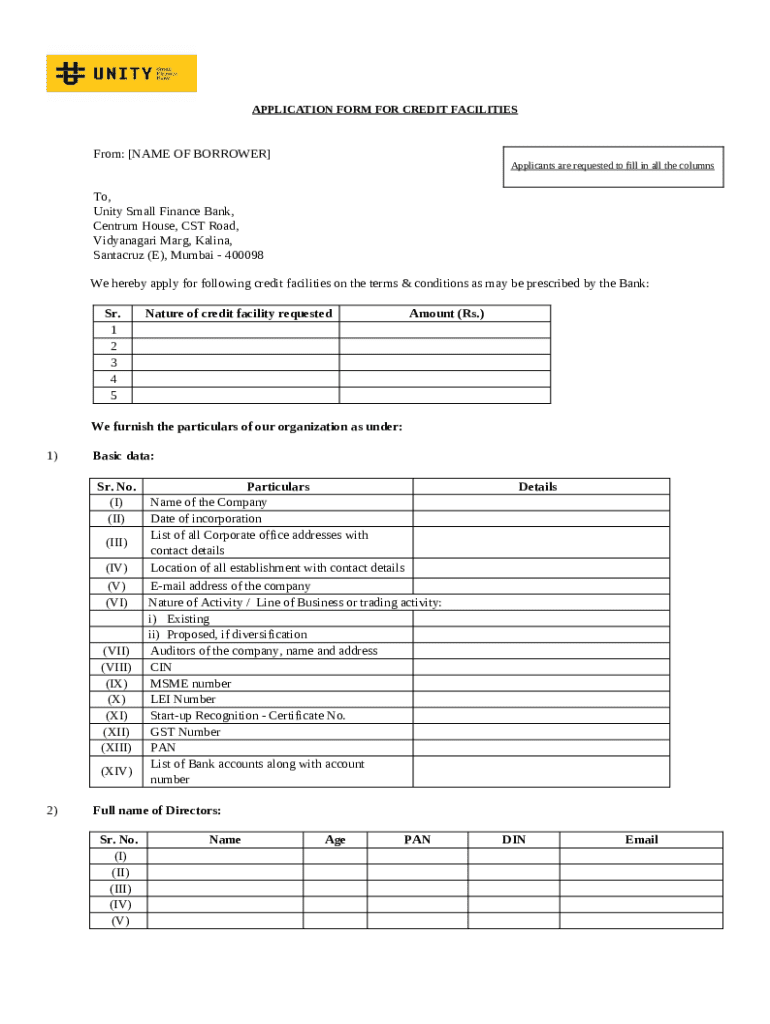

Navigating the application for credit facilities form

The application for credit facilities form can be daunting, but breaking it down into sections can help streamline the process. Typically, the form will include the following components:

Personal Information Section: This includes your name, contact information, employment status, and other identifying details.

Financial Status Declaration: You'll need to provide information about your income, existing debts, and assets.

Purpose of Loan or Credit Request: Clear articulation of why you are seeking credit can enhance your application.

When completing each section, clarity and precision are key. For the personal information section, ensure all details are correct and up to date. In the financial status declaration, highlight all relevant income sources and be transparent about any existing debt. Finally, when detailing the purpose of your loan, be specific about how the funds will be utilized, which can positively influence the lender’s decision.

Key documents required

Documentation is a critical component of applying for credit facilities. The following documents are generally required during the application process:

Identification Documents: These may include a driver’s license, passport, or any government-issued ID.

Proof of Income: Recent pay stubs, tax returns, or bank statements can verify your income.

Existing Debt Obligations: Information on any current loans, credit card debts, or other obligations helps lenders assess your financial capacity.

Organizing these documents before starting the application can help expedite the process. Consider creating a checklist to ensure you include everything needed for submission, arranging documents in a logical order to align with the sections of the application form.

Strategies for a successful application

Filling out the application form correctly is only part of ensuring a successful application for credit facilities. Best practices include:

Double-check all entries for accuracy; mistakes can jeopardize approval.

Conduct a credit score check well in advance of applying and take steps to improve it if necessary.

Craft a strong purpose statement that clearly outlines how you plan to use the funds and the benefits it will bring.

The importance of a good credit score cannot be understated; it influences lenders' perceptions of your creditworthiness. If your score is subpar, consider paying down existing debts or disputing any inaccuracies on your report before submitting your application.

Utilizing pdfFiller for your application

pdfFiller provides an efficient, cloud-based platform for managing your application for credit facilities form. Here’s how to use pdfFiller effectively:

Upload the application form to your pdfFiller account to begin editing.

Use pdfFiller’s tools to edit fields, add any necessary notes or comments, and eSign where required.

Collaborate with team members or advisors if needed, using the platform's sharing features.

Using pdfFiller not only simplifies the documentation process but also helps streamline collaboration, ensuring everyone involved can contribute efficiently.

Submitting your application

Once you have completed your application form and gathered all necessary documents, you can submit your application. There are several options available, including online submission, in-person delivery, or mailing the documents. Each method has its advantages, so choose one that is most convenient for you.

After submission, applicants should be prepared for a waiting period. Depending on the lender, this can range from a few days to several weeks. Here’s what to expect post-submission:

Timeline for Approval or Rejection: Lenders will typically notify you via email or phone.

Follow-Up Procedures: If additional information is needed, lenders will contact you for clarification.

Being proactive during this period can be beneficial — feel free to follow up on your application status if you have not received updates within the expected timeline.

Troubleshooting common issues

Even with careful preparation, applicants may encounter challenges when applying for credit facilities. Common mistakes include incomplete forms or providing outdated information. Avoiding these missteps is crucial for a successful application. If your application is rejected, don’t be disheartened; address the reasons for denial, which are often provided in the rejection notice.

When reapplying, make sure to:

Correct any mistakes identified in the previous application.

Provide additional documentation if necessary.

Consider speaking with a financial advisor for guidance specific to your situation.

Various online resources are also available, including forums and blogs, where applicants can find support and advice from others who have navigated the credit application process.

Frequently asked questions (FAQs)

Many prospective borrowers have questions regarding credit facilities applications. Common queries include the types of credit available, application fees, and how to approach the process.

What types of credit facilities can I apply for? Options generally include personal loans, business loans, lines of credit, and credit cards.

Are there application fees? Some lenders may charge fees, so it’s wise to read the fine print.

Where can I find further assistance? Local financial institutions and online resources like pdfFiller offer support and tools to facilitate the application process.

Being informed and prepared can significantly ease the anxiety associated with applying for credit facilities, allowing applicants to approach the process confidently.